TIDMBOIL

RNS Number : 0925D

Baron Oil PLC

14 February 2020

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement

14 February 2020

Baron Oil Plc

("Baron" or "the Company")

Conditional Placing and Subscription to raise GBP2.5 million

Baron Oil Plc (AIM:BOIL), the AIM-quoted oil and gas exploration

and production company, focused on opportunities in SE Asia, Latin

America and the UK, is pleased to announce that it has raised

GBP2.5 million by way of a Conditional Placing and Subscription of

2,500,000,000 new ordinary shares of 0.025p each ("New Ordinary

Shares") at a price of 0.1 pence per New Ordinary Share (the

"Placing Price") (together, the "Fundraising"). Turner Pope

Investments (TPI) Limited acted as sole placing agent.

It is intended that the proceeds of the Placing will largely be

used to fund Baron's share of the ongoing TL-SO-19-16 PSC

("Chuditch PSC") Work Programme and the drilling of the onshore El

Barco-3x well in Peru, as well as providing additional working

capital. As previously announced, the Chuditch PSC has a gross

estimate made by Shell of Mean gas in place of 2,320 billion cubic

feet ("BCF") and gas recovery potential, based on Shell's original

estimates in the range of 55% to 75%, in the order of 1,276 to

1,740 BCF, considered by Baron to be Prospective Resources but not

SPE PRMS compliant. In Peru, Baron hopes to drill El Barco-3x later

this year targeting 2U (P50) SPE PRMS compliant unrisked

recoverable Prospective Resources of 8.5 million barrels of oil

recoverable from the higher risk Amotape Basement and 14.7 BCF of

gas recoverable from the low risk, shallower Mancora Sand.

The Fundraising

The Fundraising comprises a placing of 2,442,500,000 New

Ordinary Shares (the "Placing") and a subscription of 57,500,000

New Ordinary Shares (the "Subscription"). The Company has utilised

its existing share authorities under the disapplication of

pre-emption rights to issue 735,714,286 New Ordinary Shares for

settlement and admission on 20 February 2020 (the "Tranche 1

Placing Shares") with the balance of 1,764,285,714 New Ordinary

Shares (the "Tranche 2 Placing Shares") conditional on the passing

of the Resolutions to be proposed at a General Meeting on or around

10 March 2020.

The Placing Price represents a discount of 58.3 per cent. to the

closing middle market price of 0.24 pence per Existing Ordinary

Share on 13 February 2020, being the latest practicable date prior

to the announcement of the Placing. The New Ordinary Shares will

represent 56.48 per cent. of the Company's Enlarged Share Capital

immediately following Admission.

The Circular relating to the General Meeting will be sent to

shareholders shortly. A further announcement will be made when the

circular is published and it will also be made available for

download from the Company's website ( https://www.baronoilplc.com/

).

Malcolm Butler, Executive Chairman of Baron Oil, commented:

"The Board is pleased that this Fundraising has been completed

successfully, albeit at a significant discount to recent share

prices.

"We continue to be very excited by the potential value that can

be realised through our investment in SundaGas (Timor-Leste Sahul)

Pte. Ltd, parent company of the Operator of the Chuditch PSC, in

the initial phases of seismic reprocessing and thereafter through

an appraisal and exploration drilling programme. We also have

provisional plans to drill the low-cost, low risk El Barco-3x well

in Peru which offers the potential for significant value on

discovery."

Director Subscriptions

Andrew Yeo and Jon Ford have subscribed for a total of

57,500,000 New Ordinary Shares at a price of 0.1p per share (the

"Director Subscriptions"). These form part of the Tranche 2 Placing

Shares. Details of the Director Subscriptions are outlined in the

table below.

Director Position New Ordinary Shareholding % holding

Shares being following following

subscribed Admission Admission

Andrew Yeo Managing Director 50,000,000 106,250,000 2.40%

------------------- ---------------------- --------------------- -----------------

Non-Executive

Jon Ford Director 7,500,000 7,500,000 0.17%

------------------- ---------------------- --------------------- -----------------

Related Party Transaction

As both Andrew Yeo and Jon Ford are directors of the Company,

the Director Subscriptions are deemed related party transactions

for the purposes of Rule 13 the AIM Rules ("Related Party

Transactions").

