TIDMBOIL

RNS Number : 9588Z

Baron Oil PLC

27 May 2021

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 (which forms part of domestic UK law

pursuant to the European Union (withdrawal) act 2018) until the

release of this announcement.

27 May 2021

Baron Oil Plc

("Baron" or "the Company")

Final Results for the Year Ended 31 December 2020

Baron Oil Plc (AIM:BOIL), the AIM-quoted oil and gas exploration

company with projects in SE Asia, Latin America and the UK, is

pleased to announce its audited financial results for the year

ended 31 December 2020.

Highlights

-- Material milestone in March 2020 with the funding of the

initial 25% effective interest in the TL-SO-19-16 production

sharing contract, offshore Timor-Leste ("Chuditch"); subsequently

increased to 63.75%.

-- Strategic intent to acquire significant working interests in

potentially large oil & gas prospects signalled following board

changes in October.

-- During first half 2021, considerable progress made on Chuditch:

o One year extension to Contract Year 1 of the production

sharing contract granted;

o Significant upgrade in non-SPE PRMS compliant volumes;

o Successful raise of GBP3m (gross) via a placing and

subscription to support funding an Earn In agreement which

increased effective interest in the PSC to 63.75%;

o Baron's net share of estimated Mean prospective resources

increased to 2,248 BCF (375 MMBOE);

o Execution of a 3D seismic licensing and reprocessing

contract.

-- UK offshore licence P2478 (15% interest)

o Technical studies, delivered in early 2021, confirmed Dunrobin

prospect as a potentially attractive and substantial

opportunity;

o Activity set to increase once technical studies results

incorporated

-- Relinquishment of all other interests in United Kingdom licences.

-- Peru onshore Block XXI (100% interest)

o Ongoing COVID-19 restrictions throughout Peru prevented

tangible progress;

o Decision on drilling the El Barco-3X well expected during the

second half of 2021

Financials

-- Net result for the year was a loss before taxation of GBP920,000 (2019: loss of GBP1,674,000)

-- Loss after taxation attributable to shareholders was GBP920,000 (2019: loss of GBP1,674,000)

-- Exploration and evaluation expenditure of GBP145,000 (2019: GBP1,207,000)

-- IFRS6 intangible asset impairment charge of GBPnil (2019: GBP1,108,000)

-- Administration expenditure for the year was GBP710,000 (2019:

GBP442,000), largely reflecting share-based charges and the

temporary reduction in directors' contracted salaries in 2019

-- The end of year free cash balance was GBP1,190,000 (2019: GBP347,000)

The Company will hold its Annual General Meeting on 23 June 2021

and the Notice of Annual General Meeting to that effect will be

sent to Shareholders shortly.

Qualified Person's Statement

Pursuant to the requirements of the AIM Rules - Note for Mining

and Oil and Gas Companies, the technical information and resource

reporting contained in this announcement has been reviewed by Jon

Ford BSc, Fellow of the Geological Society, Technical Director of

the Company. Mr Ford has more than 39 years' experience as a

petroleum geoscientist. He has compiled, read and approved the

technical disclosure in this regulatory announcement and indicated

where it does not comply with the Society of Petroleum Engineers'

standard.

Commenting on the results, John Wakefield, Non-executive

Chairman, said:

"Over the next 12 months our focus will be on driving the

Chuditch PSC forward. Through the operator SundaGas Banda we have

already engaged TGS and will be working with them to undertake the

critical 3D seismic reprocessing project. The acceleration in

Timor-Leste's oil & gas activity is expected to continue and

the Chuditch PSC, with its potential Mean gross prospective

resources of 3,527 BCF (580 MMBOE) is sufficiently large to attract

interest from the major regional gas players and other potential

partners.

"In the UK, we anticipate renewed activity on the Dunrobin

prospect P2478 later in the year once the results of the regional

technical work have been incorporated; Peru is likely to remain

subdued. Elsewhere, the Company continues to screen new

opportunities which are consistent with its new asset

strategy."

"On a personal note, I would like to thank my colleagues and

partners for their warm welcome and hard work in ensuring that

Baron is well-placed to evaluate the potential of its Chuditch

asset during the current year as well as consider opportunities for

our other and future assets in due course."

"As for the next twelve months, our current commitments are

funded and we look forward to executing on our ambitious

plans."

The Company's Annual Report and Financial Statements for the

year ended 31 December 2020 will shortly be available for download

from the Company's website ( https://www.baronoilplc.com/ ) and

will be despatched by post shortly to those shareholders that have

requested a hard copy.

For further information, please contact:

Baron Oil Plc +44 (0)20 7117 2849

Andy Yeo, Chief Executive

Jon Ford, Technical Director

Allenby Capital Limited +44 (0)20 3328 5656

Nominated Adviser and Joint Broker

Alex Brearley, Nick Harriss, Nick Athanas (Corporate

Finance)

Kelly Gardiner (Sales and Corporate Broking)

Turner Pope Investments (TPI) Limited +44 (0)20 3657 0050

Joint Broker

Andy Thacker

CHAIRMAN'S STATEMENT & OPERATIONS REPORT

Financial and Financial Results

The net result for the year was a loss before taxation of

GBP920,000, which compares to a loss of GBP1,674,000 for the

preceding financial year; the loss after taxation attributable to

Baron Oil shareholders was GBP920,000, compared to a loss of

GBP1,674,000 in the preceding year.

