AB Foods Resumes Dividend, Plans to Repay Government Support Despite GBP1.1 Billion Hit on Primark -- Update

20 Aprile 2021 - 2:20PM

Dow Jones News

--Associated British Foods' clothing arm Primark took a GBP1.10

billion hit on sales, pulling group profits down in 1H fiscal

2021

--The U.K. conglomerate has resumed dividends and plans to repay

GBP121 million of job retention support

--The company anticipates a further hit on Primark revenue of

GBP700 million in the second half but retains plans of expansion

for the fashion retailer

By Matteo Castia

Associated British Foods PLC said Tuesday that lost sales at

Primark amid the coronavirus pandemic caused a fall in fiscal 2021

first-half profit, but that it has resumed dividends and intends to

repay 121 million pounds ($169.2 million) in job-retention

support.

The British conglomerate made a pretax profit of GBP275 million

in the 24 weeks ended Feb. 27, compared with GBP298 million in the

year-earlier period.

Revenue fell to GBP6.31 billion from GBP7.65 billion, largely

due to declining sales at Primark amid store closures owing to the

pandemic.

Sales lost at the fashion retailer amounted to GBP1.10 billion

in the first half compared with a year ago, and were down 15% on

year on a like-for-like basis after reopening due to lower footfall

and category spending, the company said.

"Even in the brief period when stores were open, customers were

generally less willing to travel on the basis of government

guidelines and, in any event, many were carrying the burden of an

uncertain jobs outlook," Interactive Investor's Richard Hunter

said.

Primark revenue in the first half came in at GBP2.23

billion.

"On the assumption that our English and Welsh stores remain

open, Primark will return to cash generation," it said.

Associated British Foods warned that it expects a further GBP700

million of lost sales in the second half, owing to the remaining

periods of store closures.

The company had warned on Feb. 25 that Primark would suffer loss

of sales of GBP1.10 billion in the first half and a further GBP480

million in the second half due to the pandemic.

Despite the worsening of loss of sales estimate, the FTSE 100

group said Tuesday that it intends to repay GBP121 million of job

retention schemes, including GBP72 million to the U.K.

government.

The company also said business in its other divisions--grocery,

sugar, agriculture, ingredients--was strong during the first

half.

"AB Foods has again displayed the benefits of not having all of

its eggs in one basket," according to Mr. Hunter.

The conglomerate said it expects those divisions' performance to

be weaker in the second half.

Given the improving environment, the board declared an interim

dividend of 6.2 pence. No dividend was declared at half-year

results for fiscal 2020, due to the pandemic.

"The degree of uncertainty is now substantially lower than last

year due to a large proportion of the U.K. adult population having

been vaccinated and the successful reopening of Primark's English

and Welsh stores," the company said.

With the reopening of stores in England and Wales on April 12

and expected reopenings in some markets over the coming weeks,

Primark will be trading at the end of April from 68% of its selling

space, Associated British Food said. This figure increases to 79%

if stores with restricted trading are included, it said.

U.K. bank Barclays warned that no reopening dates are on the

table yet for Primark shops in France, Germany and Ireland.

The company said Primark pipeline of store openings remains

strong across a number of markets.

"We are opening three further stores in Spain this financial

year, and a second store in Rome, the first of eight new store

openings in Italy by 2022. We are in the early stages of our

expansion into eastern Europe, with a second store to open in

Poland and our first store in [the Czech Republic]...In addition,

we have plans to accelerate our growth in the U.S. over the next

five years," Associated British Food said.

The upheaval in retail caused by the pandemic will provide

opportunities to accelerate store openings and take market share,

given the sustained pace of the planned expansion and a proposition

still relevant to today's digitally native consumers, brokerage

Liberum said.

Write to Matteo Castia at matteo.castia@dowjones.com

(END) Dow Jones Newswires

April 20, 2021 08:05 ET (12:05 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

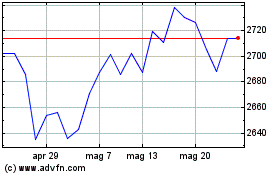

Grafico Azioni Associated British Foods (LSE:ABF)

Storico

Da Mar 2024 a Apr 2024

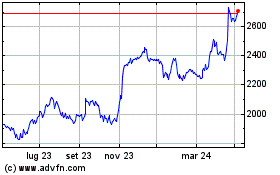

Grafico Azioni Associated British Foods (LSE:ABF)

Storico

Da Apr 2023 a Apr 2024