TIDMBOOM

RNS Number : 9788B

Audioboom Group PLC

14 October 2020

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014 ("MAR").

Audioboom Group plc

("Audioboom", the "Group" or the "Company")

Q3 trading update

Record third quarter revenue of US$6.5 million

Significant improvement in EBITDA performance over Q3 2019

Conclusion of formal sale process

GBP3.15 million subscription for new shares at GBP2.25 per

share

26.8% premium to last closing share price

Audioboom (AIM: BOOM), the leading global podcast company, is

pleased to provide an update on record trading for the quarter

ended 30 September 2020 and announces the conclusion of its

strategic review and formal sale process together with a

subscription for new ordinary shares to raise GBP3.15 million at a

significant premium to the last closing share price.

Financial and operating highlights

-- Q3 2020 revenue of approximately US$6.5 million, up 15% on Q3

2019 (US$5.7 million) and up 19% on Q2 2020 (US$5.4 million). Total

revenue for the nine months to 30 September was US$18.3 million, up

18% on the same period last year (US$15.5 million). Year-on-year

growth for the nine months to 30 September outpaced the predicted

wider industry average by 73%*

-- Adjusted EBITDA** loss in Q3 of US$0.4 million represents an

improvement of 59% on Q3 2019 (US$1.0 million loss). Year to date

loss improved 32% to US$1.6 million (nine months to 30 September

2020: US$2.4 million loss)

-- Brand advertiser count of 252 as at 30 September 2020, up 3% on 30 September 2019 (244)

-- Global revenue per 1,000 downloads (eCPM) for September 2020

increased to US$32.69, up 19% on the same period last year

(September 2019: US$27.38) and up 29% from June 2020 (US$25.32).

Additionally, in Q3, the Audioboom Originals Network achieved an

eCPM of US$35.85, outperforming our wider network and providing

strong value to the business through an enhanced gross margin

-- Total available premium advertising impressions for the nine

months to 30 September 2020 up 8% to 1,235 million (2019: 1,138

million)

-- Access to capital of US$3.8 million as at 30 September 2020,

representing Group cash of US$0.5 million and US$3.3 million of the

SPV loan facility remaining undrawn. This does not include

additional proceeds of GBP3.15 million raised from the subscription

announced today. In addition, the Company has US$3.0 million of the

SPV content funding guarantee facility available, which was

announced on 17 June 2019.

* eMarketers August 2020 Podcast Advertising Revenue Report

states that US podcast advertising revenue is expected to grow by

10.4% in FY 2020 relative to FY 2019

**earnings before interest, tax, depreciation, amortisation,

share-based payments and material one-off items

Key commercial developments

-- Expansion of the Audioboom Originals Network with the launch

of Truth Vs Hollywood, Baby Mamas No Dramas, Huddled Masses, and

Because Mom Said So. Audioboom Originals continue to be a key

performing area of the business, with an eCPM of US$35.85, 10%

higher than our wider network

-- Enhanced our premium sales network through new commercial

partnerships with leading podcasts including Rotten Mango and Ari

Shaffir's Skeptic Tank

-- Maintained position as the 6(th) largest US podcast publisher

and largest international publisher in Australia in the Triton

Digital Podcast Reports

-- Signed a new commercial partnership with Rogers Sports &

Media to monetise Audioboom's advertising inventory in Canada, our

fourth largest market

-- Renewed our partnership with Nielsen to provide qualitative

audience data to inform Audioboom's sales operation

-- Significantly improved performance during the quarter from

our Ad Network, the programmatic advertising sector of our

business, with Q3 revenue from this area being 292% higher than Q1

2020

-- Concluded our strategic review and formal sale process with a

commitment to providing maximum long-term shareholder value through

continued independent growth, supported by a subscription for new

shares to raise GBP3.15 million at a significant premium to the

last closing share price

Conclusion of strategic review and formal sale process

The Company announced on 19 February 2020 that it had commenced

a formal sale process ("FSP") under the Takeover Code as part of

the Board's strategic review. Despite the impact of the coronavirus

pandemic, which was declared shortly after the FSP was launched,

the Company engaged with several interested parties during the

process and a number of these discussions advanced to a stage at

which potential deal structures and outline valuations were

proposed and considered. Throughout, the Board has been focussed on

achieving what it considers to be maximum value for shareholders

and would only consider recommending any potential transaction

where the terms of any such deal would create greater shareholder

value than would likely be achieved by continuing to pursue the

Group's own growth trajectory and plans in its current form. In the

current climate, there has been limited interest in paying the

level of premium to the prevailing share price that the Board

considers would represent appropriate value for shareholders and,

as such, the Board has not taken these discussions further.

The Board considers that, given the time elapsed, and in light

of the very encouraging continued growth and resilience to global

events evidenced by today's trading update, it is in the interests

of all shareholders to end the strategic review and FSP at this

stage and focus on further organic growth. This does not prevent

any parties approaching the Company in due course, but this would

no longer be within the framework of a FSP and the Company will not

be actively seeking prospective buyers. Audioboom is therefore no

longer deemed to be in an "offer period", as defined in the City

Code on Takeovers and Mergers.

Management notes that consistent feedback from interested

parties during the FSP highlighted the nascent stage of the

Company's original content and production operation. Although in

its early stages, the Audioboom Originals Network is at the core of

the Company's growth strategy with five new podcasts premiering in

the final quarter of 2020. Additionally, investment in the

production operation during 2021 will provide an enhanced level of

original content, IP, and network audience that the Directors

believe will improve business performance significantly.

As the FSP has concluded, the Company has terminated the

engagement with Raine Advisors Limited ("Raine"). There are no

transaction fees paid or payable to Raine.

