TIDMBOIL

RNS Number : 2213L

Baron Oil PLC

29 April 2020

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

29 April 2020

Baron Oil Plc

("Baron Oil" or "the Company")

Final Results for the Year Ended 31 December 2019

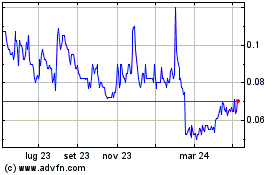

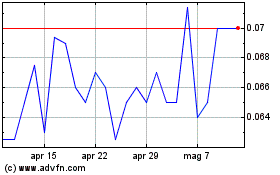

Baron Oil Plc (AIM:BOIL), the AIM-quoted oil and gas exploration

and production company focused on opportunities in SE Asia, Latin

America and the UK, is pleased to announce its audited financial

results for the year ended 31 December 2019.

Operations

Chuditch PSC: The award in November of the TL-SO-19-16

Production Sharing Contract ("Chuditch PSC"), offshore Democratic

Republic of Timor-Leste, marks a major step forward for the

Company. Shell's internal analyses following the drilling of the

Chuditch-1 discovery in 1999, indicate a Mean Gas Initially in

Place (GIIP) for the surrounding group of prospects in the Chuditch

PSC of 2,320 BCF, considered by Baron to be low-risk GIIP Pmean

Prospective Resources (but not SPE PRMS compliant). Baron has an

indirect interest of 25% in the Chuditch PSC, held through its

shareholding in SundaGas (Timor-Leste Sahul) Pte. Ltd.

Block XXI: The Company continues to pursue efforts to drill the

El Barco-3X well in Peru, including introducing a partner. However,

plans for drilling are currently halted by COVID-19 issues, with

strict movement restrictions including the inability to visit the

site. Baron has a 100% interest.

Inner Moray Firth (UK): Initial subsurface work on Licence

P2478, which contains the large Dunrobin and smaller Golspie

prospects, is under review and further seismic reprocessing is

planned. Licences P2470 and P2235 have been relinquished. Baron has

a 15% interest in the Inner Moray Firth.

Dorset (UK): The latest analysis of the Colter South Prospect

(on Licence P1918), in which oil was found during 2019, indicates

that a further appraisal well is required to define the resources

before development can be planned. The current oil price collapse

and short remaining duration of the Licence mean efforts to bring

in a new drilling partner are now unlikely to succeed. Hence, under

IFRS6, the entire carrying amount for Colter has been impaired. The

status of PEDL330 and PEDL345 onshore Licences, lying to the south

of Wytch Farm oilfield, continue to be reviewed in light of the

current business environment. Baron has an 8% interest in the

Dorset Licences.

Financials

-- Net result for the year was a loss before taxation of

GBP1,674,000 (2018: loss of GBP3,280,000)

-- Loss after taxation attributable to shareholders was

GBP1,674,000 (2018: loss of GBP2,495,000)

-- Exploration and evaluation expenditure of GBP1,207,000 (2018: GBP1,592,000)

-- IFRS6 intangible asset impairment charge of GBP1,047,000,

mainly relating to P1918 Colter (2018: IFRS6 charge of GBP1,360,000

relating to Block XXI, Peru)

-- Administration expenditure for the year was GBP442,000 (2018: GBP549,000), a 20% reduction

-- The end of year free cash balance was GBP347,000 (2018:

GBP1,709,000). Excluding the proceeds of a share placing in June

2019 amounting to GBP440,000 gross (GBP408,000 net), the overall

cash outflow during the year amounted to GBP1,770,000.

-- In Q1 2020, the Company undertook a further capital raise of

GBP2.5m gross (GBP2.3m net) at 0.1p per share.

The Company intends to hold its AGM in June 2020 and the Notice

of Annual General Meeting to that effect will be sent to

Shareholders in due course.

Competent Person's Statement

Pursuant to the requirements of the AIM Rules for Companies, the

technical information and resource reporting contained in this

announcement has been reviewed by Dr Malcolm Butler BSc, PhD, FGS,

Executive Chairman of the Company. Dr Butler has more than 45

years' experience as a petroleum geologist. He has compiled, read

and approved the technical disclosure in this regulatory

announcement. The technical disclosures in this announcement comply

with the Society of Petroleum Engineers ' standard, except as

stated.

Commenting on the results, Malcolm Butler, Executive Chairman,

said:

"The final award of the Chuditch PSC was a great result for your

Company and marks a step-change in Baron's asset base. However, our

industry is currently faced with the dual global impact of

significantly lower oil prices and the rapid spread of the COVID-19

virus. While Baron is not insulated from the oil price shock, it

should be noted that the Company's assets are all in the

pre-cashflow exploration phase and, following the award of the

Chuditch PSC, are now heavily weighted towards gas where regional

markets play a much greater role in pricing.

In Timor-Leste, there is no obligation to drill before 2022 and

any commercial production is unlikely to be achieved before 2025.

There are no plans to fund drilling in the UK for the foreseeable

future. In both cases, work on these projects over the next 12

months is desk and computer-based and should not be affected by

current movement restrictions, although gaining access to the

necessary data is being delayed.

As regards the El Barco-3X well in Peru, it is unclear how much

local oil companies' appetite for drilling will be affected by oil

price movements and although it is unlikely that local gas prices

in this part of Peru will be affected by the drop in oil prices, it

is impossible to predict the effects on short term gas demand of a

COVID-19 related recession.

Critically for shareholders, following our GBP2.5m (gross) fund

raise in Q1 2020, our proposed work programme for 2020 and into

2021 is funded."

For further information, please contact:

Baron Oil Plc +44 (0)20 7117 2849

Dr Malcolm Butler, Executive Chairman

Andy Yeo, Managing Director

SP Angel Corporate Finance LLP +44 (0)20 3470 0470

Nominated Adviser and Joint Broker

Stuart Gledhill, Caroline Rowe

Turner Pope Investments (TPI) Limited +44 (0)20 3657 0050

Joint Broker

Andy Thacker, Zoe Alexander

CHAIRMAN'S STATEMENT & OPERATIONS REPORT

Financial and Financial Results

The net result for the year was a loss before taxation of

GBP1,674,000, which compares to a loss of GBP3,280,000 for the

preceding financial year; the loss after taxation attributable to

Baron Oil shareholders was GBP1,674,000, compared to a loss of

GBP2,495,000 in the preceding year.

Turnover for the year was GBPnil (2018: GBPnil), there being no

sales activity during the period.

Exploration and evaluation expenditure written off included in

the Income Statement amounts to GBP160,000. This arises from

expenditure of GBP133,000 in Peru on Block XXI, GBP42,000 in costs

regarding the South East Asia Joint Study Agreement with SundaGas

prior to the award of the TL-SO-19-16 Production Sharing Contract

in November 2019, minor pre-licence expenditures of GBP9,000

relating to the UK Offshore 31(st) Licensing Round and technical

consultancy, less GBP24,000 recovered in respect of 2018

exploration activities in Licence P2235 (Wick).

