AIR FRANCE-KLM: THIRD QUARTER 2020 RESULTS

30 October 2020

|

THIRD QUARTER 2020

Increase of demand until mid-August, then

new governmental restrictions impacted the expected level of demand

recovery |

The continuation of the Covid-19 crisis severely

impacted the Third quarter 2020 results:

- Revenue at 2,524 million euros, down 67% compared to last

year

- EBITDA loss at -442 million euros, limited thanks to cost

control and state aid

- Operating result at –1,046 million euros, down 1,955 million

euros compared to last year

- Net income at -1,665 million euros, including restructuring

provision at -565 million euros, Covid-19 related over-hedging at

-39 million euros and fleet impairment at -31 million euros

- Net debt at 9,308 million euros, up 3,161 million compared to

end of 2019

- At 30 September 2020, the Group has 12.4 billion euros of

liquidity or credit lines at disposal

Air France and KLM have agreed with labour

representatives on substantial restructuring plans and submitted

them for final validation to the French and Dutch states.

OUTLOOKAir France-KLM Group

continues to implement the highest safety standards for its

customers and employees to counter virus transmission risks.

After the lockdown, the Group observed a

positive demand recovery trend until mid-August. Then, the negative

trend reversal for the Passenger activity led the airlines of the

Group to adjust downwards the capacity planned for the fall and

winter period.

There is limited visibility on the demand

recovery curve as customer booking behavior is much more short-term

oriented and also highly dependent on the imposed travel

restrictions, especially on the Long Haul network. The period of

lockdown starting today in France is a new difficulty that will

weigh on the Group's activities.In this context the Group

expects:

- Capacity in Available Seat kilometers circa index 45 for KLM

and inferior to index 35 for Air France in the Fourth quarter 2020

compared to 2019 for the Network passenger activity

- Negative load factor developments for the Fourth quarter 2020,

particularly on the long-haul network, and negative yield mix

effects due to a delayed recovery in business traffic

The Group anticipates a challenging fourth

quarter 2020, with a substantial lower EBITDA compared to Q3

2020.

|

Air France-KLM Group |

Third quarter |

Nine months |

|

2020 |

Change |

2020 |

Change |

|

Passengers (thousands) |

8,796 |

-69.8% |

28,124 |

-64.7% |

|

Passenger Unit revenue per ASK1 (€ cts) |

4.01 |

-42.7% |

5.05 |

-24.5% |

|

Operating result (€m) |

-1,046 |

-1,955 |

-3,414 |

-4,460 |

|

Net income – Group part (€m) |

-1,665 |

-2,026 |

-6,078 |

-6,213 |

|

Adj. operating free cash flow (€m) |

-1,220 |

-985 |

-3,547 |

-3,663 |

|

Net debt at end of period (€m) |

|

|

9,308 |

3,161 |

The Board of Directors of Air France-KLM, chaired by Anne-Marie

Couderc, met on 29 October 2020 to approve the financial statements

for the nine months 2020. Group CEO Mr. Benjamin Smith said:

“After a promising recovery during the summer,

the gradual closure of international borders in the second half of

August and the resurgence of the pandemic strongly impacted our

results in the Third Quarter, with the Group reporting an operating

loss of 1.0 billion euros. We have accelerated the implementation

of cost reduction and cash preservation measures. We are also

working closely with our partners on various means, such as rapid

detection tests, that would allow traffic within the best sanitary

conditions for our customers and employees. Beyond these immediate

necessary measures, we are engaged in a more profound

transformation of our Group, with the objective of exiting this

crisis in a stronger position, ready to address the future

challenges of our industry. Air transport will continue to connect

people and cultures, but we foresee changes in customers’

expectations that we anticipate too.We expect a challenging Fourth

quarter 2020, with current forward booking sharply down compared to

last year.”

Business review

Network: With active management of capacity to

meet the increasing demand, the Group was able to

ramp up capacity with incremental cash positive

flights

|

Network |

Third quarter |

Nine months |

|

2020 |

Change |

Change constant currency |

2020 |

Change |

Change constant currency |

|

Total revenues (€m) |

2,004 |

-68.6% |

-68.3% |

7,220 |

-58.8% |

-58.8% |

|

Scheduled revenues (€m) |

1,856 |

-69.8% |

-69.4% |

6,753 |

-59.7% |

-59.7% |

|

Operating result (€m) |

-990 |

-1,649 |

-1,631 |

-2,842 |

-3,555 |

-3,564 |

Third quarter 2020 revenues decreased by 68.3%

at constant currency to 2,004 million euros. The operating result

amounted to -990 million euros, a -1,631 million euros decrease at

constant currency compared to last year. Measures were strengthened

to preserve cash, including reduction of investments, cost savings

measures, deferral of supplier payments and partial activity for

employees.

Passenger network:

Long-haul suffering from travel restrictions, ability to

capture traffic when border controls are less

restrictive

|

|

Third quarter |

Nine months |

|

Passenger network |

2020 |

Change |

Change constant currency |

2020 |

Change |

Change constant currency |

|

Passengers (thousands) |

6,782 |

-71.3% |

|

23,671 |

-64.3% |

|

|

Capacity (ASK m) |

32,100 |

-59.6% |

|

103,268 |

-54.1% |

|

|

Traffic (RPK m) |

13,752 |

-80.7% |

|

66,861 |

-66.3% |

|

|

Load factor |

42.8% |

-46.9

pt |

|

64.7% |

-23.5

pt |

|

|

Total passenger revenues (€m) |

1,329 |

-77.4% |

-77.1% |

5,512 |

-65.4% |

-65.4% |

|

Scheduled passenger revenues (€m) |

1,265 |

-77.9% |

-77.6% |

5,271 |

-65.7% |

-65.7% |

|

Unit revenue per ASK (€ cts) |

3.94 |

-45.2% |

-44.5% |

5.10 |

-25.4% |

-25.3% |

The passenger network activity was, as

anticipated strongly reduced, at around 40% of last year’s levels.

The tightening of travel restrictions, border closures and absence

of corporate travel delayed the expected traffic recovery. July and

August were relatively strong in term of traffic compared to a

disappointing September affected by restrictive travel

measures.

For the third quarter, the unit revenues were

down at -44.5% at constant currency compared to last year primarily

due to load factors decline on Long Haul operations. The Group’s

strategy was to only operate incremental cash positive flight and

several routes were taking advantage of the strong worldwide cargo

demand while having few passenger on board.

The visiting friend and relative demand was

driving the summer traffic, with the French Domestic, African &

Middle East and Caribbean & Indian Ocean as the more resilient

with a unit revenue performance between -22% and -27% at constant

currency.

The medium-haul performance was mixed during

summer, with some leisure destinations such as Italy, Spain,

Portugal and Greece benefiting from easing travel restrictions and

other strongly affected by quarantine and testing process like UK

or Germany.

North Atlantic, South American and Asian

networks continued to be strongly affected by the border

restrictions in place with an important decline in capacity and

passenger traffic during summer.

