TIDMCOD

RNS Number : 7110K

Compagnie de Saint-Gobain

23 April 2020

PRESS RELEASE

Paris, April 23, 2020, 5:45pm

First-quarter 2020 sales

EUR9,363 million:

down 4.9% like-for-like

-- Volumes down 5.5% as a result of disruptions related to the

coronavirus pandemic, with very different situations from one

country to the next

-- Prices holding up well, up 0.6% in a slightly inflationary cost environment

-- Negative currency impact of 0.5% and negative Group structure

impact of 4.4%, reflecting disposals carried out in the context of

"Transform & Grow" and the consolidation of Continental

Building Products

-- No dividend distribution in respect of 2019

-- General Shareholders' Meeting to be held behind closed doors

on June 4, 2020 and streamed live on the Group's website

Pierre-André de Chalendar, Chairman and Chief Executive Officer

of Saint-Gobain, commented:

"In the unprecedented context of the coronavirus pandemic,

Saint-Gobain has reacted firmly and efficiently thanks to the new

organization by country and by market, taking decisions locally and

coordinating internationally. Our priorities are clear. First and

foremost, we want to protect the health and safety of the Group's

employees and other stakeholders across the globe. Secondly, we

have further strengthened our liquidity and cash with new financing

facilities, significantly cut planned investments and are strictly

monitoring working capital. In addition to this financial solidity,

the Group is adapting its production by reducing costs and using

the available government-backed measures, particularly in terms of

partial unemployment. Together with Benoit Bazin, Chief Operating

Officer, I would like to thank all of our teams for their

commitment and their responsiveness, and for leading by example. In

the current context, the Board of Directors has today decided not

to recommend any dividend distribution to the June 4, 2020

Shareholders' Meeting. Depending on how the situation evolves, it

will review the Group's shareholder return policy by the end of the

year.

Given the impact of the global economic crisis caused by the

coronavirus, the Group expects a challenging second quarter 2020

before a recovery in the second half. Due to the scale of the

current uncertainties and the very different patterns of recovery

from one country to the next, the Group is not currently in a

position to give an earnings outlook for 2020."

Sales Sales Change Change on Like-for-like

Q1 2019 Q1 2020 on an actual a comparable change

structure structure

basis basis

--------- --------- -------------- -------------- --------------

EUR million

High Performance Solutions 1,893 1,712 -9.6% -8.5% -8.4%

Northern Europe 3,660 3,219 -12.0% -0.9% -0.2%

Southern Europe - ME

& Africa 3,386 2,983 -11.9% -8.9% -8.9%

Americas 1,307 1,370 +4.8% -2.2% -0.5%

Asia-Pacific 426 337 -20.9% -11.6% -12.7%

Internal sales and

misc. -294 -258 --- --- ---

Group Total 10,378 9,363 -9.8% -5.4% -4.9%

--------- -------------- --------------

Sales were down 4.9% on a like-for-like basis. Despite a good

start to the year in the European Regions and in the Americas,

March saw the effects of the coronavirus spread beyond Asia-Pacific

to the rest of the world. Volumes contracted 5.5% while prices rose

0.6% amid low inflation in energy and raw material costs.

On a reported basis, sales totaled EUR9,363 million, with a

negative currency effect of 0.5% related mainly to the depreciation

of the Brazilian real and Nordic krona. Note that the depreciation

of these currencies was more pronounced in March alone (down 2.2%),

along with that of the pound sterling and other emerging country

currencies.

Changes in Group structure had a negative 4.4% impact on sales,

chiefly reflecting disposals carried out as part of "Transform

& Grow", with negative structure impacts of 11.1% in Northern

Europe (Distribution in Germany, Optimera in Denmark), 3.0% in

Southern Europe - Middle East & Africa (in France with DMTP and

K par K in distribution and expanded polystyrene, in the

Netherlands with Glassolutions) and 9.3% in Asia-Pacific (Hankuk

Glass Industries in South Korea). The structure impact also

reflects the consolidation of our strong positions (Continental

Building Products in North America as from February), and

acquisitions in new niche technologies and services (American

Seal), as well as in emerging countries (gypsum and mortars in

Latin America). In light of the hyperinflationary environment in

Argentina, this country which represents less than 1% of the

Group's consolidated sales, is excluded from the like-for-like

analysis.

