TIDMCCEP

RNS Number : 6951O

Coca-Cola European Partners plc

11 February 2021

COCA-COLA EUROPEAN PARTNERS

Preliminary Unaudited Results for the Full-Year Ended 31

December 2020

Resilient performance despite the challenging backdrop;

well-positioned for a digital & green led future

FY 2020 Metric ([1]) As Reported Comparable Change vs 2019

================================= ------------------------------------------

As Reported Comparable Comparable

Fx-Neutral

================================= ============= ============ =============

Volume (m unit cases)([2]) 2,277 2,277 (9.5)% (10.0)%

================================= ----------- ---------- -------- -------- -------------

Revenue (EURM) 10,606 10,606 (11.5)% (11.5)% (11.0)%

--------------------------------- ----------- ---------- -------- -------- ---------

Cost of sales (EURM) 6,871 6,809 (7.5)% (8.5)% (7.5)%

--------------------------------- ----------- ---------- -------- -------- ---------

Operating expenses (EURM) 2,922 2,603 (4.0)% (11.0)% (10.0)%

--------------------------------- ----------- ---------- -------- -------- ---------

Operating profit (EURM) 813 1,194 (47.5)% (29.0)% (28.5)%

--------------------------------- ----------- ---------- -------- -------- ---------

Profit after taxes (EURM) 498 821 (54.5)% (30.5)% (30.5)%

--------------------------------- ----------- ---------- -------- -------- ---------

Diluted EPS (EUR) 1.09 1.80 (53.0)% (29.0)% (28.5)%

--------------------------------- ----------- ---------- -------- -------- ---------

Revenue per unit case (EUR) 4.69 (1.5)%

--------------------------------- ----------- ---------- ------------- ------------ ---------

Cost of sales per unit case(EUR) 3.01 2.5%

--------------------------------- ----------- ---------- ------------- ------------ ---------

Free cash flow (EURM) 924

================================= =========== ========== ============= ============ =============

Capital Returns:

--------------------------------- ----------- ---------- ------------- ------------ -------------

Maintained dividend payout

Dividend per share([3]) (EUR) 0.85 ratio of c.50%

--------------------------------- ----------- ----------

2020 Share buyback (EURM) c.130

--------------------------------- ----------- ---------- ------------- ------------ -------------

DAMIAN GAMMELL, CHIEF EXECUTIVE OFFICER, SAID:

"2020 was a challenging year like no other, and I am very proud

of how well we have managed through such a rapidly changing

environment. That is down to the extraordinary work and commitment

of our colleagues, supporting each other as well as our customers

and communities, and to all of whom, I am sincerely grateful.

"The crisis also reinforced the power of our relationship with

The Coca-Cola Company and our other brand partners. Our collective

belief in continuing to invest in our core brands has served us

well, gaining share([4]) both in the home channel and online. We

also took meaningful actions to protect our performance, ending the

year with strong free cash flow([1]) and a solid balance sheet.

This enabled us to continue to return cash to shareholders, as

evidenced by the dividend paid in December.

"While our business continues to face significant restrictions,

which we confidently continue to navigate, the crisis has

strengthened our determination to move further and faster towards a

stronger and even more sustainable future. We protected the

short-term without compromising the longer-term by continuing to

invest, particularly in digital, sustainability and our portfolio.

These investments enabled us to provide exceptional service and

support for our customers and colleagues, to progress faster

towards our 2040 net zero carbon ambition and to seed future

revenue streams like Costa, Tropico and Topo Chico. We also

adjusted our cost base to a new reality with more to come.

"So, we are confident about the future, built upon three

pillars: great people, great service and great beverages. We are

making a difference and believe we have the right foundation,

alongside the exciting Coca-Cola Amatil acquisition, to drive

sustainable growth and deliver increased shareholder value."

___________________________

[1] Refer to 'Note Regarding the Presentation of Alternative

Performance Measures' for further details

[2] Unit Case = approximately 5.678 litres or 24 8-ounce

servings

[3] 25 October 2020 declared EUR0.85 dividend per share, paid 1

December 2020

[4] Source: NARTD (non-alcoholic ready to drink) Nielsen Global

Track Data for ES, PT, DE, GB, FR, BE, NL, SE, NO to YE

27.12.20

FULL-YEAR & Q4 2020 HIGHLIGHTS([1])

FY Revenue (-11.0%) ([2])

-- FY NARTD value share gains across measured channels both in

store([3]) (+40pts) & online([3]) (+140pts)

-- Comparable volume -10.0%([4]) driven by the impact of the

COVID-19 pandemic & some customer disruption as a result of our

planned pricing strategy (resolved in August) partially offset by

growth in Monster & Coca-Cola Zero Sugar

Adverse away from home (AFH) volumes (-27.5%) reflecting outlet

closures & restrictive measures, partially offset by growth in

the home channel (+1.5%) supported by growth in online grocery([5])

(+44%)

Immediate consumption (IC) volumes (-24.5%) significantly

impacted in both AFH & home channels reflecting lower consumer

mobility. Future consumption (FC) volumes outperformed (-2.0%)

-- Revenue per unit case -1.5% ([2]) with positive momentum in

Q1 (+1.5%) & Q3 (+1.0%) offset by Q2 (-5.0%) & Q4 (-3.5%)

reflecting the varying extent of restrictions during the year

Q4 Revenue ( -10.5%) ([2])

-- Comparable volume -9.5% driven by continued impact of the

COVID-19 pandemic across our markets reflecting renewed restrictive

measures

Decline in AFH volumes (-32.0%) reflecting the increase of

restrictive measures & outlet closures

Robust home channel volumes (+4.0%) driven by solid Christmas

execution & the outperformance of FC packs, partially offset by

weaker IC trends

Broadly similar volumes across Q4 however weaker volumes in

January 2021 reflecting even tougher restrictions

-- Reported volumes -7.0% reflecting the benefit of two

additional selling days when compared to the prior year

-- Revenue per unit case -3.5% ([2]) reflecting negative geographic, channel & pack mix

Comparable Operating Profit -28.5% ([2]) (Reported Operating

Profit -47.5%)

