TIDM88E

RNS Number : 8004Y

88 Energy Limited

18 January 2022

88 Energy Limited

QUARTERLY ACTIVITIES REPORT

For the quarter ended 31 December 2021

88 Energy Limited (ASX:88E, AIM:88E, OTC:EEENF) (88 Energy or

the Company) provides the following report for the quarter ended 31

December 2021.

Highlights

Project Peregrine (100% WI)

-- Merlin-2 targeting gross mean prospective resource of 652

million barrels(1) with 56% aggregated geological chance of

success.

-- Drilling location selected is situated east and downdip of

Merlin-1, where enhanced reservior thickness and higher

permeability/porsity of sands are expected.

-- Rig contract executed for Artic Fox to drill the Merlin-2 appraisal well.

-- Merlin-2 Permit to Drill in the final stages of review by the

Bureau of Land Management (BLM)

-- Snow road contruction underway, with commissioning of drill rig commenced in January 2022.

-- Spud of Merlin-2 appraisal well on track for February 2022.

Umiat Oil Field (100% WI)

-- Optimisation studies continue, including full field

development planning and evaluation of oil field synergies with

Project Peregrine.

Project Icewine (75% WI)

-- Assessment indicates extension of Pantheon Resources'

Talitha-A targets onto Icewine acerage.

-- Updated prospective resource estimates to be finalized in H1 2022.

Yukon Leases (100% WI)

-- Joint regional development negotiations and due dilligence

processes well advanced with nearby resource owner.

-- Future potential exploration drill planning is ongoing -

subject to farm-out and joint development negotiations.

Corporate

-- Mr Oliver Mortensen appointed Chief Financial Officer.

-- Cash of A$32.3M and no debt (as at 31 December 2021).

1. Mean unrisked prospective resource - Net Entitlement to 88

Energy. Please refer to cautionary statement on page 3

Project Peregrine (100% WI)

Merlin-2 Appraisal Well

The Merlin-2 appraisal well is scheduled for spud in February

2022 and permitted to a total depth of 8,000 feet. Merlin-2 is

targeting a net mean aggregate prospective resource of 652(1,2)

million barrels across the N20, N19 and N18 horizons. The Merlin-2

well location has been selected from the three permitted locations

and will be located east and downdip of the successful Merlin-1

well. This location is expected to encounter thicker reservoir

sections and higher permeability/porosity sands.

On 26 October 2021, 88 Energy announced the execution of a rig

contract with Doyon Drilling Inc for the Arctic Fox Rig to drill

the Merlin-2 appraisal well. The Arctic Fox rig is a fully

integrated, multi-module unit featuring a lightweight design

crucial to early drill site access. Importantly, the rig unit

allows for maximum over-the-hole drilling and with an eight-line

hook-up, the substructure is capable of simultaneous load of

281,000lbs (for pipe set back) and 337,000lbs (rotary table).

Commissioning of the rig will occur following inspection in January

2022 for immediate mobilisation to the Merlin-2 drill site. Snow

road construction commenced in December 2021 and is progressing

well.

A production testing program for the Merlin-2 was designed

during the quarter and will be on standby during initial wellsite

operations. The production test is contingent upon the wireline

program results, government approvals and subject to operational,

funding and weather considerations.

As at year end, the Permit to Drill for the Merlin-2 well was in

the final stages of review by the BLM and remains pending.

Permitting and planning for the Merlin-2 well is largely complete,

with the last major permit being the Permit to Drill, with the well

on track to spud in February 2022.

1. Mean unrisked prospective resource - Net Entitlement to 88 Energy

2. Please refer to cautionary statement on page 3.

Table 1: Project Peregrine Prospective Resource Estimate (August

2021)

PROSPECTIVE RESOURCE (MMBO, UNRISKED) (1)

Prospects Formation Low Best High Mean

Merlin-2 (N20, N19

& N18) Nanushuk 64 329 1,467 652

==================== ====================== ===== ====== ====== =======

Merlin-1A (N14S) Nanushuk 25 87 282 132

==================== ====================== ===== ====== ====== =======

Harrier Nanushuk 41 175 796 353

==================== ====================== ===== ====== ====== =======

Torok / Basin Floor

Harrier Deep Fan 35 226 1,132 486

1,624

TOTAL MEAN PROSPECTIVE OIL RESOURCE (1)

=================================================================== =======

1. Please refer to the ASX release dated 16 August 2021 for full

details with respect to the Prospective Resource estimate,

associated risking

Cautionary Statement: The estimated quantities of petroleum that

may be potentially recovered by the application of a future

development project relate to undiscovered accumulations. These

estimates have both an associated risk of discovery and a risk of

development. Further exploration, appraisal and evaluation are

required to determine the existence of a significant quantity of

potentially movable hydrocarbons.