Segment performance (like-for-like sales)

High Performance Solutions (HPS) sales fell 8.4%, hit by slowing

industrial markets and the initial impacts of the coronavirus,

particularly in the automotive market in March.

- Mobility continued to outperform the automotive market, thanks

mainly to its exposure to high value-added products and electric

vehicles. After a good start to the year, it reported a sharp

decline in sales in March following the gradual shutdown of

automotive manufacturing plants around the world. Only the Chinese

business saw its situation improve in March compared to the start

of the year.

- As from mid-March, Industry also saw a sharp slowdown in industrial markets in most regions.

- Activities serving the Construction Industry saw further

growth, including in March, buoyed by gains in market share and

upbeat trends in external thermal insulation solutions (ETICS).

- Life Sciences continued to enjoy a strong growth dynamic in

the pharmaceutical and medical sector, benefiting from recent

investments in additional capacity. The business is also engaged in

the fight against the coronavirus, prioritizing components for

critical medical devices (silicone membranes, flexible tubes,

filters, connectors and fixings) used in respirators, ventilators

and infusion pumps in particular.

Northern Europe stabilized over the quarter, slipping 0.2%,

thanks to a good start to the year in January and February and a

limited coronavirus impact in March, except in the UK during the

last week of the month.

Nordic countries reported good sales growth over the quarter,

including in March, particularly in Distribution which benefited

from good momentum in the renovation market. Germany and Eastern

Europe progressed over the quarter as well as in March, with local

construction activities relatively unscathed except glass towards

the end of the month, which is adapting its production in line with

the drop in demand. Only UK sales suffered over the quarter,

experiencing a sharp downturn at the end of the period with all

operations at a virtual standstill.

Southern Europe - Middle East & Africa reported an 8.9%

decrease in sales. After a good start to the year in

January-February, March was affected by the lockdown measures put

in place across much of the Region.

France delivered robust growth at the beginning of the year,

buoyed by a dynamic renovation market which benefited Distribution

and energy efficiency solutions. In March, France came to a

standstill for several days after lockdown measures were

introduced, before business partially resumed as from March 23.

Spain, Italy, the Middle East and Africa saw their operations

penalized to an increasing extent by the restrictions put in place

in March. Only the Netherlands reported quarterly and March sales

that remained relatively unaffected by the coronavirus.

Sales in the Americas remained virtually stable, slipping 0.5%,

thanks to a good start to the year in January and February. North

America benefited from stable volumes over the quarter and from

slightly higher prices in a dynamic construction market before the

impact of the coronavirus. Gypsum delivered double-digit

like-for-like volume growth over the quarter. The integration of

Continental Building Products is progressing well, in line with

expectations, and allows the Group to considerably strengthen its

geographic footprint. In March, most plants remained operational in

the US, with most states considering construction an essential

industry. Latin America had a good start to the year in

January-February, before disruptions hit construction markets in

March due to the quarantine measures introduced in various

countries and certain Brazilian states, where construction activity

was generally no longer permitted.

Asia-Pacific reported a 12.7% contraction in sales.

As the first country to be affected by the coronavirus, the

Group's operations in China hit a low in February, before resuming

all production in early March to meet the gradual increase in

demand observed throughout the month, which accelerated

significantly in the last few days of March. This rally allowed

local construction businesses to reach their prior-year levels as

from mid-April. Other Asian countries have seen varying degrees of

disruption, with very limited effects in Japan and South Korea and

increasingly more pronounced effects in South-East Asia. After two

months of double-digit growth supported by productivity solutions

(plaster and mortars), India was placed under total lockdown on

March 24, leading to the shutdown of industry.

