TIDMBT.A

RNS Number : 9340N

BT Group PLC

04 February 2021

Trading update

Results for the nine months to 31 December 2020

BT Group plc

4 February 2021

BT Group plc (BT.L) today announced its trading update for the

nine months to 31 December 2020.

Key strategic developments:

-- Creation of a new technology unit - Digital - to lead our

digital innovation agenda from 1 April 2021; Digital will lead the

IT, process and business transformation of BT and develop and

deliver new growth products, platforms and services

-- Sale agreed of selected business units in Italy

-- Continued progress on our wider modernisation programme

including the creation of a standalone procurement company

Operational:

-- Openreach's FTTP network now reaches 4.1m premises, built at

an average run rate of 42k premises passed per week in the quarter;

remains on track to achieve 4.5m by March 2021

-- Openreach's first copper stop-sell now live in Salisbury,

extending to 2.2m premises by January 2022

-- FTTP commercial offers extended; all of Openreach's major

communications provider customers now selling FTTP with strong

increase in sales in Q3; Openreach achieved record 17k FTTP orders

per week

-- 5G in 125 locations and 5G ready customer base now over 2.1m;

EE has taken top spot in Rootmetrics' latest national results for

the 15th consecutive time with 5G in more places than any other

network according to Rootmetrics

-- Consumer fixed ARPC down 5.8% year on year due to commitments

to meet our fairness agenda, investment in our long term strategic

base and declining voice usage; postpaid mobile ARPC down 6.9% year

on year due to increased SIM-only mix, decline in roaming and out

of bundle revenue

-- In Consumer, BT brand at its highest NPS(1) ever, as

evidenced by strong BT sales and churn performance

-- Enterprise retail and wholesale order intakes up 8% to

GBP3.2bn and 5% to GBP1.2bn respectively on a 12-month rolling

basis

-- Global order intake up 1% to GBP4.1bn on a 12-month rolling basis

Financial:

-- Revenue GBP16,058m, down 7% due primarily to the impact of

Covid-19 on Consumer and our enterprise units, ongoing legacy

product declines and divestments of domestic businesses in Spain,

Latin America and France

-- Adjusted(1) EBITDA GBP5,603m, down 5%, driven by the fall in

revenue, partially offset by H1 sports rights rebates, savings from

our modernisation programme and other cost initiatives including

Covid-19 mitigating actions

-- Reported profit before tax GBP1,591m, down 17%, due to reduced EBITDA

-- Normalised free cash flow(1) GBP830m, down 17%, due to

reduced EBITDA and higher cash capital expenditure, offset by a

cash receipt from the monetisation of a non-strategic revenue

stream generated from our building infrastructure and timing of tax

payments

-- Capital expenditure up 5% to GBP3,030m, primarily driven by

increased fixed and mobile network investment

-- Outlook for 2020/21: Unchanged except for lower end of

normalised free cash flow(1) outlook range raised to GBP1.3bn;

revised range GBP1.3bn-GBP1.5bn; the EBITDA outlook range remains

at GBP7.3bn-GBP7.5bn

Philip Jansen, Chief Executive, commenting on the results, said

During the current Covid-19 pandemic, BT has continued to deliver

for our customers and invest in our networks, our modernisation

programme, and our products and services in recognition of the

ever increasing need for improved and faster connectivity. We delivered

results in line with our expectations for the third quarter and

remain on track to deliver our 2020/21 outlook despite even greater

Covid-19 restrictions than previously forecast. BT has shown again

that it has the spirit and determination to step up and deliver

for our customers, keeping them connected with a range of initiatives.

I am particularly proud of the ongoing work and investments we

are making to support school children, SMEs and the NHS during

the pandemic.

We continue to make significant investments in our industry leading

networks; with FTTP having now passed over 4m premises and 5G available

in 125 towns and cities, we're firmly on track to deliver our March

2021 targets. Openreach FTTP orders accelerated even further to

reach another record level of 17k per week. We have demonstrated

continued improvement in our operational performance, including

acceleration of FTTP and 5G take-up, and customer satisfaction

metrics. This reflects our progress in creating valued, reliable,

stand out customer experiences and propositions; the next evolution

of our flagship convergence proposition, Halo 3+, will drive even

further progress.