Umiat Oil Field (100% WI)

During Q1 2021, 88 Energy acquired the Umiat Oil Field. As part

of the acquisition, the Company received the Umiat data pack which

includes Umiat 3D seismic data. The Umiat 3D survey abuts the

southern edge of the Project Peregrine lease blocks. Integrating

the Linc/Malamute seismic interpretation has provided a better

understanding of the Peregrine reservoir geometries to the north as

well as enriching our petrophysical database with additional well

control (Umiat-8 and Umiat-23H).

Internal reinterpretation of modern 3D seismic is suggestive of

untested reservoirs at Umiat. Prospects have been mapped in the

footwall of the Umiat structure as well as downdip from the proven

oil zone in the hanging wall. Initial internal volumetric

calculations suggest there may be multi-million barrels of

recoverable oil combined in the hanging wall and footwall. Both

prospects are deeper than the current reserves at Umiat which

should have a positive impact on productivity.

Development studies continued in the quarter focusing on the

potential integration of Ultra Low Sulphur Diesel (ULSD) production

with previous studies. Initial screening economics suggest that

this development option adds further value to a future Umiat

development, considering the high cost of diesel (currently $5/gal)

on the North Slope of Alaska

A separate Umiat-23H well performance review was also finalised

during the quarter. This well was drilled in 2014 by a previous

owner and flowed at a sustained rate of 200 BOPD with no water, and

a maximum rate of 800 BOPD. The review concluded that this well

significantly underperformed due to poor drilling and completion

techniques. A more conventional trajectory and completion design

for a 5000 ft horizontal section was modelled to produce at

stabilised rates of between 800 and 1600 BOPD. Consequently, an

opportunity exists for the optimisation of historic subsurface

development plans.

Project Icewine (75% WI)

88 Energy was buoyed by the drilling results of the Talitha-A

well in Q1 of 2021, where multiple formations reported oil shows in

the Talitha-A well by Pantheon Resources (see AIM:PANR release

dated 19 April 2021). 88 Energy is closely monitoring activity

proximate to the northern border of its Project Icewine acreage

planned for Q1 2022.

There has been additional insight into the prospects of the

Schrader Bluff, Canning, Seabee and Kuparuk formations, highlighted

from the results of the Talitha-A program, which may have positive

implications for the same formations in 88 Energy's Icewine

acreage.

All three wells drilled by 88 Energy at Project Icewine have

encountered good quality reservoir in the Kuparuk formation, with

indications of hydrocarbons. These had previously been interpreted

as likely gas condensate or residual oil, and no mapped targets

were identified.

The results at Talitha-A are regionally highly encouraging for

all target formations, including those interpreted across Project

Icewine. Given the results from the Talitha-A well, 88 Energy's

internal geoscience team is reassessing the potential across the

acreage with an updated prospective resource estimate planned for

1H 2022.

Yukon Leases (100% WI)

The Yukon Leases contain the 82 million barrel(1) Cascade

Prospect, which was intersected peripherally by Yukon Gold-1 and

classified as a historic oil discovery.

In 2018, 88 Energy acquired 3D seismic over Cascade and, post

analysis, high-graded it from a lead to a drillable prospect. The

Yukon Leases are located adjacent to ANWR and in proximity to

recently commissioned infrastructure at Point Thompson.

Discussions advanced with nearby lease owners during the quarter

with respect to a joint development area with negotiation

agreements and due diligence underway.

1 Refer to 88 Energy release dated 7th November 2018. Note cautionary statement on page 3.

Corporate

During the quarter, Mr Oliver Mortensen joined 88 Energy in the

role of Chief Financial Officer (CFO).

On 6 December 2021, 88 Energy announced that a key contractor

involved in the Merlin-2 operations who provides snow road and

drilling management services had agreed to accept payment in new

ordinary shares in 88 Energy for payment of up to US$7,500,000

worth of invoices to be incurred in relation to services associated

with the Merlin-2 operations. This demonstrates significant support

for the Merlin-2 well proposition and broader Project Peregrine

opportunity. In consideration, 88 Energy has agreed to issue the

contractor 407,650,000 new ordinary shares ("New Shares") at a

price of A$0.026 per share to the vendor.

The New Shares will be issued as a pre-payment for services and

are to be held in escrow and subject to certain restrictions. The

New Shares will only be released from escrow following approval by

88 Energy. The vendor has the option to dispose of the New Shares,

subject to certain restrictions under the escrow arrangement,

however any proceeds will be held in trust until the associated

invoices are received and approved by 88 Energy. A reconciliation

and final payment of any outstanding invoices (in cash) is to occur

following completion of Merlin-2 drilling operations.