Cargo: Continued strong performance of cargo due to the

gap between industry capacity and demand

|

|

Third quarter |

Nine months |

|

Cargo business |

2020 |

Change |

Change constant currency |

2020 |

Change |

Change constant currency |

|

Tons (thousands) |

220 |

-20.0% |

|

611 |

-25.7% |

|

|

Capacity (ATK m) |

2,537 |

-33.3% |

|

7,309 |

-32.9% |

|

|

Traffic (RTK m) |

1,735 |

-17.0% |

|

4,747 |

-24.2% |

|

|

Load factor |

68.4% |

+13.4

pt |

|

65.0% |

+7.5

pt |

|

|

Total Cargo revenues (€m) |

676 |

+31.7% |

+34.1% |

1,708 |

+7.1% |

+6.9% |

|

Scheduled cargo revenues (€m) |

592 |

+35.7% |

+38.0% |

1,482 |

+8.7% |

+8.4% |

|

Unit revenue per ATK (€ cts ) |

23.35 |

+104.0% |

+107.6% |

20.28 |

+62.0% |

+61.6% |

Global air cargo capacity is at the end of the

Third quarter 2020 approximately 15% lower than 2019. Tightening of

supply and demand levels increased yields by significant amount

over the past months.

September was the fifth consecutive month of

gradual air cargo market improvements and Air France-KLM’s Cargo

activity continued to strongly perform with a unit revenue at

constant currency up 104.0% in the Third quarter 2020. The Cargo

capacity of the Group has been down 33.3%, primarily driven by the

reduction in belly capacity of passenger aircraft partly offset by

the increase of the full freighters’ capacity and mini cargo

flights (passenger aircraft with only belly capacity

commercialized). The load factors were strongly up 13.4 points for

the quarter.

On the demand side, world-wide air freight

volumes are down due to Covid-19 crisis but are expected to rebound

to 90 to 95% of pre Covid-19 levels in 2021. The supply-demand gap

of the past months is foreseen to narrow as industry capacity

supply will increase and will depend on the passenger traffic

recovery. Air France-KLM is in preparation to transport the future

Covid-19 vaccines.

Transavia operating loss in the Third

quarter at -13 million euros, impacted by border restrictions

reinstatement

|

|

Third quarter |

Nine months |

|

Transavia |

2020 |

Change |

2020 |

Change |

|

Passengers (thousands) |

2,014 |

-63.3% |

4,453 |

-66.6% |

|

Capacity (ASK m) |

6,009 |

-44.7% |

11,178 |

-57.4% |

|

Traffic (RPK m) |

3,869 |

-61.8% |

8,505 |

-64.9% |

|

Load factor |

64.4% |

-28.7 pt |

76.1% |

-16.4 pt |

|

Total passenger revenues (€m) |

262 |

-60.6% |

521 |

-62.9% |

|

Unit revenue per ASK (€ cts) |

4.38 |

-30.2% |

4.55 |

-16.3% |

|

Unit cost per ASK (€ cts) |

4.61 |

-1.3% |

6.39 |

+32.5% |

|

Operating result (€m) |

-13 |

-189 |

-206 |

-364 |

The Third quarter operating result ended 189

million euros lower compared to last year at an operational loss of

-13 million euros, as a result of the Covid-19 crisis.

Activity levels were close to 55% of last year’s

level, with an unit revenue down -30,2% compared to the Third

quarter 2019. Transavia France and Holland were able to capture

traffic and fill their planes with reasonable load factors and good

yields on several leisure destinations. Spain, Greece, Portugal and

Italy routes were the most resilient during the quarter. However,

severe travel restrictions from the Netherlands to Spain and Greece

in the course of the third quarter, did put pressure on activity

levels and loadfactor.

Transavia France will expend its French Domestic

operation starting in November 2020 from Paris Orly and provinces

airports.However, the resurgence of Covid-19 and border

restrictions have slowed down Transavia in the traffic

recovery.

Strict cash preservation measures are still in

place including reduction of investments, cost savings measures,

deferral of supplier payments and partial activity measures.

Maintenance business operating result for Third quarter

2020 at -46 million euros, impacted by Covid-19

|

|

Third quarter |

Nine months |

|

Maintenance |

2020 |

Change |

Change constant currency |

2020 |

Change |

Change constant currency |

|

Total revenues (€m) |

616 |

-47.1% |

|

2,255 |

-34.7% |

|

|

Third-party revenues (€m) |

247 |

-54.5% |

-53.1% |

963 |

-40.7% |

-41.6% |

|

Operating result (€m) |

-46 |

-117 |

-111 |

-366 |

-536 |

-542 |

|

Operating margin (%) |

-7.4% |

-13.5 pt |

-13.1 pt |

-16.2% |

-21.2 pt |

-21.3 pt |

The Third quarter operating result stood at -46

million euros, a decrease of 117 million euros, highly impacted by

the Covid-19 crisis. Revenues declined and were also impacted by

the Air France-KLM Group airlines decrease in activity.

During the Third quarter, contracts signature

have restarted and will be included in the order book before year

end. The Maintenance business is carefully managing agreements with

clients on payment terms.

Operating costs have been reduced in the Third

quarter 2020 by a reduced maintenance activity level, partial

activity pay schemes for employees and other initiated cost savings

measures. The Maintenance order book is assessed

to 9.3 billion dollars at 30 September 2020 a decrease of 2.2

billion dollars compared to 31 December 2019, explained by the

Covid-19 crisis effects already occurring and expected. Air

France-KLM Group: Decline of 5 billion euros in revenues and 2

billion euros in EBITDA during the third quarter

|

|

Third quarter |

Nine months |

|

|

2020 |

Change |

Change constant currency |

2020 |

Change |

Change constant currency |

|

Capacity (ASK m) |

38,109 |

-57.8% |

|

114,446 |

-54.4% |

|

|

Traffic (RPK m) |

17,621 |

-78.4% |

|

75,367 |

-66.2% |

|

|

Passenger unit revenue per ASK (€ cts) |

4.01 |

-43.4% |

-42.7% |

5.05 |

-24.6% |

-24.5% |

|

Group unit revenue per ASK (€ cts) |

5.56 |

-26.5% |

-25.6% |

6.34 |

-12.3% |

-12.3% |

|

Group unit cost per ASK (€ cts) at constant fuel |

8.31 |

+26.7% |

+38.2% |

9.33 |

+36.7% |

+40.4% |

|

Revenues (€m) |

2,524 |

-66.8% |

-66.4% |

8,725 |

-57.6% |

-57.7% |

|

EBITDA (€m) |

-442 |

-2,095 |

-2,071 |

-1,282 |

-4,545 |

-4,554 |

|

Operating result (€m) |

-1,046 |

-1,955 |

-1,931 |

-3,414 |

-4,460 |

-4,470 |

|

Operating margin (%) |

-41.4% |

-53.4

pt |

-53.2 pt |

-39.1% |

-44.2

pt |

-44.2 pt |

|

Net income - Group part (€m) |

-1,665 |

-2,027 |

|

-6,078 |

-6,213 |

|

2019 results restated for LLP componentization

accounting change and EU passenger compensation reclassification

between revenues and external expenses

In the Third quarter 2020, the Air France-KLM

Group posted an operating result of -1,046 million euros, down by

1,955 million euros compared to last year.

Net income amounted to -1,665 million euros in

the Third quarter 2020, a decrease of 2,027 million euros compared

to last year, of which exceptional accounting items due to

Covid-19:

- Restructuring costs provision of-565 million euros with

Departure Plan of French Ground staff, contractual termination for

Air France flight attendants, complement for contractual

termination for Air France pilots, Departure Plan for Air

France-KLM International Commercial staff and Departure Plan for

HOP!

- Q4 2020 and Q1 2021 fuel over hedge has been recycled to “Other

financial income and expenses” for -39 million euros

- Fleet impairment on Airbus A380 and the Canadair Jet of HOP! At

-31 million euros

Currencies had a negative 92 million euro impact

on revenues and a positive 67 million euro effect on costs

including currency hedging in the Third quarter of 2020.