As the WFTMR(2) consultation process draws to a close we're focused

on ensuring the new regulation will create an environment to allow

for fair returns across our industry including the additional significant

network investment we are poised to undertake. The latest proposals

from Ofcom are positive for investment in many areas, but there

are key points of clarity still needed to unlock the fibre investment

the country needs; and we still need to see concrete progress from

Government on the things they can do to support the fibre roll

out.

With no material impact expected from the Brexit deal and our resilient

results so far this year I remain confident in our EBITDA expectation

of at least GBP7.9bn for 2022/23. Looking further ahead our new

Digital unit will enable us to accelerate our digital and business

transformation programmes and to deliver digital platforms that

bring together best-in-class services for our customers, further

securing a brighter and more sustainable future for the group.

(1) See Glossary on page 5

(2) Wholesale Fixed Telecoms Market Review

Nine months to 31 December 2020 2019 Change

====== ======

GBPm GBPm %

Reported measures

Revenue 16,058 17,246 (7)

Profit before tax 1,591 1,911 (17)

Profit after tax 1,276 1,526 (16)

Capital expenditure 3,030 2,877 5

============================= ====== ====== =========

Adjusted measures

Adjusted(1) Revenue 16,084 17,192 (6)

Adjusted(1) EBITDA 5,603 5,900 (5)

Normalised free cash flow(1) 830 1,000 (17)

Net debt(1) 17,294 18,234 GBP(940)m

============================= ====== ====== =========

Overview of the nine months to 31 December 2020

CUSTOMER-FACING UNIT UPDATES

Adjusted(1) revenue Adjusted(1) EBITDA

Nine months to 31 2020 2019(2) Change 2020 2019(2) Change

December

GBPm GBPm % GBPm GBPm %

================== ======== ======= ====== ======= ======= ========

Consumer 7,494 7,895 (5) 1,610 1,800 (11)

Enterprise 4,086 4,445 (8) 1,268 1,436 (12)

Global 2,823 3,280 (14) 440 459 (4)

Openreach 3,898 3,817 2 2,211 2,139 3

Other 18 21 (14) 74 66 12

Intra-group items (2,235) (2,266) 1 - - -

================== ======== ======= ====== ======= ======= ======

Total 16,084 17,192 (6) 5,603 5,900 (5)

================== ======== ======= ====== ======= ======= ======

Third quarter to

31 December

================== ===== ===== ==== ===== ===== ====

Consumer 2,621 2,701 (3) 535 620 (14)

Enterprise 1,376 1,458 (6) 435 481 (10)

Global 907 1,084 (16) 151 155 (3)

Openreach 1,313 1,281 2 758 722 5

Other 6 7 (14) 3 (1) n/m

Intra-group items (746) (752) 1 - - -

================== ===== ===== ==== ===== ===== ====

Total 5,477 5,779 (5) 1,882 1,977 (5)

================== ===== ===== ==== ===== ===== ====

n/m = not meaningful

Unless otherwise stated, the following commentary relates to the

nine months to 31 December 2020

Consumer: Strong service performance, Covid-19 headwinds

continue

Revenue declined year on year as the negative impact of Covid-19

resulted in the continued partial closure of retail stores and pubs

& clubs regionally. Further pressures on mobile revenue were

reduced roaming and lower out of bundle usage; reduced prepaid

activity and increased SIM-only mix diluting postpaid ARPC, which

were partly offset by higher equipment revenue. Fixed revenue

declined through lower out of contract price rises and copper price

reductions to address back book pricing combined with a continued

decline of our voice only customer base and call volumes. EBITDA

declined in line with lower revenue and continued customer

investment in both copper to fibre migrations and growth of our

FTTP base, partially offset by H1 sports rights rebates and tight

cost management, boosted by our transformation programme. Broadband

base growth helped offset the ARPC decline aided by our largest

quarterly increase of 88k in the FTTP base which now stands at

686k. Our 5G ready customer base has increased to over 2.1m and 5G

is now live in 125 towns and cities. Our exclusive Full Works Plan

for iPhone supported a successful iPhone 12 launch, with EE

customers enjoying Apple Music, Apple TV+ and Apple Arcade for the

duration of their plan, along with unlimited mobile data on the

UK's number one network. Lockdown restrictions in Q4 are expected

to further impact trading performance with almost our entire retail

estate closed in addition to all pubs and clubs.