On the Colter prospect (licence P1918), wells 98/11a-6 and its

sidetrack 98/11a-6z were drilled in February and March 2019 at a

total cost to Baron of GBP996,000. GBP376,000 had been invoiced

during 2018 in respect of preparations for the drilling of the well

and had previously been treated as a prepayment. Including other

licence costs, total expenditure in the year was GBP1,042,000,

which was capitalised to give a total intangible asset value of

GBP1,108,000. The initial evaluation of the well results indicated

that the Colter South Prospect had the potential to contain

commercial quantities of oil and the licence was therefore

continued into its second term in February 2020. However,

re-evaluation of the geophysical information, the failure of

attempts to bring in an additional partner, and, most recently, the

precipitous drop in oil prices in March 2020 has led to a further

reassessment of the economic case, increasing the likelihood that

the licence will be relinquished before expiry of the Second Term

of the licence on 31 January 2021. IFRS6 (the relevant accounting

standard) states that an asset should be impaired if there is a

prospect of a licence coming to an end in the near future, which

for the purposes of this Annual Report would be the next 12 months.

On this basis, the decision has now been taken to impair the entire

carrying amount for Colter of GBP1,108,000.There was a small

reduction in the provision relating to Peru Block XXI of GBP61,000

due to exchange rate fluctuations, leading to a total net cost of

impairment amounting to GBP1,047,000.

In Colombia, the liquidation of Inversiones Petroleras de

Colombia SAS ("Invepetrol"), in which the Company held a 50%

interest, was completed on 2 October 2019, with no further

liability to the Company.

Administration expenditure for the year was GBP442,000, compared

to GBP549,000 in the preceding year, excluding the effects of

exchange rate movements. Directors and employee costs amounted to

GBP258,000, listing compliance and other professional fees

GBP133,000 and other overheads GBP51,000. During the year, the

directors agreed to a temporary reduction in their contracted

salaries which resulted in cost savings of GBP89,000.

We saw a modest strengthening of the Pound Sterling against the

US Dollar and, with the majority of the group's assets being

denominated in US dollars, this has given rise to a loss of

GBP41,000. This compares with a gain of GBP130,000 in the preceding

year, when the Pound Sterling showed relative weakness against the

US Dollar.

At the end of the financial year, free cash reserves of the

Group had decreased to GBP347,000 from a level at the preceding

year end of GBP1,709,000. Excluding the proceeds of a share placing

in June 2019 amounting to GBP440,000 gross (GBP408,000 net of

costs), the overall cash outflow amounted to GBP1,770,000,

consisting of GBP1,207,000 in respect of exploration and evaluation

activity and GBP563,000 operating cash outflow. In Q1 2020, the

Company undertook a further capital raise with a new ordinary share

Placing of GBP2,500,000 gross (GBP2,306,000 net).

The Group continues to pursue a conservative view of its asset

impairment policy, giving it a Balance Sheet that consists largely

of net current assets and what it considers to be a realistic value

for its exploration assets. Given limited cash resources, the Board

will take a prudent approach in entering into new capital

expenditures beyond those expected to be committed to existing

ventures.

Report On Operations

Introduction

The directors are pleased to report the success of SundaGas

Pte.Ltd. in gaining the award of the TL-SO-19-16 Production Sharing

Contract in Timor-Leste. As shareholders will be aware, this

follows an application made in early 2016, during the period of the

Joint Study Agreement between Baron and SundaGas. Baron now holds a

33.33% interest in SundaGas (Timor-Leste Sahul) Pte.Ltd, whichgives

it an indirect interest of 25% in a substantial gas discovery. The

Company continues to pursue efforts to drill the El Barco-3X well

on Block XXI in Peru in 2020. As announced during the year, Baron

participated in the drilling of two vertical wells and a sidetrack

in offshore UK waters. Although oil was encountered in Triassic

Sherwood Sandstones on the Colter South Prospect by well 98/11a-06,

the results of subsequent analysis indicate that a further

appraisal well must be drilled before Colter South can be moved

towards development. Efforts to bring in a new partner to

participate in the necessary additional work have been unsuccessful

so far and the recent precipitous drop in oil prices makes it

unlikely that such work can be carried out before the expiry of the

current licence term in January 2021.

It is difficult to predict what effect the COVID-19 pandemic

will have on operations planned for 2020 but it is already clear

that drilling activities will suffer significant delays, which will

impact plans for Peru Block XXI. In addition, it is impossible to

predict the effects on short term gas demand in Peru and longer

term gas demand in Southeast Asia of a potential global

recession.

Southeast Asia: Timor-Leste Tl-S0-19-16 Psc (Baron 25%,

Effective)

The award in November 2019 to a subsidiary of SundaGas Pte.Ltd.

of the TL-SO-19-16 Production Sharing Contract (the "Chuditch

PSC"), offshore Democratic Republic of Timor-Leste, marks a major

step forward for the Company. Baron supported the original

application for a PSC in this area made by the SundaGas group in

October 2016, which gave it the right to an interest in the

subsequent award. A Shareholders' Agreement ("SHA") has been

executed with SundaGas Resources Pte. Ltd ("SundaGas") governing

the operation of SundaGas (Timor-Leste Sahul) Pte.Ltd ("SundaGas

TLS"), in which Baron now has a 33.33% shareholding and SundaGas

retains 66.67%. The sole asset of SundaGas TLS is its 100%

shareholding in SundaGas Banda Unipessoal Lda., Operator of the

Chuditch PSC, in which it holds a 75% interest.

The SHA contains provisions typical of an agreement of this

nature including, but not limited to, mutual undertakings, the

right to appoint one of the three directors of SundaGas TLS and

certain shareholder rights protections.

Under the terms of the Carry Agreement, executed between

SundaGas and Baron on 27(th) January 2020, and the SHA, US$521,149

was paid to SundaGas on 21(st) April 2020 to reimburse Baron's

33.33% share of costs incurred since the Chuditch PSC was signed on

8 November 2019. This amount includes Baron's 33.33% share of the

$1,000,000 Bank Guarantee and the subscription for 3,333 shares in

SundaGas TLS, representing 33.33% of the issued share capital of

that company. Baron now plans to maintain its interest by

continuing to pay 33.33% of the costs incurred on the Chuditch PSC

through additional investment into SundaGas TLS. The Company's

33.33% interest in SundaGas TLS equates to an indirect 25% interest

in the Chuditch PSC after accounting for the 25% carried interest

of the Timor-Leste state company. Information has been derived from

publicly released reports on the area, prepared by Shell

Development (Australia) Pty. Ltd. ("Shell") in 1998 and 2001 after

the drilling of the discovery well Chuditch-1. These indicate that

the well, drilled in 64 metres water depth in a total of 25 days

for US$8 million, encountered a 25m gas column in Jurassic Plover

Formation reservoir sandstones on the flank of a large faulted

structure. The reports include estimated ranges of gas in place and

recovery factors derived from Shell's internal analyses and, whilst

not compliant with the 2018 SPE PRMS Prospective Resources

standard, are considered to be a valid indication of the potential

for the Chuditch gas accumulation.

The key Shell estimates for the combined Chuditch, Chuditch

North and Chuditch South closures ("Greater Chuditch") tested by

Chuditch-1 within the area of the PSC are:

1. Estimated Mean Gas in Place (GIIP) of 2,320 BCF, considered

by Baron to be Pmean Prospective Resources;

2. Gas recovery factors in the range of 55% to 75%, leading

Baron to estimate Mean Recoverable Gas of 1,276 to 1,740 BCF,

considered by Baron to be recoverable Pmean Prospective

Resources;

3. Risks associated with trap, reservoir and charge for the

Greater Chuditch closure considered to be zero (that is, the

Geological Chance of Success is 100%), with remaining uncertainty

around in place and recoverable volumes.