Finance

The ASX Appendix 5B attached to this quarterly report contains

the Company's cash flow statement for the quarter. The significant

cash flows for the period were:

-- Exploration and evaluation expenditure totalled A$3.1M

(September 2021 quarter: A$4.9M), primarily associated with

expenditure on Project Peregrine Merlin-2 well including planning,

permitting, snow road construction and securing Arctic Fox Rig

-- Lease rental payments totalled A$0.05M.

-- Cash call proceeds received from Joint Venture partners

totalled A$0.4M (September 2021 quarter A$6.7M)

-- Administration and other operating costs, totalled A$0.9M and staff costs totalled A$0.6M.

Note: Includes fees paid to Directors in the quarter of

$0.4M

At quarter end, the Company had cash reserves of A$32.3M and no

debt.

ESG

88 Energy is committed to building its credentials and making

disclosures against the World Economic Forum (WEF) ESG framework.

During the quarter, 88 Energy has made the following progress:

-- Engagement of Socialsuite technology platform to establish

ESG baseline and deliver the Company's inaugural quarterly ESG

Dashboard and tailored action plan.

-- Providing employment to local Alaskans throughout the Merlin-2 drilling program.

-- Participation in the Carbonfree(R) Business Partnership

Program, thus offsetting emissions from the Merlin-1 program and

other operating activities. In 2021 the Company reduced 6500 tonnes

of CO2 emissions through a donation to Carbonfree(R) which supports

verified projects that promote global warming solutions and help

provide cleaner air and energy. The project chosen to offset the

CO2 emissions was a U.S. based forestry conservation and carbon

sequestration project.

Table 3: Information required by ASX Listing Rule 5.4.3

Project Name Location Net Area Interest Interest

(acres) at beginning at end

of Quarter of Quarter

-------------- ------------

Project Icewine Onshore, North Slope Alaska 192,830 75% 75%

------------------- ----------------------------- --------- -------------- ------------

Yukon Leases Onshore, North Slope Alaska 38,681 100% 100%

------------------- ----------------------------- --------- -------------- ------------

Onshore, North Slope Alaska

Umiat Unit (NPR-A) 17,633 100% 100%

------------------- ----------------------------- --------- -------------- ------------

Onshore, North Slope Alaska

Project Peregrine (NPR-A) 195,373 100% 100%

------------------- ----------------------------- --------- -------------- ------------

Pursuant to the requirements of the ASX Listing Rules Chapter 5

and the AIM Rules for Companies, the technical information and

resource reporting contained in this announcement was prepared by,

or under the supervision of, Dr Stephen Staley, who is a

Non-Executive Director of the Company. Dr Staley has more than 35

years' experience in the petroleum industry, is a Fellow of the

Geological Society of London, and a qualified Geologist /

Geophysicist who has sufficient experience that is relevant to the

style and nature of the oil prospects under consideration and to

the activities discussed in this document. Dr Staley has reviewed

the information and supporting documentation referred to in this

announcement and considers the prospective resource estimates to be

fairly represented and consents to its release in the form and

context in which it appears. His academic qualifications and

industry memberships appear on the Company's website and both

comply with the criteria for "Competence" under clause 3.1 of the

Valmin Code 2015. Terminology and standards adopted by the Society

of Petroleum Engineers "Petroleum Resources Management System" have

been applied in producing this document.

This announcement has been authorised by the Board.

Images of Project Peregrine long section showing: expected

enhanced reservoir thickness to the east Wireframe; Merlin-2 well

location, facing east and reservoir sands can be viewed in the pdf

of this announcement on the Company's website; Surface attribute

map of the Lower Grandstand Unit; Shelf Margin Deltaic Extension

into Project Icewine

Media and Investor Relations:

88 Energy Ltd

Ashley Gilbert, Managing Director

Tel: +61 8 9485 0990

Email:investor-relations@88energy.com

Finlay Thomson , Investor Relations Tel: +44 7976 248471

Fivemark Partners , Investor and Media Relations Tel: +61 410 276 744

Andrew Edge / Michael Vaughan Tel: +61 422 602 720

EurozHartleys Ltd

Dale Bryan Tel: + 61 8 9268 2829

Cenkos Securities Tel: + 44 131 220 6939

Neil McDonald / Derrick Lee

Appendix 5B

Mining exploration entity or oil and gas exploration entity

quarterly cash flow report

1.1 Name of entity

---------------------------------------------------

88 Energy Limited

1.2 ABN 1.3 1.4 Quarter ended ("current

quarter")