Malcolm Butler, being the independent Director for the purposes

of the Related Party Transactions, considers, having consulted with

the Company's nominated adviser, SP Angel Corporate Finance LLP,

that the terms and conditions of the Director Subscription are fair

and reasonable insofar as all shareholders of the Company are

concerned.

Application for Admission

Completion of the Fundraising is conditional, inter alia, upon

admission of the New Ordinary Shares to trading on AIM

("Admission").

Application has been made to the London Stock Exchange for the

Tranche 1 Placing Shares to be admitted to trading on AIM and it is

expected that admission of the Tranche 1 Placing Shares will take

place and that trading will commence on or around 8:00 a.m. on 20

February 2020. The Tranche 1 Placing Shares will rank pari passu in

all respects with the existing ordinary shares.

The Tranche 2 Placing Shares will admit following approval at

the General Meeting.

Total Voting Rights

Following admission of the Tranche 1 Placing Shares, the

Company's share capital and total voting rights will comprise

2,662,123,862 Ordinary Shares. The Company does not hold any shares

in treasury. Consequently 2662,123,862 is the figure which may be

used by shareholders as the denominator for the calculation by

which they will determine if they are required to notify their

interest in, or a change to their interest in, the Company under

the FCA's Disclosure and Transparency Rules.

For further information, please contact:

Baron Oil Plc +44 (0)20 7117 2849

Dr Malcolm Butler, Executive Chairman

Andy Yeo, Managing Director

SP Angel Corporate Finance LLP +44 (0)20 3470 0470

Nominated Adviser and Joint Broker

Stuart Gledhill, Stephen Wong

Turner Pope Investments (TPI) Limited +44 (0)20 3657 0050

Joint Broker

Andy Thacker, Zoe Alexander

PDMR Notification

1. Details of the person discharging managerial responsibilities/person

closely associated

(a) Full name of person Dealing i. Andrew Yeo

ii. Jonathan Ford

----------------------------------------- ---------------------------------------------

2. Reason for notification

----------------------------------------------------------------------------------------

(b) Position/status i. Managing Director

ii. Non-Executive Director

----------------------------------------- ---------------------------------------------

(c) Initial notification/ Amendment Initial notification

----------------------------------------- ---------------------------------------------

3. Details of the issuer, emission allowance market participant,

auction platform, auctioneer or auction monitor

----------------------------------------------------------------------------------------

(d) Name of entity Baron Oil Plc

----------------------------------------- ---------------------------------------------

(e) LEI 213800MBSOS9UZ5SW712

----------------------------------------- ---------------------------------------------

4. Details of the transaction(s): section to be repeated

for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

----------------------------------------------------------------------------------------

(a) Description of the financial instrument, Ordinary shares of

type of instrument 0.025 pence each in

the Company

----------------------------------------- ---------------------------------------------

(b) Identification code GB00B01QGH57

----------------------------------------- ---------------------------------------------

(c) Nature of the transaction Subscription for ordinary

shares

----------------------------------------- ---------------------------------------------

(d) Price(s) and volume(s) Prices(s) Volume(s)

i. 0.1 pence i. 50,000,000

ii. 0.1 ii. 7,500,000

pence

---------------

----------------------------------------- ---------------------------------------------

(e) Aggregated information: Single transaction

- Aggregated volume as in 4(d) above Prices(s) Volume(s)

- Price i. 0.1 pence i. 50,000,000

ii. 0.1 ii. 7,500,000

pence

---------------

----------------------------------------- ---------------------------------------------

(f) Date of transaction 14 February 2020

----------------------------------------- ---------------------------------------------

(g) Place of transaction Outside a trading venue

----------------------------------------- ---------------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IOETIMTTMTTBBIM

(END) Dow Jones Newswires

February 14, 2020 07:29 ET (12:29 GMT)

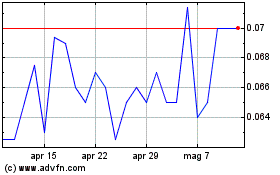

Grafico Azioni Baron Oil (LSE:BOIL)

Storico

Da Mar 2024 a Apr 2024

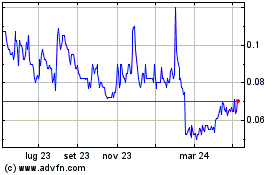

Grafico Azioni Baron Oil (LSE:BOIL)

Storico

Da Apr 2023 a Apr 2024