-- Cost of sales per unit case + 2.5% ([2]) reflects the

under-recovery of fixed manufacturing costs given lower volumes

& adverse mix, offset by the decline in revenue per unit case

driving lower concentrate costs

-- Comparable operating profit of EUR1,194m, -28.5%([2])

reflecting revenue declines offset by a reduction in discretionary

operating expenses of c.EUR260m (ahead of guidance of

EUR200-250m)

-- Comparable diluted EPS of EUR1.80 -28.5% (reported -53.0%)

Capital Returns

-- Dividends: full-year dividend of EUR0.85 per share (announced

at Q3), maintaining annualised dividend payout ratio of

approximately 50%, in line with our policy

-- Share buyback: repurchased c.EUR130m (3m shares) prior to suspension of programme in March

Other

-- Generated strong free cash flow of EUR924m (net cashflows

from operating activities of EUR1,490m)

-- ROIC 7.6% (2019: 10.3%) driven by the decline in profit

-- CCEP Ventures continued to bring new innovative solutions

into the business with 5 new investment partnerships in early stage

e-commerce, packaging free & recycling technology

businesses

-- Unable to provide FY21 outlook guidance given on-going COVID-19 uncertainty

Sustainability

-- Announced ambition to reach net zero greenhouse gas (GHG)

emissions across our entire value chain by 2040, and to reduce our

absolute GHG emissions by 30% by 2030 (vs 2019)

-- Closed 2020 at c.41 %([6]) recycled plastic (rPET); targeting 50% rPET by 2023

Sweden became first 100% rPET market in the Coke system. Norway,

the Netherlands & Iceland to transition full portfolio to 100%

rPET in 2021

-- Retained:

on Carbon Disclosures Project's A List for climate change &

water security

in Dow Jones Sustainability Indices (Europe & World)

AAA MSCI ESG rating

[1] Refer to 'Note Regarding the Presentation of Alternative

Performance Measures' for further details; Change percentages

against prior year equivalent period; [2] Comparable and

Fx-Neutral; [3] Instore: NARTD (non-alcoholic ready to drink)

Nielsen Global Track Data for ES, PT, DE, GB, FR, BE, NL, SE, NO to

YE 27.12.20; Online: Data to w/e GB 26.12.20 (Retailer EPOS), ES FR

& NL 27.12.20 (Nielsen); [4] Adjusted for 1 extra selling day

in 2020. Reported volumes (9.5)%; [5] Source: Nielsen Top 4 markets

(GB FR NL ES) to YE 27.12.20 changes; [6] Unaudited. Provisional.

Note: Changes versus equivalent 2019 period

COVID-19 FY20 UPDATE: Respond, recover & build for future led by green

& digital

Our rapid response prioritised our people, customers &

communities whilst protecting our business for the long-term &

building for the future.

Key highlights as follows:

People:

-- Implemented comprehensive measures in line with government guidance

-- Advanced digital workplace capabilities

-- Increased internal communications with colleagues

-- Provided extensive emotional & mental well-being support

-- Maintained high colleague engagement & progressed on inclusion & diversity

Communities:

-- Donated over 600,000 unit cases of product

-- Partnered with The Coca-Cola Company to provide substantial

financial aid through the Red Cross & other local NGOs

Business continuity:

-- Leveraged strong relationships with brand partners & jointly invested behind core brands

-- Optimised pack price architecture

-- Maintained great customer service levels

-- Reallocated resource to capture revenue opportunities

-- Leveraged our digital capabilities

Balance sheet & cost mitigation:

-- Delivered discretionary opex savings of c.EUR260m, ahead of

targeted EUR200-250m, & launch of Accelerate Competitiveness

efficiency programme (see Supplemental Financial Information - Cost

of Sales and Operating Expenses)

FY21 opex savings of c.EUR150m vs. FY19 (combination of

permanent discretionary savings from 2020 & new Accelerate

Competitiveness savings); FY21 opex expected to be lower than

FY19

-- Reduced Capex([1]) spend by around a third to c.EUR360m

-- Suspension of share buyback programme

-- Maintained solid balance sheet & strong free cash flow

generation (net debt/adjusted EBITDA of 3.2 times([2]) )

-- Maintained strong investment grade debt rating (Moody's

A3/P2; S&P BBB+/A2)([3]) with no covenants on our debt or

facilities

Acquisition of Coca-Cola Amatil Limited (CCL)

-- Entered into binding agreement to acquire CCL on 3 November 2020

-- Received Australian Foreign Investment Review Board regulatory approval 29 January 2021

-- The Scheme remains subject to other customary conditions,

including CCL independent shareholder approval, court approval

& the New Zealand Overseas Investment Office regulatory

approval

-- Further updates will be provided in due course ([4])

__________________________

[1] Excludes payments of principal on lease obligations; Refer

to 'Note Regarding the Presentation of Alternative Performance

Measures' for further details. Change vs initial FY20 guidance

announced 13 February 2020; [2] As at 31 December 2020. Refer to

'Note Regarding the Presentation of Alternative Performance

Measures' for further details; [3] Moody's on review for downgrade;

S&P on CreditWatch negative reflecting proposed acquisition of

Coca-Cola Amatil; [4] CCEP has not yet made an election as to how

they will purchase the remaining 20% of The Coca-Cola Company's

shares, but have agreed with The Coca-Cola Company that they will

make this election no later than 14 days before the Scheme vote

FULL-YEAR & FOURTH-QUARTER REVENUE PERFORMANCE BY GEOGRAPHY

All values are unaudited, changes versus 2019

As reported Fx-Neutral

Full-Year EUR million % of Total % change % change

=================================== =========== ============ ========== ============