--------------- ----------------------------

80 072 964 179 31 December 2021

----------------------------

1.5 Consolidated statement of Current quarter Year to date

cash flows (12 months)

$A'000 $A'000

1. Cash flows from operating

activities

1.1 Receipts from customers - -

1.2 Payments for

(a) exploration & evaluation - -

(b) development - -

(c) production - -

(d) staff costs (624) (1,900)

(e) administration and corporate

costs (854) (2,695)

1.3 Dividends received (see note - -

3)

1.4 Interest received - -

Interest and other costs of

1.5 finance paid - (1,053)

1.6 Income taxes paid - -

1.7 Government grants and tax - -

incentives

1.8 Other (XCD - redundancy payments) - -

---------------- -------------

Net cash from / (used in)

1.9 operating activities (1,478) (5,648)

----------------- ----------------------------------------------- ---------------- -------------

2. Cash flows from investing

activities

2.1 Payments to acquire or for:

(a) entities - -

(b) tenements (47) (6,749)

(c) property, plant and equipment - -

(d) exploration & evaluation (3,115) (35,042)

(e) investments - -

(f) other non-current assets - -

2.2 Proceeds from the disposal

of:

(a) entities - -

(b) tenements - -

(c) property, plant and equipment - -

(d) investments - -

(e) other non-current assets - -

2.3 Cash flows from loans to other - -

entities

2.4 Dividends received (see note - -

3)

2.5 Other - Joint Venture Contributions 412 20,816

* Proceeds from sale tax credits - 3,324

275 (113)

* Bonds

---------------- -------------

Net cash from / (used in)

2.6 investing activities (2,475) (17,764)

----------------- ----------------------------------------------- ---------------- -------------

3. Cash flows from financing

activities

Proceeds from issues of equity

securities (excluding convertible

3.1 debt securities) - 42,521

3.2 Proceeds from issue of convertible - -

debt securities

3.3 Proceeds from exercise of - -

options

Transaction costs related

to issues of equity securities

3.4 or convertible debt securities - (2,523)

3.5 Proceeds from borrowings - -

3.6 Repayment of borrowings - -

3.7 Transaction costs related - -

to loans and borrowings

3.8 Dividends paid - -

3.9 Other (provide details if - -

material)

---------------- -------------

Net cash from / (used in)

3.10 financing activities - 39,998

----------------- ----------------------------------------------- ---------------- -------------

4. Net increase / (decrease)

in cash and cash equivalents

for the period

Cash and cash equivalents

4.1 at beginning of period 36,083 14,847

Net cash from / (used in)

operating activities (item

4.2 1.9 above) (1,478) (5,648)

Net cash from / (used in)

investing activities (item

4.3 2.6 above) (2,475) (17,764)

Net cash from / (used in)

financing activities (item

4.4 3.10 above) - 39,998

Effect of movement in exchange

4.5 rates on cash held 187 884

---------------- -------------

Cash and cash equivalents

4.6 at end of period 32,317 32,317

----------------- ----------------------------------------------- ---------------- -------------

5. 1.6 Reconciliation of cash Current quarter Previous quarter

and cash equivalents $A'000 $A'000

at the end of the quarter

(as shown in the consolidated

statement of cash flows) to

the related items in the accounts

5.1 Bank balances 32,317 36,083

5.2 Call deposits - -

5.3 Bank overdrafts - -

5.4 Other (provide details) - -

---------------- -----------------

Cash and cash equivalents

at end of quarter (should

5.5 equal item 4.6 above) 32,317 36,083

----------------- ----------------------------------- ---------------- -----------------

(a)

6. 1.7 Payments to related parties of the entity Current quarter

and their associates $A'000

Aggregate amount of payments to related

parties and their associates included in

6.1 item 1 416

----------------

6.2 Aggregate amount of payments to related -

parties and their associates included in

item 2

----------------

Note: if any amounts are shown in items 6.1 or 6.2, your quarterly

activity report must include a description of, and an explanation

for, such payments.

6.1 Payments relate to Director and consulting fees paid to

Directors. All transactions involving directors and associates were

on normal commercial terms.

7. 1.8 Financing facilities Total facility Amount drawn

Note: the term "facility' amount at quarter at quarter end

includes all forms of financing end $US'000

arrangements available to $US'000

the entity. 1.9 Add notes

as necessary for an understanding

of the sources of finance

available to the entity.

