Credit Suisse Taps Lloyds Boss as Next Chairman

01 Dicembre 2020 - 11:56AM

Dow Jones News

By Margot Patrick

Credit Suisse Group AG named António Horta-Osório as its next

chairman Tuesday, marking a changing of the guard after a decade

under current chairman Urs Rohner punctuated by regulatory fines

and scandal.

Mr. Horta-Osório said on Monday he was leaving his job as chief

executive at Britain's Lloyds Banking Group PLC. The Portuguese

executive is one of Europe's most highly regarded bankers after a

turnaround at Lloyds, and Mr. Rohner said he brings an "impressive

record of accomplishments." Shareholders will vote on the proposed

appointment at the bank's annual meeting in April. Mr. Rohner had

said he would leave Credit Suisse when he hits a 12-year term limit

at that meeting.

The change comes as Credit Suisse is navigating the coronavirus

pandemic under a new CEO, Thomas Gottstein. It is also seeking to

move on from a damaging spying scandal that led to the ouster of

former CEO Tidjane Thiam in February for failing to contain the

reputational fallout. The Wall Street Journal on Monday reported

that lawyers hired by Credit Suisse found two incidents of the bank

putting employees under observation by investigators, predating two

others in 2019 that the bank had blamed on an executive who was

fired. Switzerland's financial regulator started enforcement

proceedings on how the bank controls and documents such activities

in September. Those proceedings are ongoing and Credit Suisse says

it is cooperating.

Credit Suisse separately said Tuesday that it could take a

provision in the fourth quarter to reflect a potential $680 million

judgement for damages being sought in a New York civil court. It

has already has taken a $300 million provision in the case, it

said. Credit Suisse said it believes it has strong grounds to

appeal such a judgement.

The potential provision adds to an unexpected $450 million

fourth-quarter charge announced by the bank last week to reflect

changes at a U.S. asset manager in which it holds a 30% stake.

At Lloyds, Mr. Horta-Osório, 56, carried out a sweeping overhaul

in the wake of the financial crisis. The bank narrowed its focus

largely to the U.K., shedding most of its investment banking and

investment units and simplifying its operations.

The bank's cost to income ratio fell to 48.5% last year from

56.8% in 2012.

Mr. Horta-Osório also played a pivotal role early in his tenure

in getting the U.K.'s banks to voluntarily start compensating

millions of customers who had been mis-sold insurance. The industry

initially thought the bill would be around GBP5 billion, equivalent

to $6.66 billion, but it spiraled as more claims came in, and

Lloyds alone has paid out GBP22 billion to affected customers.

While Mr. Rohner has been chairman, Credit Suisse also underwent

an overhaul to adapt to changes in banking after the financial

crisis. Its strategy under Mr. Thiam to focus on wealth management

has paid off so far in the pandemic. Loan-loss provisions have been

relatively contained compared with other European banks, reflecting

its lending in its conservative Swiss home market and to the

wealthy.

Mr. Rohner's governance of the bank has come under attack from

some shareholders, though. During his tenure, the bank paid

billions of dollars in fines and settlements to authorities in the

U.S. and globally over alleged regulatory failings and

misconduct

Write to Margot Patrick at margot.patrick@wsj.com

(END) Dow Jones Newswires

December 01, 2020 05:41 ET (10:41 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

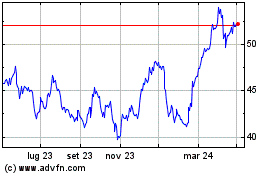

Grafico Azioni Lloyds Banking (LSE:LLOY)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Lloyds Banking (LSE:LLOY)

Storico

Da Apr 2023 a Apr 2024