Alumasc Group PLC AGM Trading Update (8221C)

22 Ottobre 2020 - 8:00AM

UK Regulatory

TIDMALU

RNS Number : 8221C

Alumasc Group PLC

22 October 2020

Thursday 22 October 2020

The Alumasc Group plc

(Alumasc)

(ALU), the premium building products, systems, and solutions

Group

AGM Trading Update

At the Alumasc AGM to be held this morning at 10.00am, the

Chairman will give the following trading update to

Shareholders:

"Alumasc has begun the new financial year to 30 June 2021

strongly with record profits in the first quarter.

Each of our three divisions - Building Envelope, Water

Management and Housebuilding Products - has contributed to this

record performance. The restructuring over the previous year, which

provided GBP2.4m in annual cost saving, undoubtedly benefitted

margins, which were well ahead in the period, helping in particular

Levolux and Gatic.

This profit performance has been accompanied by equally strong

cash generation, reducing net bank borrowing of GBP4.3 million at

30 June 2020 to below GBP1 million at today's date, against total

facilities of GBP24 million. Our borrowings continue to benefit

from VAT deferrals of GBP1.8 million, payable later in this

financial year. Furlough income received in respect of a low number

of employees who have since become redundant has already been

repaid to the Government.

It is still too early to know the extent to which the strength

in the UK construction industry, which underpins this performance,

reflects pent up demand from the period of lockdown as opposed to

the true level of ongoing demand. However, there is nothing

abnormal in the strong patterns of demand that we have experienced,

with new commercial ventures continuing to lag other subsectors of

the market.

Despite the uncertainty present in the commercial sector,

Levolux continues to respond to the prior restructuring and remains

on track to return to sustainable profit, as it has been in the

financial year to date.

The strong bounce experienced by Alumasc in the UK has been

supported by a lively export performance. Current orderbooks remain

robust in general and include a growing list of export projects won

in recent months, which are due to be delivered in the current

financial year.

In addition to the growing emphasis on sustainability, there are

early signs of the promised acceleration in infrastructure

expenditure by the UK Government, which is expected to boost demand

in the coming months.

Shareholders should be encouraged by the recovery displayed by

Alumasc at the end of the last financial year and by its

continuation. We remain very conscious of the uncertainties that

accompany the COVID-19 pandemic and Brexit negotiations and will

continue to keep the health and safety of our employees as our

highest priority.

I would like to reiterate the statement of thanks from all our

stakeholders expressed in our annual report to all our employees

for their commitment and cooperation displayed in these uncertain

times." John S. McCall, Chairman, The Alumasc Group plc.

Paul Hooper, CEO of The Alumasc Group plc commented "The

increased trading momentum has continued into Quarter One of the

new financial year and we have had a strong order intake. There

continue to be opportunities to develop our positions further in

the energy management and water management market places with an

increasing alignment with the sustainability agenda."

Enquiries:

The Alumasc Group plc +44 (0)1536 383 844

Paul Hooper (Chief Executive)

Helen Ashton (Company Secretary)

finnCap Ltd (Nomad) +44 (0)207 220 0500

Julian Blunt

Anthony Adams

Edward Whiley

Peel Hunt (Broker) +44 (0)207 418 8831

Mike Bell

Ed Allsopp

Camarco

Ginny Pulbrook +44 (0)203 757 4992

Tom Huddart +44 (0)203 757 4991

email: alumasc@camarco.co.uk

The Alumasc Group plc

Burton Latimer, Kettering, Northants NN15 5JP

LEI: 2138002MV11VKZFJ4359

Notes to Editors:

Alumasc is a UK-based supplier of premium building products,

systems and solutions. Almost 80% of group sales are driven by

building regulations and specifications (architects and structural

engineers) because of the performance characteristics offered.

The Group has three business segments with strong positions and

brands in their individual markets. The three segments are:

Building Envelope; Water Management; and Housebuilding

Products.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTXFLFLBBLFFBX

(END) Dow Jones Newswires

October 22, 2020 02:00 ET (06:00 GMT)

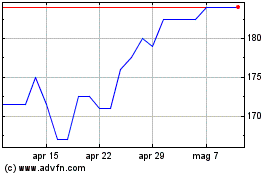

Grafico Azioni Alumasc (LSE:ALU)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Alumasc (LSE:ALU)

Storico

Da Apr 2023 a Apr 2024