Subscription

The Board was recently approached by One Nine Two Pte Ltd ("One

Nine Two"), a Singaporean company established to take advantage of

high tech growth opportunities, which expressed an interest in

subscribing for a 10% stake in the Company. Having resolved to

conclude the FSP for the reasons described above, the Board agreed

to One Nine Two's offer to subscribe at GBP2.25 per ordinary share

on the basis that it represents a significant premium of 26.8% to

the closing mid-market price on 13 October 2020.

Whilst the Company's existing funding remained sufficient to

take it through to its forecast cash breakeven position, this

subscription will provide further growth capital for investment,

principally in original content, aimed at driving additional growth

in the medium term.

The subscription, which is unconditional (other than as to

Admission) and is within the Company's existing authority to issue

shares on a non pre-emptive basis, is for a total of 1,400,000

ordinary shares of no par value in the Company (the "Subscription

Shares"), representing 9.96% of the Company's existing issued

ordinary share capital (equivalent to 9.06% of the issued ordinary

share capital as enlarged by this subscription) and raising net

proceeds of approximately GBP3.15 million.

Application has been made to the London Stock Exchange for the

Subscription Shares to be admitted to trading on AIM ("Admission").

The issue of the Subscription Shares is conditional upon Admission.

It is expected that Admission will become effective and dealings in

the Subscription Shares will commence at 8:00 am on 5 November

2020. The Subscription Shares will be issued credited as fully paid

and will rank in full for all dividends and other distributions

declared, made or paid in respect of the Company's ordinary shares

("Ordinary Shares") after the date of Admission and will otherwise

rank pari passu in all respects with the Company's existing

Ordinary Shares.

On Admission, the Company's issued ordinary share capital will

consist of 15,456,504 Ordinary Shares, with one voting right each.

The Company does not hold any Ordinary Shares in treasury.

Therefore, on Admission, the total number of Ordinary Shares and

voting rights in the Company will be 15,456,504. With effect from

Admission, this figure may be used by shareholders in the Company

as the denominator for the calculations by which they will

determine if they are required to notify their interest in, or a

change to their interest in, the share capital of the Company under

the FCA's Disclosure Guidance and Transparency Rules.

Stuart Last, CEO of Audioboom, commented: " I am delighted with

the speed at which Audioboom has rebounded from the challenges of

Covid-19, growing 19% from the second quarter, highlighting the

resilience and strong fundamentals that we have built into the

business.

Our growth continues to outpace that predicted for the wider

industry, with revenues for the nine months to 30 September 2020 up

18% on the same period in 2019 - more than 70% faster than the

projected US podcast market growth for 2020.

New content partnerships with major tier one podcasts such as

Rotten Mango and Skeptic Tank, plus strategic initiatives with

Nielsen and Rogers Sports & Media will provide good momentum as

we move into the final quarter, traditionally our strongest

performing period."

Michael Tobin, Chairman of Audioboom, commented : "I am pleased

that Audioboom can continue its growth story as an independent

business following the conclusion of our strategic review and

formal sale process. We were buoyed by the interest in Audioboom as

an acquisition target and as a leader in our field during a process

that was impacted significantly by Covid-19. In welcoming today's

subscription by One Nine Two, we are confident that our business

model and access to capital can drive our expansion independently

and provide the best route to exceptional long-term value for our

shareholders."

Enquiries

Audioboom Group plc Tel: +44(0)300 303

3765

Stuart Last, Chief Executive Officer

Brad Clarke, Chief Financial Officer

Allenby Capital Limited (Nominated Adviser Tel: +44(0)20 3328

and Broker) 5656

David Hart /Alex Brearley/Asha Chotai

(Corporate Finance)

Guy McDougall / Amrit Nahal (Equity Sales)

Walbrook PR Limited (PR & IR Advisers) Tel: +44(0)20 7933

8780

Nick Rome/Tom Cooper or audioboom@walbrookpr.com

About Audioboom

Audioboom is a global leader in podcasting - producing,

distributing and monetizing premium audio content to millions of

listeners around the world. Audioboom operates internationally,

with operations and global partnerships across North America,

Europe, Asia and Australia.

Audioboom provides technology and advertising services for a

premium network of 250 top tier podcasts, with key partners

including 'Casefile True Crime' (US), 'The Morning Toast' (US), 'No

Such Thing As A Fish' (UK), 'The Cycling Podcast' (UK) and 'The

Totally Football Show' (UK).

The Audioboom Originals Network is a slate of content produced

by Audioboom including 'The 45(th) ', 'Covert', 'It's Happening

with Snooki & Joey', 'Mafia', 'Dead Man Talking' and 'Blank

Check'.

The platform allows content to be distributed via Apple

Podcasts, Spotify, Pandora, Amazon Music, Deezer, Google Podcasts,

iHeartRadio, RadioPublic, Saavn, Stitcher, Facebook and Twitter as

well as a partner's own websites and mobile apps. For more

information, visit audioboom.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAKEDFLLEFFA

(END) Dow Jones Newswires

October 14, 2020 02:00 ET (06:00 GMT)

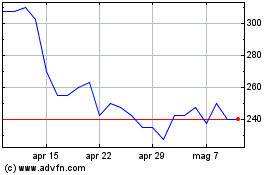

Grafico Azioni Audioboom (LSE:BOOM)

Storico

Da Mar 2024 a Apr 2024

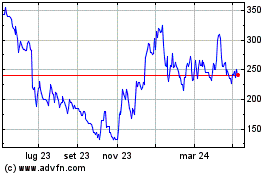

Grafico Azioni Audioboom (LSE:BOOM)

Storico

Da Apr 2023 a Apr 2024