Enterprise: Continued Covid-19 impacts but ongoing focus on

transformation, innovation and partnerships

Revenue was down predominantly due to continued impacts from

Covid-19 and ongoing declines in legacy products. Excluding the

divestments of Fleet and Tikit in the prior year, revenue was down

6% and EBITDA was down 11%. The decline in profit was mainly a

result of Covid-19, partly offset by lower costs from our

transformation programme. In the quarter, cash benefited from the

monetisation of a non-strategic revenue stream generated from our

building infrastructure. Retail order intake increased 8% to

GBP3.2bn and wholesale order intake increased 5% to GBP1.2bn on a

12-month rolling basis, both helped by a strong performance in the

third quarter. Since the relaunch of our Halo business product last

year as part of our Small Business Support Scheme, 25k businesses

are now able to stay better connected to their customers when

working remotely or on the move. We have strengthened our support

for SMEs, adding a new mentoring programme in partnership with

Digital Boost. We also collaborated with the University of Warwick

and Warwickshire County Council to switch on the UK's first

dedicated public 5G network for a connected campus, bringing

ultrafast 5G mobile to students and staff through our EE mobile

network, as well as providing a series of 5G led use cases. We

extended our partnership with RingCentral, combining the best of

BT's network leadership and resources with RingCentral's

industry-leading technology. Our 'Cloud Work provided by

RingCentral' offering provides UK businesses and public sector

customers with a seamless communications experience for distributed

workforces to collaborate effectively. We expect Covid-19 to impact

trading and business insolvencies, particularly our direct and

indirect SME customers, in Q4 and into 2021/22. In addition, we

expect to see some opex investment in Q4 as part of our

transformation plans. In the quarter we also exercised our call

option to purchase the remaining 30% non-controlling interest in BT

OnePhone Limited. We expect to finalise the purchase in H1 2021/22,

the purchase price will be based on independent valuations.

(1) See Glossary on page 5. Commentary on revenue and EBITDA is

based on adjusted measures.

(2) On 1 April 2020, Supply Chain and Pelipod, which serve

several parts of BT, were transferred from Enterprise to the

central procurement team and as a result will now be reported in

Group 'Other' financial results. The prior year comparative for the

Enterprise and Other CFU results has been restated to reflect this.

Refer to the announcement on 29 June 2020 for further

information.

Global: Continued execution of strategy helping to reduce

Covid-19 impact

Revenue was negatively impacted by Covid-19, divestments of

domestic businesses in Spain, Latin America and France, mature and

legacy portfolio declines and an GBP8m negative impact from foreign

exchange movements. Revenue excluding divestments and foreign

exchange was down 10%. EBITDA was down reflecting the impact of

divestments, prior year favourable one-offs and a GBP4m negative

impact from foreign exchange movements. EBITDA, excluding

divestments, one-offs and foreign exchange was up 6%. The negative

impact of Covid-19 on revenue was more than offset by lower

operating costs reflecting ongoing transformation and Covid-19

mitigation actions. Order intake in the quarter was GBP1.2bn, up 1%

despite the impact of Covid-19. On a 12-month rolling basis it was

GBP4.1bn, also up 1% year on year. During the quarter we completed

the sale of selected domestic operations and infrastructure in

Latin America and France. We also agreed the sale of selected

business units in Italy serving domestic public administration and

SMEs. The transaction is subject to regulatory approval and is

expected to complete in Q1 2021/22. We continue to see a reduction

in spending and a more cautious approach from our multinational

customers resulting in cancellations and delays to purchasing

cycles, which will negatively impact revenue and EBITDA in Q4 and

subsequent periods.

