TIDMASC

RNS Number : 4628L

ASOS PLC

13 January 2021

13 January 2021

ASOS plc ("the Company")

Trading Statement for the four months ended 31 December 2020

ASOS delivers strong peak trading performance

ASOS today announces trading for the four months to 31(st)

December 2020 ("P1"). Revenue growth in the period surpassed our

expectations, driven by investment in product, pricing and

marketing and stronger than anticipated consumer demand for our

products. Our multi-brand model and strong execution enabled us to

capture available demand as consumers increasingly shopped

online.

Our performance in P1 also benefited from the resumption of

lower returns rates driven by renewed social restrictions in the

period. With restrictions likely to be in place for the balance of

the first half we expect a net COVID PBT benefit(1) of at least

GBP40m in H1.

Whilst our outlook for the balance of the year remains

unchanged, given the ongoing virus and the likely economic impact

on our core 20-something consumer, the strength of our performance

in P1 with the anticipated H1 COVID PBT benefit, means we now

expect FY21 PBT to be at the top end of current market

expectations(2) .

Four months to 31 December

Reported CCY(4)

GBPm(3) 2020 2019 Increase Increase

-------- -------- ---------- ----------

UK retail sales 554.1 408.9 36% 36%

EU retail sales 390.7 332.5 18% 18%

US retail sales 156.8 139.3 13% 17%

ROW retail sales 224.2 194.2 15% 20%

International retail

sales 771.7 666.0 16% 18%

-------- -------- ---------- ----------

Total retail sales 1,325.8 1,074.9 23% 24%

-------- -------- ---------- ----------

Total group revenue(5) 1,364.1 1,106.0 23% 24%

-------- -------- ---------- ----------

(1) Incremental COVID disruption costs, more than offset by cost

reduction from lower returns rates

(2) Company compiled PBT market expectations for FY21 as at

5(th) January 2021: Consensus: GBP141m, min: GBP115m, max:

GBP170m

(3) All numbers subject to rounding throughout this document,

(4) Co nstant currency is calculated to take account of hedged rate

movements on hedged sales and spot rate movements on unhedged

sales, (5) Includes retail sales, delivery receipts and third-party

revenues

P1 Results Summary

-- Group Sales up 23% supported by investment into capturing available demand and building customer momentum;

overall demand in the market, whilst suppressed, remained more resilient than our initial expectations

-- Active customer base increased 1.1m to 24.5m; good growth in new customers offsetting impact of existing

customers having fewer occasion-led reasons to shop

-- Gross margin -90bps reflecting continued 'lockdown' category product mix, investment into customer acquisition

and increased freight costs due to COVID disruption

-- Good agility shown through reshaping of product offer and investment to capture demand through period of

accelerated online channel shift

Territory Performance

-- Exceptional UK growth reflected strength of market position as well as restrictions on non-essential retail

stores through the peak period

-- Good growth in the EU despite demand constraints in markets where hospitality closed but stores remained open

-- Increased momentum in the US, supported by continued improvement of product offer

-- ROW trading accelerated, supported by good growth in Australia and the MENA region

Outlook

-- FY21 PBT likely to be at the top end of market expectations:

-- Stronger than anticipated P1 performance

-- H121 net COVID PBT benefit of at least GBP40m

-- Unchanged outlook for remainder of FY21

-- Brexit tariff costs of c.GBP15m in FY21 associated with country of origin rules

-- Automation of US fulfilment centre to begin this year and lease signed on 4th fulfilment centre in Lichfield, UK

-- FY21 capex guidance increased by GBP20m to around GBP190m reflecting investment into US automation

-- Strong net cash and balance sheet position despite H121 working capital unwind

Nick Beighton, CEO, commented:

"We are really pleased with the strong performance we have

delivered, which is testament to both the strength of our

multi-brand model and the hard work of our people. We have

continued to execute well and deliver for our customers, whilst

investing into growing our business and driving further efficiency

through a strong operational grip.

Looking forward, given the uncertainty associated with the virus

and the impact on customers' lives, our cautious outlook for the

second half of the year remains unchanged. However, the strength of

our performance gives us confidence in our continued progress

towards capturing the global opportunity ahead."

