Capital One Beats 3Q Expectations

26 Ottobre 2021 - 10:55PM

Dow Jones News

By Robert Barba

Capital One Financial Corp. reported better-than-expected

results in the latest quarter as net interest income increased and

the company released some of the funds it had put away for

potential credit losses.

The financial services company reported total revenue for the

third quarter of $7.83 billion, compared with $7.38 billion a year

earlier. Analysts polled by FactSet expected revenue of $7.45

billion.

Net interest income was $6.16 billion, up roughly 11% from a

year earlier. Non-interest income was $1.67 billion, down roughly

8%. Analysts Pol

The quarter also benefited from a $342 million benefit related

to its credit reserves. A year earlier, the company provisioned

$331 million for credit losses.

At the end of the quarter, the company had an allowance for

credit losses of $11.57 billion, compared with $15.56 billion a

year earlier.

Total non-interest expense was $4.19 billion, up from $3.55

billion a year earlier, largely a result of rises in salary and

marketing spending.

Net income was $3.1 billion, compared with $2.4 billion a year

earlier. Earnings per share was $6.78, or $6.86 on an adjusted

basis.

Analysts were expecting adjusted earnings of $5.28 a share.

Write to Robert Barba at robert.barba@wsj.com

(END) Dow Jones Newswires

October 26, 2021 16:40 ET (20:40 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

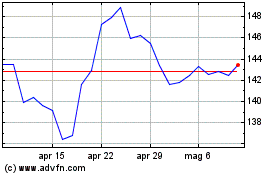

Grafico Azioni Capital One Financial (NYSE:COF)

Storico

Da Mar 2024 a Apr 2024

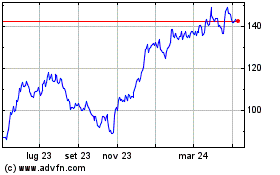

Grafico Azioni Capital One Financial (NYSE:COF)

Storico

Da Apr 2023 a Apr 2024