Openreach: FTTP build remains on track

Revenue growth was driven by higher rental bases in

fibre-enabled products(1) , up 17%, and Ethernet, up 8% at quarter

end. This was partially offset by a decline in legacy copper

products. Openreach achieved record FTTP orders of 17k per week in

the quarter, and announced it will be extending several commercial

FTTP offers, including its FTTP-only offer. EBITDA grew 3% slightly

ahead of revenue growth. Operating costs were broadly flat, with

higher service costs as we continue to deliver against our

customers' increasing service expectations, increased FTTP

provisions and pay inflation, broadly offset by ongoing efficiency

programmes. Openreach's FTTP rollout reached record levels in the

third quarter, building at an average run rate of 42k premises

passed per week and reaching 4.1m premises at quarter end.

Openreach signed its third R100 contract, covering the North of

Scotland, extending a long-standing partnership with the Scottish

Government to connect thousands of the hardest-to-reach premises.

Looking ahead, we do not anticipate any material trading impacts

arising as a result of the latest Coronavirus restrictions across

the UK in the current financial year, although we do expect some

impact on FTTP and Gfast provisioning volumes, having temporarily

paused non-essential work inside customers' premises. Our FTTP

build remains on track to reach 4.5m premises by March 2021,

despite the latest restrictions.

(1) FTTP, FTTC and Gfast (including Single Order

migrations).

RESPONSE TO COVID-19

BT has played a critical role in keeping our customers and the

country connected throughout the pandemic with a wide range of

support programmes, including a number of recent initiatives during

Q3 and since the period end.

In response to tighter restrictions around Covid-19 and schools

closing, we have launched a 'Lockdown Learning' support scheme, and

announced plans to zero rate some of the most popular educational

content websites designed to support home learning for all EE, BT

Mobile and Plusnet Mobile customers, allowing customers and their

children to access educational content even if they have run out of

data.

We have also been working with the Department for Education to

ensure school children can continue to learn online whilst face to

face learning has been paused. We are giving unlimited mobile data

to children who need it the most, as well as thousands of free WiFi

vouchers to schools and charities to distribute to families without

an internet connection. We want our offer to be nationwide and we

are looking at the quickest route to extending the mobile data

programme to administrations in Northern Ireland, Scotland and

Wales.

In addition, we have launched our Stand Out Skills Campaign.

This initiative provides job-seekers of all ages with free tips,

resources and advice to help them build confidence and stand out in

a job search.

We have worked with the NHS to connect vaccination centres up

and down the country and our Life Lines Project, which allows

relatives to see and speak to their loved ones in intensive care

units via a video-enabled tablet, has now enabled more than 65k

virtual visits in NHS hospitals, accounting for more than 400k call

minutes across 180 hospitals.

FINANCIALS FOR THE NINE MONTHS TO 31 DECEMBER 2020

Income statement

Reported revenue was GBP16,058m, down 7%, due primarily to the

impact of Covid-19 on Consumer and our enterprise units, ongoing

legacy product declines and divestments of domestic businesses in

Spain, Latin America and France, but was partially offset by higher

rental bases of fibre-enabled products and Ethernet in

Openreach.

Adjusted(1) EBITDA of GBP5,603m was down 5% or GBP297m, mainly

driven by the fall in revenue; partially offset by H1 sports rights

rebates, savings from our modernisation programme and other cost

initiatives including Covid-19 mitigating actions.

Reported profit before tax was GBP1,591m, down 17% or GBP320m,

primarily reflecting the decline in adjusted EBITDA.

Tax

The effective tax rate was 19.8% on reported profit and 19.9% on

adjusted(1) profit, based on our current estimate of the full year

effective tax rate.

Capital expenditure

Capital expenditure was GBP3,030m (2019/20: GBP2,877m). Network

investment was up 10% to GBP1,669m, largely due to increased

network investment in FTTP. Other capital expenditure components

were largely flat, with GBP715m spent on customer-driven

investments, GBP558m on systems and IT, and GBP88m on non-network

infrastructure.