Turnover for the year was GBPnil (2019: GBPnil), there being no

sales activity during the period.

Exploration and evaluation expenditure written off included in

the Income Statement amounts to GBP145,000. This arises from

expenditure of GBP114,000 in Peru on Block XXI, GBP29,000 in

technical consultancy costs and GBP2,000 relating to the

relinquished P2470 licence.

Shortly after the period end on 31 January 2021, licence P1918

(Colter) and the nearby onshore licences PEDL330 and PEDL345 were

relinquished. All expenditure on these licences was written off in

the year, however as these prospects had already been fully

impaired in 2019, there was no impact on the Income Statement.

Impairment provisions in respect of Peru Block XXI were reduced by

GBP133,000, this being attributable to exchange rate fluctuations

on the translation of US Dollar based Peruvian assets. The

directors judged that no other exploration assets required

impairment.

Administration expenditure for the year was GBP710,000, compared

to GBP442,000 in the preceding year, excluding the effects of

exchange rate movements. Directors and employee costs (less

GBP81,000 of share based charges) amounted to GBP374,000; listing,

compliance and other professional fees were GBP198,000; and other

overheads GBP55,000. The increase in Directors and employee cash

costs are largely due to a temporary reduction in directors'

contracted salaries in 2019.

During 2020, the Pound Sterling/US Dollar exchange rate was

highly volatile, but a strengthening of the Pound towards the end

of the year gave rise to an overall exchange gain of GBP157,000

(loss of GBP41,000 in 2019) on the Group's holding of US Dollar

assets.

At the end of the financial year, free cash reserves of the

Group had increased to GBP1,190,000 from a level at the preceding

year end of GBP347,000. The proceeds of new share issues in the

year amounting to GBP2,500,000 gross (GBP2,295,000 net of costs)

bolstered the Company's cash reserves; excluding this, the overall

cash outflow amounted to GBP1,452,000, consisting of GBP518,000 of

investment in SundaGas (Timor-Leste Sahul) Pte.Ltd, exploration and

evaluation activity of GBP145,000, and GBP789,000 of operating cash

outflow. During March and April 2021, the Company undertook a

further capital raise with a new ordinary share Placing and

Subscription of GBP3,000,000 gross (GBP2,768,000 net).

The Group continues to take a conservative view of its asset

impairment policy, giving it a Statement of Financial Position that

consists largely of net current assets and what the Board considers

to be a realistic value for its exploration assets. Given limited

cash resources, the Board will take a prudent approach in entering

into new capital expenditures beyond those expected to be committed

to existing ventures.

Report On Operations

Introduction

It is hard to believe that we have now lived with the

consequences of the COVID-19 pandemic for more than 18 months. We

were fortunate enough to enter 2020 without any immediate drilling

commitments and instead were able to focus on desktop studies to

advance our projects whilst maintaining control over costs.

The funding of the Chuditch Carry Agreement was a key milestone

in March 2020 as it not only secured a substantial asset but was

achieved in the early stages of the pandemic.

A number of board changes were announced in October 2020,

triggered by the retirement of Executive Chairman, Dr Malcolm

Butler. John Wakefield was appointed as Independent Non-executive

Chairman, Jon Ford changed his role to Technical Director, and

Andrew Yeo became Chief Executive of the Company.

Southeast Asia: Timor-Leste Tl-S0-19-16 PSC ("Chuditch PSC" or

"PSC")

(Baron 25% effective interest, rising to 63.75% post-reporting

period)

During 2020 Baron acquired a 33.33% interest in the shares of

SundaGas Timor-Leste (Sahul) Pte. Ltd. ("TLS"), the parent company

of the Timor-Leste subsidiary, SundaGas Banda Unipessoal Lda.

("Banda"), which is the Operator of and 75% interest holder in the

offshore Timor-Leste TL-SO-19-16 PSC. Banda had put in place the

required US$1 million Bank Guarantee (Baron assuming its share of

US$0.333 million) against the initial work commitment, which

included the reprocessing of legacy seismic data for the first two

years of the Initial Term of the PSC. Subject to satisfactory

results from the reprocessing and other technical work, the

subsequent commitment is for a well to be drilled in the third year

of the Initial Term.

The Chuditch PSC is located approximately 185 kilometres south

of Timor-Leste, 100 kilometres east of the producing Bayu-Undan

field, 50 kilometres south of the Greater Sunrise potential

development, and covers approximately 3,571km(2) in water depths of

50-100 metres. The Shell operated Chuditch-1 discovery in 1998,

which was drilled in 64 metres water depth in a total of 25 days

for around US$8 million, encountered a 25 metre gas column in

Jurassic Plover Formation reservoir sandstones on the flank of what

is interpreted to be a large faulted structure. The Chuditch area

was largely covered by part of a regional 3D survey which was

acquired by a previous operator in 2012.