7.1 Loan facilities - -

------------------- ----------------

7.2 Credit standby arrangements - -

------------------- ----------------

7.3 Other (please specify) - -

------------------- ----------------

7.4 Total financing facilities - -

------------------- ----------------

7.5 Unused financing facilities available at -

quarter end

----------------

7.6 Include in the box below a description of each facility

above, including the lender, interest rate, maturity date

and whether it is secured or unsecured. If any additional

financing facilities have been entered into or are proposed

to be entered into after quarter end, include a note providing

details of those facilities as well.

----------------- --------------------------------------------------------------------------

8. 1.10 Estimated cash available for future $A'000

operating activities

Net cash from / (used in) operating activities

8.1 (item 1.9) (1,478)

8.2 (Payments for exploration & evaluation classified (3,115)

as investing activities) (item 2.1(d))

8.3 Total relevant outgoings (item 8.1 + item (4,593)

8.2)

8.4 Cash and cash equivalents at quarter end 32,317

(item 4.6)

8.5 Unused finance facilities available at quarter -

end (item 7.5)

--------

8.6 Total available funding (item 8.4 + item 32,317

8.5)

--------

Estimated quarters of funding available

8.7 (item 8.6 divided by item 8.3) 7.0

--------

Note: if the entity has reported positive relevant outgoings

(ie a net cash inflow) in item 8.3, answer item 8.7 as

"N/A". Otherwise, a figure for the estimated quarters

of funding available must be included in item 8.7.

8.8 If item 8.7 is less than 2 quarters, please provide answers

to the following questions:

8.8.1 Does the entity expect that it will continue to

have the current level of net operating cash flows for

the time being and, if not, why not?

-------------------------------------------------------------------

Answer: n/a

-------------------------------------------------------------------

8.8.2 Has the entity taken any steps, or does it propose

to take any steps, to raise further cash to fund its operations

and, if so, what are those steps and how likely does it

believe that they will be successful?

-------------------------------------------------------------------

Answer: n/a

-------------------------------------------------------------------

8.8.3 Does the entity expect to be able to continue its

operations and to meet its business objectives and, if

so, on what basis?

-------------------------------------------------------------------

Answer: n/a

-------------------------------------------------------------------

Note: where item 8.7 is less than 2 quarters, all of questions

8.8.1, 8.8.2 and 8.8.3 above must be answered.

----------------- -------------------------------------------------------------------

1.11 Compliance statement

1 This statement has been prepared in accordance with accounting

standards and policies which comply with Listing Rule 19.11A.

2 This statement gives a true and fair view of the matters disclosed.

Date: 18 January 2022

Authorised by: By the Board

(Name of body or officer authorising release - see note 4)

1.12 Notes

1. This quarterly cash flow report and the accompanying activity

report provide a basis for informing the market about the entity's

activities for the past quarter, how they have been financed and

the effect this has had on its cash position. An entity that wishes

to disclose additional information over and above the minimum

required under the Listing Rules is encouraged to do so.

2. If this quarterly cash flow report has been prepared in

accordance with Australian Accounting Standards, the definitions

in, and provisions of, AASB 6: Exploration for and Evaluation of

Mineral Resources and AASB 107: Statement of Cash Flows apply to

this report. If this quarterly cash flow report has been prepared

in accordance with other accounting standards agreed by ASX

pursuant to Listing Rule 19.11A, the corresponding equivalent

standards apply to this report.

3. Dividends received may be classified either as cash flows

from operating activities or cash flows from investing activities,

depending on the accounting policy of the entity.

4. If this report has been authorised for release to the market

by your board of directors, you can insert here: "By the board". If

it has been authorised for release to the market by a committee of

your board of directors, you can insert here: "By the [name of

board committee - eg Audit and Risk Committee]". If it has been

authorised for release to the market by a disclosure committee, you

can insert here: "By the Disclosure Committee".

5. If this report has been authorised for release to the market

by your board of directors and you wish to hold yourself out as

complying with recommendation 4.2 of the ASX Corporate Governance

Council's Corporate Governance Principles and Recommendations, the

board should have received a declaration from its CEO and CFO that,

in their opinion, the financial records of the entity have been

properly maintained, that this report complies with the appropriate

accounting standards and gives a true and fair view of the cash

flows of the entity, and that their opinion has been formed on the

basis of a sound system of risk management and internal control

which is operating effectively.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBPMRTMTABMJT

(END) Dow Jones Newswires

January 18, 2022 03:20 ET (08:20 GMT)

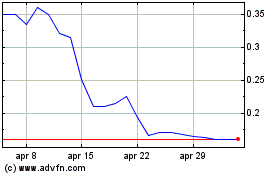

Grafico Azioni 88 Energy (LSE:88E)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni 88 Energy (LSE:88E)

Storico

Da Apr 2023 a Apr 2024