Great Britain 2,203 21.0% (8.5)% (7.5)%

----------------------------------- ----------- -------- ------ --------

France (France & Monaco) 1,709 16.0% (10.0)% (10.0)%

----------------------------------- ----------- -------- ------ --------

Germany 2,270 21.5% (6.5)% (6.5)%

----------------------------------- ----------- -------- ------ --------

Iberia (Spain, Portugal & Andorra) 2,173 20.5% (22.0)% (22.0)%

----------------------------------- ----------- -------- ------ --------

Northern Europe([1]) 2,251 21.0% (9.5)% (8.0)%

----------------------------------- ----------- -------- ------ --------

Total 10,606 100.0% (11.5)% (11.0)%

As reported Fx-Neutral

Q4 EUR million % of Total % change % change

=================================== =========== ============ ========== ============

Great Britain 565 22.0% (11.0)% (6.5)%

----------------------------------- ----------- -------- ------ --------

France (France & Monaco) 401 15.5% (12.5)% (12.5)%

----------------------------------- ----------- -------- ------ --------

Germany 586 22.5% (4.0)% (4.0)%

----------------------------------- ----------- -------- ------ --------

Iberia (Spain, Portugal & Andorra) 517 20.0% (17.0)% (17.0)%

----------------------------------- ----------- -------- ------ --------

Northern Europe([1]) 521 20.0% (13.5)% (12.5)%

----------------------------------- ----------- -------- ------ --------

Total 2,590 100.0% (11.5)% (10.5)%

___________________________

([1]) Belgium, Luxembourg, Netherlands, Norway, Sweden &

Iceland

Great Britain

-- FY & Q4 volume impacted by restrictive measures &

outlet closures. Weakness in AFH channel partially offset by home

channel volume growth, both online & in store. Coca-Cola Zero

Sugar, Monster & Schweppes mixers all grew in Q4

-- FY revenue/UC([1]) negatively impacted by the outperformance

of the home channel & in particular the growth in FC packs

(e.g. large PET +5.0% & multipack cans +23.0%), alongside IC

weakness in both channels

France (France & Monaco)

-- FY & Q4 volume mainly impacted by AFH outlet closures

& hypermarket weakness reflecting lower footfall given

restrictions. FY volume benefited from a solid Q3 when AFH outlets

reopened & consumer mobility increased, aided by favourable

weather. Coca-Cola Zero Sugar, Monster & Capri-Sun all

outperformed in Q4

-- FY revenue/UC([1]) negatively impacted by channel mix given

AFH outlet closures & pack mix due to the weakness in IC,

partially offset by lower promotions

Germany

-- FY & Q4 volume impacted by AFH outlet closures, partially

offset by the additional border trade business. Coca-Cola Zero

Sugar & Monster outperformed, while Vio & Apollinaris

underperformed given the brands' exposure to AFH & IC

-- FY revenue/UC([1]) driven by the growth in cans due to the

additional border trade business, increased promotional efficiency

in the home channel & favourable brand mix. This was partially

offset by adverse channel mix & pack mix given the

outperformance of FC packs

Iberia (Spain, Portugal & Andorra)

-- FY & Q4 volume impacted by significant exposure to the

AFH channel & weaker tourism trends, particularly in Spain

where we over-index in exposure to HoReCa([2]) . The home channel

also suffered, partly due to weakness in the cash & carry

channel([3])

-- FY revenue/UC([1]) significantly impacted by channel mix

given the closure of HoReCa([2]) outlets in addition to negative

pack mix (e.g. glass -48.0%)

Northern Europe

-- FY & Q4 impacted by negative AFH volumes reflecting

outlet clos ures partially offset by growth in the home channel led

by Norway & the Netherlands. Coca-Cola Zero Sugar, Monster

& Nalu all grew volumes during Q4

-- FY revenue/UC([1]) grew modestly due to positive country

& brand mix, offset by adverse channel mix

___________________________

[1] Revenue per unit case

[2] HoReCa = Hotels, Restaurants & Cafes

[3] Cash & Carry included in home channel for Iberia (12.5%

of 2019 Iberia volume), elsewhere included in AFH channel

Note: All values are unaudited, changes versus equivalent 2019

period; comparable volumes

FULL-YEAR & FOURTH-QUARTER VOLUME PERFORMANCE([1]) BY CATEGORY

Comparable volumes, changes versus 2019

Q4 YTD

% of Total % Change % of Total % Change

========================================= ============ ========== ============ ==========

Sparkling 90.5% (7.0)% 88.5% (7.0)%

Coca-Cola(TM) 67.5% (7.0)% 66.0% (6.5)%

Flavours, Mixers & Energy 23.0% (7.0)% 22.5% (9.0)%

Stills 9.5% (29.0)% 11.5% (27.0)%

Hydration 5.0% (38.0)% 6.5% (34.0)%

RTD Tea, RTD Coffee, Juices & Other([2]) 4.5% (15.5)% 5.0% (17.0)%

Total 100.0% (9.5)% 100.0% (10.0)%

SPARKLING

Coca-Cola(TM)

-- Q4 transactions -10.0%([3]) , reflecting decline in small

glass & PET, partially offset by growth in cans

-- Q4 Classic -10.0%; Lights -2.0%, Diet/light taste decline

(-10.5%) offset by resilient performance of Coca-Cola Zero Sugar

(+1.5%)

-- Coca-Cola Zero Sugar: FY20 #1 brand in NARTD for absolute

value growth across our markets([4])

Flavours, Mixers & Energy

-- Q4 Fanta -12.0% driven by the impact of COVID-19 on AFH

-- Q4 Energy +27.5% reflecting growth in both channels &

driven by Monster. Strong growth in Monster multipacks (+54.0%)

-- Q4 Schweppes mixers +1.0% in GB reflecting growth in the home

channel given switching of AFH occasions. Schweppes mixers gained

FY value share in GB([5])

STILLS

Hydration

-- Continued soft performance in Q4 reflecting on-going impact of COVID-19 & exposure to IC

RTD Tea, RTD Coffee, Juices & Other([2])

-- Q4 Fuze Tea -14.5% reflecting soft IC performance due to reduced on-the-go consumption

-- Q4 Juice drinks -13.0% reflecting exposure to o n-the-go

occasions, offset by solid growth in Capri-Sun in GB &

France

-- Launched Topo Chico Hard Seltzer in three flavours in GB

& NL in December. Will launch across other markets in 2021

___________________________

[1] Adjusted for selling day shifts

[2] RTD refers to Ready To Drink

[3] Defined as the serving container that is ultimately used

directly by the consumer. It can be a standalone container or one

part of a multipack

[4] Nielsen Strategic Planner FY20 Data to YE 27.12.2020.