The initial work programme is designed to extract the maximum

information from existing seismic data, utilising the technical

expertise of the TLS team and incorporating a training programme

for Timor-Leste nationals. There are issues with sea-bed topography

and shallow geological features that impact the existing seismic

image at the reservoir level local to the Chuditch area and a

pre-stack depth migration ("PSDM") processing routine, tailored to

resolve these issues, is necessary. Although the work carried out

previously by Shell determined that there were low reservoir, seal

and hydrocarbon charge risks, such modern processing is necessary

to define the size and shape of the accumulation, which impacts the

gas volumes in place and the location of potential future wells. In

particular, new advances in seismic processing technology enable a

considerably enhanced subsurface image to be achieved in areas with

complex seabeds and shallow geology. Accessing the original raw

acquisition data for the existing seismic volumes was therefore

critical for this programme. A combination of COVID-19 lockdowns

and data access issues meant that at the 2020 year end TLS had yet

to receive these key data for either 3D or 2D seismic. Despite

this, the TLS team was able to perform baseline geological and

geophysical studies and establish an initial presence in Dili, the

capital of Timor-Leste.

Since the beginning of 2021 we are pleased to report that

considerable progress has been made on the Chuditch PSC project,

building on the background work carried out during 2020:

-- in January 2021, we announced a significant upgrade in TLS's

non-SPE PRMS compliant gross volumes, based on the interpretation

of legacy 2D (unreprocessed) seismic, well and regional data:

o Mean gas initially in place volumes to 4,703 BCF (from 2,320

BCF)

o Mean prospective resources to 3,527 BCF (from 1,508 BCF)

o Inclusion of a significant new lead within the licence area,

Chuditch North East;

-- in February 2021, Autoridade Nacional do Petróleo e Minerais

("ANPM", the Timor-Leste state oil and gas regulatory authority)

granted a year's extension to Contract Year 1 of the PSC to enable

the timely completion of the committed work programme, in

particular the seismic reprocessing project;

-- in April 2021, we announced the completion of an earn in and

executed a seismic licensing and reprocessing contract:

o increasing our interest in TLS from 33.33% to 85%, thereby

increasing Baron's effective interest in the Chuditch PSC from 25%

to 63.75%;

o net share of non-SPE PRMS compliant mean prospective resources

increased from 882 BCF to 2,248 BCF (375 MMBOE);

o Baron agreed to fund the remainder of the Chuditch PSC work

programme to November 2022, estimated to be US$3.5 million. we

successfully raised gross proceeds of GBP3 million by the issue of

new shares to enable us to commit to this programme;

o Spectrum Geo Australia Pty Ltd., a wholly owned subsidiary of

TGS-NOPEC Geophysical Company ASA ("TGS"), was engaged for the

licensing and reprocessing of 1,270km(2) of 3D seismic data

covering the Chuditch-1 discovery and adjacent prospects.

Obtaining a material interest in a very large potential asset

and getting the seismic reprocessing back on track is judicious as

we are seeing a convergence of events which together have the

potential to make the Chuditch PSC an outstanding asset for the

Company:

-- an acceleration in Timor-Leste regional hydrocarbon

exploitation, including drilling activity and planned extensions of

existing infrastructure;

-- exposure to the SE Asia liquid natural gas ("LNG") market,

where future demand is forecast to exceed supply;

-- a sufficient level of prospective resources to attract the

interest of major regional gas players and other potential funding

partners.

The seismic reprocessing results are likely to be delivered

across the period from 4(th) quarter 2021 to 2(nd) quarter 2022.

Seismic data interpretation, geological and other studies will

occur in parallel ahead of a decision by Q4 2022 on whether to

enter the drilling phase, with the potential for a high impact

drilling programme in 2023.

The recent uptick in oil & gas activity in Timor-Leste

follows the Santos US$1.25 billion acquisition of ConocoPhillips'

northern Australia and Timor-Leste assets, completed in May 2020.

This package delivered Santos operatorship of a portfolio of

natural gas assets (Bayu-Undan and Barossa), partnerships with some

of SE Asia's largest LNG players, power generators and utility

companies, and a strategic holding in LNG infrastructure of

pipelines and the Darwin LNG plant located at Wickham Point,

Northern Territories, Australia. This interconnected system,

centred on Bayu-Undan (the only producing field currently in

Timor-Leste), is key to the evacuation and monetisation of gas from

the Timor Sea area. The Chuditch PSC lies only 100 kilometres east

of these facilities.

Santos and its partners have so far committed to expenditure of

more than US$4.5 billion to extend the life of existing fields and

pipelines, bring new fields onstream, and increase capacity at the

Darwin LNG plant from around 4 million tonnes per annum (mtpa) to

10mtpa. There are also moves being made by ENI (operator of the

Evans Shoal and Blackwood gas fields) and Santos to cooperate in

offshore developments in northern Australia and Timor-Leste, the

sharing of infrastructure, and CO(2) capture and storage with a

Joint Memorandum of Understanding being announced in May 2021.

In the context of these ongoing activities, the Chuditch PSC is

well placed to benefit from these activities, in terms of future

operational synergies and commercial development of gas in the

event of drilling success at Chuditch.

Peru: Block XXI, Onshore Licence (Baron 100%)

Baron has a 100% operated interest in onshore Block XXI, in the

Sechura Desert of northern Peru. As indicated in March 2021, the

Company intends to make a decision on the drilling of the El

Barco-3X project during the second half of 2021. We maintain a

preference for bringing in a drilling partner with operator

capabilities as we believe this represents the best way to develop

and monetise any discovery. However, strict COVID restrictions

remain in place throughout Peru, which prevents any progress in

relation to the drilling project, and it is unclear when and how

quickly oil and gas exploration activity will be allowed to

recommence. Currently the licence remains in Force Majeure.