Further information is available on the Company's website (

www.baronoilplc.com ) and a glossary of terms is included at the

end of the report.

SundaGas has put in place the $1 million Performance Guarantee

Bond and is moving forward with the initial agreed work programme

commitment to reprocess existing 2D and 3D seismic data over the

PSC area. Subject to satisfactory results from the reprocessing,

the subsequent commitment is for a well to be drilled in the third

year of the Initial Term of the Chuditch PSC.

Peru Onshore Block XXI (Baron Oil 100%)

The Company continues to strive to drill on Block XXI, in the

Sechura Basin of northern Peru. An experienced local operator with

onshore drilling capacity is available and together we are looking

at funding options which, subject to local community approval,

should see the El Barco-3X well drilled in 2020. However, plans for

drilling are currently halted by COVID-19 issues, with strict

movement restrictions and the inability to visit the site. It is

unclear how much our proposed partner's appetite for drilling will

be affected by this and by oil price movements. Gas production in

this part of Peru is sold at a price determined by local

industries. Although it is unlikely that local gas prices will be

greatly affected by the drop in oil prices, it is impossible to

predict the effects on short term gas demand in Peru of a potential

global recession.

Gold Oil Peru SAC ("GOP"), Baron's Peruvian subsidiary,

currently operates Block XXI with 100% interest but it is likely

that the interest will reduce to between 50% and 70% on farming out

to bring in a new partner.

The well is planned to be drilled to a total depth of 1,850

metres to test a prospect for which Baron estimates unrisked

recoverable SPE-PRMS-compliant Prospective Resources (2U-P50) of 14

BCF of gas from the shallower Mancora Sand target, with a 55%

Chance of Geological Success, and 8.5 MMBBLS, with associated gas

and a 27% Chance of Geological Success, from the higher-risk

fractured Amotape Basement. This Basement structure may be larger

than presently mapped because it extends beyond the edge of

existing 2D seismic data.

The current estimated cost of site preparation and drilling of

El Barco-3X is US$1.2 million. The proposed location is

approximately 19 kilometres east of the Pan-American Highway and

only 1.5 kilometres from the Oleoducto Nor Peruano, the oil

pipeline that crosses the Andes from the Amazon Basin and runs to

the coast at Bayovar.

The Block is in the fifth and last exploration phase with

approximately 6 months left in which to drill once Force Majeure is

lifted, which will occur when access details are agreed with the

local community. Once the well is drilled, the Company has an

agreement in principle with PeruPetro that Baron will have the

option of a three-year extension. Under the terms of the current

period, GOP is entitled to the return of its US$160,000 government

performance bond if the well is drilled.

United Kingdom Offshore Licences P2470 And P2478 (Baron 15%)

Baron Oil and its partners were formally awarded these two new

licences in the Inner Moray Firth area of the North Sea by the UK

Oil & Gas Authority in September 2019, following the UK 31st

Offshore Licensing Round. These Innovate Licences are held by

Corallian Energy Limited ("Corallian") (Operator, with 45%), Upland

Resources (UK Onshore) Limited (40%) and Baron (15%).

Licence P2478, over blocks 12/27c, 17/5, 18/1 and 18/2, contains

the Dunrobin prospect which consists of three large shallow

Jurassic rotated fault blocks that are mapped mostly on 3D seismic

data within a single culmination with Direct Hydrocarbon

Indicators. The lowest closing contour covers 40 square kilometres

and Corallian estimates the prospect to have Pmean Prospective

Resources of 172 mmboe, with upside potential of c. 400 mmboe

(P10). These resource estimates are non-SPE-PRMS compliant

recoverable Prospective Resources for the Jurassic sands primary

target. . Additional Pmean Prospective Resources of 23.5 mmboe are

estimated by Corallian for the smaller Golspie Prospect also

contained within the licence. Both prospects are already defined by

existing 3D seismic and reprocessing of these data, together with

supporting 2D seismic, is underway.

Licence P2470 includes blocks 11/23, 11/24c and 11/25b,

surrounding the Wick Prospect, on which Baron Oil participated in

the dry Wick Well (11/24b-4) at the beginning of 2019. These blocks

were applied for before the results of 11/24b-4 were known and,

although they contain the small Knockinnon oil discovery and

several small prospects, they have been downgraded by the Wick well

result. The modest work commitment on this licence consists of a

small volume of 3D seismic reprocessing, which has now been

completed. The results of such work were not encouraging and the

Licence was relinquished with effect from 31(st) March 2020.

Former Licence P2235, on which the unsuccessful Wick Well was

drilled, was relinquished at the end of Q3 2019.

United Kingdom Offshore Licence P1918 (Colter) (Baron 8%)

The Colter area lies in UKCS Licence P1918 in Poole Bay,

immediately southeast of the Wytch Farm oilfield, which has been

developed from onshore facilities. The Colter well (98/11a-06) and

its sidetrack (98/11a-06z) were drilled in February and March 2019

and indicated the presence of an oil accumulation with commercial

potential in the Colter South Prospect within P1918. Efforts since

then have been concentrated on Colter South, where a review of the

seismic data and mapping was undertaken in an attempt to improve

the subsurface imaging of this complex area. Although the Operator,

Corallian Energy Limited, estimated nonSPE-PRMS compliant Pmean

recoverable Prospective Resources of 16 mmboe in the Colter South

Prospect (1.2 mmboe net to Baron), it has become clear that an

additional vertical appraisal well is necessary before any plans

can be made for development.

The P1918 group has elected to proceed into the Second Term of

the Licence, expiring on 31 January 2021, and has simultaneously

reduced the Licence area to incorporate only that acreage

surrounding the Colter and Colter South Prospects. The Joint

Venture participants have been seeking an additional partner to

help fund the drilling of the required vertical well and thereafter

to move it forward into development. However, given the short time

frame to expiry of the licence and the current oil price situation

it is considered unlikely that this can take place before the

Second Term expires. On this basis, the directors have elected to

impair costs previously capitalised in respect of 98/11a-06 and

98/11a-06z.

United Kingdom Onshore Licences PEDL330 & PEDL345 (Baron

8%)

PEDL330 and PEDL345 are onshore Licences, lying to the south of

Wytch Farm oilfield. PEDL345 includes a major part of the Purbeck

Prospect, which is being evaluated. However, the combination of the

current low oil price and the environmental issues associated with

drilling in this coastal area of Dorset has led the directors to

conclude that it will be difficult for drilling to take place

before these licences expire in July 2021.

Conclusions

Baron is currently faced with the dual global impact of

significantly lower oil prices and the rapid spread of the COVID-19

virus. While we are not insulated from the oil price shock, it

should be noted that the Company's assets are all in the

pre-cashflow exploration phase and, following the award of the

Chuditch PSC, are now heavily weighted towards gas where regional

markets play a much greater role in pricing.

There is no obligation to drill before 2022 in Timor-Leste and

there are no plans to fund drilling in the UK in the foreseeable

future. In both cases, planned work for at least the next 12 months

is desk and computer-based and should not be affected by current

movement restrictions, although gaining access to the necessary

data is being delayed. As regards the El Barco-3X well in Peru,

plans for drilling are currently halted by strict movement

restrictions and the inability to visit the site. It is unclear how

much our proposed partner's appetite for drilling will be affected

by oil price movements. Although it is unlikely that local gas

prices in this part of Peru will be affected by the drop in oil

prices, it is impossible to predict the effects on short term gas

demand in Peru. Moreover, the impact on longer term gas demand and

the currently depressed regional gas prices in Southeast Asia from

a steep economic recession brought on by the COVID-19 pandemic

remains to be seen.