Countries included are ES, PT, DE, GB, FR, BE, NL, SE & NO

[5] Nielsen Global Track Data for GB to YE 27.12.2020

Note: All values are unaudited, changes versus equivalent 2019

period; comparable volumes

Conference Call

-- 11 February 2021 at 12:00 GMT, 13:00 CET and 7:00 a.m. EST;

accessible via www.cocacolaep.com

-- Replay & transcript will be available at www.cocacolaep.com as soon as possible

Financial Calendar

-- Financial calendar available here: https://ir.cocacolaep.com/financial-calendar/

Results & Presentations

-- Previous results & presentations available here:

https://ir.cocacolaep.com/financial-reports-and-results/financial-releases/default.aspx

Contacts

Investor Relations

Sarah Willett Claire Michael Joe Collins

+44 7970 145 218 +44 7528 251 033 +44 7583 903 560

Media Relations

Shanna Wendt Nick Carter

+44 7976 595 168 +44 7976 595 275

About CCEP

Coca-Cola European Partners plc is a leading consumer goods

company in Western Europe, making, selling & distributing an

extensive range of non-alcoholic ready to drink beverages & is

the world's largest Coca-Cola bottler based on revenue.

Coca-Cola European Partners serves a consumer population of over

300 million across Western Europe, including Andorra, Belgium,

continental France, Germany, Great Britain, Iceland, Luxembourg,

Monaco, the Netherlands, Norway, Portugal, Spain & Sweden. The

Company is listed on Euronext Amsterdam, the New York Stock

Exchange, London Stock Exchange & on the Spanish Stock

Exchanges, trading under the symbol CCEP.

For more information about CCEP, please visit www.cocacolaep.com

& follow CCEP on Twitter at @CocaColaEP.

Forward-Looking Statements

This document contains statements, estimates or projections that

constitute "forward-looking statements" concerning the financial

condition, performance, results, strategy and objectives of

Coca-Cola European Partners plc and its subsidiaries (together

"CCEP"). CCEP's proposed acquisition (the "Acquisition") of

Coca-Cola Amatil Limited and its subsidiaries (together "CCL") and

the integration of CCL into CCEP. Generally, the words "believe,"

"expect," "intend," "estimate," "anticipate," "project," "plan,"

"seek," "may," "could," "would," "should," "might," "will,"

"forecast," "outlook," "guidance," "possible," "potential,"

"predict," "objective" and similar expressions identify

forward-looking statements, which generally are not historical in

nature.

Forward-looking statements are subject to certain risks that

could cause actual results to differ materially from CCEP's and

CCL's historical experience and present expectations or

projections, including with respect to the Acquisition. As a

result, undue reliance should not be placed on forward-looking

statements, which speak only as of the date on which they are made.

These risks include but are not limited to:

1. those set forth in the "Risk Factors" section of CCEP's 2019

Integrated Report / Annual Report on Form 20-F, including the

statements under the following headings: Packaging (such as,

refillables and recycled plastic); Perceived health impacts of our

beverages and ingredients, and changing consumer preferences (such

as sugar alternatives and other ingredients); Legal, regulatory and

tax change (such as the development of regulations regarding

packaging, taxes and deposit return schemes); Market (such as

disruption due to customer negotiations, customer consolidation and

route to market); Cyber and social engineering attacks;

Competitiveness and transformation; Climate change and water (such

as net zero emission legislation and regulation, and resource

scarcity); Economic and political conditions (such as the UK's exit

from the EU, the EU-UK trade and co-operation agreement, and

uncertainty about the future relationship between the UK and EU);

The relationship with The Coca-Cola Company and other franchisors;

Product quality; and Other risks, such as widespread outbreaks of

infectious disease including the adverse impact that the COVID-19

pandemic and related government restrictions and social distancing

measures implemented in many of our markets, and any associated

economic downturn, may have on our financial results, operations,

workforce and demand for our products;

2. those set forth in the "Principal Risks" section of CCEP's

2019 Integrated Report / Annual Report on Form 20-F, as updated in

CCEP's Results for the six months ended 26 June 2020 & COVID-19

update and including principal risks under the additional headings:

Business continuity (such as government restrictions in our

countries of operation); People; and Stakeholders; and

3. risks and uncertainties relating to the Acquisition,

including the risk that the businesses will not be integrated

successfully or such integration may be more difficult,

time-consuming or costly than expected, which could result in

additional demands on CCEP's resources, systems, procedures and

controls, disruption of its ongoing business and diversion of

management's attention from other business concerns; the

possibility that certain assumptions with respect to CCL or the

Acquisition could prove to be inaccurate; the failure to receive,

delays in the receipt of, or unacceptable or burdensome conditions

imposed in connection with, all required regulatory approvals,

shareholder approvals and the satisfaction of closing conditions to

the Acquisition; ability to raise financing; the possibility that

CCEP and CCL fail to agree upon a scheme implementation agreement;

the potential that the Acquisition may involve unexpected

liabilities for which there is no indemnity; the potential failure

to retain key employees of CCEP and CCL as a result of the proposed

Acquisition or during integration of the businesses and disruptions

resulting from the proposed Acquisition, making it more difficult

to maintain business relationships; the potential if the

Acquisition is not completed in a timely manner or at all for (i)

negative reaction from financial markets, customers, regulators,

employees and other stakeholders, (ii) loss of time spent on an

unsuccessful Acquisition, and (iii) litigation related to the

Acquisition.

The full extent to which the COVID-19 pandemic will negatively

affect CCEP and/or CCL and the results of their operations,

financial condition and cash flows will depend on future

developments that are highly uncertain and cannot be predicted,

including the scope and duration of the pandemic and actions taken

by governmental authorities and other third parties in response to

the pandemic.