Normalised free cash flow

Normalised free cash flow(1) declined by GBP170m to an inflow of

GBP830m due to reduced EBITDA and higher cash capital expenditure,

offset by a cash receipt from the monetisation of a non-strategic

revenue stream generated from our building infrastructure and

timing of tax payments.

(1) See Glossary on page 5.

Net debt and liquidity

Net financial debt (which excludes lease liabilities) at 31

December 2020 was GBP11.0bn, GBP0.3bn lower than 31 March 2020

(GBP11.3bn), with net cash inflow from operating activities and net

proceeds from disposal of subsidiaries offsetting net capital

expenditure, net interest payments and lease payments.

Net debt(1) including lease liabilities was GBP17.3bn at 31

December 2020, GBP0.7bn lower than at 31 March 2020

(GBP18.0bn).

Outlook

No change to FY20/21 revenue, EBITDA or Capex guidance. The

EBITDA outlook range remains at GBP7.3bn-GBP7.5bn.

As a result of a cash receipt from the monetisation of a

non-strategic revenue stream generated from our building

infrastructure in Enterprise that more than offsets the negative

cash impact of Brexit planning and the Huawei pre-buy, we are

narrowing our FY20/21 normalised free cash flow guidance range to

GBP1.3bn-GBP1.5bn (from GBP1.2bn-GBP1.5bn).

(1) See Glossary on page 5.

OTHER DEVELOPMENTS

Regulation

Wholesale Fixed Telecoms Market Review (WFTMR) 2021-2026

In November, Ofcom published a further consultation on remedies.

We expect Ofcom to finalise its overall WFTMR proposals prior to

April 2021.

Broadband universal service obligation (USO)

In October, Ofcom opened an investigation into BT's compliance

with its obligations as a Universal Service provider. Ofcom is

gathering evidence and expects to provide an update by March

2021.

Spectrum auction

In December, we applied to bid in Ofcom's 700MHz and 3.6GHz

spectrum auction process. On 25 January, Ofcom announced that it is

planning for the principal stage of the auction (the start of

bidding) to begin in March 2021.

Consumer fairness

In November, we reported to Ofcom our adherence to its Fairness

for Customers commitments, in preparation for Ofcom's industry

report planned for Q4 2020/21. In December, Ofcom published

research on the affordability of telecoms services, calling on

communications providers (CPs) to do more to support customers in

financial difficulty. We are developing BT's new social tariff, and

we have continued to take action to address the Competition and

Markets Authority's "loyalty penalty" concerns. We committed to

carrying out regular account reviews for vulnerable customers, to

ensure they are on the best package to suit their needs.

European Electronic Communications Code (EECC)

We have made good progress in scoping and implementing the EECC

end-user rights. We are meeting with Ofcom to seek its view on how

it would assess compliance in areas that we have encountered

practical difficulties in implementing the requirements.

Wholesale Voice Markets Review

In November, we responded to Ofcom's Wholesale Voice Markets

Review consultation. The consultation covered mobile termination

rates, non-UK calls, point of interconnection migration, IP

interconnection services to wholesale call origination. This is a

critical piece of work from Ofcom as it regulates wholesale voice

services for the next five years when BT is planning an important

set of migrations and portfolio simplifications towards all-IP. The

ability to navigate this period with minimal and clear regulation

is essential for our business. Key risks we are seeking to mitigate

include revenue loss connected with lower termination charges, and

potential costs related to the introduction of new rules on IP

interconnection and uncertainty with the IP migration mentioned

above. Ofcom's final statement will be published in March 2021.

Other matters

Brexit

A post-Brexit deal on trade and other issues was agreed in

December between the UK and the EU. While there is clearly more for

the UK and EU to work through, we believe that the deal as agreed,

coupled with our own contingency planning, means we do not

currently expect any material financial or operational impact

resulting from Brexit. We're confident that we can continue

supporting and delivering great products and services for our UK

and global customers.

Government publishes draft telecommunications (security) bill

& spending review

In November, the Government published its draft

telecommunications (security) bill, which proposes to grant the

Government powers to enforce a ban on the use of high-risk vendor

equipment in UK telecommunications networks. It is understood that

the bill will go through the various parliamentary stages in early

2021. The costs to adhere with the draft telecommunications bill

are included within our outlook.