Investor and Analyst conference call:

ASOS will be hosting a webcast for analysts and investors at

8.30am (UK time) today. Please join via the link:

https://asosq1results.sparq.me.uk/live or dial +44 208 080 6591,

and use Meeting ID: 937 4777 7938 and passcode: 881003

A recording of this webcast will be available on the ASOS Plc

investor centre website later today:

http://www.asosplc.com/investors.aspx

For further information:

ASOS plc Tel: 020 7756 1000

Nick Beighton, Chief Executive Officer

Mathew Dunn, Chief Financial Officer

Alison Lygo, Investor Relations

Website: www.asosplc.com/investors

Headland Consultancy Tel: 020 3805 4822

Susanna Voyle / Stephen Malthouse / Fay

Rajaratnam

JPMorgan Cazenove Tel: 020 7742 4000

Bill Hutchings / Christopher Wood

Numis Securities Tel: 020 7260 1000

Alex Ham / Jonathan Wilcox / Tom Jacob

Forward looking statements:

This announcement may include statements that are, or may be

deemed to be, "forward-looking statements" (including words such as

"believe", "expect", "estimate", "intend", "anticipate" and words

of similar meaning). By their nature, forward-looking statements

involve risk and uncertainty since they relate to future events and

circumstances, and actual results may, and often do, differ

materially from any forward-looking statements. Any forward-looking

statements in this announcement reflect management's view with

respect to future events as at the date of this announcement. Save

as required by applicable law, the Company undertakes no obligation

to publicly revise any forward-looking statements in this

announcement, whether following any change in its expectations or

to reflect events or circumstances after the date of this

announcement.

Background note

ASOS is an online retailer for fashion-loving 20-somethings

around the world, with a purpose to give its customers the

confidence to be whoever they want to be. Through its

market-leading app and mobile/desktop web experience, available in

ten languages and in over 200 markets, ASOS customers can shop a

curated edit of 85,000 products, sourced from 850 of the best

global and local third-party brands and its mix of fashion-led

in-house labels - ASOS Design, ASOS Edition, ASOS 4505 and

Collusion. ASOS aims to give all of its customers a truly

frictionless experience, with an ever-greater number of different

payment methods and hundreds of local deliveries and returns

options, including Next-Day and Same-Day Delivery, dispatched from

state-of-the-art fulfilment centres in the UK, US and Germany.

ASOS's websites attracted 280.4 million visits during December

2020 (December 2019(1) : 233.8 million) and as at 31 December 2020

it had 24.5 million active customers(2) (31 December 2019: 21.7

million), of which 7.6 million were located in the UK and 16.9

million were located in our international territories (31 December

2019: 6.7 million in the UK and 15.0 million internationally).

