Arbuthnot Banking Group PLC Acquisition of Asset Alliance (2187I)

10 Dicembre 2020 - 10:32AM

UK Regulatory

TIDMARBB

RNS Number : 2187I

Arbuthnot Banking Group PLC

10 December 2020

FOR IMMEDIATE RELEASE

10 December 2020

Arbuthnot Banking Group PLC

Acquisition of Asset Alliance

Arbuthnot Banking Group PLC ("Arbuthnot" or the "Group") today

announces that its subsidiary Arbuthnot Latham ("AL" or the "Bank")

has agreed the purchase of the entire issued share capital of Asset

Alliance Group Holdings Limited ("Asset Alliance")

Asset Alliance provides vehicle finance and related services,

predominantly in the truck & trailer and bus & coach

markets. Operating from five locations, it is the UK's leading

independent end-to-end specialist in commercial vehicle financing

and has over 4000 vehicles under management. As at 31 August 2020

Asset Alliance had assets for lease with a net book value of

approximately GBP150 million.

The consideration is based on an agreed discount to the tangible

net assets of Asset Alliance at completion, after adjusting for the

fair value of the assets available for lease. The consideration is

expected to be approximately GBP4.1 million.

The shares are being purchased from CS Capital Partners III LP

("Cabot Square") and a small number of other investors which

include the senior management of Asset Alliance.

Completion will take place after, inter alia, regulatory change

of control approval is received. This is expected to be within

three months.

The third-party funding of Asset Alliance at completion, which

is associated with the assets available for lease, and includes a

revolving credit facility of approximately GBP140 million, is

expected to be refinanced by Arbuthnot soon after the completion

date.

Asset Alliance had adjusted net assets of GBP8.1 million as at

31 August 2020. It reported an EBITDA of approximately GBP7.2

million for 2019 and is expecting to record GBP2.3 million for the

same measure in 2020. This is anticipated to increase to GBP5.5

million in 2021. In addition, this acquisition should generate a

net negative goodwill accounting adjustment of GBP1.7 million.

Therefore, the transaction is expected to be earnings accretive to

the Group in the year ending 31 December 2021. The Group

anticipates Asset Alliance transaction costs of approximately

GBP0.8 million will be recognised in its 2020 trading results.

The consideration for the purchase of Asset Alliance's share

capital and the refinancing of the third-party funding will be

satisfied by cash from the Group's own resources.

Willie Paterson, the CEO of Asset Alliance, and his management

team, who collectively have many years of experience within the

leasing and banking industries will remain in place to help deliver

the business's growth plans.

Sir Henry Angest Chairman and CEO of the Group said:

"We are delighted to welcome Willie and his team to the Group.

This acquisition of Asset Alliance is complementary to our strategy

of diversification and developing businesses in the specialist

commercial finance sectors. Their experienced management team have

built the foundations for future growth and now that it will no

longer be constrained by third party funding limits, I look forward

to Arbuthnot enabling this business to grow and prosper in the

future."

The information contained within this announcement is deemed to

constitute inside information as stipulated under the Market Abuse

Regulations (EU No. 596/2014). Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

The Directors of the Company accept responsibility for the

contents of this announcement.

Enquiries:

Arbuthnot Banking Group

Sir Henry Angest, Chairman and Chief Executive

Andrew Salmon, Group Chief Operating Officer

James Cobb, Group Finance Director 0207 012 2400

Grant Thornton UK LLP (Nominated Adviser and AQSE

Exchange Corporate Adviser)

Colin Aaronson

Samantha Harrison

Seamus Fricker 020 7383 5100

Numis Securities Ltd (Joint Broker)

Stephen Westgate 0207 260 1000

Shore Capital (Joint Broker)

Hugh Morgan

Daniel Bush 020 7408 4090

Maitland/AMO

Neil Bennett

Sam Cartwright 020 7379 5151

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQFZMMZLGMGGZG

(END) Dow Jones Newswires

December 10, 2020 04:32 ET (09:32 GMT)

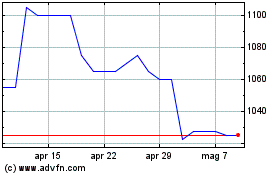

Grafico Azioni Arbuthnot Banking (LSE:ARBB)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Arbuthnot Banking (LSE:ARBB)

Storico

Da Apr 2023 a Apr 2024