In November, the Government also published its spending review.

It committed GBP250m of funding to help diversify the UK 5G supply

chain; it changed its 2025 gigabit coverage target from all of the

UK to 85% of the UK; and it announced a plan to spend GBP1.2bn of

its committed GBP5bn rural subsidy for gigabit broadband by 2025,

which DCMS outlined in more detail on 22 December.

Contingent liabilities

The group is involved in various proceedings, including actual

or threatened litigation, and government or regulatory

investigations. Save for the updates provided below, there have

been no material updates relating to the legal proceedings and

regulatory matters as disclosed in our 31 March 2020 Annual Report

and our 30 September 2020 half year report.

Legal proceedings

In respect of each of the claims below, the nature and

progression of such proceedings and investigations can make it

difficult to predict the impact they will have on the group. There

are many reasons why we cannot make these assessments with

certainty, including, among others, that they are in early stages,

no damages or remedies have been specified, and/or the often slow

pace of litigation.

Brazilian tax claims

In October, the sale of BT Latam Inc. and its subsidiaries to

CIH Telecommunications Americas LLC was completed. As a result of

the sale the entities liable for the majority of all ICMS and

FUST/FUNTTEL matters are no longer a part of BT Group plc and it

will have no ongoing exposure with respect to those matters. The

retained business continues to be responsible for three ICMS cases

with a current estimated potential value of GBP11m, and 17

FUST/FUNTTEL cases with a current estimated potential value of

GBP4m. Other than these BT Group plc retains no material direct

exposures.

Class action claim

In January, law firm Mishcon de Reya applied to the Competition

Appeal Tribunal to bring a proposed class action claim for damages

estimated at GBP589 million on behalf of BT's landline-only

customers alleging anti-competitive behaviour through excessive

pricing by BT to customers with certain residential landline

services. BT intends to defend itself vigorously and regrets being

drawn into litigation on a topic which Ofcom considered more than

three years ago. At that time, Ofcom's final statement made no

finding of excessive pricing or breach of competition law more

generally. The claim seeks to hold against BT the fact that it

implemented a voluntary commitment to reduce prices for customers

that have a BT landline only and not to increase those prices

beyond inflation (CPI).

Regulatory and compliance matters

Northern Ireland Public Sector Shared Network contract

In December, Ofcom issued a final Confirmation Decision that BT

had contravened SMP Condition 5 (which requires BT to provide

network access on an 'Equivalence of Inputs' basis) in relation to

the above tender process. BT entered into a voluntary agreement

with Ofcom and paid a penalty of GBP6.3 million (which included a

30% discount for cooperating with Ofcom's investigation).

Other regulatory and compliance matters

In the ordinary course of business, we are periodically notified

of regulatory and compliance matters and investigations. We hold

provisions reflecting management's estimates of regulatory and

compliance risks across a range of issues, including price and

service issues. The precise outcome of each matter depends on

whether it becomes an active issue, and the extent to which

negotiation or regulatory and compliance decisions will result in

financial settlement.

Glossary

Adjusted Before specific items. Adjusted results are consistent

with the way that financial performance is measured

by management and assist in providing an additional

analysis of the reporting trading results of the group.

EBITDA Earnings before interest, tax, depreciation and amortisation.

Adjusted EBITDA EBITDA before specific items, share of post tax profits/losses

of associates and joint ventures and net non-interest

related finance expense.

Free cash flow Net cash inflow from operating activities after net

capital expenditure.

Capital expenditure Additions to property, plant and equipment and intangible

assets in the period.

Group NPS Group NPS measures Net Promoter Score in our retail

business and Net Satisfaction in our wholesale business.

Normalised free Free cash flow after net interest paid and payment

cash flow of lease liabilities, before pension deficit payments

(including the cash tax benefit of pension deficit

payments) and specific items.