Due to these risks, CCEP's actual future results, dividend

payments, and capital and leverage ratios may differ materially

from the plans, goals, expectations and guidance set out in

forward-looking statements (including those issued by CCL prior to

the Acquisition). These risks may also adversely affect CCEP's

share price. Additional risks that may impact CCEP's future

financial condition and performance are identified in filings with

the United States Securities and Exchange Commission ("SEC") which

are available on the SEC's website at www.sec.gov. CCEP does not

undertake any obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events, or otherwise, except as required under applicable

rules, laws and regulations. Furthermore, CCEP assumes no

responsibility for the accuracy and completeness of any

forward-looking statements. Any or all of the forward-looking

statements contained in this filing and in any other of CCEP's

public statements (whether prior or subsequent to the Acquisition)

may prove to be incorrect.

Note Regarding the Presentation of Alternative Performance Measures

We use certain alternative performance measures (non-GAAP

performance measures) to make financial, operating and planning

decisions and to evaluate and report performance. We believe these

measures provide useful information to investors and as such, where

clearly identified, we have included certain alternative

performance measures in this document to allow investors to better

analyse our business performance and allow for greater

comparability. To do so, we have excluded items affecting the

comparability of period-over-period financial performance as

described below. The alternative performance measures included

herein should be read in conjunction with and do not replace the

directly reconcilable GAAP measure.

For purposes of this document, the following terms are

defined:

"As reported" are results extracted from our consolidated

financial statements.

"Comparable" is defined as results excluding items impacting

comparability, such as restructuring charges, out of period

mark-to-market impact of hedges and net tax items relating to rate

and law changes. Comparable volume is also adjusted for selling

days.

"Fx-neutral" is defined as comparable results excluding the

impact of foreign exchange rate changes. Foreign exchange impact is

calculated by recasting current year results at prior year exchange

rates.

"Capex" or "Capital expenditures" is defined as purchases of

property, plant and equipment and capitalised software, plus

payments of principal on lease obligations, less proceeds from

disposals of property, plant and equipment. Capex is used as a

measure to ensure that cash spending on capital investment is in

line with the Group's overall strategy for the use of cash.

"Free cash flow" is defined as net cash flows from operating

activities less capital expenditures (as defined above) and

interest paid. Free cash flow is used as a measure of the Group's

cash generation from operating activities, taking into account

investments in property, plant and equipment and non-discretionary

lease and interest payments. Free cash flow is not intended to

represent residual cash flow available for discretionary

expenditures.

"Adjusted EBITDA" is calculated as Earnings Before Interest,

Tax, Depreciation and Amortisation (EBITDA), after adding back

items impacting the comparability of year over year financial

performance. Adjusted EBITDA does not reflect cash expenditures, or

future requirements for capital expenditures or contractual

commitments. Further, adjusted EBITDA does not reflect changes in,

or cash requirements for, working capital needs, and although

depreciation and amortisation are non-cash charges, the assets

being depreciated and amortised are likely to be replaced in the

future and adjusted EBITDA does not reflect cash requirements for

such replacements.

"Net Debt" is defined as the net of cash and cash equivalents

less currency adjusted borrowing. We believe that reporting net

debt is useful as it reflects a metric used by the Group to assess

cash management and leverage. In addition, the ratio of net debt to

adjusted EBITDA is used by investors, analysts and credit rating

agencies to analyse our operating performance in the context of

targeted financial leverage.

"ROIC" is defined as comparable operating profit after tax

divided by the average of opening and closing invested capital for

the year. Invested capital is calculated as the addition of

borrowings and equity less cash and cash equivalents. ROIC is used

as a measure of capital efficiency and reflects how well the Group

generates comparable operating profit relative to the capital

invested in the business.

"Dividend Payout Ratio" is defined as dividends as a proportion

of comparable profit after tax.

Additionally, within this document, we provide certain

forward-looking non-GAAP financial Information, which management

uses for planning and measuring performance. We are not able to

reconcile forward-looking non-GAAP measures to reported measures

without unreasonable efforts because it is not possible to predict

with a reasonable degree of certainty the actual impact or exact

timing of items that may impact comparability throughout year.

Unless otherwise stated, percent amounts are rounded to the

nearest 0.5%.

Supplementary Financial Information - Income Statement

The following provides a summary reconciliation of CCEP's

reported and comparable results for the periods presented:

As Reported Items Impacting Comparability Comparable

----------- ---------------------------------------------------------- ------------

Full year 2020 CCEP Mark-to-market Restructuring Acquisition Net tax([4]) CCEP

Unaudited, in effects([1]) Charges([2]) Related

millions Costs([3])

of EUR except per

share

data which is

calculated

prior to rounding

=========== ================ ============= =========== ============ ============

Revenue 10,606 - - - - 10,606

Cost of sales 6,871 - (62) - - 6,809

----------------- ----------- ---------------- ------------- ----------- ------------ ----------

Gross profit 3,735 - 62 - - 3,797

Operating

expenses 2,922 (2) (306) (11) - 2,603

----------------- ----------- ---------------- ------------- ----------- ------------ ----------

Operating profit 813 2 368 11 - 1,194

Total finance

costs,

net 111 - - (3) - 108

Non-operating

items 7 - - - - 7

----------------- ----------- ---------------- ------------- ----------- ------------ ----------

Profit before

taxes 695 2 368 14 - 1,079

Taxes 197 - 103 3 (45) 258

----------------- ----------- ---------------- ------------- ----------- ------------ ----------

Profit after

taxes 498 2 265 11 45 821

Diluted earnings

per

share (EUR) 1.09 - 0.58 0.03 0.10 1.80

----------------- ----------- ---------------- ------------- ----------- ------------ ----------

Diluted weighted average shares outstanding 456

As Reported Items Impacting Comparability Comparable

=========================== ----------- ------------------------------------------------ ------------

Full year 2019 CCEP Mark-to-market Restructuring Net tax([4]) CCEP

Unaudited, in millions effects([1]) Charges([2])

of EUR except per share

data which is calculated

prior to rounding

=========================== =========== =================== ============= ============ ============