Following our GBP2.5m (gross) fund raise in February 2020, our

proposed work programme for 2020 and into 2021 is funded. The

majority of the funds are planned to be used to pay Baron's share

of the ongoing TL-SO-19-16 PSC ("Chuditch PSC") work programme and

the drilling of the onshore El Barco-3X well in Peru.

Once the global economic outlook becomes clearer, we look

forward to progressing the drilling of El Barco-3X and moving

forward with the Timor-Leste project, which has the potential to

make a step-change in the value of your Company .

This has been a stressful period that has required intense

effort by our small team and I would like to record my particular

thanks to Andy Yeo for the long hours he has put in to maintain and

strengthen the Company's financial capability.

CONSOLIDATED INCOME STATEMENT FOR THE YEARED 31 DECEMBER

2019

Notes 2019 2018

GBP'000 GBP'000

Revenue - -

Cost of sales - -

Gross profit - -

Exploration and evaluation expenditure (160) (1,526)

Intangible asset impairment 11 (1,047) (1,360)

Receivables impairment 3 16 (54)

Administration expenses (442) (549)

(Loss)/profit on exchange 3 (41) 130

Other operating Income 4 - 83

Operating loss 3 (1,674) (3,276)

Finance cost 6 (1) (10)

Finance income 6 1 6

Loss on ordinary activities

before taxation (1,674) (3,280)

Income tax credit/(expense) 7 - 785

Loss on ordinary activities

after taxation (1,674) (2,495)

Dividends - -

Loss for the year (1,674) (2,495)

------------------------------------------ ------ --------------------------- -------------------------------

Loss on ordinary activities

after taxation is attributable

to:

Equity shareholders (1,674) (2,495)

Non-controlling interests - -

Loss for the year (1,674) (2,495)

------------------------------------------ ------ --------------------------- -------------------------------

Earnings per ordinary share -

continuing 9

Basic (0.099p) (0.181p)

Diluted (0.099p) (0.181p)

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE

YEARED 31 DECEMBER 2019

Notes 2019 2018

GBP'000 GBP'000

Loss on ordinary activities after

taxation attributable to the parent (1,674) (2,495)

Other comprehensive income:

Exchange difference on translating

foreign operations (69) (11)

Total comprehensive income for

the year (1,743) (2,506)

------------------------------------------ ------- -------- --------

Total comprehensive income attributable

to

Owners of the parent (1,743) (2,506)

---------------------------------------------------- -------- --------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AT 31 DECEMBER

2019

Notes 2019 2018

GBP'000 GBP'000

Assets

Non current assets

Property plant and equipment

--- oil and gas assets 10 - -

--- others 10 - -

Intangibles 11 5 66

Goodwill 12 - -

5 66

-------------------------------- --------------------------- --------------------------- ----------------------------- --------------------------- -------------------------------

Current assets

Trade and other receivables 14 49 503

Cash and cash equivalents 15 472 1,838

521 2,341

-------------------------------- --------------------------- --------------------------- ----------------------------- --------------------------- -------------------------------

Total assets 526 2,407

-------------------------------- --------------------------- --------------------------- ----------------------------- --------------------------- -------------------------------

Equity and liabilities

Capital and reserves attributable

to owners of the parent

Share capital 17 482 344

Share premium account 18 30,507 30,237

Share option reserve 18 74 74

Foreign exchange translation

reserve 18 1,643 1,712

Retained earnings 18 (32,251) (30,577)

Total equity 455 1,790

-------------------------------- --------------------------- --------------------------- ----------------------------- --------------------------- -------------------------------

Current liabilities

Trade and other payables 16 64 594

Taxes payable 16 7 23

71 617

-------------------------------- --------------------------- --------------------------- ----------------------------- --------------------------- -------------------------------

Total equity and liabilities 526 2,407

-------------------------------- --------------------------- --------------------------- ----------------------------- --------------------------- -------------------------------

COMPANY STATEMENT OF FINANCIAL POSITION AT 31 DECEMBER 2019

Notes 2019 2018

GBP'000 GBP'000

Assets

Non current

assets

Property plant and

equipment

--- oil and

gas

assets - -

Intangibles 11 5 66

Investments 13 25 25

30 91

--------------- --------------- -------------------------------------------------------- ----------------------------- --------------------------- -------------------------------

Current assets

Trade and

other

receivables 14 46 502

Cash and cash

equivalents 15 336 1,692

382 2,194

--------------- --------------- -------------------------------------------------------- ----------------------------- --------------------------- -------------------------------

Total assets 412 2,285

--------------- --------------- -------------------------------------------------------- ----------------------------- --------------------------- -------------------------------

Equity and

liabilities

Capital and reserves attributable

to owners of the parent

Share capital 17 482 344

Share premium

account 18 30,507 30,237

Share option

reserve 18 74 74

Foreign exchange translation

reserve 18 (163) (163)

Retained

earnings 18 (32,261) (30,510)

Total equity (1,361) (18)

--------------- --------------- -------------------------------------------------------- ----------------------------- --------------------------- -------------------------------

Current

liabilities

Trade and

other

payables 16 1,766 2,295

Taxes payable 16 7 8

1,773 2,303

--------------- --------------- -------------------------------------------------------- ----------------------------- --------------------------- -------------------------------

Total equity

and

liabilities 412 2,285

--------------- --------------- -------------------------------------------------------- ----------------------------- --------------------------- -------------------------------

The financial statements were approved and authorised for

issue by the Board of Directors on 28 April 2020.

CONSOLIDATED AND COMPANY STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2019

Share Foreign

Share Share Retained option exchange Total

capital premium earnings reserve translation equity

Group GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1

January 2018 344 30,237 (28,163) 122 1,723 4,263

--------------- -------------------------------------------- --------------------------- ----------------------------- --------------------------- ------------------------------- -------------------------------

Shares issued - - - - - -

--------------- -------------------------------

Transactions

with

owners - - - - - -

--------------- -------------------------------------------- --------------------------- ----------------------------- --------------------------- ------------------------------- -------------------------------

(Loss) for the

year

attributable

to equity

shareholders - - (2,495) - (2,495)

Share based

payments - - - 33 - 33

Release of

option

reserve - - 81 (81) - -

Foreign

exchange

translation

adjustments - - - - (11) (11)

--------------- --------------------------- -------------------------------

Total

comprehensive

income for

the period - - (2,414) (48) (11) (2,473)

--------------- -------------------------------------------- --------------------------- ----------------------------- --------------------------- ------------------------------- -------------------------------

As at 1

January 2019 344 30,237 (30,577) 74 1,712 1,790

--------------- -------------------------------------------- --------------------------- ----------------------------- --------------------------- ------------------------------- -------------------------------

Shares issued 138 270 - - - 408

--------------- -------------------------------

Transactions

with

owners 138 270 - - - 408

--------------- -------------------------------------------- --------------------------- ----------------------------- --------------------------- ------------------------------- -------------------------------

(Loss) for the

year

attributable

to equity

shareholders - - (1,674) - - (1,674)

Foreign

exchange

translation

adjustments - - - - (69) (69)

--------------- --------------------------- -------------------------------

Total

comprehensive

income for

the period - - (1,674) - (69) (1,743)