Our application for a three year extension option to the

licence, a prerequisite for attracting a drilling partner, given

that we currently have only six months to drill and evaluate well

results once Force Majeure is lifted, is currently being assessed

by Perupetro, the Peru state regulatory authority. Once approved,

this will trigger a prescribed Government process which, if

successful, should allow a way forward for the project. In the

Piura area where the proposed well is situated, we are required to

undertake workshops with the local communities of Belisario and El

Barco ahead of any drilling authorisation.

United Kingdom Offshore Licence P2478 (Baron 15%)

Innovate Licence P2478, awarded in September 2019, is held by

Corallian Energy Limited (Operator, 45%), Upland Resources (UK

Onshore) Limited (40%) and Baron (15%). The licence's current

modest work commitment is to undertake reprocessing of legacy 2D

and 3D seismic data and perform other studies in order to reduce

risk and refine volumetric estimates ahead of making a "drill or

drop" decision before the end of Phase A of the licence period in

July 2023.

Covering blocks 12/27c, 17/5, 18/1 and 18/2 in the Inner Moray

Firth area of the North Sea, the licence contains the Dunrobin

prospect which consists of large shallow rotated fault blocks which

are mapped mostly on 3D seismic data including Direct Hydrocarbon

Indicators. The prospect is understood to be one of the few

remaining targets with Pmean prospective resources of the order of

100 MMBOE yet to be drilled in the North Sea.

In April 2020, the joint venture partners signed a Work Sharing

and Confidentiality Agreement with a large European E&P Company

("Interested Party") for licence P2478. Under the terms of the

agreement the Interested Party completed its own regional technical

work and shared its data and interpretations over the area with

Corallian and its partners in February 2021. The technical studies

delivered by the Interested Party confirmed and enhanced our

geological understanding and corroborated our view of Dunrobin as a

potentially attractive and substantial target. The results are

being incorporated into the ongoing work programme which includes

preparations for the seismic reprocessing in order to reduce

further the pre-drill risk on the prospect.

Other United Kingdom Licences

In keeping with its revised strategy to focus on high potential

impact projects, and by way of the normal course of portfolio

management, Baron has relinquished its interests in all other

United Kingdom Licences.

Conclusions

Over the next 12 months our focus - both operational and

financial - will be on driving the Chuditch PSC forward. Through

the operator SundaGas Banda we have already engaged TGS, and will

be working with them to undertake the critical 3D seismic

reprocessing which will provide an up-to-date assessment of the

true potential of the Chuditch discovery and offset prospects.

Notwithstanding the expected benefits of global economic

recovery as normality gradually returns, SE Asia gas prices are

already ahead of pre-COVID levels. An acceleration in Timor-Leste's

oil & gas activity is expected and the Chuditch PSC with its

potential Mean gross prospective resources of 3,527 BCF of gas is

sufficient to get noticed. The Earn In increased Baron's net share

of estimated non-SPE PRMS compliant Mean gas prospective resources

to 2,248BCF (equivalent to 375MMBOE).

Activity in Peru is likely to remain subdued in the short

term.

In the UK, we expect to see activity on P2478 once the results

of the regional technical work have been incorporated into the

ongoing work programme. Whilst we only have a modest 15% interest,

it remains a significant opportunity.

The Company continues to screen opportunities for acquiring

significant equity interests in high potential impact exploration

and appraisal activity at low entry costs.

As for the next twelve months, our current commitments are fully

funded and we look forward to executing on our ambitious plans.

I would like to thank my colleagues and partners for their warm

welcome and hard work in ensuring that Baron is well-placed to

evaluate the potential of its Chuditch asset during the current

year as well as consider opportunities for our other and future

assets in due course.

John Wakefield

Non-executive Chairman

26 May 2021

CONSOLIDATED INCOME STATEMENT FOR THE YEARED 31 DECEMBER 2020

Notes 2020 2019

GBP'000 GBP'000

Revenue - -

Cost of sales - -

Gross profit - -

Exploration and evaluation expenditure (145) (160)

Intangible asset impairment 10 59 (1,047)

Property, plant and equipment impairment

and depreciation 9 (2) -

Receivables and inventory impairment 3 74 16

Administration expenses (710) (442)

Loss on exchange 3 (157) (41)

Operating loss 3 (881) (1,674)

Loss from associated

undertaking 12 (44) -

Loss before interest

and taxation (925) (1,674)

Finance cost 5 - (1)

Finance income 5 5 1

Loss on ordinary activities

before taxation (920) (1,674)

Income tax expense 6 - -

Loss on ordinary activities

after taxation (920) (1,674)

Dividends - -

Loss for the year (920) (1,674)

-------------------------------------------- ------ ------------------- -----------------------

Loss on ordinary activities

after taxation is attributable to:

Equity shareholders (920) (1,674)

Non-controlling interests - -

(920) (1,674)

------------------------------------------ ------ ------------------- -----------------------

Earnings per ordinary share - continuing 8

Basic (0.023p) (0.099p)

Diluted (0.023p) (0.099p)

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE

YEARED 31 DECEMBER 2020

Notes 2020 2019

GBP'000 GBP'000

Loss on ordinary activities after taxation

attributable to the parent (920) (1,674)

