TIDMBOIL

RNS Number : 1411F

Baron Oil PLC

14 July 2021

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF REGULATION 11 OF THE MARKET ABUSE (AMMENT) (EU EXIT) REGULATIONS

2019/310

14 July 2021

Baron Oil Plc

("Baron" or the "Company")

Independent Resource Update for the Chuditch PSC

Baron Oil Plc (AIM:BOIL), the AIM-quoted oil and gas exploration

company, is pleased to announce the results of an independent

review of Prospective Resources by THREE60 Energy Asia Sdn. Bhd.

("THREE60 Energy") for the TL-SO-19-16 Production Sharing Contract,

offshore Timor-Leste (the "Chuditch PSC" or the "PSC").

Key Points

-- Independent review of the Chuditch PSC, validated to SPE PRMS

2018 industry standards, indicates gross Mean Prospective Resources

of 3,368 Bscf of gas and 30 MMbbl of condensate, equivalent to a

total of 592 MMBOE.

-- Subsurface risks for prospects and lead estimated to be low

since they share analogous geological characteristics to the

Chuditch-1 and other gas discoveries in adjacent Timor-Leste and

Australian waters.

-- High Estimate of gross Prospective Resources equivalent to

1,156 MMBOE may reflect potential for a single, large

accumulation.

Background

Baron's Timor-Leste subsidiary SundaGas Banda Unipessoal, Lda.

("Banda" or "SundaGas Banda") holds a 75% operating interest in the

Chuditch PSC, offshore Timor-Leste. The remaining 25% interest in

the PSC is held by TIMOR GAP Chuditch Unipessoal, Lda., a

subsidiary of the Timor-Leste state oil company, which is carried

for all exploration and development costs through to first

production. Baron therefore has an effective interest of 75% in the

PSC.

Banda commissioned THREE60 Energy to critically review and

validate Banda's interpretation of available subsurface data and to

perform independent volumetric and risk factor calculations on the

Chuditch-1 discovery and the adjacent prospects and lead. THREE60

Energy independently assessed the petrophysics, reservoir geology

and reservoir engineering aspects of Chuditch-1. THREE60 Energy did

not undertake an independent seismic interpretation, but reviewed

in detail Banda's mapping, which is based on the 2D seismic data

available to date.

As previously announced, Banda has now licensed pre-existing 3D

seismic data which are being reprocessed by TGS-NOPEC Geophysical

Company ASA ("TGS") and it is intended that these data will be

incorporated in future resource updates at the appropriate

junctures.

THREE60 Energy assessed volumes of gas and associated

condensate, the latter being included in Baron's published resource

assessments for the first time.

THREE60 Energy has applied to its resource volume estimates the

definitions and guidelines set out in the 2018 Petroleum Resources

Management System prepared by the Oil and Gas Reserves Committee of

the Society of Petroleum Engineers (SPE) and reviewed and jointly

sponsored by the World Petroleum Council (WPC), the American

Association of Petroleum Geologists (AAPG), the Society of

Petroleum Evaluation Engineers (SPEE), the Society of Exploration

Geophysicists (SEG), the Society of Petrophysicists and Well Log

Analysts (SPWLA) and the European Association of Geoscientists

& Engineers (EAGE) - abbreviated to the "SPE PRMS 2018".

Prospective Resources

The table below summarises THREE60 Energy's independent

assessment of Gross Prospective Resources, from which are derived

the Net Prospective Resources attributable to Baron's 75% effective

interest, wholly within the Chuditch PSC licence areas. Totals are

by arithmetic summation.

Prospective Gross Attributable to Net Attributable to Risk Operator

Resources Licence Baron Oil plc Factor

------------- ------------------------------------------- ------------------------------------------- ------- ---------

Low Best High Mean Low Best High Mean

Estimate Estimate Estimate Estimate Estimate Estimate Estimate Estimate

------------- ------- ---------

(1U) (2U) (3U) (1U) (2U) (3U)

------------- --------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Gas (Bscf)

---------------------------------------------------------------------------------------------------------------------------

Chuditch SundaGas

Discovery 457.0 713.3 1,077.0 729.0 342 535 808 547 100% Banda

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Chuditch SundaGas

W Prospect 162.5 405.0 986.9 483.0 122 304 740 362 51% Banda

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Chuditch SundaGas

SW Prospect 193.1 481.5 1,173.9 575.3 145 361 880 431 40% Banda

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Chuditch SundaGas

N Prospect 142.4 354.8 864.5 423.0 107 266 648 317 44% Banda

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Chuditch

NE SundaGas

Lead 389.4 969.8 2,364.7 1,158.0 292 727 1,774 869 20% Banda

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Total

Gas (Bscf) 1,344 2,924 6,467 3,368 1,008 2,193 4,850 2,525

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Associated Condensate (MMbbl)