-------------------------------------------- --------------------------- ----------------------------- --------------------------- ------------------------------- -------------------------------

As at 31

December

2019 482 30,507 (32,251) 74 1,643 455

--------------- -------------------------------------------- --------------------------- ----------------------------- --------------------------- ------------------------------- -------------------------------

CONSOLIDATED AND COMPANY STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2019

Share Foreign

Share Share Retained option exchange Total

capital premium earnings reserve translation equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Company

As at 1

January

2018 344 30,237 (27,892) 122 (163) 2,648

--------------- -------------------------------------------- --------------------------- ----------------------------- --------------------------- ------------------------------- -------------------------------

Shares issued - - - - - -

---------------

Transactions

with

owners - - - - - -

--------------- -------------------------------------------- --------------------------- ----------------------------- --------------------------- ------------------------------- -------------------------------

(Loss) for the

year - - (2,699) - - (2,699)

Share based

payments - - - 33 - 33

Release of

option

reserve - - 81 (81) - -

---------------------------

Total

comprehensive

income for

the period - - (2,618) (48) - (2,666)

--------------- -------------------------------------------- --------------------------- ----------------------------- --------------------------- ------------------------------- -------------------------------

As at 1

January

2019 344 30,237 (30,510) 74 (163) (18)

--------------- -------------------------------------------- --------------------------- ----------------------------- --------------------------- ------------------------------- -------------------------------

Shares issued 138 270 - - - 408

---------------

Transactions

with

owners 138 270 - - - 408

--------------- -------------------------------------------- --------------------------- ----------------------------- --------------------------- ------------------------------- -------------------------------

(Loss) for the

year - - (1,751) - - (1,751)

Total

comprehensive

income for

the period - - (1,751) - - (1,751)

--------------- -------------------------------------------- --------------------------- ----------------------------- --------------------------- ------------------------------- -------------------------------

As at 31

December

2019 482 30,507 (32,261) 74 (163) (1,361)

--------------- -------------------------------------------- --------------------------- ----------------------------- --------------------------- ------------------------------- -------------------------------

Share capital is the amount subscribed for shares at nominal

value.

Share premium represents the excess of the amount subscribed

for share capital over the nominal value of those shares net

of share issue expenses.

Retained earnings represents the cumulative loss of the group

attributable to equity shareholders.

Foreign exchange translation occurs on consolidation of the

translation of the subsidiaries balance sheets at the closing

rate of exchange and their income statements at the average

rate.

CONSOLIDATED AND COMPANY STATEMENT OF CASH FLOWS FOR THE

YEARED 31 DECEMBER 2019

Group Company Group Company

2019 2019 2018 2018

--------------- ------------------------------------------------------------------------- ----------------------------- --------------------------- ------------------------------- ---------------------------------

GBP'000 GBP'000 GBP'000 GBP'000

Operating

activities (724) (563) (2,104) (1,875)

Investing

activities

Return from investment and

servicing of finance 1 1 6 6

Loan to subsidiary advanced - (155) - (236)

Acquisition of intangible

assets (1,047) (1,047) (66) (66)

(1,046) (1,201) (60) (296)

Financing

activities

Proceeds from issue of share

capital 408 408 - -

Net cash

outflow (1,362) (1,356) (2,164) (2,171)

Cash and cash

equivalents

at the

beginning

of the year 1,709 1,692 3,873 3,863

Cash and cash

equivalents

at the end of

the

year 347 336 1,709 1,692

--------------- ------------------------------------------------------------------------- ----------------------------- --------------------------- ------------------------------- ---------------------------------

Reconciliation to Consolidated

Statement of Financial Position

Cash not

available

for use 125 - 129 -

Cash and cash equivalents

as shown in the Consolidated

Statement of Financial Position 472 336 1,838 1,692

------------------------------------------------------------------------------------------ ----------------------------- --------------------------- ------------------------------- ---------------------------------

CONSOLIDATED AND COMPANY STATEMENT OF CASH FLOWS FOR THE

YEARED 31

DECEMBER 2019

Group Company Group Company

2019 2019 2018 2018

--------------------- ----------------------- -------------------- -------------------- ------------------------------

GBP'000 GBP'000 GBP'000 GBP'000

Operating activities

Loss for the year

attributable to

controlling

interests (1,674) (1,751) (2,495) (2,699)

Depreciation,

amortisation

and impairment

charges 1,047 1,240 1,360 923

Share based payments - - 33 33

Finance income shown

as an

investing activity (1) (1) (6) (6)

Tax benefit - - (785) -

Foreign exchange

translation (4) 23 (73) (122)

Operating cash

outflow before

movements in working

capital (632) (489) (1,966) (1,871)

---------------------- ----------------------- -------------------- -------------------- ------------------------------

Decrease/(increase)

in receivables 454 456 (485) (488)

Tax paid - - (53) -

(Decrease)/increase

in payables (546) (530) 400 484

Net cash outflow from

operating

activities (724) (563) (2,104) (1,875)

---------------------- ----------------------- -------------------- -------------------- ------------------------------

NOTES TO THE FINANCIAL STATEMENTS

General Information

Baron Oil Plc is a company incorporated in England and Wales and

quoted on the AIM market of the London Stock Exchange. The address

of the registered office is disclosed in the financial statements.

The principal activity of the Group is described in the Strategic

Report.

(1) Significant accounting policies

The principal accounting policies applied in the preparation of

these consolidated financial statements are set out below. These

policies have been consistently applied to all the periods

presented, unless otherwise stated.

Going concern basis

The directors have prepared a cash ow forecast covering a period

extending beyond 12 months from the date of these nancial

statements which contains certain assumptions about the development

and strategy of the business. The directors are aware of the risks

and uncertainties facing the business but the assumptions used are

the directors' best estimate of its future development.

After considering the forecasts and the risks, the directors

have a reasonable expectation that the Group has adequate resources

to continue in operational existence for the foreseeable future.

For these reasons, they continue to adopt the going concern basis

of accounting in preparing the annual nancial statements.

The nancial statements do not include any adjustments that would

result if the Group was unable to continue as a going concern.

Basis of preparation

The financial statements have been prepared in accordance with

International Financial Reporting Standards (IFRSs) and IFRIC

interpretations issued by the International Accounting Standards

Board (IASB) as adopted by the European Union and with those parts

of the Companies Act 2006 applicable to companies reporting under

IFRS. The financial statements have been prepared under the

historical cost convention. The principal accounting policies

adopted are set out below.

Changes in accounting policies and disclosures

New and amended standards adopted by the Group

IFRS 16 'Leases' became effective for the Group from 1 January

2019. The core principle of IFRS 16 is to provide a single lessee

accounting model, requiring lessees to recognise a right-of-use

asset and lease liability for all leases unless the term is less

than 12 months, or the underlying asset has a low value.

As a result of applying IFRS 16, the Group is not impacted by

IFRS 16, as no operating leases exists within the Group.

New and amended standards not yet adopted

A number of new and amended accounting standards and

interpretations have been published that are not mandatory for the

Group's accounts ended 31 December 2019, nor have they been early

adopted. These standards and interpretations are not expected to

have a material impact on the Group's consolidated Financial

Statements:

-- Amendments to References to Conceptual Framework in IFRS

Standards (effective from 1 January 2020);

-- Amendments to IFRS 3 'Definition of a Business' (effective

from 1 January 2020);

-- Amendments to IFRS 10 and IAS 28 - Sale or Contribution of

Assets between an Investor and its Associate or Joint Venture

(effective date not yet confirmed); and

-- IFRS 17 'Insurance Contracts' (effective from 1 January

2022).