Revenue 12,017 - - - 12,017

Cost of sales 7,424 (1) - - 7,423

--------------------------- ----------- ------------------- ------------- ------------ ----------

Gross profit 4,593 1 - - 4,594

Operating expenses 3,045 3 (130) - 2,918

--------------------------- ----------- ------------------- ------------- ------------ ----------

Operating profit 1,548 (2) 130 - 1,676

Total finance costs, net 96 - - - 96

Non-operating items (2) - - - (2)

--------------------------- ----------- ------------------- ------------- ------------ ----------

Profit before taxes 1,454 (2) 130 - 1,582

Taxes 364 (1) 36 (2) 397

--------------------------- ----------- ------------------- ------------- ------------ ----------

Profit after taxes 1,090 (1) 94 2 1,185

--------------------------- ----------- ------------------- ------------- ------------ ----------

Diluted earnings per share

(EUR) 2.32 - 0.21 - 2.53

--------------------------- ----------- ------------------- ------------- ------------ ----------

Diluted weighted average shares outstanding 469

___________________________

([1]) Amounts represent the net out-of-period mark-to-market

impact of non-designated commodity hedges.

([2]) During the full-year 2020, we recognised restructuring

charges totalling EUR368million, which include EUR202 million

related to Accelerate Competitiveness proposals announced in

October 2020. These proposals are aimed at reshaping CCEP using

technology enabled solutions to improve productivity and include

the closure of certain production sites in Germany and Iberia .

([3]) Amounts represent costs associated with the proposed

acquisition of Coca-Cola Amatil Limited.

([4]) Amounts include the deferred tax impact related to income

tax rate and law changes.

Supplemental Financial Information - Revenue

Fourth Quarter Ended Year Ended

------------------------------------ ------------------------------------

Revenue 31 December 31 December % Change 31 December 31 December % Change

In millions of 2020 2019 2020 2019

EUR, except per

case data which

is calculated

prior to rounding.

FX impact calculated

by recasting current

year results at

prior year rates.

=========== =========== ========== =========== =========== ==========

As reported 2,590 2,933 (11.5)% 10,606 12,017 (11.5)%

Adjust: Total

items impacting

comparability - - -% - - -%

Comparable 2,590 2,933 (11.5)% 10,606 12,017 (11.5)%

Adjust: Impact

of fx changes 36 n/a (1.0)% 75 n/a (0.5)%

Comparable & fx-neutral 2,626 2,933 (10.5)% 10,681 12,017 (11.0)%

Revenue per unit

case 4.59 4.76 (3.5)% 4.69 4.77 (1.5)%

Fourth Quarter Ended 31 December

2020 Year Ended 31 December 2020

----------------------------------------- --------------------------------------

Revenue by Geography As reported Reported Fx-Neutral As reported Reported Fx-Neutral

In millions of % change % change % change % change

EUR

Iberia ([1]) 517 (17.0)% (17.0)% 2,173 (22.0)% (22.0)%

---------------------- -------------- ------- -------- ----------- ------- --------

Germany 586 (4.0)% (4.0)% 2,270 (6.5)% (6.5)%

---------------------- -------------- ------- -------- ----------- ------- --------

Great Britain 565 (11.0)% (6.5)% 2,203 (8.5)% (7.5)%

---------------------- -------------- ------- -------- ----------- ------- --------

France ([2]) 401 (12.5)% (12.5)% 1,709 (10.0)% (10.0)%

---------------------- -------------- ------- -------- ----------- -------

Belgium/Luxembourg 892 (11.0)%

---------------------- -------------- ----------- ------------ ----------- ------- ------------

Netherlands 529 (12.0)%

---------------------- -------------- ----------- ------------ ----------- ------- ------------

Norway 423 (3.0)%

---------------------- -------------- ----------- ------------ ----------- ------- ------------

Sweden 337 (8.0)%

---------------------- -------------- ----------- ------------ ----------- ------- ------------

Iceland 70 (17.5)%

---------------------- -------------- ----------- ------------ ----------- ------- ------------

Northern Europe 521 (13.5)% (12.5)% 2,251 (9.5)% (8.0)%

---------------------- -------------- ------- -------- ----------- ------- --------

Total 2,590 (11.5)% (10.5)% 10,606 (11.5)% (11.0)%

___________________________

([1]) Iberia refers to Spain, Portugal & Andorra.

([2]) France refers to continental France & Monaco.

Fourth Quarter Ended Year Ended

------------------------------------ ------------------------------------

Comparable Volume 31 December 31 December % Change 31 December 31 December % Change

- Selling Day 2020 2019 2020 2019

Shift

In millions of

unit cases, prior

period volume

recast using current

year selling days

=========== =========== ========== =========== =========== ==========

Volume 572 616 (7.0)% 2,277 2,521 (9.5)%

Impact of selling

day shift n/a 16 n/a n/a 8 n/a

Comparable volume

- Selling Day

Shift adjusted 572 632 (9.5)% 2,277 2,529 (10.0)%

Fourth Quarter Ended Year Ended

---------------------------------------- ----------------------------------------

31 December 31 December Volume % 31 December 31 December % Change

2020 2019 Change 2020 2019

Comparable Volume % of Total % of Total % of Total % of Total

by Brand Category

Adjusted for selling

day shift

============= ============= ============= =============

Sparkling 90.5% 88.0% (7.0)% 88.5% 86.0% (7.0)%

Coca-Cola(TM) 67.5% 65.5% (7.0)% 66.0% 63.5% (6.5)%

Flavours, Mixers

& Energy 23.0% 22.5% (7.0)% 22.5% 22.5% (9.0)%

Stills 9.5% 12.0% (29.0)% 11.5% 14.0% (27.0)%

Hydration 5.0% 7.0% (38.0)% 6.5% 8.5% (34.0)%

RTD Tea, RTD Coffee,

Juices & Other

([1]) 4.5% 5.0% (15.5)% 5.0% 5.5% (17.0)%

Total 100.0% 100.0% (9.5)% 100.0% 100.0% (10.0)%

___________________________

([1]) RTD refers to Ready To Drink.