---------------------------------------------------------------------------------------------------------------------------

Chuditch SundaGas

Discovery 1.1 3.3 8.4 3.9 0.8 2.4 6.3 3.0 100% Banda

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Chuditch SundaGas

W Prospect 0.5 3.1 12.4 4.8 0.4 2.3 9.3 3.6 51% Banda

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Chuditch SundaGas

SW Prospect 0.6 3.7 14.7 5.8 0.4 2.7 11.1 4.4 40% Banda

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Chuditch SundaGas

N Prospect 0.5 2.7 10.9 4.2 0.4 2.0 8.2 3.2 44% Banda

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Chuditch SundaGas

NE Lead 1.3 7.5 32.1 11.6 1.0 5.6 24.1 8.8 20% Banda

--------- --------- --------- ---------- --------- --------- --------- ---------- ------- ---------

Total

Associated

Condensate

(MMbbl) 4 20 78 30 3 15 59 23

Barrels of Oil Equivalent (MMBOE)

Total

Barrels

of Oil

Equivalent

(MMBOE) 228 508 1,156 592 171 381 867 444

--------- --------- --------- ---------- --------- --------- --------- ---------- -------

Notes:

-- Prospective Resources are those quantities of petroleum

estimated, as of a given date, to be potentially recoverable from

unappraised or undiscovered accumulations. Volumes are reported in

billions of standard cubic feet (Bscf) of gas and millions of

barrels (MMbbl) of associated condensate. Conversion of gas to

barrels of oil equivalent (BOE) applies a ratio of 1 BOE is

equivalent to 6,000 scf.

-- Low, Best and High estimates correspond to the 1U, 2U and 3U

Prospective Resource categories defined in SPE PRMS 2018. These in

turn correspond to the P90, P50 and P10 volumes of the

probabilistic Prospective Resource range.

-- Arithmetic summation of P90, P50, P10 values is not

statistically correct, and therefore we adopt SPE PRMS 2018

guidance in referring to the corresponding totals for Low, Best and

High estimates.

-- "Risk Factor" for Prospective Resources, means Chance of

Geologic Discovery (Pg) for the specific prospect success outcome

to which the reported resource estimates pertain. THREE60 Energy

has ensured that the risk value is appropriate for the stated

resource size distribution. This, then, is the chance or

probability of the Prospective Resource maturing into a Contingent

Resource.

-- A second risk factor applicable to Pg, i.e. Chance of

Development (Pd), has not been assessed.

-- "Gross Attributable" are 100% of the resources attributable

to the licence whilst "Net Attributable" are those attributable to

Baron's effective interest in the PSC (75%).

Jon Ford, Technical Director of Baron commented...

"THREE60 Energy's independent review of Prospective Resources

confirms our view that the Chuditch PSC contains the significant

hydrocarbon potential of some 592 MMBOE of aggregate gross Mean

Prospective Resources, now validated to the SPE PRMS 2018 industry

standard. Moreover, subsurface risks are considered to be low since

the prospects and lead share analogous geological characteristics

to the Chuditch discovery itself, as well as with other large gas

discoveries in Timor-Leste and adjacent Australian waters. We note

THREE60 Energy's High estimate of aggregate gross Mean Prospective

Resources, of approximately 1,156 MMBOE, which we believe reflects

the potential for a single, large accumulation incorporating the

Chuditch discovery and the adjacent prospects and lead."

"The ongoing 3D seismic reprocessing has the potential to reduce

the range of volumetric uncertainty, including investigating the

single large accumulation concept, reducing subsurface risk, and

providing multiple drilling location candidates. On completion of

this work and associated studies, some or all of the resources in

the Chuditch-1 discovery may be reclassified from Prospective to

Contingent."

Qualified Person's Statement

Pursuant to the requirements of the AIM Rules - Note for Mining

and Oil and Gas Companies, the technical information and resource

reporting contained in this announcement has been reviewed by Jon

Ford BSc, Fellow of the Geological Society, Technical Director of

the Company. Mr Ford has more than 39 years' experience as a

petroleum geoscientist. He has compiled, read, and approved the

technical disclosure in this regulatory announcement.