Basis of consolidation

The consolidated financial statements include the financial

statements of the Company and its subsidiaries and associated

undertakings.

Subsidiaries

Subsidiaries are all entities over which Baron Oil Plc has the

power to govern the financial and operating policies generally

accompanying a shareholding of more than one half of the voting

rights, or where Baron Oil Plc exercises effective operational

control. The existence and effect of potential voting rights that

are currently exercisable or convertible are considered when

assessing whether the Group controls another entity. Subsidiaries

are fully consolidated from the date on which control is

transferred to the Company. They are de-consolidated from the date

that control ceases.

The purchase method of accounting is used to account for the

acquisition of subsidiaries by the Group. The cost of an

acquisition is measured as the fair value of the assets given,

equity instruments issued and liabilities incurred or assumed at

the date of exchange, plus costs directly attributable to the

acquisition. Identifiable assets acquired and liabilities and

contingent liabilities assumed in a business combination are

measured initially at their fair values at the acquisition date,

irrespective of the extent of any minority interest. The excess of

the cost of acquisition over the fair value of the Group's share of

the identifiable net assets acquired is recorded as goodwill. If

the cost of acquisition is less than the fair value of the net

assets of the subsidiary acquired, the difference is recognised

directly in the income statement.

Inter-company transactions, balances and unrealised gains on

transactions between Group companies are eliminated. Unrealised

losses are also eliminated but considered an impairment indicator

of the asset transferred. Accounting policies of subsidiaries have

been changed where necessary to ensure consistency with the

policies adopted by the Group.

Joint ventures

Where the Group is engaged in oil and gas exploration and

appraisal through unincorporated joint ventures, the Group accounts

for its share of the results and net assets of these joint ventures

as jointly controlled assets. The Group's interests in jointly

controlled entities are accounted for by proportionate

consolidation. The Group combines its share of the joint ventures'

individual income and expenses, assets and liabilities and cash

flows on a line-by-line basis with similar items in the Group's

financial statements. The Group recognises the portion of gains or

losses on the sale of assets by the group to the joint venture that

is attributable to the other venturers. The Group does not

recognise its share of profits or losses from the joint venture

that result from the Group's purchase of assets from the joint

venture until it re-sells the assets to an independent party.

However, a loss on the transaction is recognised immediately if the

loss provides evidence of a reduction in the net realisable value

of current assets, or an impairment loss. In addition, where the

Group acts as operator of the joint venture, the gross liabilities

and receivables (including amounts due to or from non-operating

partners) of the joint venture are included in the Consolidated

Statement of Financial Position.

Goodwill

Goodwill represents the excess of the cost of an acquisition

over the fair value of the Group's share of the net identifiable

assets of the acquired subsidiary or associate at the date of

acquisition. Goodwill on acquisitions of subsidiaries is included

in 'intangible assets'. Separately recognised goodwill is tested

annually for impairment and carried at cost less accumulated

impairment losses. Impairment losses on goodwill are not reversed.

Gains and losses on the disposal of an entity include the carrying

amount of goodwill relating to the entity sold.

Goodwill is allocated to cash-generating units for the purpose

of impairment testing. The allocation is made to those

cash-generating units or groups of cash-generating units that are

expected to benefit from the business combination in which the

goodwill arose. The Group allocates goodwill to each business

segment in each country in which it operates.

Impairment of non-financial assets

Assets that have an indefinite useful life, for example

goodwill, are not subject to amortisation and are tested annually

for impairment.

At each statement of financial position date, the Group reviews

the carrying amounts of its tangible and intangible assets to

determine whether there is any indication that those assets have

suffered an impairment loss. If any such indication exists, the

recoverable amount of the asset is estimated in order to determine

the extent of the impairment loss (if any). Where the asset does

not generate cash flows that are independent from other assets, the

Group estimates the recoverable amount of the cash-generating unit

to which the asset belongs. An intangible asset with an indefinite

useful life is tested for impairment annually and whenever there is

an indication that the asset may be impaired.

Recoverable amount is the higher of fair value less costs to

sell and value in use. In assessing value in use, the estimated

future cash flows are discounted to their present value using a

pre-tax discount rate that reflects current market assessments of

the time value of money and the risks specific to the asset for

which the estimates of future cash flows have not been

adjusted.

If the recoverable amount of an asset (or cash-generating unit)

is estimated to be less than its carrying amount, the carrying

amount of the asset (cash-generating unit) is reduced to its

recoverable amount. An impairment loss is recognised as an expense

immediately, unless the relevant asset is carried at a re-valued

amount, in which case the impairment loss is treated as a

revaluation decrease.

Where an impairment loss subsequently reverses, the carrying

amount of the asset (cash-generating unit) is increased to the

revised estimate of its recoverable amount, but so that the

increased carrying amount does not exceed the carrying amount that

would have been determined had no impairment loss been recognised

for the asset (cash-generating unit) in prior periods. A reversal

of an impairment loss is recognised as income immediately, unless

the relevant asset is carried at a revalued amount, in which case

the reversal of the impairment loss is treated as a revaluation

increase.

Intangible Assets

Oil and gas assets: exploration and evaluation

The Group has continued to apply the 'successful efforts' method

of accounting for Exploration and Evaluation ("E&E") costs,

having regard to the requirements of IFRS 6 'Exploration for the

Evaluation of Mineral Resources'.

The successful efforts method means that only the costs which

relate directly to the discovery and development of specific oil

and gas reserves are capitalised. Such costs may include costs of

licence acquisition, technical services and studies, seismic

acquisition; exploration drilling and testing but do not include

costs incurred prior to having obtained the legal rights to explore

the area. Under successful efforts accounting, exploration

expenditure which is general in nature is charged directly to the

income statement and that which relates to unsuccessful drilling

operations, though initially capitalised pending determination, is

subsequently written off. Only costs which relate directly to the

discovery and development of specific commercial oil and gas

reserves will remain capitalised and to be depreciated over the

lives of these reserves. The success or failure of each exploration

effort will be judged on a well-by-well basis as each potentially

hydrocarbon-bearing structure is identified and tested. Exploration

and evaluation costs are capitalised within intangible assets.

Capital expenditure on producing assets is accounted for in

accordance with SORP 'Accounting for Oil and Gas Exploration'.

Costs incurred prior to obtaining legal rights to explore are

expensed immediately to the income statement.

All lease and licence acquisition costs, geological and

geophysical costs and other direct costs of exploration, evaluation

and development are capitalised as intangible or property, plant

and equipment according to their nature. Intangible assets comprise

costs relating to the exploration and evaluation of properties

which the directors consider to be unevaluated until reserves are

appraised as commercial, at which time they are transferred to

tangible assets as 'Developed oil and gas assets' following an

impairment review and depreciated accordingly. Where properties are

appraised to have no commercial value, the associated costs are

treated as an impairment loss in the period in which the

determination is made.

Costs are amortised on a field by field unit of production

method based on commercial proven and probable reserves, or to the

expiry of the licence, whichever is earlier.

The calculation of the 'unit of production' amortisation takes

account of the estimated future development costs and is based on

the current period and un-escalated price levels. Changes in

reserves and cost estimates are recognised prospectively.

E&E costs are not amortised prior to the conclusion of

appraisal activities.

