ASML Raises 2021 Outlook as Chip Shortage Boosts Demand -- Update

21 Aprile 2021 - 1:23PM

Dow Jones News

--ASML said first-quarter sales benefited from customers' plans

to accelerate output

--Company helped chip makers to upgrade their machines to

increase productivity

--CEO expects short-term surge in demand to taper off next

year

By Adria Calatayud

ASML Holding NV on Wednesday raised its revenue guidance for

2021 citing a significant increase in demand, as semiconductor

makers worldwide look to increase production to address a global

chip shortage.

The Dutch company, which supplies equipment to the world's

largest chip makers, said it received a boost from the

semiconductor shortage in the first quarter as customers sought to

upgrade their machines to enhance productivity. As a result, ASML's

net profit soared and sales were ahead of the company's

forecasts.

Analysts say ASML stands to gain further as chip makers

accelerate their spending plans to strengthen production capacity

amid a chip shortage that has slowed production at car makers and

electronics companies around the world.

"We have seen a significant spurt in terms of customer demand,"

ASML President and Chief Executive Peter Wennink said.

ASML now expects revenue growth to be toward 30% this year

compared with its previous guidance of double-digit sales growth.

Based on divisional guidance, analysts had estimated that ASML's

previous revenue expectations implied a 12% rise.

The Dutch maker of semiconductor equipment made a net profit for

the first quarter of 1.33 billion euros ($1.60 billion) compared

with EUR390.6 million for the same period last year.

Quarterly net sales increased to EUR4.36 billion from EUR2.44

billion a year before, with a gross margin of 53.9%.

The company had guided for first-quarter net sales of between

EUR3.9 billion and EUR4.1 billion, and for a gross margin of

between 50% and 51%.

Mr. Wennink said the company benefited from higher-than-expected

revenue from its installed-base business on the back of software

upgrades in installed machines. Revenue from software upgrades

carries a higher margin, he noted.

Order intake for the quarter came in at EUR4.7 billion, with

orders worth EUR2.3 billion for ASML's most advanced technology,

called extreme ultraviolet or EUV.

For the second quarter, ASML expects revenue to be between

EUR4.0 billion and EUR4.1 billion with a gross margin around

49%.

Mr. Wennink said the company's second-quarter performance will

be held back by software upgrades that were brought forward to the

first quarter and revenue recognition that will be booked in the

third.

To accelerate chip production, customers have asked ASML to skip

machine factory-acceptance tests in the Netherlands and ship the

units directly to the customers to do tests at their facilities,

which saves a couple of weeks, Mr. Wennink added.

The current surge in demand is being driven by last year's

caution regarding Covid-19 and should subside in 2022, Mr. Wennink

said. However, there is a secular demand driver linked to

innovations like 5G, artificial intelligence and high-performance

computing that will be there for years to come, he added.

The company said it is planning to increase production of EUV

tools to 55 systems next year, but that it is limited by supply

constraints for this year.

ASML also said it expects an early completion of its EUR6

billion share-buyback program launched in January 2020, as its

expected cash generation will enable significant share repurchases

in the coming quarters.

Shares at 1026 GMT were up 4.4% at EUR534.50 pence.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

April 21, 2021 07:08 ET (11:08 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

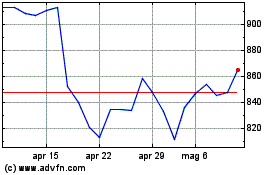

Grafico Azioni ASML Holding NV (EU:ASML)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni ASML Holding NV (EU:ASML)

Storico

Da Apr 2023 a Apr 2024