Since the beginning of the crisis, Air France,

KLM and Transavia proceeded 1.8 billion euros of refunds including

300 million euros of voucher issued.

The Third quarter 2020 unit cost

increased by 26.7%, primarily caused by Covid-19 related capacity

reductions

Group net employee costs were down 36% in the

Third quarter 2020 compared to last year, supported by partial

activity implementation at Air France and KLM, release of temporary

and hired staff and no profit sharing provisions to be made at both

airlines. The average number of FTEs (Full Time Equivalent) in the

Third quarter 2020 decreased by 5,500 compared to the Third quarter

2019, including 2,500 temporary contracts.

Net debt up 3.2 billion euros

|

|

Third quarter |

Nine months |

|

In € million |

2020 |

Change |

2020 |

Change |

|

Cash flow before change in WCR and Voluntary Departure Plans,

continuing operations (€m) |

-594 |

-2,115 |

-1,926 |

-4,950 |

|

Cash out related to Voluntary Departure Plans (€m) |

-137 |

-115 |

-152 |

-119 |

|

Change in Working Capital Requirement (WCR) (€m) |

124 |

+831 |

666 |

+582 |

|

Net cash flow from operating activities

(€m) |

-609 |

-1,399 |

-1,412 |

-4,487 |

|

Net investments* (€m) |

-362 |

+418 |

-1,473 |

+738 |

|

Operating free cash flow

(€m) |

-970 |

-981 |

-2,885 |

-3,749 |

|

Repayment of lease debt |

-251 |

-5 |

-662 |

+86 |

|

Adjusted operating free cash flow** |

-1,220 |

-985 |

-3,547 |

-3,663 |

* Sum of ‘Purchase of property, plant and equipment and

intangible assets’ and ‘Proceeds on disposal of property, plant and

equipment and intangible assets’ as presented in the consolidated

cash flow statement.

** The “Adjusted operating free cash flow” is

operating free cash flow after deducting the repayment of lease

debt.

The Group generated adjusted operating free cash

flow in the Third quarter 2020 of -1,220 million euros, a decrease

of 985 million euros compared to last year, mainly explained by an

operating cash flow decline of 1,399 million euros, partly offset

by a reduction in net investments of 418 million euros.

Postponement of social charges, taxes and

negotiation with suppliers compensated the refunds process and the

low inflow of bookings and generated an improvement of +582 million

euros in Change in Working Capital Requirement compared to last

year.

| In € million |

30 Sep 2020 |

31 Dec 2019 |

|

Net debt |

9,308 |

6 147 |

| EBITDA

trailing 12 months |

-417 |

4 128 |

|

Net debt/EBITDA trailing 12

months |

-22.3 x |

1,5 x |

Both airlines results negatively impacted in the Third

quarter 2020

|

|

Third quarter |

Nine months |

|

|

2020 |

Change |

2020 |

Change |

|

Air France Group Operating result (€m) |

-807 |

-1,200 |

-2,401 |

-2,699 |

|

Operating margin (%) |

-54.1% |

-62.6 pt |

-47.4% |

-49.8 pt |

|

KLM Group Operating result (€m) |

-234 |

-745 |

-1,002 |

-1,736 |

|

Operating margin (%) |

-20.5% |

-36.8 pt |

-25.2% |

-33.9 pt |

OUTLOOK

Air France-KLM Group continues to implement

highest safety standards for customers and employees to counter

virus transmission risks.

After the lockdown, the Group observed a

promising demand recovery trend until mid-August. Then, the

negative trend reversal for the Passenger activity led the airlines

of the Group to adjust downwards the capacity planned for the fall

and winter period.

There is limited visibility on the demand

recovery curve as customer booking behavior is much more short-term

oriented than before the Covid-19 crisis and also highly dependent

of the imposed travel restrictions, especially on the Long Haul

network. The period of lockdown starting today in France is a new

difficulty that will weigh on the Group's activities.In this

context the Group expects:

- Capacity in Available Seat kilometers circa index 45 for KLM

and inferior to index 35 for Air France in the Fourth quarter 2020

compared to 2019 for the Network passenger activity

- Negative load factor developments for the Fourth quarter 2020,

particularly on long-haul network, and negative yield mix effects

due to a delayed recovery in business

The Full year 2020 Network passenger activity will be inferior

to index 50 compared to 2019, due to the Covid-19 crisis.

The Group anticipates a challenging fourth

quarter 2020, with a substantial lower EBITDA compared to Q3

2020.

At 30 September 2020, the Group has 12.4 billion euros of

liquidity or credit lines at disposal.

The Group foresees important liquidity

requirements in the Fourth quarter 2020 with:

- Negative Fourth quarter working capital requirement influenced

by deferred payments and substantial lower level of new bookings

compared to Q4 2019.

- Capex spending at 0.6 billion euros, of which half is fleet

Capex fully financed. The Group has reduced to 2.1 billion euros

his 2020 capex guidance. This is a reduction of -1.5 billion euros

compared to the initial 2020 guidance of 3.6 billion euros.

- The hybrid bond was repaid in October for 0.4 billion

euros.

AIR FRANCE AND KLM HAVE AGREED ON SUSBTANTIAL

RESTRUCTURING PLAN WITH LABOUR REPRESENTATIVES

The Group’s strategic orientations defined

during the 2019 Investor day started to deliver results in 2019 and

in early 2020. However, the Covid-19 which began in the first

quarter of 2020 around the world is having an unprecedented impact

on the industry and the Group has immediately reacted with safety,

operational and cash protection measures.

The focus on reducing external expenses and the

number of employees were one of the top priorities. Futhermore, the

French and the Dutch governments have provided financial packages

and the partial activity implemented in France and the “NOW”

mechanism in Holland allowed the Group to further reduce labor

costs.

To weather the crisis and cope with the new

reality, Air France-KLM Group is accelerating its transformation

plans and presented a substantial restructuring plan around the

competitiveness and sustainability pillars. Negotiations with the

trade unions have resulted in several agreements in Air France and

KLM.

To better align the fleet with the lower

passenger demand, Air France-KLM Group has accelerated the

phase-out of the Airbus 380, Airbus 340, Boeing 747, Canadair Jet

and Embraer 145 aircraft. These decisions will bring forward cost

savings and efficiency gains due to operating fewer aircraft types.

The Group does not anticipate to return to the pre-crisis levels of

global demand before several years and the short-term recovery

expected has been delayed with the resurgence of Covid-19 end of

summer.

KLM business model is still both valid and

valuable but needs to be reshaped to the new reality. KLM will be

smaller, cheaper, more frugal, more agile and more

sustainable.Operating costs will structurally being reduced in 2021

and beyond, with 750 million euros benefits in 2021 coming from

labour, fleet, procurements and fuel costs decrease. KLM's

restructuring plan calls for a reduction of 5,000 FTEs end of 2020.

The plan submitted to Dutch Government early October complies with

state aid conditions.

Air France will enlarge and accelerate its

restructuring plan to build a post-crisis successful model on

several pillars to restructure the French domestic, optimize

external spendings, transform support functions, adapt the

opeartions to the new activity, modernize the fleet and regain

commercial success. This will bring 800 million euros structural

benefits by 2021 and 1.2 billion euros in total by 2022. Air

France’s restructuring plan calls for a reduction of 4,000 FTEs end

of 2020 and a total of 8,500 FTEs by 2022. The plan submitted to

French Government complies with state aid conditions. The long term

partial activity establishement is under discussion with

representative unions.