Property, plant and equipment

Oil and gas assets: development and production

Development and production ("D&P") assets are accumulated on

a well by well basis and represent the cost of developing the

commercial reserves discovered and bringing them into production,

together with the E&E expenditures incurred in finding

commercial reserves transferred from intangible E&E assets as

outlined above. The carrying values of producing assets are

depreciated on a well by well basis using the unit of production

method based on entitlement to provide by reference to the ratio of

production in the period to the related commercial reserves of the

well, taking into account any estimated future development

expenditures necessary to bring additional non producing reserves

into production.

An impairment test is performed for D&P assets whenever

events and circumstances arise that indicate that the carrying

value of development or production phase assets may exceed its

recoverable amount. The aggregate carrying value is compared

against the expected recoverable amount of each well, generally by

reference to the present value of the future net cash flows

expected to be derived from production of commercial reserves.

The cost of the workovers and extended production testing is

capitalised within property, plant and equipment as a D&P

asset.

Decommissioning

Site restoration provisions are made in respect of the estimated

future costs of closure and restoration, and for environmental

rehabilitation costs (which include the dismantling and demolition

of infrastructure, removal of residual materials and remediation of

disturbed areas) in the accounting period when the related

environmental disturbance occurs. The provision is discounted where

material and the unwinding of the discount is included in finance

costs. Over time, the discounted provision is increased for the

change in present value based on the discount rates that reflect

current market assessments and the risks specific to the liability.

At the time of establishing the provision, a corresponding asset is

capitalised where it gives rise to a future benefit and depreciated

over future production from the field to which it relates. The

provision is reviewed on an annual basis for changes in cost

estimates, discount rates or life of operations. Any change in

restoration costs or assumptions will be recognised as additions or

charges to the corresponding asset and provision when they occur.

For permanently closed sites, changes to estimated costs are

recognised immediately in the income statement.

Non oil and gas assets

Non oil and gas assets are stated at cost of acquisition less

accumulated depreciation and impairment losses. Depreciation is

provided on a straight-line basis at rates calculated to write off

the cost less the estimated residual value of each asset over its

expected useful economic life. The residual value is the estimated

amount that would currently be obtained from disposal of the asset

if the asset were already of the age and in the condition expected

at the end of its useful life.

Buildings, plant and equipment unrelated to production are

depreciated using the straight-line method based on estimated

useful lives.

The annual rate of depreciation for each class of depreciable

asset is:

Equipment and machinery 4-10 years

The carrying value of tangible fixed assets is assessed annually

and any impairment is charged to the income statement.

Investments

Investments are stated at cost less provision for any impairment

in value.

Trade and other receivables

Trade receivables are recognised initially at fair value and

subsequently measured at amortised cost using the effective

interest method, less provision for impairment. A provision for

impairment is established when there is objective evidence that the

Group will not be able to collect all amounts due according to the

original terms of the receivables. Significant financial

difficulties of the debtor, probability that the debtor will enter

bankruptcy or financial reorganisation, and default or delinquency

in payments are considered indicators that the trade receivable is

impaired.

Cash and cash equivalents

Cash and cash equivalents include cash in hand, deposits held on

call with banks, other short-term highly liquid investments with

original maturities of three months or less, and bank overdrafts.

Bank overdrafts are shown within borrowings in current liabilities

on the statement of financial position.

Inventories

Inventories, including materials, equipment and inventories of

gas and oil held for sale in the ordinary course of business, are

stated at weighted average historical cost, less provision for

deterioration and obsolescence or, if lower, net realisable

value.

Revenue

Oil and gas sales revenue is measured at the fair value of the

consideration received or receivable and represents amounts

receivable for the Group's share of oil and gas supplied in the

period. Revenue is shown net of value-added tax, returns, rebates

and discounts and after eliminating sales within the Group. Revenue

is recognised when the oil and gas produced is despatched and

received by the customers.

Taxation

Income tax

Income tax expense represents the sum of the tax currently

payable and deferred tax.

The tax currently payable is based on taxable profit or loss for

the year. Taxable profit or loss differs from profit or loss as

reported in the same income statement because it excludes items of

income or expense that are taxable or deductible in other periods

and it further excludes items that are never taxable or deductible.

The Company's liability for current tax is calculated using tax

rates that have been enacted or substantively enacted by the

statement of financial position date.

Deferred tax

Deferred tax is recognised on differences between the carrying

amounts of assets and liabilities in the financial statements and

the corresponding tax bases used in the computation of taxable

profit, and is accounted for using the statement of financial

position liability method. Deferred tax liabilities are generally

recognised for all taxable temporary differences and deferred tax

assets are recognised to the extent that it is probable that

taxable profits will be available against which deductible

temporary differences can be utilised. Such assets and liabilities

are not recognised if the temporary difference arises from goodwill

or from the initial recognition (other than in a business

combination) of other assets and liabilities in a transaction that

affects neither the taxable profit nor the accounting profit.

The carrying amount of deferred tax is reviewed at each

statement of financial position date and reduced to the extent that

it is no longer probable that sufficient taxable profits will be

available to allow all or part of the asset to be recovered.

Deferred tax is calculated at the tax rates that are expected to

apply in the period when the liability is settled or the asset

realised. Deferred tax is charged or credited to income statement,

except when it relates to items charged or credited directly to

equity, in which case the deferred tax is also dealt with in

equity.

Deferred tax assets and liabilities are offset when there is a

legally enforceable right to set off current tax assets against

current tax liabilities and when they relate to income taxes levied

by the same taxation authority and the Company intends to settle

its current tax assets and liabilities on a net basis.

Trade and other payables

Trade payables are not interest bearing and are stated at their

nominal value. Trade and other payables are initially recognised at

fair value. They are subsequently measured at amortised cost using

the effective interest method unless the effect of discounting

would be immaterial, in which case they are stated at cost.

Fair values

The carrying amounts of the financial assets and liabilities

such as cash and cash equivalents, receivables and payables of the

Group at the statement of financial position date approximated

their fair values, due to relatively short term nature of these

financial instruments.

Share-based compensation

The fair value of the employee and suppliers services received

in exchange for the grant of the options is recognised as an

expense. The total amount to be expensed over the vesting period is

determined by reference to the fair value of the options granted,

excluding the impact of any non-market vesting conditions (for

example, profitability and sales growth targets). Non-market

vesting conditions are included in assumptions about the number of

options that are expected to vest. At each statement of financial

position date, the entity revises its estimates of the number of

options that are expected to vest. It recognises the impact of the

revision to original estimates, if any, in the income statement,

with a corresponding adjustment to equity.

The proceeds received net of any directly attributable

transaction costs are credited to share capital (nominal value) and

share premium when the options are exercised.

Share based payments (Note 19)

The fair value of share-based payments recognised in the income

statement is measured by use of the Black Scholes model, which

takes into account conditions attached to the vesting and exercise

of the equity instruments. The expected life used in the model is

adjusted based on management's best estimate, for the effects of

non-transferability, exercise restrictions and behavioural

considerations. The share price volatility percentage factor used

in the calculation is based on management's best estimate of future

share price behaviour and is selected based on past experience,

future expectations and benchmarked against peer companies in the

industry.

Equity instruments

Ordinary shares are classified as equity.

Incremental costs directly attributable to the issue of new

shares or options are shown in equity as a deduction, net of tax,

from proceeds.