Other comprehensive income:

Release of option reserve 41 -

Exchange difference on translating foreign

operations (115) (69)

Total comprehensive loss for the year (994) (1,743)

--------------------------------------------- ------- ------------------- --------------------

Total comprehensive loss attributable

to

owners of the parent (994) (1,743)

------------------------------------------------------- ------------------- --------------------

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AT 31 DECEMBER 2020

Notes 2020 2019

GBP'000 GBP'000

Assets

Non current assets

Property plant and equipment

--- oil and gas assets 9 - -

--- others 9 43 -

Intangibles 10 18 5

Goodwill - -

Associated undertaking 12 151 -

212 5

------------------------------------------------ --------- ------------------ ------------

Current assets

Trade and other receivables 376 49

Cash and cash equivalents 1,311 472

1,687 521

------------------------------------------------ --------- ------------------ ------------

Total assets 1,899 526

-------------------------------------------------- --------- ------------------ ------------

Equity and liabilities

Capital and reserves attributable to

owners of the parent

Share capital 1,107 482

Share premium account 32,156 30,507

Share option reserve 135 74

Foreign exchange translation

reserve 1,528 1,643

Retained earnings (33,130) (32,251)

Total equity 1,796 455

-------------------------------------------------- --------- ------------------ ------------

Current liabilities

Trade and other payables 58 64

Taxes payable 16 7

74 71

------------------------------------------------ --------- ------------------ ------------

Non-current liabilities

Lease finance 29 -

------------------------------ -------------- --------- ------------------ ------------

Total equity and liabilities 1,899 526

-------------------------------------------------- --------- ------------------ ------------

The financial statements were approved and authorised for issue

by the Board of Directors on 26 May 2021 and were signed on

its behalf by:

John Wakefield Andrew Yeo

Director Director

Company number: 05098776

COMPANY STATEMENT OF FINANCIAL POSITION AT 31 DECEMBER 2020

Notes 2020 2019

GBP'000 GBP'000

Assets

Non current assets

Property plant and equipment

--- oil and gas

assets - -

--- others 9 43 -

Intangibles 10 18 5

Investments 195 25

256 30

-------------------------------------- ------ --------------------- ----------------------

Current assets

Trade and other

receivables 375 46

Cash and cash equivalents 1,183 336

1,558 382

-------------------------------------- ------ --------------------- ----------------------

Total assets 1,814 412

---------------------------------------- ------ --------------------- ----------------------

Equity and liabilities

Capital and reserves attributable

to owners of the parent

Share capital 1,107 482

Share premium account 32,156 30,507

Share option reserve 135 74

Foreign exchange translation reserve (163) (163)

Retained earnings (31,523) (32,261)

Total equity 1,712 (1,361)

---------------------------------------- ------ --------------------- ----------------------

Current liabilities

Trade and other

payables 58 1,766

Taxes payable 15 7

73 1,773

-------------------------------------- ------ --------------------- ----------------------

Non-current liabilities

Lease finance 29 -

-------------------------------------- ------ --------------------- ----------------------

Total equity and

liabilities 1,814 412

---------------------------------------- ------ --------------------- ----------------------

The financial statements were approved and authorised for issue

by the Board of Directors on 26 May 2021 and were signed on its

behalf by:

John Wakefield Andrew Yeo

Director Director

Company number:

05098776

CONSOLIDATED AND COMPANY STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 DECEMBER 2020

Foreign

Share Share Retained Share option exchange Total

capital premium earnings reserve translation equity

Group GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1

January

2019 344 30,237 (30,577) 74 1,712 1,790

--------------- ------------------------------------------ --------------------------- --------------------------- --------------------------- ------------------------------- ------------------

Shares issued 138 270 - - - 408

--------------- ------------------

Transactions

with

owners 138 270 - - - 408

--------------- ------------------------------------------ --------------------------- --------------------------- --------------------------- ------------------------------- ------------------

Loss for the

year

attributable

to

equity

shareholders - - (1,674) - (1,674)

Foreign

exchange

translation

adjustments - - - - (69) (69)

--------------- --------------------------- ------------------

Total

comprehensive

income for

the period - - (1,674) - (69) (1,743)

--------------- ------------------------------------------ --------------------------- --------------------------- --------------------------- ------------------------------- ------------------

As at 1

January

2020 482 30,507 (32,251) 74 1,643 455

--------------- ------------------------------------------ --------------------------- --------------------------- --------------------------- ------------------------------- ------------------

Shares issued 625 1,670 - - - 2,295

--------------- ------------------

Transactions

with

owners 625 1,670 - - - 2,295

--------------- ------------------------------------------ --------------------------- --------------------------- --------------------------- ------------------------------- ------------------

Loss for the

year

attributable

to

equity

shareholders - - (920) - (920)

Share based

payments - (21) - 102 - 81

Share option

reserve

released - - 41 (41) - -

Foreign

exchange

translation

adjustments - - - - (115) (115)

--------------- --------------------------- ------------------

Total

comprehensive

income for

the period - (21) (879) 61 (115) (954)

------------------------------------------ --------------------------- --------------------------- --------------------------- ------------------------------- ------------------