Update on operations as of mid-April

Prioritizing the health and safety of all of our employees and

other stakeholders, the Group is working to achieve operational

continuity in each country by quickly adapting to changes in demand

depending on the health situation and on local government

decisions.

- High Performance Solutions (HPS) : automotive activities have

significantly adjusted their production and, with the exception of

China which has seen operations resume, are manufacturing only very

small volumes in light of plant shutdowns by their customers. These

activities are expected to gradually resume in line with the

recovery in automotive production. Adjustments were also made in

other activities serving industrial markets, although most sites

remain operational and continue to serve their customers. After

hitting a low point in the second quarter, all these industrial

activities should see a gradual recovery. Elsewhere, the

Construction Industry and Life Sciences businesses continue to show

further growth.

- Northern Europe : disruptions across the Region vary widely

from one country to the next. While Nordic countries, Germany and

Eastern Europe all reported a good level of trading in the first

quarter and remain, relatively speaking, little affected, the UK

has been at a virtual standstill since the end of March and is in

the process of starting up again.

- Southern Europe - Middle East & Africa : the Region has

seen substantial disruptions, although trends point to a gradual

resumption of business. After a shutdown of several days in France

in the week of March 23 so that new operating and health procedures

could be put in place, the majority of Distribution outlets have

reopened and reported a constant improvement in trading, up from

25% of 2019 levels at the end of March to more than 50% already by

mid-April, in line with industrial activities. Most of Italy

remains shut down, while operations have resumed in Spain.

Operations in the Netherlands remain relatively unaffected, while

the Middle East and Africa have been impacted in varying degrees.

After significant disruptions in the second quarter, construction

markets should show a substantial improvement.

- Americas : the situation across North America is mixed,

depending on each state, with business slowing in April but almost

all plants generally able to continue operating, with the

construction sector often considered an essential industry. Latin

America is trading at approximately 40% of its 2019 level, with the

situation varying widely depending on the business and type of

market; after coming to an abrupt halt at the end of March, the

construction sector is ramping up again in Brazil. After an overall

decline in the second quarter, markets should return to some degree

of normality.

- Asia-Pacific : after the gradual restart of all of its

production sites in China in March, construction sales in the

country accelerated and at mid-April had reached the level recorded

for the same period in 2019. India remains at a standstill. Other

Asian countries have seen varying degrees of disruption, which are

limited in Thailand and Vietnam. After a challenging second quarter

outside China, Asia-Pacific should show a substantial

improvement.

Measures put in place to address the coronavirus pandemic

Since the start of the pandemic, Saint-Gobain has taken all

necessary steps in real time to limit its impacts as far as

possible. The Group's new organization by country and by market,

put in place within the scope of "Transform & Grow", has given

it the agility and flexibility it needs to take decisions quickly

at the local level and to coordinate internationally by sharing the

experience of its different countries. The Group has the following

priorities:

Ensure employee health and safety:

Since the outbreak of the health crisis in China, the Group has

taken the necessary measures to protect the health of its employees

and other stakeholders, by putting in place strict hygiene measures

adapted to its different businesses, encouraging working from home

wherever possible and cooperating with the authorities in each

country where it is present.

Strengthen liquidity:

The Group has a very solid financial position in terms of cash

and financing. At March 31, 2020, the Group's cash and cash

equivalents represented an estimated EUR3.8 billion, before taking

into account the EUR1.5 billion bond issue at the end of March

(proceeds received on April 3). In light of the current

environment, the Group also recently reinforced its financing

sources:

- A EUR1.5 billion bond issue on March 26, consisting of EUR750

million with a 3 year maturity and a 1.75% coupon, and EUR750

million with a 7 1/2 year maturity and a 2.375% coupon;

- A syndicated credit line totaling EUR2.0 billion, including

EUR1.0 billion drawn for a bond repayment of the same amount at the

end of March, in addition to the confirmed and undrawn back-up

credit lines of EUR4.0 billion;

- Access to the new commercial paper Pandemic Emergency Purchase

Program (PEPP) launched by the European Central Bank on March 18,

2020.