Financial assets

On initial recognition, financial assets are classified as

either financial assets at fair value through the statement of

profit or loss, held-to-maturity investments, loans and receivables

financial assets, or available-for-sale financial assets, as

appropriate.

Loans and receivables

The Group classifies all its financial assets as trade and other

receivables. The classification depends on the purpose for which

the financial assets were acquired.

Trade receivables and other receivables that have fixed or

determinable payments that are not quoted in an active market are

classified as loans and receivables financial assets. Loans and

receivables financial assets are measured at amortised cost using

the effective interest method, less any impairment loss.

The Group's loans and receivables financial assets comprise

other receivables (excluding prepayments) and cash and cash

equivalents included in the Statement of Financial Position.

Financial liabilities

Financial liabilities are recognised when, and only when, the

Group becomes a party to the contracts which give rise to them and

are classified as financial liabilities at fair value through the

profit and loss or loans and payables as appropriate. The Group's

loans and payable comprise trade and other.

When financial liabilities are recognised initially, they are

measured at fair value plus directly attributable transaction costs

and subsequently measured at amortised cost using the effective

interest method other than those categorised as fair value through

income statement.

Fair value through the income statement category comprises

financial liabilities that are either held for trading or are

designated to eliminate or significantly reduce a measurement or

recognition inconsistency that would otherwise arise. Derivatives

are also classified as held for trading unless they are designated

as hedges. There were no financial liabilities classified under

this category.

The Group determines the classification of its financial

liabilities at initial recognition and re-evaluate the designation

at each financial year end.

A financial liability is derecognised when the obligation under

the liability is discharged, cancelled or expires.

When an existing financial liability is replaced by another from

the same party on substantially different terms, or the terms of an

existing liability are substantially modified, such an exchange or

modification is treated as a de-recognition of the original

liability and the recognition of a new liability, and the

difference in the respective carrying amounts is recognised in the

income statement.

Provisions

Provisions are recognised when the Company has a present

obligation as a result of a past event, and it is probable that the

Company will be required to settle that obligation. Provisions are

measured at the directors' best estimate of the expenditure

required to settle the obligation at the statement of financial

position date, and are discounted to present value where the effect

is material.

Financial instruments

Non-derivative financial instruments comprise investments in

equity and debt securities, trade and other receivables, cash and

cash equivalents, loans and borrowings, and trade and other

payables.

Non-derivative financial instruments are recognised initially at

fair value plus, for instruments not at fair value through profit

or loss, any directly attributable transactions costs, except as

described below. Subsequent to initial recognition non-derivative

financial instruments are measured as described below.

A financial instrument is recognised when the Group becomes a

party to the contractual provisions of the instrument. Financial

assets are derecognised if the Group's contractual rights to the

cash flows from the financial assets expire or if the Group

transfers the financial assets to another party without retaining

control or substantially all risks and rewards of the asset.

Regular purchases and sales of financial assets are accounted for

at trade date, i.e. the date that the Group commits itself to

purchase or sell the asset. Financial liabilities are derecognised

if the Group's obligations specified in the contract expire or are

discharged or cancelled.

Foreign currencies

i) Functional and presentation currency

Items included in the financial statements of the Group are

measured using the currency of the primary economic environment in

which the entity operates (the functional currency), which are

mainly in Pounds Sterling (GBP), US Dollars (USD), and Peruvian

Nuevo Sol (PEN). The financial statements are presented in Pounds

Sterling (GBP), which is the Group's presentation currency.

ii) Transactions and balances

Foreign currency transactions are translated into the

presentational currency using exchange rates prevailing at the

dates of the transactions. Foreign exchange gains and losses

resulting from the settlement of such transactions and from the

translation at period-end exchange rates of monetary assets and

liabilities denominated in foreign currencies are recognised in the

income statement.

iii) Group companies

The results and financial position of all Group entities (none

of which has the currency of a hyper-inflationary economy) that

have a functional currency different from the presentation currency

are translated into the presentation currency as follows:

(a) assets and liabilities for each statement of financial

position presented are translated at the closing rate at the date

of that statement of financial position;

(b) income and expenses for each income statement are translated

at average exchange rates (unless this average is not a reasonable

approximation of the cumulative effect of the rates prevailing on

the transaction dates, in which case income and expenses are

translated at the rate on the dates of the transactions); and

(c) all resulting exchange differences are recognised as a

separate component of equity.

On consolidation, exchange differences arising from the

translation of the net investment in foreign operations, and of

borrowings and other currency instruments designated as hedges of

such investments, are taken to shareholders' equity. When a foreign

operation is partially disposed of or sold, exchange differences

that were recorded in equity are recognised in the income statement

as part of the gain or loss on sale.

Goodwill and fair value adjustments arising on the acquisition

of a foreign entity are treated as assets and liabilities of the

foreign entity and translated at the closing rate.

Management of capital

The Group's policy is to ensure that it will always have

sufficient cash to allow it to meet its liabilities when they

become due. The principal liabilities of the Group arise in respect

of committed expenditure in respect of its ongoing exploration

work. To achieve this aim, it seeks to raise new equity finance and

debt sufficient to meet the next phase of exploration and where

relevant development expenditure.

The Board receives cash flow projections on a monthly basis as

well as information on cash balances. The Board will not commit to

material expenditure in respect of its ongoing exploration work

prior to being satisfied that sufficient funding is available to

the Group to finance the planned programmes.

Dividends cannot be issued until there are sufficient reserves

available.

Critica l accounting judgments and key sources of estimation

uncertainty

The preparation of the consolidated financial statements

requires management to make estimates and assumptions concerning

the future that affect the reported amounts of assets and

liabilities and the disclosure of contingent assets and liabilities

at the dates of the financial statements and the reported amounts

of revenues and expenses during the reporting periods. The

resulting accounting estimates will, by definition, differ from the

related actual results.

Carrying value of intangible exploration and evaluation

assets

Valuation of oil and gas properties: judgements regarding timing

of regulatory approval, the general economic environment, and the

ability to finance future activities has an impact on the

impairment analysis of intangible exploration and evaluation

assets. All these factors may impact the viability of future

commercial production from unproved properties, and therefore may

be a need to recognise an impairment. The timing of an impairment

review and the judgement of when there could be a significant

change affecting the carrying value of the intangible exploration

and and evaluation asset is a critical accounting judgement in

itself.

Commercial reserves estimates

Oil and gas reserve estimates: estimation of recoverable

reserves include assumptions regarding commodity prices, exchange

rates, discount rates, production and transportation costs all of

which impact future cashflows. It also requires the interpretation

of complex geological and geophysical models in order to make an

assessment of the size, shape, depth and quality of reservoirs and

their anticipated recoveries. The economic, geological and

technical factors used to estimate reserves may change from period

to period. Changes in estimated reserves can impact developed and

undeveloped property carrying values, asset retirement costs and

the recognition of income tax assets, due to changes in expected

future cash flows. Reserve estimates are also integral to the

amount of depletion and depreciation charged to income.

Decommissioning costs

Asset retirement obligations: the amounts recorded for asset

retirement obligations are based on each field's operator's best

estimate of future costs and the remaining time to abandonment of

oil and gas properties, which may also depend on commodity

prices.

2. Segmental

information

In the opinion of the Directors the Group has one class of business,

being the exploration for, and development and production of,

oil and gas reserves, and other related activities.

The Group's primary reporting format is determined to be the

geographical segment according to the location of the oil and

gas asset. There are currently three geographic reporting segments:

South America, which has been involved in production, development