(1) Restated visits, previously reported number 239.0 million,

(2) Defined as having shopped in the last twelve months as at 31

December

Appendix 1 - Retail sales growth by period in sterling

Year ending 31 August 2021

2020/21

GBPm P1(1) YOY% P2(1) YOY% P3(1) YOY% P4(1) YOY% YTD YOY%

------- ----- ----- ----- --------

UK retail sales 554.1 36% 554.1 36%

18

EU retail sales 390.7 18% 390.7 %

13 13

US retail sales 156.8 % 156.8 %

15 15

ROW retail sales 224.2 % 224.2 %

International

retail sales 771.7 16% 771.7 16%

------- ---- ----- ---- ----- ---- ----- ---- -------- ----

Total retail

sales 1,325.8 23% 1,325.8 23%

------- ---- ----- ---- ----- ---- ----- ---- -------- ----

Year ended 31 August 2020

GBPm P1(1) YOY% P2(1) YOY% P3(1) YOY% P4(1) YOY% 2019/20 YOY%

------- ----- ----- ----- --------

UK retail sales 408.9 18% 168.2 26% 329.2 (1%) 269.6 52% 1,175.9 18%

EU retail sales 332.5 21% 155.6 23% 328.0 22% 189.2 22% 1,005.3 22%

US retail sales 139.3 23% 63.3 32% 124.9 3% 74.4 28% 401.9 18%

ROW retail sales 194.2 23% 89.4 14% 201.2 19% 103.1 12% 587.9 18%

International

retail sales 666.0 22% 308.3 22% 654.1 17% 366.7 20% 1,995.1 20%

------- ---- ----- ---- ----- ---- ----- ---- -------- ----

Total retail sales 1,074.9 20% 476.5 23% 983.3 10% 636.3 32% 3,171.0 19%

------- ---- ----- ---- ----- ---- ----- ---- -------- ----

Year ended 31 August 2019

GBPm P1(1) YOY% P2(1) YOY% P3(1) YOY% P4(1) YOY% 2018/19 YOY%

----- ----- ----- ----- --------

UK retail sales 347.8 16% 133.7 18% 334.1 16% 177.8 12% 993.4 15%

EU retail sales 275.9 17% 126.3 11% 269.0 5% 154.5 17% 825.7 12%

US retail sales 113.5 11% 48.1 3% 121.4 12% 58.2 7% 341.2 9%

ROW retail sales 157.8 4% 78.2 17% 169.5 14% 91.9 22% 497.4 12%

International

retail sales 547.2 12% 252.6 11% 559.9 9% 304.6 16% 1,664.3 11%

----- ---- ----- ---- ----- ---- ----- ---- -------- ----

Total retail sales 895.0 13% 386.3 13% 894.0 11% 482.4 15% 2,657.7 13%

----- ---- ----- ---- ----- ---- ----- ---- -------- ----

(1) Periods are as follows:

P1: four months to 31 December

P2: two months to 28/29 February

P3: four months to 30 June

P4: two months to 31 August

Appendix 2 - Retail sales growth by period at constant

currency

Year ending 31 August 2021

2020/21

GBPm P1(1) YOY% P2(1) YOY% P3(1) YOY% P4(1) YOY% YTD YOY%

------- ----- ----- ----- --------

UK retail sales 554.1 36% 554.1 36%

18

EU retail sales 390.7 18% 390.7 %

17

US retail sales 156.8 17% 156.8 %

ROW retail sales 224.2 20% 224.2 20%

International

retail sales 771.7 18% 771.7 18%

------- ---- ----- ---- ----- ---- ----- ---- -------- ------

Total retail

sales 1,325.8 24% 1,325.8 24%

------- ---- ----- ---- ----- ---- ----- ---- -------- ------

Year ended 31 August 2020

GBPm P1(1) YOY% P2(1) YOY% P3(1) YOY% P4(1) YOY% 2019/20 YOY%

------- ----- ----- ----- --------

UK retail sales 408.9 18% 168.2 26% 329.2 (1%) 269.6 52% 1,175.9 18%

EU retail sales 332.5 22% 155.6 24% 328.0 20% 189.2 22% 1,005.3 22%

US retail sales 139.3 20% 63.3 33% 124.9 (2%) 74.4 28% 401.9 16%

ROW retail sales 194.2 23% 89.4 14% 201.2 18% 103.1 15% 587.9 18%

International

retail sales 666.0 22% 308.3 23% 654.1 15% 366.7 21% 1,995.1 19%

------- ---- ----- ---- ----- ---- ----- ---- -------- ----

Total retail sales 1,074.9 20% 476.5 23% 983.3 9% 636.3 32% 3,171.0 19%

------- ---- ----- ---- ----- ---- ----- ---- -------- ----

Year ended 31 August 2019

GBPm P1(1) YOY% P2(1) YOY% P3(1) YOY% P4(1) YOY% 2018/19 YOY%

----- ----- ----- ----- ---------

UK retail sales 347.8 16% 133.7 18% 334.1 16% 177.8 12% 993.4 15%

EU retail sales 275.9 13% 126.3 7% 269.0 3% 154.5 16% 825.7 9%

US retail sales 113.5 8% 48.1 (4%) 121.4 6% 58.2 2% 341.2 4%

ROW retail sales 157.8 5% 78.2 18% 169.5 16% 91.9 24% 497.4 14%

International

retail sales 547.2 9% 252.6 8% 559.9 8% 304.6 15% 1,664.3 10%

----- ---- ----- ---- ----- ---- ----- ---- --------- ----

Total retail sales 895.0 12% 386.3 11% 894.0 11% 482.4 14% 2,657.7 12%

----- ---- ----- ---- ----- ---- ----- ---- --------- ----

(1) Periods are as follows:

P1: four months to 31 December

P2: two months to 28/29 February

P3: four months to 30 June

P4: two months to 31 August

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBTMPTMTMBBMB

(END) Dow Jones Newswires

January 13, 2021 02:00 ET (07:00 GMT)

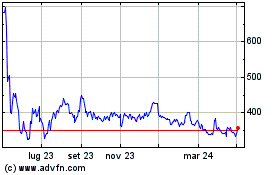

Grafico Azioni Asos (LSE:ASC)

Storico

Da Mar 2024 a Apr 2024

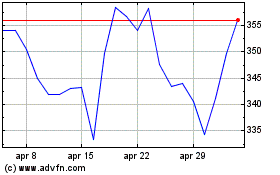

Grafico Azioni Asos (LSE:ASC)

Storico

Da Apr 2023 a Apr 2024