Canadian Dollar Falls After BoC Decision

30 Ottobre 2019 - 12:02PM

RTTF2

The Canadian dollar declined against its major counterparts in

the New York session on Thursday, after the Bank of Canada left its

key rate unchanged and downgraded its growth forecast for next two

years amid worsening global economic conditions.

The BoC kept its key rate unchanged at 1.75 percent, as

expected.

The bank said that economic growth is likely to slow in the

second half of this year, reflecting trade uncertainty, continuing

adjustment in the energy sector, and the unwinding of temporary

factors that boosted growth in the second quarter.

"In considering the appropriate path for monetary policy, the

Bank will be monitoring the extent to which the global slowdown

spreads beyond manufacturing and investment," according to the

accompanying statement.

The Bank said it expects the real GDP to grow by 1.5 percent for

this year, up from previous outlook of 1.5 percent.

For 2020 and 2021, the real GDP is seen at 1.7 percent and 1.8

percent, compared to earlier projections of 2 percent in both

years.

The loonie depreciated to near a 2-week low of 1.3154 against

the greenback, from a high of 1.3075 seen at 6:45 am ET. The loonie

is seen finding support around the 1.33 region.

Data from payroll processor ADP showed that U.S. private sector

employment increased slightly more than anticipated in October.

ADP said private sector employment climbed by 125,000 jobs in

October compared to economist estimates for an increase of about

120,000 jobs.

After rising to 1.4528 at 9:15 am ET, the loonie fell to a 9-day

low of 1.4616 against the euro. The next likely support for the

loonie is seen around the 1.49 region.

Data from the Federal Employment Agency showed that German

unemployment increased and the jobless rate remained unchanged in

October.

The number of unemployed increased by a seasonally adjusted

6,000 after falling 9,000 in September. Economists had forecast a

monthly rise of 3,000.

The loonie dipped to near a 3-week low of 0.9024 against the

aussie, pulling away from a high of 0.8967 it touched at 8:15 pm

ET. The loonie may possibly challenge support around the 0.92

level.

The loonie dropped to a weekly low of 82.81 the against yen,

following an uptick to 83.28 at 9:15 am ET. On the downside, 78.5

is possibly seen as the next support level for the loonie.

Data from the Ministry of Economy, Trade and Industry showed

that Japan retail sales climbed 9.1 percent on year in September -

exceeding expectations for an increase of 6.0 percent following the

1.8 percent gain in August.

On a seasonally adjusted monthly basis, retail sales spiked 7.1

percent - again topping expectations for 3.5 percent and up from

4.6 percent in the previous month.

Looking ahead, at 2:00 pm ET, the Fed announces its decision on

interest rates. Economists widely expect the Fed to cut federal

funds rate to between 1.50 percent and 1.75 percent.

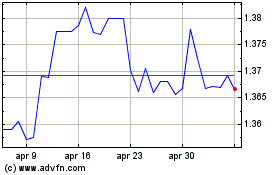

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Mar 2024 a Apr 2024

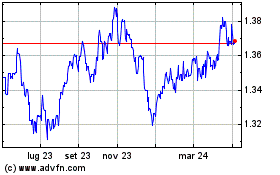

Grafico Cross US Dollar vs CAD (FX:USDCAD)

Da Apr 2023 a Apr 2024