American Express Logs Big Bump in 2Q Earnings, Revenue Climbs

23 Luglio 2021 - 1:16PM

Dow Jones News

By Allison Prang

American Express Co. reported higher second-quarter revenue and

increased earnings as spending on travel and entertainment kept

improving, and the company logged credit-reserve releases.

Net income at American Express grew to $2.28 billion from $257

million a year earlier. Earnings were $2.80 a share, up from 29

cents a share. According to FactSet, analysts had been expecting

$1.63 a share.

Revenue at the company, net of interest expense, rose 33% to

$10.24 billion. Analysts had been expecting $9.57 billion.

The company had negative credit-loss provisions of $606 million,

compared with a year earlier when its provisions were $1.56

billion.

"We saw card-member spending accelerate from the prior quarter

and exceed pre-pandemic levels in June, with the largest portion of

this spending growth coming from millennial, Gen Z and

small-business customers," Chief Executive and Chairman Stephen

Squeri said in prepared remarks. He said "travel and entertainment

spending continued to improve."

"Based on current trends, we are confident in our ability to be

within the high end of the range of EPS expectations we had for

2020 in 2022," Mr. Squeri added.

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

July 23, 2021 07:15 ET (11:15 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

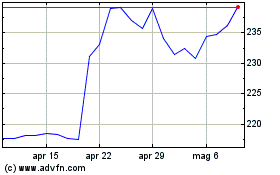

Grafico Azioni American Express (NYSE:AXP)

Storico

Da Mar 2024 a Apr 2024

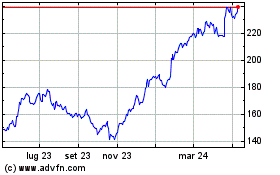

Grafico Azioni American Express (NYSE:AXP)

Storico

Da Apr 2023 a Apr 2024