Bank Earnings: Expect a Messy Quarter and a Peek at 2021

14 Gennaio 2021 - 11:59AM

Dow Jones News

By Orla McCaffrey

2020 was a whiplash kind of year for U.S. banks. When the firms

start reporting fourth-quarter earnings this week, investors will

want to know if they should expect another.

The spring and summer of 2020, when the coronavirus pandemic

first started to ravage the U.S. economy, looked bad for banks.

Profits plunged as they set aside money for bad loans. So did their

stock prices. But by the fall, things had improved. Strong mortgage

demand, healthy trading revenue and an economy kept afloat by

generous government stimulus helped insulate the banks from a

worst-case scenario.

What isn't clear now is how long those boosters can last.

"The fourth quarter is going to be messy," KBW analyst Brian

Klock said. "But the real focus is going to be what 2021 is going

to look like."

JPMorgan Chase & Co., Citigroup Inc. and Wells Fargo &

Co. report results Friday. Bank of America Corp., Goldman Sachs

Group Inc. and Morgan Stanley follow next week.

KBW analysts expect per-share bank earnings to fall 8% in the

fourth quarter compared with the same time in 2019. They also

expect profits to fall compared with the third quarter, when some

of the largest banks delivered better-than-expected results.

Net charge-offs are expected to rise in the fourth quarter from

the third but remain far below historic highs, analysts said.

Concerns over deteriorating credit quality ate into profits in

2020, when banks set aside billions of dollars to cover potential

losses. Banks and analysts have lowered their loan-loss estimates

since the pandemic's early days, but those could rise again if the

current jump in coronavirus cases further slows the economic

recovery.

Banks are expected to announce plans for stock buybacks, one of

the main ways they return capital to shareholders. The Federal

Reserve stopped buybacks at big banks last year, a move to preserve

capital in an unsettled economy, but said in December that banks

could restart them with limitations.

The unusual nature of the coronavirus recession padded bank

revenue in ways that few could have predicted at the pandemic's

outset. Mortgage originations, a key source of fee income, reached

record levels as well-off families looked for homes with more

space. The stock market, boosted by tech companies that profited

from the stay-at-home economy, soared to records, lifting trading

desks. Stimulus checks, loan deferrals and expanded unemployment

helped many consumers and businesses, driving loan defaults lower

-- not higher -- for some companies.

Bank stocks mounted an impressive recovery in the fall after

trailing the broader market for much of 2020. The KBW Nasdaq Bank

Index rose 34% between October and December, compared with a 12%

increase in the S&P 500.

"We're going to look back on 2020 and think 'Oh my God, what in

the world did we have to live through?'" said Marty Mosby, director

of bank and equity strategy at Vining Sparks. "But in reality,

things happened in a way that definitely helped bank

profitability."

Still, mortgage levels are expected to decline in 2021. Rising

coronavirus cases and job losses threaten to keep consumers at home

and squeeze their income, which would likely weigh on credit-card

spending and leave some customers unable to pay their bills.

Low interest rates, which crimp bank profits by limiting what

banks can charge on loans, are also a challenge. The Fed slashed

its benchmark rate to near zero last March. Analysts expect net

interest margin, a key measure of lending profitability, to decline

even from what was already an all-time low of 2.68% in the third

quarter.

What's more, making loans in such an uncertain economy could

prove difficult, in part because lenders aren't sure how to

evaluate customers' risk profiles after months of loan deferrals.

Loan growth decelerated in the fourth quarter, falling by an

annualized 3% from the previous quarter, according to analyst

estimates. And businesses that socked away cash earlier in the

pandemic won't need loans.

"When businesses feel optimistic about the outlook and want to

expand or hire, they've got the cash to do that," said Terry

McEvoy, a bank analyst at Stephens Inc. "They will not need to call

their banker and ask for a loan."

Write to Orla McCaffrey at orla.mccaffrey@wsj.com

(END) Dow Jones Newswires

January 14, 2021 05:44 ET (10:44 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

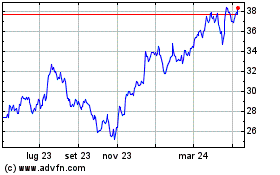

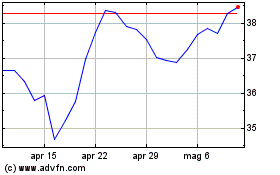

Grafico Azioni Bank of America (NYSE:BAC)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Bank of America (NYSE:BAC)

Storico

Da Apr 2023 a Apr 2024