Supplemental Financial Information - Cost of Sales and Operating

Expenses

Cost of Sales

Year Ended

------------------------------------

Cost of Sales 31 December 31 December % Change

In millions of EUR, except per case data 2020 2019

which is calculated prior to rounding.

FX impact calculated by recasting current

year results at prior year rates.

=========== =========== ==========

As reported 6,871 7,424 (7.5)%

Adjust: Total items impacting comparability (62) (1) (1.0)%

Comparable 6,809 7,423 (8.5)%

Adjust: Impact of fx changes 54 n/a (1.0)%

Comparable & fx-neutral 6,863 7,423 (7.5)%

Cost of sales per unit case 3.01 2.94 2.5%

Reported cost of sales were EUR6,871 million, down 7.5 percent.

Comparable cost of sales were EUR6,809 million, down 8.5 percent on

a comparable basis and 7.5 percent on a comparable and fx-neutral

basis. Cost of sales per unit case increased by 2.5 percent on a

comparable and fx-neutral basis. This reflects the impact of the

under-recovery of fixed manufacturing costs given lower volumes

& adverse mix, offset by the decline in revenue per unit case

driving lower concentrate costs.

Operating Expenses

Year Ended

------------------------------------

Operating Expenses 31 December 31 December % Change

In millions of EUR. FX impact calculated 2020 2019

by recasting current year results at prior

year rates.

=========== =========== ==========

As reported 2,922 3,045 (4.0)%

Adjust: Total items impacting comparability (319) (127) (7.0)%

Comparable 2,603 2,918 (11.0)%

Adjust: Impact of fx changes 16 n/a (1.0)%

Comparable & fx-neutral 2,619 2,918 (10.0)%

Reported operating expenses were EUR2,922 million, down 4.0

percent. Comparable operating expenses were EUR2,603 million, down

11.0 percent on a comparable basis and 10.0 percent on a comparable

and fx-neutral basis. Lower volumes resulted in a reduction of

variable expenses, such as distribution costs. Operating expenses

also benefited from a reduction in discretionary spend, partially

offset by our continued investments for the future in areas such as

our digital capabilities.

During the full-year 2020, we recognised restructuring charges

totalling EUR368million, which include EUR202 million related to

Accelerate Competitiveness proposals announced in October 2020.

These proposals are aimed at reshaping CCEP using technology

enabled solutions to improve productivity and include the closure

of certain production sites in Germany and Iberia.

Effective Tax Rate

The effective tax rate was 28 percent and 25 percent for the

years ended 31 December 2020 and 31 December 2019,

respectively.

The increase in effective tax rate to 28 percent from 2019 is

largely due to the remeasurement of deferred tax positions

following tax rate changes in United Kingdom and the Netherlands,

offset by changes in profit mix and the impact of lower corporate

income tax rates in France and Belgium.

The comparable effective tax rate was 24 percent and 25 percent

for the years ended 31 December 2020 and 31 December 2019,

respectively.

Supplemental Financial Information - Free Cash Flow

Year Ended

================================================= --------------------------

Free Cash Flow 31 December 31 December

In millions of EUR 2020 2019

================================================= =========== =============

Net cash flows from operating activities 1,490 1,904

Less: Purchases of property, plant and equipment (348) (506)

Less: Purchases of capitalised software (60) (96)

Less: Interest paid, net (91) (86)

Add: Proceeds from sales of property, plant and

equipment 49 11

Less: Payments of principal on lease obligations (116) (128)

Free Cash Flow 924 1,099

Supplemental Financial Information - Borrowings

As at

------------------------

31 December 31 December Credit Ratings Moody's Standard

Net Debt 2020 2019 As of 11 February & Poor's

In millions of EUR 2021

=========== =========== ============== ==============

Long-term

Total borrowings 7,187 6,421 rating A3 BBB+

Add: fx impact of On review On CreditWatch

non-EUR borrowings 36 6 Outlook for downgrade negative

Note: Rating outlooks were updated

to reflect proposed acquisition

of Coca-Cola Amatil Limited.

Our credit ratings can be materially

influenced by a number of factors

including, but not limited to,

acquisitions, investment decisions

and working capital management

activities of TCCC and/or changes

in the credit rating of TCCC.

A credit rating is not a recommendation

to buy, sell or hold securities

and may be subject to revision

Adjusted total borrowings 7,223 6,427 or withdrawal at any time.

Less: cash and cash

equivalents (1,523) (316)

Net debt 5,700 6,111

Supplemental Financial Information - Adjusted EBITDA

Year Ended

============================== --------------------------

Adjusted EBITDA 31 December 31 December

In millions of EUR 2020 2019

============================== =========== =============

Reported profit after tax 498 1,090

Taxes 197 364

Finance costs, net 111 96

Non-operating items 7 (2)

Reported operating profit 813 1,548

Depreciation and amortisation 727 639

Reported EBITDA 1,540 2,187

Items impacting comparability

Mark-to-market effects([1]) 2 (2)

Restructuring charges([2]) 247 92

Adjusted EBITDA 1,789 2,277

Net Debt to EBITDA 3.70 2.79

Net Debt to Adjusted EBITDA 3.19 2.68

______________________

([1]) Amounts represent the net out-of-period mark-to-market

impact of non-designated commodity hedges.

([2]) Amounts represent restructuring charges related to

business transformation activities, excluding accelerated

depreciation included in the depreciation and amortisation

line.

Supplemental Financial Information - Return on invested capital

Year Ended

================================================== ----------------------------

ROIC 31 December 31 December

In millions of EUR 2020 2019

================================================== ============= =============

Comparable operating profit([1]) 1,194 1,676

Taxes([2]) (286) (421)

Comparable operating profit after tax 908 1,255

Opening borrowings less cash and cash equivalents 6,105 5,631

Opening equity 6,156 6,564

Opening Invested Capital 12,261 12,195

Closing borrowings less cash and cash equivalents 5,664 6,105

Closing equity 6,025 6,156

Closing Invested Capital 11,689 12,261

Average Invested Capital 11,975 12,228

ROIC 7.6% 10.3%

______________________

([1]) Reconciliation from reported operating profit to

comparable operating profit is included in Supplementary Financial

Information - Income Statement section.