******

The results presentation is available at

www.airfranceklm.com on 30 October 2020 from 7:15

am CET.

A conference call hosted by Mr. Smith (CEO) and Mr. Gagey (CFO)

will be held on 30 October 2020 at 08.30

CET.

To connect to the conference call, please dial:

France: Local +33 (0)1 70 72 25 50Netherlands:

Local +31 (0) 20 703 8211UK: Local +44 (0)330 336 9125US: Local +1

720 543 0214

Confirmation code: 9700330

To listen to the audio-replay of the conference

call, please dial:

- France: Local +33 (0) 1 70 48 00 94

- Netherlands: Local +31 (0) 20 721 8903

- UK: Local +44 (0)207 660 0134

- US: Local +1 719-457-0820

Confirmation code: 9700330

Investor

Relations

PressOlivier

Gall

Wouter van

Beek

+33 1 49 89 52

59

+33 1 49 89 52

60

+33 1 41 56 56

00olgall@airfranceklm.com

Wouter-van.Beek@airfranceklm.com

Income Statement

|

|

Third quarter |

Nine months |

| €m |

2020 |

2019 |

Change |

2020 |

2019 |

Change |

|

Sales |

2,524 |

7,609 |

-66.8% |

8,725 |

20,572 |

-57.6% |

|

Other revenues |

0 |

0 |

nm |

0 |

0 |

nm |

|

Revenues |

2,524 |

7,609 |

-66.8% |

8,725 |

20,572 |

-57.6% |

| Aircraft

fuel |

-489 |

-1,513 |

-67.7% |

-1,886 |

-4,118 |

-54.2% |

|

Chartering costs |

-68 |

-138 |

-50.7% |

-181 |

-407 |

-55.5% |

| Landing

fees and en route charges |

-266 |

-531 |

-49.9% |

-743 |

-1,471 |

-49.5% |

|

Catering |

-58 |

-221 |

-73.8% |

-236 |

-617 |

-61.8% |

| Handling

charges and other operating costs |

-204 |

-453 |

-55.0% |

-646 |

-1,294 |

-50.1% |

| Aircraft

maintenance costs |

-331 |

-624 |

-47.0% |

-1,243 |

-1,920 |

-35.3% |

|

Commercial and distribution costs |

-61 |

-266 |

-77.1% |

-291 |

-783 |

-62.8% |

| Other

external expenses |

-263 |

-419 |

-37.2% |

-937 |

-1,292 |

-27.5% |

| Salaries

and related costs |

-1,293 |

-2,011 |

-35.7% |

-4,224 |

-6,031 |

-30.0% |

| Taxes

other than income taxes |

-28 |

-27 |

+3.7% |

-108 |

-119 |

-10.0% |

| Other

income and expenses |

95 |

247 |

-61.5% |

488 |

742 |

-34.3% |

|

EBITDA |

-442 |

1,653 |

nm |

-1,282 |

3,263 |

nm |

|

Amortization, depreciation and provisions |

-604 |

-744 |

-18.8% |

-2,132 |

-2,217 |

-3.8% |

|

Income from current operations |

-1,046 |

909 |

nm |

-3,414 |

1,046 |

nm |

| Sales of

aircraft equipment |

8 |

1 |

+700.0% |

31 |

24 |

+29.2% |

| Other

non-current income and expenses |

-597 |

-103 |

+479.9% |

-1,452 |

-133 |

+992% |

|

Income from operating activities |

-1,635 |

807 |

nm |

-4,835 |

937 |

nm |

| Cost of

financial debt |

-136 |

-111 |

+22.5% |

-350 |

-332 |

+5.4% |

| Income

from cash and cash equivalent |

5 |

14 |

-64.3% |

18 |

40 |

-55.0% |

|

Net cost of financial debt |

-131 |

-97 |

+35.1% |

-332 |

-292 |

+13.7% |

| Other

financial income and expenses |

111 |

-259 |

nm |

-621 |

-391 |

+58.8% |

|

Income before tax |

-1,655 |

451 |

nm |

-5,788 |

254 |

nm |

| Income

taxes |

12 |

-94 |

nm |

-242 |

-131 |

+84.7% |

|

Net income of consolidated companies |

-1,643 |

356 |

nm |

-6,030 |

123 |

nm |

| Share of

profits (losses) of associates |

-22 |

6 |

nm |

-52 |

14 |

nm |

|

Net income for the period |

-1,665 |

363 |

nm |

-6,082 |

137 |

nm |

| Minority

interest |

0 |

1 |

nm |

-4 |

2 |

nm |

|

Net income for the period – Group part |

-1,665 |

362 |

nm |

-6,078 |

135 |

nm |

2019 results restated (with a similar impact in both years) for

limited life parts componentization accounting change.