Preserve cash:

- Swiftly adapting production (reduction of teams or stoppages)

to local demand on a site-by-site basis, thanks to permanent

contact with our customers;

- Reducing costs and discretionary spending and using the

appropriate local measures, in particular in terms of employment

and partial unemployment, in addition to the cost savings planned

for 2020 as part of "Transform & Grow";

- Focusing constantly on the price-cost spread, with strict pricing discipline;

- Reduction in capital expenditure in 2020 of more than EUR 500 million compared to 2019;

- Strict monitoring of working capital, with the aim of limiting

inventory levels and tracking inflows of customer payments on a

daily basis;

- Cancellation of the dividend: given the current context of the

coronavirus pandemic and the introduction of partial unemployment

measures, the Board of Directors has today decided not to recommend

any dividend distribution to the June 4, 2020 Shareholders'

Meeting. Although the Group recently further strengthened its

liquidity, the Board of Directors considered that this exceptional

decision was in the best interests of the Group and its

stakeholders, given the uncertainty as to the impact and duration

of the crisis, and the caution required at this time. Depending on

how the situation evolves, it will review the Group's shareholder

return policy by the end of the year.

Decision by Pierre-André de Chalendar, Benoit Bazin and the

Directors of the Board to reduce their compensation

Pierre-André de Chalendar, Chairman and Chief Executive Officer

of Saint-Gobain, and Benoit Bazin, Chief Operating Officer, wish to

show their solidarity with the efforts being made by the Group's

employees and stakeholders impacted by this unprecedented crisis.

Consequently, they have informed the Board of Directors of their

decision to waive 25% of their compensation to be paid in 2020 for

as long as the Group's employees are subject to partial employment

in the context of the emergency measures taken by the Government to

halt the spread of the coronavirus epidemic. Saint-Gobain will

donate the unpaid compensation to the Paris public hospitals

foundation (Fondation de l'Assistance Publique - Hôpitaux de Paris,

AP-HP).

In a similar move of solidarity, the Directors of the Board have

decided to join this effort by also waiving 25% of their

compensation for the same period. Saint-Gobain will donate the

unpaid compensation to charities, with the aim of supporting

fragile populations impacted by the coronavirus.

Outlook

Given the impact of the global economic crisis caused by the

coronavirus, the Group expects a challenging second quarter 2020

before a recovery in the second half. Due to the scale of the

current uncertainties and the very different patterns of recovery

from one country to the next, the Group is not currently in a

position to give an earnings outlook for 2020.

Saint-Gobain's medium and long-term outlook remains robust

thanks to its enhanced profile as part of "Transform & Grow"

and to its successful strategic choices. The strategy of

differentiation and innovation puts Saint-Gobain in the best

position to benefit from its three profitable growth drivers:

sustainability, productivity and well-being.

Financial calendar

- First-half 2020 results: July 30, 2020, after close of trading

on the Paris Bourse.

Analyst/Investor relations Press relations

+33 1 47 62 30

+33 1 47 62 44 10

29 +33 1 47 62 51

Vivien Dardel +33 1 47 62 35 Laurence Pernot 37

Floriana Michalowska 98 +33 1 47 62 Patricia Marie +33 1 47 62 43

Christelle Gannage 30 93 Susanne Trabitzsch 25

------------------------ ------------------ -------------------------------------------- -----------------

A conference call will be held at 6:30pm (Paris time) on April

23, 2020: +33 1 72 72 74 03, dial-in code: 53318217#

Glossary :

Indicators of organic growth and like-for-like changes in sales

reflect the Group's underlying performance excluding the impact

of:

-- changes in Group structure, by calculating indicators for the

year under review based on the scope of consolidation of the

previous year (Group structure impact);

-- changes in foreign exchange rates, by calculating the

indicators for the year under review and those for the previous

year based on identical foreign exchange rates for the previous

year (currency impact);

-- changes in applicable accounting policies.