([2]) Tax rate used is the comparable effective tax rate for the

year (2020: 23.9%; 2019: 25.1%).

Coca-Cola European Partners plc

Consolidated Income Statement (Unaudited)

Year ended

--------------------------

31 December 31 December

2020 2019

EUR million EUR million

---------------------------------- ----------- -------------

Revenue 10,606 12,017

Cost of sales (6,871) (7,424)

----------- -----------

Gross profit 3,735 4,593

Selling and distribution expenses (1,939) (2,258)

Administrative expenses (983) (787)

----------- -----------

Operating profit 813 1,548

Finance income 33 49

Finance costs (144) (145)

----------- -----------

Total finance costs, net (111) (96)

Non-operating items (7) 2

----------- -----------

Profit before taxes 695 1,454

Taxes (197) (364)

----------- -----------

Profit after taxes 498 1,090

=========== ===========

Basic earnings per share (EUR) 1.09 2.34

Diluted earnings per share (EUR) 1.09 2.32

The financial information presented in the unaudited

consolidated income statement, consolidated statement of financial

position and consolidated statement of cash flows within this

document does not constitute statutory accounts as defined in

section 434 of the Companies Act 2006. This financial information

has been extracted from CCEP's consolidated financial statements

which will be delivered to the Registrar of Companies in due

course.

Coca-Cola European Partners plc

Consolidated Statement of Financial Position (Unaudited)

31 December 31 December

2020 2019

EUR million EUR million

------------------------------------------------ ----------- -------------

ASSETS

Non-current:

Intangible assets 8,414 8,506

Goodwill 2,517 2,520

Property, plant and equipment 3,860 4,205

Non-current derivative assets 6 3

Deferred tax assets 27 27

Other non-current assets 337 321

----------- -----------

Total non-current assets 15,161 15,582

----------- -----------

Current:

Current derivative assets 40 12

Current tax assets 19 18

Inventories 681 723

Amounts receivable from related parties 150 106

Trade accounts receivable 1,439 1,669

Other current assets 224 259

Cash and cash equivalents 1,523 316

----------- -----------

Total current assets 4,076 3,103

----------- -----------

Total assets 19,237 18,685

=========== ===========

LIABILITIES

Non-current:

Borrowings, less current portion 6,382 5,622

Employee benefit liabilities 283 221

Non-current provisions 83 54

Non-current derivative liabilities 15 13

Deferred tax liabilities 2,134 2,203

Non-current tax liabilities 131 254

Other non-current liabilities 44 47

----------- -----------

Total non-current liabilities 9,072 8,414

----------- -----------

Current:

Current portion of borrowings 805 799

Current portion of employee benefit liabilities 13 17

Current provisions 154 142

Current derivative liabilities 62 28

Current tax liabilities 171 95

Amounts payable to related parties 181 249

Trade and other payables 2,754 2,785

----------- -----------

Total current liabilities 4,140 4,115

----------- -----------

Total liabilities 13,212 12,529

=========== ===========

EQUITY

Share capital 5 5

Share premium 192 178

Merger reserves 287 287

Other reserves (537) (449)

Retained earnings 6,078 6,135

----------- -----------

Total equity 6,025 6,156

----------- -----------

Total equity and liabilities 19,237 18,685

=========== ===========

Coca-Cola European Partners plc

Consolidated Statement of Cash Flows (Unaudited)

Year ended

31 December 31 December

2020 2019

EUR million EUR million

----------------------------------------------------------- ----------- -------------

Cash flows from operating activities:

Profit before taxes 695 1,454

Adjustments to reconcile profit before tax to

net cash flows from operating activities:

Depreciation 665 587

Amortisation of intangible assets 62 52

Share-based payment expense 14 15

Finance costs, net 111 96

Income taxes paid (273) (270)

Changes in assets and liabilities:

Decrease in trade and other receivables 208 5

Decrease/(increase) in inventories 34 (25)

(Decrease)/increase in trade and other payables 53 (63)

Increase/(decrease) in net payable / receivable

from related parties (112) 59

(Decrease)/increase in provisions 43 (57)

Change in other operating assets and liabilities (10) 51

----------- -----------

Net cash flows from operating activities 1,490 1,904

----------- -----------

Cash flows from investing activities:

Purchases of property, plant and equipment (348) (506)

Purchases of capitalised software (60) (96)

Proceeds from sales of property, plant and equipment 49 11

Investments in equity instruments (11) (8)

----------- -----------

Net cash flows used in investing activities (370) (599)

----------- -----------

Cash flows from financing activities:

Proceeds from borrowings, net 1,598 987

Changes in short-term borrowings (221) 101

Repayments on third party borrowings (569) (625)

Payments of principal on lease obligations (116) (128)

Interest paid, net (91) (86)

Dividends paid (386) (574)

Purchase of own shares under share buyback programme (129) (1,005)

Exercise of employee share options 14 26

Other financing activities, net - 2

----------- -----------

Net cash flows used in financing activities 100 (1,302)

----------- -----------

Net change in cash and cash equivalents 1,220 3

----------- -----------

Net effect of currency exchange rate changes on

cash and cash equivalents (13) 4

Cash and cash equivalents at beginning of period 316 309

----------- -----------

Cash and cash equivalents at end of period 1,523 316

=========== ===========

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR DKKBKNBKBCBD

(END) Dow Jones Newswires

February 11, 2021 02:00 ET (07:00 GMT)

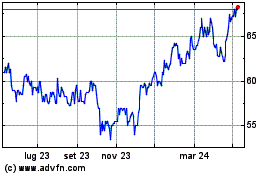

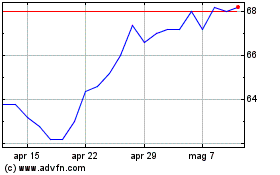

Grafico Azioni Coca-cola Europacific Pa... (LSE:CCEP)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Coca-cola Europacific Pa... (LSE:CCEP)

Storico

Da Apr 2023 a Apr 2024