Consolidated Balance Sheet

| Assets |

30 Sep 2020 |

31 Dec 2019 |

| €m |

|

Goodwill |

216 |

217 |

|

Intangible assets |

1,253 |

1,305 |

| Flight

equipment |

11,009 |

11,334 |

| Other

property, plant and equipment |

1,535 |

1,580 |

|

Right-of-use assets |

4,789 |

5,173 |

|

Investments in equity associates |

224 |

307 |

| Pension

assets |

96 |

420 |

| Other

financial assets |

1,004 |

1,096 |

| Deferred

tax assets |

271 |

523 |

| Other

non-current assets |

176 |

241 |

|

Total non-current assets |

20,573 |

22,196 |

| Other

short-term financial assets |

443 |

800 |

|

Inventories |

561 |

737 |

| Trade

receivables |

1,208 |

2,164 |

| Other

current assets |

883 |

1,123 |

| Cash and

cash equivalents |

5,917 |

3,715 |

|

Total current assets |

9,012 |

8,539 |

|

Total assets |

29,585 |

30,735 |

| Liabilities and

equity |

30 Sep 2020 |

31 Dec 2019 |

| In million euros |

|

Issued capital |

429 |

429 |

|

Additional paid-in capital |

4,139 |

4,139 |

| Treasury

shares |

-67 |

-67 |

|

Perpetual |

0 |

403 |

| Reserves

and retained earnings |

-9,183 |

-2,620 |

|

Equity attributable to equity holders of Air

France-KLM |

-4,682 |

2,284 |

|

Non-controlling interests |

9 |

15 |

|

Total Equity |

-4,673 |

2,299 |

| Pension

provisions |

2,123 |

2,253 |

| Return

obligation liability and other provisions |

3,712 |

3,750 |

|

Financial debt |

10,814 |

6,271 |

| Lease

debt |

2,634 |

3,149 |

| Deferred

tax liabilities |

5 |

142 |

| Other

non-current liabilities |

532 |

222 |

|

Total non-current liabilities |

19,820 |

15,787 |

| Return

obligation liability and other provisions |

1,573 |

714 |

| Current

portion of financial debt |

2,179 |

842 |

| Current

portion of lease debt |

961 |

971 |

| Trade

payables |

1,555 |

2,379 |

| Deferred

revenue on ticket sales |

2,794 |

3,289 |

| Frequent

flyer program |

913 |

848 |

| Other

current liabilities |

4,462 |

3,602 |

| Bank

overdrafts |

1 |

4 |

|

Total current liabilities |

14,438 |

12,649 |

|

Total equity and liabilities |

29,585 |

30,735 |

Statement of Consolidated Cash Flows

from 1st Jan until 30 Sept 2020

| €m |

30 Sep 2020 |

30 Sep 2019 |

|

Net income from continuing operations |

-6,082 |

137 |

|

Amortization, depreciation and operating provisions |

2,132 |

2,217 |

|

Financial provisions |

135 |

162 |

| Loss

(gain) on disposals of tangible and intangible assets |

-43 |

-34 |

| Loss

(gain)on disposals of subsidiaries and associates |

1 |

0 |

|

Derivatives – non monetary result |

70 |

15 |

|

Unrealized foreign exchange gains and losses, net |

-83 |

223 |

|

Impairment |

670 |

0 |

| Other

non-monetary items |

761 |

218 |

| Share of

(profits) losses of associates |

52 |

-14 |

|

Deferred taxes |

309 |

67 |

|

Financial Capacity |

-2,078 |

2,991 |

|

(Increase) / decrease in inventories |

134 |

-83 |

|

(Increase) / decrease in trade receivables |

823 |

-147 |

| Increase

/ (decrease) in trade payables |

-792 |

41 |

| Increase

/ (decrease) in advanced ticket sales |

-435 |

327 |

| Change

in other receivables and payables |

936 |

-54 |

|

Change in working capital requirements |

666 |

84 |

|

Net cash flow from operating activities |

-1,412 |

3,075 |

| Purchase

of property, plant and equipment and intangible assets |

-1,654 |

-2,295 |

| Proceeds

on disposal of property, plant and equipment and intangible

assets |

181 |

84 |

| Proceeds

on disposal of subsidiaries, of shares in non-controlled

entities |

357 |

8 |

|

Acquisition of subsidiaries, of shares in non-controlled

entities |

-1 |

-1 |

|

Dividends received |

0 |

10 |

| Decrease

(increase) in net investments, more than 3 months |

-9 |

-9 |

|

Net cash flow used in investing activities |

-1,126 |

-2,203 |

| Increase

of equity due to new convertible bond |

0 |

54 |

|

Perpetual (including premium) |

0 |

0 |

| Issuance

of debt |

7,598 |

904 |

|

Repayment on financial debt |

-2,202 |

-560 |

| Payments

on lease debt |

-662 |

-748 |

| Decrease

(increase ) in loans, net |

48 |

-17 |

|

Dividends and coupons on perpetual paid |

0 |

-1 |

|

Net cash flow from financing activities |

4,782 |

-368 |

| Effect

of exchange rate on cash and cash equivalents and bank

overdrafts |

-39 |

9 |

|

Change in cash and cash equivalents and bank

overdrafts |

2,205 |

513 |

| Cash and

cash equivalents and bank overdrafts at beginning of period |

3,711 |

3,580 |

| Cash and

cash equivalents and bank overdrafts at end of period |

5,916 |

4,093 |

|

Change in treasury of discontinued operations |

0 |

0 |

Key Performance Indicators

Restated net result, group

share

| |

Third quarter |

Nine months |

| In million euros |

2020 |

2019 |

2020 |

2019 |

|

Net income/(loss), Group share |

-1,665 |

361 |

-6,078 |

135 |

|

Unrealized foreign exchange gains and losses, net |

-152 |

167 |

-78 |

223 |

| Change

in fair value of financial assets and liabilities

(derivatives) |

-154 |

11 |

70 |

-9 |

|

Non-current income and expenses |

591 |

102 |

1,421 |

109 |

| Tax

impact on gross adjustments net result |

-84 |

0 |

-401 |

-13 |

|

Restated net income/(loss), group part |

-1,464 |

642 |

-5,066 |

445 |

| Coupons

on perpetual |

0 |

-4 |

0 |

-12 |

|

Restated net income/(loss), group share including coupons

on perpetual (used to calculate earnings per share) |

-1,464 |

638 |

-5,066 |

433 |

|

Restated net income/(loss) per share (in €) |

-3.42 |

1.49 |

-11.85 |

1.01 |