Important disclaimer - forward-looking statements :

This press release contains forward-looking statements with

respect to Saint-Gobain's financial condition, results, business,

strategy, plans and outlook. Forward-looking statements are

generally identified by the use of the words "expect",

"anticipate", "believe", "intend", "estimate", "plan" and similar

expressions. Although Saint-Gobain believes that the expectations

reflected in such forward-looking statements are based on

reasonable assumptions as at the time of publishing this document,

investors are cautioned that these statements are not guarantees of

its future performance. Actual results may differ materially from

the forward-looking statements as a result of a number of known and

unknown risks, uncertainties and other factors, many of which are

difficult to predict and are generally beyond the control of

Saint-Gobain, including but not limited to the risks described in

Saint-Gobain's registration document available on its website

(www.saint-gobain.com). Accordingly, readers of this document are

cautioned against relying on these forward-looking statements.

These forward-looking statements are made as of the date of this

document. Saint-Gobain disclaims any intention or obligation to

complete, update or revise these forward-looking statements,

whether as a result of new information, future events or

otherwise.

This press release does not constitute any offer to purchase or

exchange, nor any solicitation of an offer to sell or exchange

securities of Saint-Gobain.

For further information, please visit www.saint-gobain.com .

Appendix 1: Prices and Volumes on organic growth sales by

Segment

First-quarter 2020 Like-for-like Prices Volumes

change

High Performance Solutions -8.4% +1.5% -9.9%

Northern Europe -0.2% -0.2% +0.0%

Southern Europe - ME &

Africa -8.9% +0.9% -9.8%

Americas -0.5% +0.4% -0.9%

Asia-Pacific -12.7% -1.3% -11.4%

------- --------

Group Total -4.9% +0.6% -5.5%

------- --------

Appendix 2: Breakdown of organic sales growth and external

sales

First-quarter 2020 Like-for-like % Group

change

High Performance Solutions -8.4% 18%

Mobility -10.5% 8%

Other industries -7.0% 10%

Northern Europe -0.2% 34%

Nordics +4.2% 12%

United Kingdom - Ireland -8.7% 10%

Germany - Austria +1.0% 4%

Southern Europe - ME

& Africa -8.9% 31%

France -9.3% 23%

Spain - Italy -10.2% 4%

Americas -0.5% 14%

North America +0.3% 10%

Latin America -2.1% 4%

Asia-Pacific -12.7% 3%

Group Total -4.9% 100%

Appendix 3: Industry and Distribution Europe

Sales Sales Change Change on Like-for-like

Q1 2019 Q1 2020 on an a comparable change

actual structure

structure basis

basis

--------- --------- ----------- -------------- --------------

EUR million

Industry Europe 2,520 2,360 -6.3% -4.6% -4.6%

Distribution Europe 4,640 3,926 -15.4% -4.9% -4.3%

--------------------- --------- --------- ----------- -------------- --------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

QRFPPUBCCUPUGAW

(END) Dow Jones Newswires

April 23, 2020 11:52 ET (15:52 GMT)

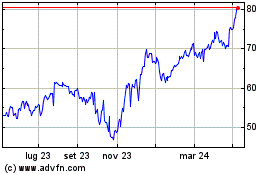

Grafico Azioni Compagnie De Saint-gobain (LSE:COD)

Storico

Da Mar 2024 a Apr 2024

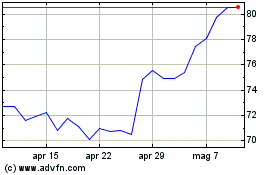

Grafico Azioni Compagnie De Saint-gobain (LSE:COD)

Storico

Da Apr 2023 a Apr 2024