Covid-19 Crisis Puts Further Pressure on Big Jets

09 Luglio 2020 - 4:52PM

Dow Jones News

By Benjamin Katz

LONDON -- The aviation-industry crisis triggered by the

coronavirus pandemic is exacerbating a yearslong move by airlines

away from big jets.

Rolls-Royce Holdings PLC, a bellwether for the market for

so-called wide-body aircraft, said it raised a further GBP2 billion

pounds ($2.53 billion) to help shore up its liquidity as demand for

its engines wanes among airline customers. The U.K. supplier

specializes in making and servicing engines for the industry's

biggest aircraft.

It said Thursday that its revenue will be lower than forecast

until at least 2027 as it cuts back production and has fewer

engines flying as a result, cutting back revenue related to engine

servicing and maintenance. Shares fell as much as 9.5% in

London.

Airbus SE, meanwhile, the world's biggest jet maker by

deliveries, said late Wednesday it had booked 21 orders for

wide-bodies, but received cancellations for 22 in the first six

months of the year.

As demand for flying has cratered amid the pandemic, carriers

have laid out plans to lay off or furlough tens of thousands of

workers. They have sought investor and government rescue cash and

have dramatically reduced routes. They have also scaled back

sharply plans to purchase new planes.

Now that many economies are starting to open up again, airlines

have more recently started to add back some capacity. But the type

of demand that is returning -- typically for shorter

intracontinental or domestic routes -- threatens to exacerbate a

yearslong shift by airlines into smaller, nimbler jets.

Airbus said that it received 344 new orders for narrowbodies, or

single-aisle jets, with 45 cancellations in the first six months of

the year.

Airbus and rival Boeing Co. have been pivoting in recent years

to adjust to airline customers' new reluctance to buy their biggest

jets. Instead, carriers have flocked to smaller, single-aisle

planes that are more fuel efficient, more flexible on range and can

be filled up with passengers more easily.

Unlike its main rival, General Electric Co., Rolls-Royce bowed

out of the market for the more popular and better selling

narrow-body market in 2012. Rolls-Royce has already outlined plans

to cut some 9,000 jobs from its 52,000 global workforce. Chief

Executive Officer Warren East has indicated that the company could

close or consolidate some of its manufacturing sites.

Rolls-Royce said its engines flew 50% fewer hours in the first

half of this year compared with 2019, with the trough in April when

usage was down 80%. The company has previously said it would

manufacture 250 engines this year, compared with previous guidance

for 450 deliveries.

"We play in wide-body, we do not play in single-aisle," Mr. East

said. "As much as it might be nice to be in a larger scale market,

it's a slightly academic question."

Analysts and industry officials believe business travel, which

is critical to making long-haul flying financially feasible, could

be the last travel segments to recover. Companies have been

reluctant to send employees traveling during the pandemic and wary

of the expense during an economic crisis. Many have also gotten

used to going without travel.

"We've seen this in China, that domestic recovers much faster

and to a much greater degree than international does," said Nick

Cunningham, a London-based analyst at Agency Partners. "If your

exposure is wide-bodies, then yes, you have a problem."

Airlines across the globe have been downsizing their fleets amid

the crisis. They have typically started with their bigger, less

fuel-efficient, older jets. Deutsche Lufthansa AG, for example, has

said it would retire four-engined Airbus A380s, A340s and Boeing

747s.

Qantas Airways Ltd. is permanently parking its 747 jumbo jets

and hibernating its own A380s for the next three years. Air France

and Emirates are also cutting back their operation of the

double-decker.

Boeing had twice cut its production rates for its 787 Dreamliner

before the pandemic, while development delays have hampered its

newest and bigger 777X, which has struggled to drum up a

significant order backlog. The company has also indicated that it

plans to cease production of the 747.

Airbus had taken the move to shutter the production program for

its A380 superjumbo program, the world's biggest airliner. It has

also cut production rates for its smaller wide-body, the A330.

Write to Benjamin Katz at ben.katz@wsj.com

(END) Dow Jones Newswires

July 09, 2020 10:37 ET (14:37 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

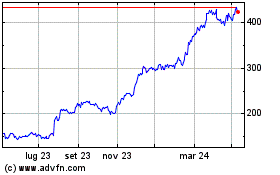

Grafico Azioni Rolls-royce (LSE:RR.)

Storico

Da Mar 2024 a Apr 2024

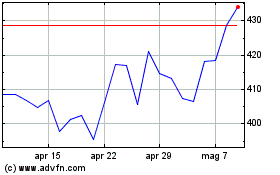

Grafico Azioni Rolls-royce (LSE:RR.)

Storico

Da Apr 2023 a Apr 2024