Net debt Loans and other borrowings and lease liabilities (both

current and non-current), less current asset investments

and cash and cash equivalents, including items which

have been classified as held for sale on the balance

sheet. Currency denominated balances within net debt

are translated into sterling at swapped rates where

hedged. Fair value adjustments and accrued interest

applied to reflect the effective interest method are

removed.

Specific items Items that in management's judgement need to be disclosed

separately by virtue of their size, nature or incidence.

In the current period these relate predominantly to

retrospective regulatory charges, restructuring charges

linked with our modernisation programme and other

cost initiatives, and divestment related items.

=================== ==============================================================

Our commentary focuses on the trading results on an adjusted

basis, which is a non-GAAP measure, being before specific items.

The directors believe that presentation of the group's results in

this way is relevant to an understanding of the group's financial

performance as specific items are those that in management's

judgement need to be disclosed by virtue of their size, nature or

incidence. This is consistent with the way that financial

performance is measured by management and reported to the Board and

the Executive Committee and assists in providing a meaningful

analysis of the trading results of the group. In determining

whether an event or transaction is specific, management considers

quantitative as well as qualitative factors such as the frequency

or predictability of occurrence. Reported revenue, reported

operating costs, reported operating profit and reported profit

before tax are the equivalent unadjusted or statutory measures.

Enquiries

Press office:

Tom Engel Tel: 020 7356 5369

Investor relations:

Mark Lidiard Tel: 020 7356 4909

We will hold a conference call for analysts and investors in

London at 9am today and a simultaneous webcast will be available at

www.bt.com/results

We are scheduled to announce the full year results for 2020/21

on 13 May 2021.

Forward-looking statements - caution advised

This results release contains certain forward-looking statements

which are made in reliance on the safe harbour provisions of the US

Private Securities Litigation Reform Act of 1995. These statements

relate to analyses and other information which are based on

forecasts of future results and estimates of amounts not yet

determinable. These statements include, without limitation, those

concerning: the potential impact of Covid-19 on our people,

operations, suppliers and customers, and BT's response to Covid-19;

the potential impact of Brexit on our people, operations, suppliers

and customers; current and future years' outlook; revenue and

revenue trends; EBITDA and profitability; free cash flow; capital

expenditure and costs; return on capital employed; return on

investment; shareholder returns including dividends and share

buyback; net debt; credit ratings; capital markets; our group-wide

transformation and restructuring programme (including the

establishment of any new business units), cost transformation plans

and restructuring costs; investment in and roll out of our fibre

network and its reach, innovations, increased speeds and speed

availability; our broadband-based service and strategy; investment

in and rollout of 5G; the investment in converged network;

improvements to the customer experience and customer perceptions;

our investment in TV, enhancing our TV service and BT Sport; the

recovery plan, operating charge, regular cash contributions and

interest expense for our defined benefit pension schemes; effective

tax rate; growth opportunities in technologies, networked IT

services, the pay-TV services market, broadband, artificial

intelligence and mobility and future voice; growth of, and

opportunities available in, the communications industry and BT's

positioning to take advantage of those opportunities; expectations

regarding competition, market shares, customers (including spend),

prices and growth; expectations regarding the convergence of

technologies; plans for the launch of new products, platforms and

services; retail and marketing initiatives including pricing and

account reviews; network performance and quality; the impact of

regulatory and/or legislative initiatives, decisions and outcomes

on operations; BT's possible or assumed future results of

operations and/or those of its associates and joint ventures;

investment plans (including mergers and acquisitions);

modernisation plans; adequacy of capital; financing plans and

refinancing requirements; divestments; demand for and access to

broadband and the promotion of broadband by third-party service

providers; improvements to the control environment; digital skills,

climate/environment, responsible tech/human rights and

diversity/inclusion targets (including plans in respect of

operations, progress monitoring/reporting, engagement, resources,

training and recruitment); investigations and litigation; and those

statements preceded by, followed by, or that include the words

'aims', 'believes', 'expects', 'anticipates', 'intends', 'will',

'should', 'plans', 'strategy', 'future', 'likely', 'seeks',

'projects', 'estimates' or similar expressions.