As at 31

December

2020 1,107 32,156 (33,130) 135 1,528 1,796

--------------- ------------------------------------------ --------------------------- --------------------------- --------------------------- ------------------------------- ------------------

CONSOLIDATED AND COMPANY STATEMENT OF CHANGES IN EQUITY FOR

THE YEARED 31 DECEMBER 2020 - continued

Foreign

Share Share Retained Share option exchange Total

capital premium earnings reserve translation equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Company

As at 1

January

2019 344 30,237 (30,510) 74 (163) (18)

--------------- -------------------------------------------- --------------------------- ------------------------ --------------------------- --------------------------------- -----------------------

Shares issued 138 270 - - - 408

---------------

Transactions

with

owners 138 270 - - - 408

--------------- -------------------------------------------- --------------------------- ------------------------ --------------------------- --------------------------------- -----------------------

Loss for the

year - - (1,751) - - (1,751)

Total

comprehensive

income for

the period - - (1,751) - - (1,751)

--------------- -------------------------------------------- --------------------------- ------------------------ --------------------------- --------------------------------- -----------------------

As at 1

January

2020 482 30,507 (32,261) 74 (163) (1,361)

--------------- -------------------------------------------- --------------------------- ------------------------ --------------------------- --------------------------------- -----------------------

Shares issued 625 1,670 - - - 2,295

---------------

Transactions

with

owners 625 1,670 - - - 2,295

--------------- -------------------------------------------- --------------------------- ------------------------ --------------------------- --------------------------------- -----------------------

Profit for the

year - - 697 - - 697

Share based

payments - (21) - 102 - 81

Share option

reserve

released - - 41 (41) - -

Total

comprehensive

income for

the period - (21) 738 61 - 778

--------------- -------------------------------------------- --------------------------- ------------------------ --------------------------- --------------------------------- -----------------------

As at 31

December

2020 1,107 32,156 (31,523) 135 (163) 1,712

--------------- -------------------------------------------- --------------------------- ------------------------ --------------------------- --------------------------------- -----------------------

Share capital is the amount subscribed for shares at nominal

value.

Share premium represents the excess of the amount subscribed

for share capital over the nominal value of those shares net

of share issue expenses.

Retained earnings represents the cumulative loss of the group

attributable to equity shareholders.

Foreign exchange translation occurs on consolidation of the

translation of the subsidiaries balance sheets at the closing

rate of exchange and their income statements at the average

rate.

CONSOLIDATED AND COMPANY STATEMENT OF CASH FLOWS

FOR THE

YEARED 31 DECEMBER 2020

Group Company Group Company

2020 2020 2019 2,019

--------------------------------------- ------------- ------------------ ----------------- -----------------

GBP'000 GBP'000 GBP'000 GBP'000

Operating activities (919) (797) (724) (563)

Investing activities

Return from investment and servicing

of finance 5 5 1 1

Advances to subsidiary and associated

undertakings (323) (441) - (155)

Acquisition of intangible assets (14) (14) (1,047) (1,047)

Investment in associated undertaking (195) (195) - -

(527) (645) (1,046) (1,201)

Financing activities

Proceeds from issue of share capital 2,295 2,295 408 408

Lease financing (6) (6) - -

Net cash inflow 843 847 (1,362) (1,356)

Cash and cash equivalents

at the beginning of

the year 347 336 1,709 1,692

Cash and cash equivalents

at the end of the year 1,190 1,183 347 336

---------------------------------------- ------------- ------------------ ----------------- -----------------

Reconciliation to Consolidated

Statement of Financial Position

Cash not available for

use 121 - 125 -

Cash and cash equivalents as shown

in the Consolidated Statement

of Financial Position 1,311 1,183 472 336

---------------------------------------- ------------- ------------------ ----------------- -----------------

CONSOLIDATED AND COMPANY STATEMENT OF CASH FLOWS

FOR THE

YEARED 31 DECEMBER 2020 -

continued

Group Company Group Company

2020 2020 2019 2019

---------------------------------- ------------------ ------------------- ------------------ ------------------

GBP'000 GBP'000 GBP'000 GBP'000

Operating activities

Loss for the year

attributable to

controlling interests (920) 697 (1,674) (1,751)

Depreciation, amortisation and

impairment charges (57) 90 1,047 1,240

Share based payments 81 81 - -

Finance income shown as an

investing

activity (5) (5) (1) (1)

Profit on disposal of subsidiary

undertaking - (1,679) - -

Income from associated undertaking 44 - - -

Foreign exchange translation (52) 30 (4) 23

Operating cash outflows before

movements in working capital (909) (786) (632) (489)

----------------------------------- ------------------ ------------------- ------------------ ------------------

(Increase)/decrease in receivables (4) (5) 454 456

Tax paid - - - -

Decrease in payables (6) (6) (546) (530)

Net cash outflows from operating

activities (919) (797) (724) (563)

----------------------------------- ------------------ ------------------- ------------------ ------------------

NOTES TO THE FINANCIAL STATEMENTS

3. Operating Loss 2020 2019

------------------- -----------------------

GBP'000 GBP'000

The loss on ordinary activities before

taxation is stated after charging:

Auditors' remuneration

Group - audit 32 26

Company - audit 32 21

Group - other non-audit services 2 5

Company - other non-audit services 2 5

Exploration and evaluation expenditure 145 160

Impairment of intangible assets (59) 1,047

Depreciation of property, plant

and equipment 2 -

Impairment of foreign tax receivables (74) (16)

