BT Group's 1Q Beat Overshadowed by Downbeat Guidance -- Earnings Review

31 Luglio 2020 - 2:41PM

Dow Jones News

By Adria Calatayud

BT Group PLC reported results for the first quarter of fiscal

2021 on Friday. Here's what you need to know:

REVENUE: The U.K. telecommunications company generated revenue

of 5.25 billion pounds ($6.87 billion), ahead of expectations of

GBP5.16 billion, according to a consensus provided by the company.

This was lower than the GBP5.63 billion reported for the

year-earlier period.

ADJUSTED EBITDA: BT's adjusted earnings before interest, taxes,

depreciation and amortization--the company's preferred metric,

which strips out exceptional and other one-off items--came in at

GBP1.81 billion, exceeding a company-provided consensus of GBP1.75

billion. In the same period last year, BT's adjusted Ebitda was

GBP1.96 billion.

WHAT WE WATCHED:

--GUIDANCE: BT surprised analysts by issuing guidance for the

year ending March 31, 2021 for the first time. The company said

adjusted revenue is expected to fall between 5% and 6%, and

adjusted Ebitda is forecast to decline to between GBP7.2 billion

and GBP7.5 billion. Current consensus expectations for adjusted

Ebitda sit at the top of the range given by the company, prompting

analysts at Citi to say BT's outlook was weaker than anticipated.

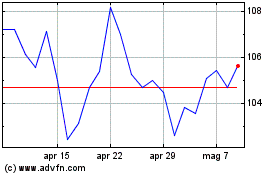

Shares at 1156 GMT traded 3.6% lower at 104 pence.

--CORONAVIRUS: BT attributed the first-quarter revenue decline

to the effects of the coronavirus pandemic. The company was hit by

lower BT Sport revenue and a fall in business activity in its

enterprise unit. BT also warned that the pandemic continues to

weigh on its consumer division and that it expects a further hit to

its enterprise unit in future quarters.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

July 31, 2020 08:26 ET (12:26 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

Grafico Azioni Bt (LSE:BT.A)

Storico

Da Mar 2024 a Apr 2024

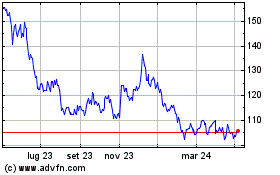

Grafico Azioni Bt (LSE:BT.A)

Storico

Da Apr 2023 a Apr 2024