Although BT believes that the expectations reflected in these

forward-looking statements are reasonable, it can give no assurance

that these expectations will prove to have been correct. Because

these statements involve risks and uncertainties, actual results

may differ materially from those expressed or implied by these

forward-looking statements. Factors that could cause differences

between actual results and those implied by the forward-looking

statements include, but are not limited to: the duration and

severity of Covid-19 impacts on our people, operations, suppliers

and customers; failure to respond effectively to intensifying

competition and technology developments; failure to address the

lingering perception of slow pace and connectivity in broadband and

mobile coverage, which continues to be raised at a UK parliamentary

level; undermining of our strategy and investor confidence caused

by an adversarial political environment; challenges presented by

Covid-19 around network resilience, support for staff and

customers, data sharing and cyber security defence; unfavourable

regulatory changes; attacks on our infrastructure and assets by

people inside BT or by external sources like hacktivists,

criminals, terrorists or nation states; a failure in the supplier

selection process or in the ongoing management of a third-party

supplier in our supply chain, including failures arising as a

result of Covid-19; risks relating to our BT transformation plan;

failure to successfully manage our large, complex and high-value

national and multinational customer contracts (including the

Emergency Services Network and the Building Digital UK (BDUK)

programme) and deliver the anticipated benefits; changes to our

customers' needs, budgets or strategies that adversely affect our

ability to meet contractual commitments or realise expected

revenues, profitability or cash generation; customer experiences

that are not brand enhancing nor drive sustainable profitable

revenue growth; pandemics, natural perils, network and system

faults, malicious acts, supply chain failure, software changes or

infrastructure outages that could cause disruptions or otherwise

damage the continuity of end to end customer services including

network connectivity, network performance, IT systems and service

platforms; insufficient engagement from our people; adverse

developments in respect of our defined benefit pension schemes;

risks related to funding and liquidity, interest rates, foreign

exchange, counterparties and tax; failures in the protection of the

health, safety and wellbeing of our employees or members of the

public or breaches of health and safety law and regulations;

financial controls that may not prevent or detect fraud, financial

misstatement or other financial loss; security breaches relating to

our customers' and employees' data or breaches of data privacy

laws; failure to recognise or promptly report wrongdoing by our

people or those working for us or on our behalf (including a

failure to comply with our internal policies and procedures or the

laws to which we are subject); and the potential impacts of climate

change on our business.

BT undertakes no obligation to update any forward-looking

statements whether written or oral that may be made from time to

time, whether as a result of new information, future events or

otherwise.

About BT

BT Group is the UK's leading telecommunications and network

provider and a leading provider of global communications services

and solutions, serving customers in 180 countries. Its principal

activities in the UK include the provision of fixed voice, mobile,

broadband and TV (including Sport) and a range of products and

services over converged fixed and mobile networks to consumer,

business and public sector customers. For its global customers, BT

provides managed services, security and network and IT

infrastructure services to support their operations all over the

world. BT consists of four customer-facing units: Consumer,

Enterprise, Global and its wholly-owned subsidiary, Openreach,

which provides access network services to over 650 communications

provider customers who sell phone, broadband and Ethernet services

to homes and businesses across the UK.

For the year ended 31 March 2020, BT Group's reported revenue

was GBP22,905m with reported profit before taxation of

GBP2,353m.

British Telecommunications plc is a wholly-owned subsidiary of

BT Group plc and encompasses virtually all businesses and assets of

the BT Group. BT Group plc is listed on the London Stock

Exchange.

For more information, visit www.bt.com/about .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTUOAKRAKUURAR

(END) Dow Jones Newswires

February 04, 2021 02:00 ET (07:00 GMT)

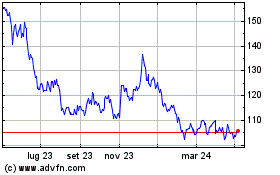

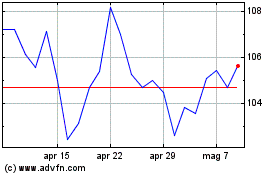

Grafico Azioni Bt (LSE:BT.A)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Bt (LSE:BT.A)

Storico

Da Apr 2023 a Apr 2024