Return on capital employed (ROCE)1

| In million euros |

30 Sep 2020 |

30 June 2020 |

31 Mar 2020 |

31 Dec 2019 |

30 Sep 2019 |

30 June 2019 |

31 Mar 2019 |

31 Dec 2018 |

|

Goodwill and intangible assets |

1,470 |

1,500 |

1,564 |

1,522 |

1,481 |

1,465 |

1,485 |

1,411 |

| Flight

equipment |

11,009 |

10,919 |

11,465 |

11,334 |

10,829 |

10,747 |

10,456 |

10,308 |

| Other

property, plant and equipment |

1,535 |

1,551 |

1,579 |

1,580 |

1,554 |

1,530 |

1,504 |

1,503 |

| Right of

use assets |

4,789 |

4,938 |

5,119 |

5,173 |

5,300 |

5,470 |

5,453 |

5,664 |

|

Investments in equity associates |

224 |

267 |

299 |

307 |

310 |

305 |

306 |

311 |

|

Financial assets excluding marketable securities and financial

deposits |

135 |

133 |

142 |

140 |

131 |

125 |

127 |

125 |

|

Provisions, excluding pension, cargo litigation and

restructuring |

-4,001 |

-4,130 |

-4,190 |

-4,058 |

-4,101 |

-3,888 |

-3,907 |

-3,760 |

| WCR,

excluding market value of derivatives |

-6,894 |

-6,779 |

-6,650 |

-6,310 |

-6,285 |

-6,957 |

-6,938 |

-6,133 |

|

Capital employed |

8,267 |

8,399 |

9,328 |

9,688 |

9,219 |

8,797 |

8,486 |

9,429 |

|

Average capital employed (A) |

8,921 |

8,983 |

| Adjusted

results from current operations |

-3,320 |

1,099 |

| -

Dividends received |

-1 |

-2 |

| - Share

of profits (losses) of associates |

-44 |

23 |

| -

Normative income tax |

1,045 |

-305 |

|

Adjusted result from current operations after tax

(B) |

-2,320 |

815 |

|

ROCE, trailing 12 months (B/A) |

-26.0% |

9.1% |

Net debt

| |

Balance sheet at |

| €m |

30 Sep 2020 |

31 Dec 2019 |

|

Financial debt |

12,768 |

6,886 |

| Lease

debt |

3,511 |

4,029 |

| Currency

hedge on financial debt |

9 |

4 |

| Accrued

interest |

-108 |

-62 |

|

Gross financial debt (A) |

16,180 |

10,857 |

| Cash and

cash equivalents |

5,917 |

3,715 |

|

Marketable securities |

109 |

111 |

| Cash

securities |

309 |

300 |

| Deposits

(bonds) |

535 |

585 |

| Bank

overdrafts |

-1 |

-4 |

|

Others |

3 |

3 |

|

Net cash (B) |

6,872 |

4,710 |

|

Net debt (A) – (B) |

9,308 |

6,147 |

Adjusted operating free cash

flow

| |

Third quarter |

Nine months |

| €m |

2020 |

2019 |

2020 |

2019 |

|

Net cash flow from operating activities, continued operations |

-609 |

792 |

-1,412 |

3,075 |

|

Investment in property, plant, equipment and intangible assets |

-370 |

-788 |

-1,654 |

-2,295 |

| Proceeds

on disposal of property, plant, equipment and intangible

assets |

9 |

8 |

181 |

84 |

|

Operating free cash flow |

-970 |

12 |

-2,885 |

864 |

|

Payments on lease debt |

-251 |

-246 |

-662 |

-748 |

|

Adjusted operating free cash flow |

-1,220 |

-234 |

-3,547 |

116 |

Operating cash burn

| |

Third quarter |

Nine months |

| |

2020 |

2019 |

2020 |

2019 |

|

EBITDA |

-442 |

1,653 |

-1,282 |

3,263 |

|

Provisions (CO2 and other) |

7 |

14 |

-26 |

8 |

|

Correction of spare parts inventory |

2 |

-2 |

2 |

0 |

|

Addition to pension provisions |

78 |

68 |

232 |

201 |

|

Reversal to pension provisions (cash-out) |

-47 |

-49 |

-142 |

-145 |

|

Payment linked with shares |

0 |

1 |

-2 |

1 |

|

Sales of tangible and intangible assets (excluding

aeronauticals) |

-1 |

6 |

40 |

48 |

|

Income from operation activities - cash

impact |

-402 |

1,690 |

-1,177 |

3,376 |

|

Restructuring costs |

-137 |

-4 |

-152 |

-15 |

|

Other non-current income and expenses |

0 |

2 |

-1 |

2 |

|

Cost of financial debt |

-118 |

-107 |

-318 |

-319 |

|

Financial income |

0 |

7 |

2 |

21 |

|

Realized foreign exchanges gain/loss |

29 |

-24 |

28 |

-9 |

|

Termination of trading hedges - cash |

-177 |

0 |

-499 |

0 |

|

Current income tax |

77 |

-62 |

67 |

-64 |

|

Other financial charges & expenses - cash |

1 |

-2 |

-25 |

-6 |

|

Other elements |

-3 |

-2 |

-2 |

5 |

|

|

|

|

|

|

|

Financial capacity |

-732 |

1,499 |

-2,078 |

2,991 |

Unit cost: net cost per ASK

| |

Third quarter |

Nine months |

| |

2020 |

2019 |

2020 |

2019 |

|

Revenues (in €m) |

2,524 |

7,609 |

8,725 |

20,572 |

|

Income/(loss) from current operations (in €m) -/- |

1,046 |

-909 |

3,414 |

-1,046 |

| Total

operating expense (in €m) |

3,570 |

6,700 |

12,139 |

19,526 |

| Passenger

network business – other revenues (in €m) |

-64 |

-163 |

-241 |

-534 |

| Cargo

network business – other revenues (in €m) |

-84 |

-77 |

-226 |

-231 |

|

Third-party revenues in the maintenance business (in €m) |

-247 |

-543 |

-963 |

-1,623 |

| Transavia

- other revenues (in €m) |

1 |

17 |

-13 |

16 |

|

Third-party revenues of other businesses (in €m) |

-10 |

-10 |

-21 |

-26 |

|

Net cost (in €m) |

3,166 |

5,924 |

10,675 |

17,128 |

|

Capacity produced, reported in ASK* |

38,109 |

90,317 |

114,446 |

251,110 |

|

Net cost per ASK (in € cents per ASK) |

8.31 |

6.56 |

9.33 |

6.82 |

|

Gross change |

|

26.7% |

|

36.7% |

|

Currency effect on net costs (in €m) |

|

60 |

|

19 |

|

Change at constant currency |

|

25.4% |

|

36.6% |

|

Capacity effect on net cost |

|

-3,393 |

|

-9,345 |

|

Fuel price effect (in €m) |

|

-179 |

|

-162 |

|

Net cost per ASK on a constant currency and fuel price

basis (in € cents per ASK) |

8.31 |

6.01 |

9.33 |

6.64 |

|

Change at constant currency and fuel price

basis |

|

+38.2% |

|

+40.4% |

* The capacity produced by the transportation activities is

combined by adding the capacity of the Passenger network (in ASK)

to that of Transavia (in ASK).

