TIDMBWNG

RNS Number : 1634C

Brown (N.) Group PLC

17 June 2021

17(th) June 2021

TRADING UPDATE FOR THE 13 WEEKS TO 29(th) MAY 2021

Q1 FY22 trading in line with expectations

Highlights

-- Good momentum in product revenue which returned to growth with a 4.6% increase in Q1

-- Five strategic brands of Jacamo, Simply Be, JD Williams,

Ambrose Wilson and Home Essentials, grew product revenue by

15.5%

-- As guided, Financial Services revenue was 5.9% lower than the prior year

-- Customer repayment rates higher than the prior year

-- Amanda Holden and Davina McCall signed as brand ambassadors for JD Williams

-- Strong net cash position of GBP84.9m(1) at 29(th) May 2021

-- FY22 guidance remains unchanged

Q1 FY22 Revenue performance

Q1 FY22(2) vs. Q1 FY21(3) Q1 FY22(2) % change

GBPm

Product revenue 106.9 +4.6%

----------------- ---------------

Strategic brands(4) 86.1 +15.5%

----------------- ---------------

Other brands(5) 20.8 (24.6)%

----------------- ---------------

Financial Services revenue 61.8 (5.9)%

----------------- ---------------

Group revenue 168.7 +0.5%

----------------- ---------------

Product revenue growth

The Group's Q1 product revenue growth was driven by the five

strategic brands which grew 15.5% in the period. This is as a

result of the strategic transformation which has taken place over

the last two years. In Q1 FY22 strategic brands were 81% of product

revenue compared to 67% in the same period 2 years ago and this

represents the first quarter of product revenue growth since Q3

FY18.

Within our product lines, Clothing & Footwear sales have

continued to recover and demand increased 21% compared to the prior

period with own brand Womenswear +27% and Menswear own brand +25%.

Demand for Home & Gift was lower than the prior period which

benefitted from pandemic related purchases of garden furniture and

personal grooming products.

As previously guided, lower product revenue in the prior year

resulted in a smaller debtor book and a 5.9% reduction in Financial

Services revenue. Customer repayment rates are higher than the

prior year and as at 29(th) May 2021 less than 0.2% of debtor

balances remained on a Covid-19 related payment deferral, down from

a peak of 3% in May 2020.

We continue to invest in effective marketing spend to increase

awareness of our strategic brands and their customer offer. This

month, we have signed Amanda Holden and Davina McCall as brand

ambassadors for JD Williams to increase consideration for our

boutique shopping experience amongst the target audience.

Strong financial position

The Group finished the period with net cash of GBP84.9m(1) ,

leaving it well positioned to continue its investment in strategic

initiatives to drive profitable growth. Adjusted net debt was

GBP287.7m(6) , incorporating GBP84.9m of cash and GBP372.6m of debt

drawn against the securitisation funding facility which is backed

by the eligible customer receivables. The GBP502.3m net customer

loan book significantly exceeds this adjusted net debt figure. The

Group has no unsecured debt.

FY22 guidance is unchanged

-- Product revenue growth of between 3% and 7%

-- Financial services revenue is expected to be lower compared to FY21

-- Group revenue growth to be +1% to +4%

-- Adjusted EBITDA(7) to be in the range of GBP93m to GBP100m

-- Capex of GBP30m - GBP35m

-- Depreciation and amortisation of c.GBP40m

-- Net interest costs of c.GBP16m

-- Adjusted net debt(6) is expected to be in the range of GBP280m to GBP300m

Steve Johnson, Chief Executive, said:

"The strategic transformation initiatives we have enacted over

the past two years have now started to deliver product revenue

growth, with customers responding well to the new ranges across our

core brands.

We have a number of exciting initiatives in the pipeline and

today we have announced a new partnership with Amanda Holden and

Davina McCall to be the new faces of JD Williams, leading some

innovative new campaigns which will serve as a rich source of

inspiration for our customers.

Whilst the external environment remains challenging, we have

made a good start to the financial year and trading remains in-line

with our expectations."

1. Excludes debt securitised against receivables (customer loan

book) of GBP372.6m and lease liabilities of GBP4.3m.

2. Q1 FY22 is the 13 weeks to 29(th) May 2021.

3. Q1 FY21 is the 13 weeks to 30(th) May 2020 and is adjusted to

reflect the actual returns performance in Q1 FY21, as reflected in

the FY21 results.

4. JD Williams, Simply Be, Ambrose Wilson, Jacamo and Home Essentials.

5. Other brands are Fashion World, Marisota, Oxendales and

Premier Man. High & Mighty, House of Bath and Figleaves were

folded into Strategic brands in FY21.

6. Total liabilities from financing activities less cash, excluding lease liabilities.

7. Adjusted EBITDA is defined as operating profit, excluding

exceptional items, with depreciation and amortisation added

back.

For further information:

N Brown Group

Will MacLaren, Director of Investor Relations and +44(0)7557 014

Corporate Communications 657

MHP Communications

Simon Hockridge / James Midmer +44(0)203 128

8789

NBrown@mhpc.com

Shore Capital - Nomad and Broker

Dru Danford / Stephane Auton / Daniel Bush / John +44 (0) 20 7408

More 4090

About N Brown Group:

N Brown is a top 10 UK clothing and footwear digital retailer,

with a Home proposition, serving customers across five strategic

brands. Our strategic brands are JD Williams, Simply Be, Jacamo,

Ambrose Wilson and Home Essentials and our financial services

proposition allows customers to spread the cost of shopping with

us. We are headquartered in Manchester where we design, source and

create our product offer and we employ over 1,800 people across the

UK.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFFDRDIRLIL

(END) Dow Jones Newswires

June 17, 2021 02:00 ET (06:00 GMT)

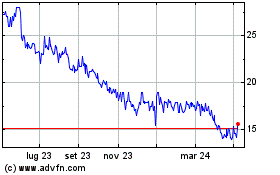

Grafico Azioni Brown (n) (LSE:BWNG)

Storico

Da Mar 2024 a Apr 2024

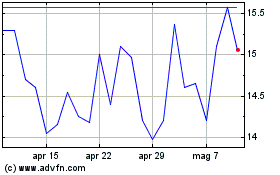

Grafico Azioni Brown (n) (LSE:BWNG)

Storico

Da Apr 2023 a Apr 2024