TIDMBOOM

RNS Number : 2677C

Audioboom Group PLC

07 February 2020

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014 ("MAR").

Audioboom Group plc

("Audioboom", the "Group" or the "Company")

US$4 million loan facility

Funded through to sustainable positive cash generation

Related party transaction

The Board of Audioboom (AIM: BOOM), the leading global podcast

company, is pleased to announce that the Company has entered into a

US$4 million secured loan facility arrangement (the "Facility")

with SPV Investments Limited (the "SPV"), a special purpose vehicle

owned equally by Tobin Ventures Limited (which is owned by Michael

Tobin, the Company's Chairman) and Candy Ventures sarl (the

Company's largest shareholder).

The Facility

Historically, the growth of Audioboom has been financed by the

issue of equity with consequential dilution to the Company's

shareholders, and the Board believes that the expectation of

potential equity issues has had a negative impact on the Company's

share price. The Board is increasingly confident in management's

ability to forecast performance and growth prospects, as

demonstrated by the recently announced 2019 year-end trading

update, in which market expectations were exceeded for the first

time in the Company's history. Whilst the Facility may not need to

be drawn down in full, the Board is confident that it will provide

sufficient headroom to fund the Company and its growth strategy

through to sustainable positive cash generation on a monthly

basis.

The Facility will be drawn down in accordance with an agreed

cash flow forecast schedule and has a minimum draw down amount of

US$200,000. The Facility will attract interest at a rate of 8 per

cent. per annum on drawn down funds, together with a US$80,000

arrangement fee payable on the first draw down, equivalent to 2 per

cent. of the full US$4 million available under the Facility.

Audioboom will also pay the SPV's legal and other costs incurred in

conjunction with the Facility, which are not expected to be

material. The accrued interest is payable at the date of repayment

of the principal amount outstanding. The latest date for repayment

is 24 months from the commencement of the Facility, however it may

be repaid earlier at the Company's election. Any amounts repaid

will not be available for subsequent drawdown. The SPV may require

early repayment of some or all of the amounts outstanding if the

Company undertakes a future equity fundraising (provided that a

minimum of US$3 million of any such fundraise must remain available

for other uses by the Company) or if there is a change of control

of the Company. The Facility will be secured against the assets of

Audioboom Limited and will contain events of default which are

customary in nature for this type of loan facility. The interest

rate payable will increase to 12 per cent. per annum in the case of

default on repayment by Audioboom.

The provision of the Facility is independent of the guarantee

facility provided by the SPV referred to in announcements on 17

June 2019 and 14 January 2020, which remains in force and

effect.

Stuart Last, Chief Executive Officer of Audioboom, commented: "I

am delighted that our Chairman and largest shareholder have

continued to demonstrate their support and belief in the Company's

prospects and strategy. This non-dilutive financing should fund

Audioboom through to sustainable positive cash generation and

allows the management team to remain focussed on delivering further

growth in what is an increasingly exciting market. We have made a

strong start to the year with bookings for 2020 ahead of management

expectations."

Related party transaction

The SPV is owned equally by Tobin Ventures Limited (a company

controlled by Michael Tobin, Audioboom's Chairman) and Candy

Ventures sarl (a substantial shareholder in the Company which

currently holds 25.6 per cent. of the Company's voting rights and

of which Steven Smith, a non-executive Director of Audioboom, is a

director and 10 per cent. shareholder). Nick Candy, a 90 per cent

shareholder of Candy Ventures sarl, has an interest in 26.1 per

cent of the Company's ordinary shares (including those held by

Candy Ventures sarl). Michael Tobin and Steven Smith are also

directors of the SPV. Consequently, entering into the Facility with

the SPV constitutes a related party transaction under rule 13 of

the AIM Rules.

The independent Directors (being Roger Maddock, Stuart Last and

Brad Clarke) consider, having consulted with the Company's

nominated adviser Allenby Capital Limited, that the terms of the

Facility are fair and reasonable insofar as the Company's

shareholders are concerned.

Enquiries

Audioboom Group plc Tel: +44(0)20 7403 6688

Stuart Last, Chief Executive Officer

Brad Clarke, Chief Financial Officer

Allenby Capital Limited (Nominated Adviser Tel: +44(0)20 3328 5656

and Broker)

David Hart /Alex Brearley/Asha Chotai

Walbrook PR Limited (PR & IR Advisers) Tel: +44(0)20 7933 8780

Nick Rome/Tom Cooper or audioboom@walbrookpr.com

About Audioboom

Audioboom is a global leader in podcasting - producing,

distributing and monetising premium audio content to millions of

listeners around the world. Audioboom operates internationally,

with operations and global partnerships across North America,

Europe, Asia and Australia.

Audioboom provides technology and advertising services for a

premium network of 250 top tier podcasts, with key partners

including 'Casefile True Crime' (US), 'The Morning Toast' (US),

'And That's Why We Drink' (US), 'No Such Thing As A Fish' (UK),

'Starburns Audio' (US), 'The Cycling Podcast' (UK) and 'The Totally

Football Show' (UK).

The Audioboom Originals Network is a slate of content produced

by Audioboom including 'The 45(th) ', 'Covert', 'It's Happening

with Snooki & Joey', 'Mafia', 'Dead Man Talking' and 'Blank

Check'.

The platform allows content to be distributed via Apple

Podcasts, Spotify, BookMyShow, Deezer, Google Podcasts,

iHeartRadio, RadioPublic, Saavn, Stitcher, Facebook and Twitter as

well as a partner's own websites and mobile apps.

For more information, visit audioboom.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCUPUPUPUPUPGQ

(END) Dow Jones Newswires

February 07, 2020 02:01 ET (07:01 GMT)

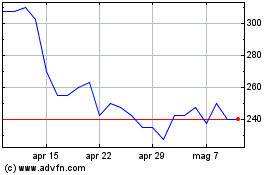

Grafico Azioni Audioboom (LSE:BOOM)

Storico

Da Mar 2024 a Apr 2024

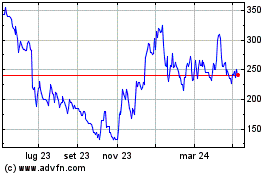

Grafico Azioni Audioboom (LSE:BOOM)

Storico

Da Apr 2023 a Apr 2024