Group resultsAir France

Group

| |

Third quarter |

Nine months |

| |

2020 |

Change |

2020 |

Change |

|

Revenue (in €m) |

1,492 |

-67.5% |

5,066 |

-59.6% |

| EBITDA

(in €m) |

-461 |

-1,321 |

-1,095 |

-2,801 |

|

Operating result (en m€) |

-807 |

-1,200 |

-2,401 |

-2,699 |

|

Operating margin (%) |

-54.1% |

-62.6 pt |

-47.4% |

-49.8 pt |

|

Operating cash flow before WCR and restructuring cash out (in

€m) |

-608 |

-1,421 |

-1,519 |

-3,129 |

|

Operating cash flow (before WCR and restructuring) margin |

-40.7% |

-58.5 pt |

-30.0% |

-42.8 pt |

| KLM

Group |

Third quarter |

Nine months |

| |

2020 |

Change |

2020 |

Change |

|

Revenue (in €m) |

1,144 |

-63.5% |

3,984 |

-52.5% |

| EBITDA

(in €m) |

25 |

-763 |

-176 |

-1,713 |

|

Operating result (en m€) |

-234 |

-745 |

-1,002 |

-1,736 |

|

Operating margin (%) |

-20.5% |

-36.8 pt |

-25.2% |

-33.9 pt |

|

Operating cash flow before WCR and restructuring cash out (in

€m) |

13 |

-671 |

-355 |

-1,736 |

|

Operating cash flow (before WCR and restructuring) margin |

1.1% |

-20.7 pt |

-8.9% |

-25.4 pt |

NB: Sum of individual airline results does not add up to Air

France-KLM total due to intercompany eliminations at Group

level

Group fleet at 30 Sept 2020

|

Aircraft type |

AF (incl. HOP) |

KL (incl. KLC & MP) |

Transavia |

Owned |

Finance lease |

Operating lease |

Total |

In operation |

Change / 31/12/19 |

|

B747-400 |

|

4 |

|

4 |

|

|

4 |

3 |

-5 |

|

B777-300 |

43 |

14 |

|

18 |

17 |

22 |

57 |

57 |

|

|

B777-200 |

25 |

15 |

|

26 |

|

14 |

40 |

40 |

|

|

B787-9 |

10 |

13 |

|

7 |

4 |

12 |

23 |

23 |

1 |

|

B787-10 |

|

5 |

|

3 |

2 |

|

5 |

5 |

1 |

|

A380-800 |

9 |

|

|

2 |

3 |

4 |

9 |

|

-10 |

|

A350-900 |

6 |

|

|

1 |

5 |

|

6 |

6 |

3 |

|

A340-300 |

3 |

|

|

3 |

|

|

3 |

|

-4 |

|

A330-300 |

|

5 |

|

|

|

5 |

5 |

5 |

|

|

A330-200 |

15 |

8 |

|

11 |

|

12 |

23 |

22 |

-1 |

|

Total Long-Haul |

111 |

64 |

0 |

75 |

31 |

69 |

175 |

161 |

-15 |

|

B737-900 |

|

5 |

|

3 |

|

2 |

5 |

5 |

|

|

B737-800 |

|

31 |

75 |

29 |

10 |

67 |

106 |

106 |

2 |

|

B737-700 |

|

16 |

7 |

3 |

5 |

15 |

23 |

23 |

|

|

A321 |

20 |

|

|

11 |

|

9 |

20 |

20 |

|

|

A320 |

44 |

|

|

3 |

5 |

36 |

44 |

43 |

|

|

A319 |

33 |

|

|

14 |

|

19 |

33 |

33 |

|

|

A318 |

18 |

|

|

8 |

|

10 |

18 |

18 |

|

|

Total Medium-Haul |

115 |

52 |

82 |

71 |

20 |

158 |

249 |

248 |

2 |

|

ATR72-600 |

|

|

|

|

|

|

|

|

-2 |

|

ATR72-500 |

|

|

|

|

|

|

|

|

|

|

ATR42-500 |

|

|

|

|

|

|

|

|

|

| Canadair

Jet 1000 |

14 |

|

|

14 |

|

|

14 |

14 |

|

| Canadair

Jet 700 |

11 |

|

|

11 |

|

|

11 |

10 |

|

| Embraer

190 |

17 |

32 |

|

11 |

10 |

28 |

49 |

48 |

1 |

| Embraer

175 |

|

17 |

|

3 |

14 |

|

17 |

17 |

|

| Embraer

170 |

15 |

|

|

10 |

|

5 |

15 |

15 |

|

| Embraer

145 |

15 |

|

|

15 |

|

|

15 |

|

-13 |

|

Total Regional |

72 |

49 |

0 |

64 |

24 |

33 |

121 |

104 |

-14 |

|

B747-400ERF |

|

3 |

|

3 |

|

|

3 |

3 |

|

|

B747-400BCF |

|

1 |

|

1 |

|

|

1 |

1 |

|

|

B777-F |

2 |

|

|

2 |

|

|

2 |

2 |

|

|

Total Cargo |

2 |

4 |

0 |

6 |

0 |

0 |

6 |

6 |

0 |

|

|

|

|

|

|

|

|

|

|

|

|

Total |

300 |

169 |

82 |

216 |

75 |

260 |

551 |

519 |

-27 |

THIRD QUARTER 2020 TRAFFIC

Passenger network activity*

|

|

|

Q3 |

|

|

Year to date |

|

Total Passenger network* |

2020 |

2019 |

Variation |

|

2020 |

2019 |

Variation |

|

Passengers carried (‘000s) |

6,782 |

23,631 |

(71.3%) |

|

23,671 |

66,286 |

(64.3%) |

|

Revenue pax-kilometers (m RPK) |

13,752 |

71,323 |

(80.7%) |

|

66,861 |

198,566 |

(66.3%) |

|

Available seat-kilometers (m ASK) |

32,100 |

79,457 |

(59.6%) |

|

103,267 |

224,902 |

(54.1%) |

|

Load factor (%) |

42.8% |

89.8% |

(46.9) |

|

64.7% |

88.3% |

(23.5) |

|

|

|

|

|

|

|

|

|

|

Long-haul |

|

|

|

|

|

|

|

|

Passengers carried (‘000s) |

1,219 |

7,660 |

(84.1%) |

|

7,072 |

21,288 |

(66.8%) |

|

Revenue pax-kilometers (m RPK) |

8,705 |

57,382 |

(84.8%) |

|

52,783 |

160,536 |

(67.1%) |

|

Available seat-kilometers (m ASK) |

23,987 |

63,392 |

(62.2%) |

|

82,837 |

180,125 |

(54.0%) |

|

Load factor (%) |

36.3% |

90.5% |

(54.2) |

|

63.7% |

89.1% |

(25.4) |

|

|

|

|

|

|

|

|

|

|

North America |

|

|

|

|

|

|

|

|

Passengers carried (‘000s) |

284 |

2,630 |

(89.2%) |

|

1,870 |

6,686 |

(72.0%) |

|

Revenue pax-kilometers (m RPK) |

2,063 |

18,608 |

(88.9%) |

|

13,397 |

47,494 |

(71.8%) |

|

Available seat-kilometers (m ASK) |

7,597 |

20,456 |

(62.9%) |

|

23,409 |

53,116 |

(55.9%) |

|

Load factor (%) |

27.2% |

91.0% |

(63.8) |

|

57.2% |

89.4% |

(32.2) |

|

|

|

|

|

|

|

|

|

|

Latin America |

|

|

|

|

|

|

|

|

Passengers carried (‘000s) |

96 |

934 |

(89.7%) |

|

969 |

2,729 |

(64.5%) |

|

Revenue pax-kilometers (m RPK) |

942 |

8,900 |

(89.4%) |

|

9,177 |

25,973 |

(64.7%) |

|

Available seat-kilometers (m ASK) |

3,177 |

9,800 |

(67.6%) |

|

13,524 |

28,975 |

(53.3%) |

|

Load factor (%) |

29.6% |

90.8% |

(61.2) |

|

67.9% |

89.6% |

(21.8) |

|

|

|

|

|

|

|

|

|

|

Asia / Pacific |

|

|

|

|

|

|

|

|

Passengers carried (‘000s) |

173 |

1,723 |

(90.0%) |

|

1,361 |

4,969 |

(72.6%) |

|

Revenue pax-kilometers (m RPK) |

1,526 |

15,066 |

(89.9%) |

|

11,803 |

43,399 |

(72.8%) |

|

Available seat-kilometers (m ASK) |

6,037 |

16,453 |

(63.3%) |

|

20,702 |

47,734 |

(56.6%) |

|

Load factor (%) |

25.3% |

91.6% |

(66.3) |

|

57.0% |

90.9% |

(33.9) |

|

|

|

|

|

|

|

|

|

|

Africa / Middle East |

|

|

|

|

|

|

|

|

Passengers carried (‘000s) |

328 |

1,453 |

(77.4%) |

|

1,563 |

4,089 |

(61.8%) |

|

Revenue pax-kilometers (m RPK) |

1,674 |

8,164 |

(79.5%) |

|

8,825 |

23,117 |

(61.8%) |

|

Available seat-kilometers (m ASK) |

3,188 |

9,284 |

(65.7%) |

|

12,337 |

27,360 |

(54.9%) |

|

Load factor (%) |

52.5% |

87.9% |

(35.4) |

|

71.5% |

84.5% |

(13.0) |

|

|

|

|

|

|

|

|

|

|

Caribbean / Indian Ocean |

|

|

|

|

|

