Bekaert set to significantly outperform expectations

19 Luglio 2021 - 7:30AM

Bekaert set to significantly outperform expectations

Based on preliminary and unaudited financial statements, Bekaert

will disclose a strong set of H1 results on 30 July 2021,

significantly above the results of previous reporting periods and

consensus estimates.

Bekaert’s preliminary and unaudited H1 figures indicate:

- € 2.3 billion in consolidated revenue, up 30% from H1 2020 and

back to pre-Covid levels

- underlying EBIT of € 285 million, tripling the level of H1

2020

- an underlying EBIT margin on sales of approximately 12%, ~7 ppt

above H1 2020

- an underlying EBITDA margin of approximately 16%, ~5 ppt above

H1 2020

- further deleveraging: net debt on underlying EBITDA of

~0.70

The margin level for the first half of 2021 has been supported

by:

- the strong volume rebound to pre-Covid levels

- the structural improvements with lasting effects on the

business portfolio and performance of Bekaert

- a very strong positive inventory valuation impact driven by the

price increases of raw materials

Preliminary outlook for the second half of 2021:

We project good demand in most markets in the second half of the

year but take into account the usual seasonality effects and remain

cautious about supply chain interruptions and other challenges

posed by the Covid-19 pandemic. We project a much lower inventory

valuation impact in the second half due to the anticipated

stabilization trend in raw material prices. The underlying EBIT of

the second half will therefore be lower than the first half of 2021

and is projected to approximate the level of the second half last

year.

The full disclosure of the final H1 results and more detailed

guidance for the fiscal year 2021 will be published and explained

on 30 July 2021.

- p210719E - Bekaert set to significantly outperform

expectations

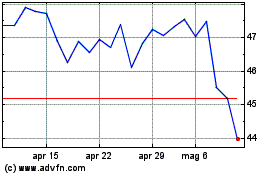

Grafico Azioni NV Bekaert (EU:BEKB)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni NV Bekaert (EU:BEKB)

Storico

Da Apr 2023 a Apr 2024