(Gain)/loss on exchange 157 41

The analysis of development and administrative expenses in the

consolidated income statement by nature of expense is:

2020 2019

---------------------------------------- ------------------- -----------------------

GBP'000 GBP'000

Employee benefit

expense 374 258

Share based payments 81 -

Exploration and evaluation expenditure 145 160

Depreciation, amortisation and

impairment charges (131) 1,031

Legal and professional

fees 198 133

Loss on exchange 157 41

Other expenses 57 51

881 1,674

---------------------------------------- ------------------- -----------------------

5. Finance income 2020 2019

------------------------------------------- ------------------ --------------------

GBP'000 GBP'000

Bank and other interest received 5 1

Finance cost - (1)

Total 5 -

6. Income tax expense 2020 2019

------------------------------------------- ------------------ --------------------

GBP'000 GBP'000

The tax charge on the loss on

ordinary activities was:-

UK Corporation Tax

- current - -

Foreign taxation - -

- -

------------------------------------------- ------------------ --------------------

The total charge for the year can be reconciled to the accounting

profit as follows:

2020 2019

------------------------------------------- ------------------ --------------------

GBP'000 GBP'000

Loss before tax

Continuing operations (920) 1,674

Tax at composite group rate of 19% (2019:

19%) (174) (318)

Effects of:

Losses not subject to tax 340 221

Movement on capital allowances (126) (153)

Increase in tax

losses (40) 250

Foreign taxation - -

Tax expense - -

---------------------------------------------- ------------------ --------------------

At 31 December 2020, the Group has tax losses of GBP28,990,000

(2019 - GBP28,208,000) to carry forward against future profits.

The deferred tax asset on these tax losses at 19% of GBP5,508,000

(2019: at 19%, GBP5,359,000) has not been recognised due to

the uncertainty of the recovery.

8. Earnings per

share

2020 2019

----------------------------------------------- -------------- --------------

Loss per ordinary

share

- Basic (0.023p) (0.099p)

- Diluted (0.023p) (0.099p)

Earnings per ordinary share is based on the Group's loss attributable

to controlling interests for the year of GBP920,000 (2019:

GBP1,674,000).

The weighted average number of shares used in the calculation

is the weighted average ordinary shares in issue during the

year.

2020 2019

-------------- --------------

Number Number

Weighted average ordinary shares in issue

during the year 3,988,470,466 1,685,313,686

Weighted average potentially dilutive options

and warrants issued 373,396,517 82,150,685

Weighted average ordinary shares for

diluted earnings per share 4,361,866,983 1,767,464,371

------------------------------------------------- -------------- --------------

Due to the Group's results, the diluted earnings per share

was deemed to be the same as the basic earnings per share for

that year.

9. Property,

plant and

equipment

Development Equipment Right for

and and use

production machinery asset

costs Total

GBP'000 GBP'000 GBP'000 GBP'000

Group

Cost

At 1 January

2019 - 34 - 34

Foreign

exchange

translation

adjustment - (4) - (4)

At 1 January

2020 - 30 - 30

Foreign

exchange

translation

adjustment - (1) - (1)

Expenditure - - 45 45

At 31 December

2020 - 29 45 74

--------------- ------------------------ ------------------------ ------------------------ ----------------------

Depreciation

At 1 January

2019 - 34 - 34

Foreign

exchange

translation

adjustment - (4) - (4)

At 1 January

2020 - 30 - 30

Foreign

exchange

translation

adjustment - (1) - (1)

Charge for the

period - - 2 2

At 31 December

2020 - 29 2 31

--------------- ------------------------ ------------------------ ------------------------ ----------------------

Net book

value

At 31 December

2020 - - 43 43

At 31

December 2019 - - - -

Company

Cost

At 1 January - - - -

2019

and 2020

Expenditure - - 45 45

At 31 December

2020 - - 45 45

--------------- ------------------------ ------------------------ ------------------------ ----------------------

Depreciation

At 1 January - - - -

2019

and 2020

Charge for the

period - - 2 2

At 31 December

2020 - - 2 2

--------------- ------------------------ ------------------------ ------------------------ ----------------------

Net book

value

At 31 December

2020 - - 43 43

At 31 December

2019 - - - -

9. Property, plant and equipment (continued)

Included in the above line items is a right-of-use asset of

GBP43,000 (2019: nil) in respect of a motor vehicle.

At lease commencement date, the Group recognises a right-of-use

asset and a lease liability on the balance sheet. The right-of-use

asset is measured at cost, which is made up of the initial

measurement of the lease liability, any initial direct costs

incurred by the Group, an estimate of any costs to dismantle and

remove the asset at the end of the lease, and any lease payments

made in advance of the lease commencement date.

The Group depreciates the right-of-use assets on a straight-line

basis from the lease commencement date to the earlier of the end of

the useful life of the right-of-use asset or the end of the lease

term. The Group also assesses the right-of-use asset for impairment

when such indicators exist.

On the statement of financial position, right-of-use assets have

been included in property, plant and equipment.