|

|

|

Passengers carried (‘000s) |

337 |

919 |

(63.3%) |

|

1,309 |

2,815 |

(53.5%) |

|

Revenue pax-kilometers (m RPK) |

2,500 |

6,645 |

(62.4%) |

|

9,580 |

20,553 |

(53.4%) |

|

Available seat-kilometers (m ASK) |

3,988 |

7,398 |

(46.1%) |

|

12,864 |

22,941 |

(43.9%) |

|

Load factor (%) |

62.7% |

89.8% |

(27.1) |

|

74.5% |

89.6% |

(15.1) |

|

|

|

|

|

|

|

|

|

|

Short and Medium-haul |

|

|

|

|

|

|

|

|

Passengers carried (‘000s) |

5,563 |

15,972 |

(65.2%) |

|

16,600 |

44,998 |

(63.1%) |

|

Revenue pax-kilometers (m RPK) |

5,047 |

13,941 |

(63.8%) |

|

14,079 |

38,030 |

(63.0%) |

|

Available seat-kilometers (m ASK) |

8,113 |

16,066 |

(49.5%) |

|

20,430 |

44,776 |

(54.4%) |

|

Load factor (%) |

62.2% |

86.8% |

(24.6) |

|

68.9% |

84.9% |

(16.0) |

* Air France and KLM

Transavia

activity

|

|

|

Q3 |

|

|

Year to date |

|

Transavia |

2020 |

2019 |

Variation |

|

2020 |

2019 |

Variation |

|

Passengers carried (‘000s) |

2,014 |

5,492 |

(63.3%) |

|

4,453 |

13,315 |

(66.6%) |

|

Revenue pax-kilometers (m RPK) |

3,869 |

10,117 |

(61.8%) |

|

8,505 |

24,239 |

(64.9%) |

|

Available seat-kilometers (m ASK) |

6,009 |

10,874 |

(44.7%) |

|

11,178 |

26,227 |

(57.4%) |

|

Load factor (%) |

64.4% |

93.0% |

(28.7) |

|

76.1% |

92.4% |

(16.3) |

Total group passenger

activity**

|

|

|

Q3 |

|

|

Year to date |

|

Total group** |

2020 |

2019 |

Variation |

|

2020 |

2019 |

Variation |

|

Passengers carried (‘000s) |

8,796 |

29,123 |

(69.8%) |

|

28,124 |

79,601 |

(64.7%) |

|

Revenue pax-kilometers (m RPK) |

17,621 |

81,440 |

(78.4%) |

|

75,367 |

222,805 |

(66.2%) |

|

Available seat-kilometers (m ASK) |

38,109 |

90,331 |

(57.8%) |

|

114,446 |

251,129 |

(54.4%) |

|

Load factor (%) |

46.2% |

90.2% |

(43.9) |

|

65.9% |

88.7% |

(22.9) |

** Air France, KLM and Transavia

Cargo activity

|

|

|

Q3 |

|

|

Year to date |

|

Total Group |

2020 |

2019 |

Variation |

|

2020 |

2019 |

Variation |

|

Revenue tonne-km (m RTK) |

1,735 |

2,091 |

(17.0%) |

|

4,747 |

6,260 |

(24.2%) |

|

Available tonne-km (m ATK) |

2,537 |

3,804 |

(33.3%) |

|

7,309 |

10,896 |

(32.9%) |

|

Load factor (%) |

68.4% |

55.0% |

13.4 |

|

64.9% |

57.4% |

7.5 |

Air France activity

|

|

|

Q3 |

|

|

Year to date |

|

Total Passenger network activity |

2020 |

2019 |

Variation |

|

2020 |

2019 |

Variation |

|

Passengers carried (‘000s) |

4,487 |

14,168 |

(68.3%) |

|

14,635 |

39,844 |

(63.3%) |

|

Revenue pax-kilometers (m RPK) |

8,538 |

42,184 |

(79.8%) |

|

39,394 |

116,449 |

(66.2%) |

|

Available seat-kilometers (m ASK) |

16,589 |

47,464 |

(65.0%) |

|

56,909 |

133,309 |

(57.3%) |

|

Load factor (%) |

51.5% |

88.9% |

(37.4) |

|

69.2% |

87.4% |

(18.1) |

|

Long-haul |

|

|

|

|

|

|

|

|

Passengers carried (‘000s) |

782 |

4,632 |

(83.1%) |

|

4,243 |

12,723 |

(66.7%) |

|

Revenue pax-kilometers (m RPK) |

5,242 |

33,849 |

(84.5%) |

|

30,669 |

93,664 |

(67.3%) |

|

Available seat-kilometers (m ASK) |

11,526 |

37,664 |

(69.4%) |

|

44,431 |

105,944 |

(58.1%) |

|

Load factor (%) |

45.5% |

89.9% |

(44.4) |

|

69.0% |

88.4% |

(19.4) |

|

Short and Medium-haul |

|

|

|

|

|

|

|

|

Passengers carried (‘000s) |

3,704 |

9,536 |

(61.2%) |

|

10,393 |

27,121 |

(61.7%) |

|

Revenue pax-kilometers (m RPK) |

3,296 |

8,335 |

(60.5%) |

|

8,725 |

22,785 |

(61.7%) |

|

Available seat-kilometers (m ASK) |

5,063 |

9,800 |

(48.3%) |

|

12,477 |

27,365 |

(54.4%) |

|

Load factor (%) |

65.1% |

85.1% |

(20.0) |

|

69.9% |

83.3% |

(13.3) |

|

|

|

Q3 |

|

|

Year to date |

|

Cargo activity |

2020 |

2019 |

Variation |

|

2020 |

2019 |

Variation |

|

Revenue tonne-km (m RTK) |

605 |

927 |

(34.7%) |

|

1,802 |

2,794 |

(35.5%) |

|

Available tonne-km (m ATK) |

1,139 |

1,946 |

(41.4%) |

|

3,390 |

5,489 |

(38.2%) |

|

Load factor (%) |

53.1% |

47.7% |

5.5 |

|

53.2% |

50.9% |

2.2 |

KLM activity

|

|

|

Q3 |

|

|

Year to date |

|

Total Passenger network activity |

2020 |

2019 |

Variation |

|

2020 |

2019 |

Variation |

|

Passengers carried (‘000s) |

2,295 |

9,464 |

(75.7%) |

|

9,036 |

26,442 |

(65.8%) |

|

Revenue pax-kilometers (m RPK) |

5,214 |

29,138 |

(82.1%) |

|

27,468 |

82,117 |

(66.6%) |

|

Available seat-kilometers (m ASK) |

15,511 |

31,993 |

(51.5%) |

|

46,359 |

91,593 |

(49.4%) |

|

Load factor (%) |

33.6% |

91.1% |

(57.5) |

|

59.3% |

89.7% |

(30.4) |

|

Long-haul |

|

|

|

|

|

|

|

|

Passengers carried (‘000s) |

436 |

3,028 |

(85.6%) |

|

2,829 |

8,566 |

(67.0%) |

|

Revenue pax-kilometers (m RPK) |

3,462 |

23,533 |

(85.3%) |

|

22,114 |

66,871 |

(66.9%) |

|

Available seat-kilometers (m ASK) |

12,461 |

25,728 |

(51.6%) |

|

38,406 |

74,182 |

(48.2%) |

|

Load factor (%) |

27.8% |

91.5% |

(63.7) |

|

57.6% |

90.1% |

(32.6) |

|

Short and Medium-haul |

|

|

|

|

|

|

|

|

Passengers carried (‘000s) |

1,859 |

6,436 |

(71.1%) |

|

6,207 |

17,876 |

(65.3%) |

|

Revenue pax-kilometers (m RPK) |

1,752 |

5,605 |

(68.7%) |

|

5,353 |

15,246 |

(64.9%) |

|

Available seat-kilometers (m ASK) |

3,050 |

6,266 |

(51.3%) |

|

7,953 |

17,411 |

(54.3%) |

|

Load factor (%) |

57.4% |

89.5% |

(32.0) |

|

67.3% |

87.6% |

(20.2) |

|

|

|

Q3 |

|

|

Year to date |

|

Cargo activity |

2020 |

2019 |

Variation |

|

2020 |

2019 |

Variation |

|

Revenue tonne-km (m RTK) |

1,127 |

1,164 |

(3.2%) |

|

2,942 |

3,466 |

(15.1%) |

|

Available tonne-km (m ATK) |

1,398 |

1,858 |

(24.8%) |

|

3,919 |

5,407 |

(27.5%) |

|

Load factor (%) |

80.6% |

62.6% |

18.0 |

|

75.1% |

64.1% |

11.0 |

1 Passenger unit revenue is the aggregate of Passenger network

and Transavia unit revenues, change at constant currency

1 The definition of ROCE has been revised to

take into account the seasonal effects of the activity.

- Q3_2020 Press release EN final

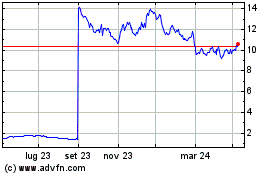

Grafico Azioni Air FranceKLM (EU:AF)

Storico

Da Mar 2024 a Apr 2024

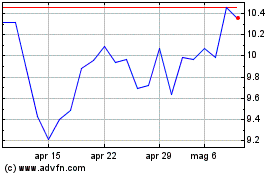

Grafico Azioni Air FranceKLM (EU:AF)

Storico

Da Apr 2023 a Apr 2024