Canadian Dollar Weakens On Falling Oil Prices

27 Dicembre 2021 - 4:58AM

RTTF2

The Canadian dollar declined against its most major counterparts

in the Asian session on Monday, as oil prices dropped following a

spike in Omicron cases across the globe, triggering worries about

more restrictions that could threaten the recovery in demand.

Despite indications that the Omicron variant is less severe than

the Delta strain, the number of cases would continue to surge due

to its high transmissibility, the U.S. chief medical adviser,

Anthony Fauci, said on Sunday.

Fauci warned about being optimistic regarding the severity of

the virus.

Data from Johns Hopkins University showed that new daily

infections averaged about 190,000 for the past seven days in the

United States.

In China, new daily cases rose to its highest level in 21

months, with infections more than doubling in the northwestern city

of Xian.

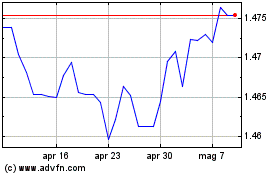

The loonie dropped to 1.2826 against the greenback and 1.4529

against the euro, off its early highs of 1.2803 and 1.4480,

respectively. The next possible support for the loonie is seen

around 1.30 against the greenback and 1.48 against the euro.

The loonie fell to 0.9274 against the aussie around 6:30 pm ET

and held steady thereafter. The pair had closed Friday's trading at

0.9258.

In contrast, the loonie rose against the yen, with the pair

worth 89.42. The loonie may locate resistance around the 92.00

level.

Grafico Cross Euro vs CAD (FX:EURCAD)

Da Mar 2024 a Apr 2024

Grafico Cross Euro vs CAD (FX:EURCAD)

Da Apr 2023 a Apr 2024