10. Intangible fixed

assets Exploration

and evaluation

Licence costs Total

GBP'000 GBP'000 GBP'000

Group

Cost

At 1 January 2019 - 2,486 2,486

Foreign exchange translation adjustment - (61) (61)

Expenditure - 1,047 1,047

------------------------------------------ ----------------------------- ------------------- --------

At 1 January 2020 - 3,472 3,472

Foreign exchange translation adjustment - (59) (59)

Expenditure - 14 14

Disposals - (1,108) (1,108)

At 31 December 2020 - 2,319 2,319

------------------------------------------ ----------------------------- ------------------- --------

Impairment

At 1 January 2019 - 2,420 2,420

Charge for the period - 1,047 1,047

------------------------------------------ ----------------------------- ------------------- --------

At 1 January 2020 - 3,467 3,467

Charge for the period - (59) (59)

Disposals - (1,107) (1,107)

At 31 December 2020 - 2,301 2,301

------------------------------------------ ----------------------------- ------------------- --------

Net book value

At 31 December 2020 - 18 18

At 31 December 2019 - 5 5

10.

Intangible

fixed assets

(continued) Exploration

and evaluation

Licence costs Total

GBP'000 GBP'000 GBP'000

Company

Cost

At 1 January

2019 - 701 701

Expenditure - 1,047 1,047

At 1 January

2020 - 1,748 1,748

Expenditure - 14 14

Disposals - (1,109) (1,109)

At 31 December

2020 - 653 653

--------------- -------------------------------- --------------------------------- ---------------------------------

Impairment

At 1 January

2019 - 635 635

Charge for the

year - 1,108 1,108

At 1 January

2020 - 1,743 1,743

Charge for -

the year - -

Disposals (1,108) (1,108)

At 31 December

2020 - 635 635

--------------- -------------------------------- --------------------------------- ---------------------------------

Net book

value

At 31 December

2020 - 18 18

At 31 December

2019 - 5 5

The exploration and evaluation costs above represent the cost

in acquiring, exploring and evaluating the company's and group's

assets.

The impairment of all intangible assets has been reviewed, giving

rise to the following impairment charges, or reduction in impairment

charges.

Block XXI Peru: this licence was fully impaired in 2018.

UK offshore block P1918 ("Colter"): the drilling of an exploration

well commenced on 6 February 2019 and was completed on 25 February

2019, with a further side-track well being drilled, completing

on 8 March 2019. This licence continued into the second term

with effect from 1 February 2020 but the Company has now written

off this asset against the impairment provision, as the licence,

along with related licences PEDL330 and PEDL 345, were relinquished

on 31 January 2021.

12. Associated undertaking

Shares in

associated

undertaking Total

GBP'000 GBP'000

Group

Gross investment

value

At 1 January 2019

and 2020 - -

Additions 195 195

Share of post acquisition net

result (44) (44)

At 31 December 2020 151 151

----------------------------------- ------------------------ ---------------------

Impairment

At 1 January 2019 and 2020, and

31 December 2020 - -

---------------------------------- ------------------------ ---------------------

Carrying value

At 31 December 2020 151 151

At 31 December 2019 - -

On 27 April 2020, the Group acquired a 33.33% interest in

SundaGas (Timor-Leste Sahul) Pte. Ltd, incorporated in Singapore at

a gross cost of GBP195,000. In accordance with IAS28, the Group

accounts for its investment in this company using the equity

method.

Glossary

BCF Billion cubic feet.

Mean Reflects a mid-case volume estimate of resource derived using probabilistic methodology. This

is the mean of the probability distribution for the resource estimates and may be skewed by

high resource numbers with relatively low probabilities.

MMBOE Million barrels of oil equivalent. Volume derived by dividing the estimate of the volume of

natural gas in billion cubic feet by six in order to convert it to an equivalent in million

barrels of oil and, where relevant, adding this to an estimate of the volume of oil in millions

of barrels.

Prospective Resources Quantities of petroleum that are estimated to exist originally in naturally occurring

reservoirs,

as of a given date. Crude oil in-place, natural gas in-place, and natural bitumen in-place

are defined in the same manner.

SPE PRMS The Society of Petroleum Engineers' ("SPE") Petroleum Resources Management System ("PRMS"):

a system developed for consistent and reliable definition, classification, and estimation

of hydrocarbon resources prepared by the Oil and Gas Reserves Committee of SPE and approved

by the SPE Board in June 2018 following input from six sponsoring societies: the World

Petroleum

Council, the American Association of Petroleum Geologists, the Society of Petroleum Evaluation

Engineers, the Society of Exploration Geophysicists, the European Association of Geoscientists

and Engineers, and the Society of Petrophysicists and Well Log Analysts.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR DKABBCBKDDPB

(END) Dow Jones Newswires

May 27, 2021 02:00 ET (06:00 GMT)

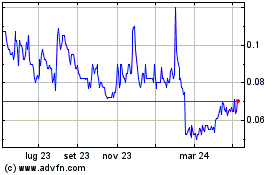

Grafico Azioni Baron Oil (LSE:BOIL)

Storico

Da Mar 2024 a Apr 2024

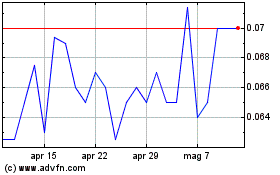

Grafico Azioni Baron Oil (LSE:BOIL)

Storico

Da Apr 2023 a Apr 2024