About THREE60 Energy Asia Sdn. Bhd.

THREE60 Energy is an independent consultancy specialising in

petroleum reservoir assessment and asset evaluation. It offers a

full range of integrated E&P consulting solutions, from

exploration, appraisal, field development planning, well drilling

and completions to reservoir management and production

optimisation. Based in Kuala Lumpur, Malaysia, THREE60 Energy

currently has operations in Asia Pacific, Europe, and

Australia.

THREE60 Energy is independent of SundaGas Banda and is

remunerated by way of a fee that is neither linked to the value of

SundaGas Banda nor their entitlement to Petroleum Resources

volumes. Neither THREE60 Energy nor any of its directors, staff or

sub-consultants who contributed to the report has any interest in

SundaGas Banda, its subsidiaries, or any of its assets or

securities.

For further information, please contact:

Baron Oil Plc +44 (0) 20 7117 2849

Andy Yeo, Chief Executive

Allenby Capital Limited +44 (0) 20 3328 5656

Nominated Adviser and Joint Broker

Alex Brearley, Nick Harriss, Nick Athanas (Corporate

Finance)

Kelly Gardiner (Sales and Corporate Broking)

Turner Pope Investments (TPI) Limited +44 (0) 20 3657 0050

Joint Broker

Andy Thacker

Glossary

Bscf Billion standard cubic feet.

Best Estimate or 2U Denotes the mid estimate qualifying as Prospective Resources. Reflects a volume estimate

that

there is a 50% probability that the quantities actually recovered will equal or exceed

the

estimate.

Chance of Geologic Discovery The estimated probability that exploration activities will confirm the existence of a

significant

accumulation of potentially recoverable petroleum (abbreviated to Pg).

High Estimate or 3U Denotes the high estimate qualifying as Prospective Resources. Reflects a volume

estimate

that there is a 10% probability that the quantities actually recovered will equal or

exceed

the estimate.

Low Estimate or 1U Denotes the low estimate qualifying as Prospective Resources. Reflects a volume estimate

that

there is a 90% probability that the quantities actually recovered will equal or exceed

the

estimate.

Mean Reflects a mid-case volume estimate of resource derived using probabilistic methodology.

This

is the mean of the probability distribution for the resource estimates and may be skewed

by

high resource numbers with relatively low probabilities.

MMbbl Million barrels (in this case meaning associated condensate liquids).

MMBOE Million barrels of oil equivalent. Volume derived by dividing the estimate of the volume

of

natural gas in billion cubic feet by six in order to convert it to an equivalent in

million

barrels of oil and, where relevant, adding this to an estimate of the volume of oil in

millions

of barrels.

Prospective Resources Quantities of petroleum that are estimated to exist originally in naturally occurring

reservoirs,

as of a given date. Crude oil in-place, natural gas in-place, and natural bitumen

in-place

are defined in the same manner.

SPE PRMS The Society of Petroleum Engineers' ("SPE") Petroleum Resources Management System

("PRMS"):

a system developed for consistent and reliable definition, classification, and

estimation

of hydrocarbon resources prepared by the Oil and Gas Reserves Committee of SPE and

approved

by the SPE Board in June 2018 following input from six sponsoring societies: the World

Petroleum

Council, the American Association of Petroleum Geologists, the Society of Petroleum

Evaluation

Engineers, the Society of Exploration Geophysicists, the European Association of

Geoscientists

and Engineers, and the Society of Petrophysicists and Well Log Analysts. Quantities of

petroleum

estimated, as of a given date, to be potentially recoverable from undiscovered

accumulations

by application of future development projects. The total quantity of petroleum that is

estimated

to exist originally in naturally occurring reservoirs, as of a given date. Crude oil

in-place,

natural gas in-place, and natural bitumen in-place are defined in the same manner.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUORKRAWUBAAR

(END) Dow Jones Newswires

July 14, 2021 02:00 ET (06:00 GMT)

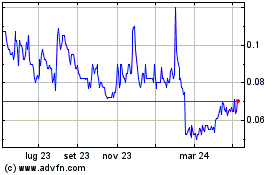

Grafico Azioni Baron Oil (LSE:BOIL)

Storico

Da Mar 2024 a Apr 2024

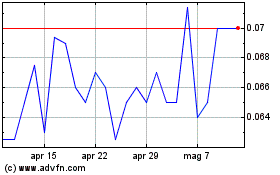

Grafico Azioni Baron Oil (LSE:BOIL)

Storico

Da Apr 2023 a Apr 2024