Current Report Filing (8-k)

13 Settembre 2021 - 10:33PM

Edgar (US Regulatory)

00014948770001297996falsefalse 0001297996 2021-09-08 2021-09-08 0001297996 dlr:DigitalRealtyTrustLPMember 2021-09-08 2021-09-08 0001297996 us-gaap:CommonStockMember 2021-09-08 2021-09-08 0001297996 dlr:SeriesJPreferredStockMember 2021-09-08 2021-09-08 0001297996 dlr:SeriesKPreferredStockMember 2021-09-08 2021-09-08 0001297996 dlr:SeriesLPreferredStockMember 2021-09-08 2021-09-08

SECURITIES AND EXCHANGE COMMISSION

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 8, 2021

DIGITAL REALTY TRUST, INC.

DIGITAL REALTY TRUST, L.P.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(State or other jurisdiction

of incorporation)

|

|

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

5707 Southwest Parkway, Building 1, Suite 275

Austin, Texas

|

|

|

(Address of principal executive offices)

|

|

|

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the

Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to

Rule 14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to

Rule 14d-2(b) under

the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to

Rule 13e-4(c) under

the Exchange Act (17 CFR

240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Series J Cumulative Redeemable Preferred Stock

|

|

|

|

|

Series K Cumulative Redeemable Preferred Stock

|

|

|

|

|

Series L Cumulative Redeemable Preferred Stock

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2

of the Securities Exchange Act of 1934

(§240.12b-2

of this chapter).

|

|

|

|

|

|

|

Digital Realty Trust, Inc.:

|

|

|

|

Emerging growth company ☐

|

|

|

|

|

|

Digital Realty Trust, L.P.:

|

|

|

|

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

|

|

|

Digital Realty Trust, Inc.:

|

|

☐

|

Digital Realty Trust, L.P.:

|

|

☐

|

Unless otherwise indicated or unless the context requires otherwise, all references in this report to “we,” “us,” “our,” “our company,” “the company” or “Digital Realty” refer to Digital Realty Trust, Inc., together with its consolidated subsidiaries, including Digital Realty Trust, L.P., our “operating partnership.”

On September 8, 2021, Digital Realty Trust, Inc. entered into (a) forward sale agreements with each of Bank of America, N.A., Citibank, N.A. and JPMorgan Chase Bank, National Association (collectively, the “forward purchasers”), and (b) together with the operating partnership, an underwriting agreement with BofA Securities, Inc., Citigroup Global Markets Inc. and J.P. Morgan Securities LLC, as representatives of the several underwriters named therein (collectively, the “underwriters”) and as forward sellers (in such capacity, collectively, the “forward sellers”), and the forward purchasers, relating to the forward issuance and sale of up to 7,187,500 shares (including 937,500 shares that the underwriters have the option to purchase) of our common stock at a public offering price of $160.50 per share (the “offering”).

On September 13, 2021, the forward purchasers or their affiliates borrowed and sold an aggregate of 6,250,000 shares of our common stock to the underwriters in connection with the closing of the offering. We intend (subject to our right to elect cash or net share settlement subject to certain conditions) to deliver, upon physical settlement of the forward sale agreements on one or more dates specified by us occurring no later than March 13, 2023, an aggregate of 6,250,000 shares of our common stock to the forward purchasers in exchange for cash proceeds per share equal to the applicable forward sale price, which will be the public offering price, less underwriting discounts and commissions, subject to certain adjustments as provided in the forward sale agreements.

The forward sellers have granted the underwriters a

30-day

option from September 8, 2021, exercisable in whole or in part from time to time, to purchase up to an additional 937,500 shares of our common stock at the initial price to the public less the underwriting discount. Upon any exercise of such option, the number of shares of our common stock underlying each forward sale agreement will be increased by the number of shares sold by the applicable forward purchaser or its affiliate in respect of such option exercise. In such event, if any forward purchaser or its affiliates does not deliver and sell all of the shares of our common stock to be sold by it in connection with the exercise of such option, Digital Realty Trust, Inc. will issue and sell to the underwriters a number of shares of our common stock equal to the number of shares that the forward purchaser or its affiliates does not deliver and sell, and the number of shares underlying the relevant forward sale agreement will not be increased in respect of the number of shares that Digital Realty Trust, Inc. issues and sells.

The shares were offered and sold under a prospectus supplement and related prospectus filed with the Securities and Exchange Commission pursuant to our effective shelf registration statement on Form

S-3

(File Nos.

333-237232

and

Copies of the underwriting agreement and each forward sale agreement are attached as exhibits to this Current Report on Form

8-K

and are incorporated herein by reference. The summary set forth above is qualified in its entirety by reference to such exhibits.

In connection with the filing of the prospectus supplement, we are filing as Exhibit 5.1 to this Current Report on Form

8-K

an opinion of our counsel, Venable LLP, regarding certain Maryland law issues regarding our common stock.

|

|

Financial Statements and Exhibits.

|

|

|

|

|

|

|

|

|

|

|

|

1.1

|

|

Underwriting Agreement, dated September 8, 2021, by and among Digital Realty Trust, Inc., Digital Realty Trust, L.P., and BofA Securities, Inc., Citigroup Global Markets Inc. and J.P. Morgan Securities LLC, as representatives of the several underwriters named therein and as forward sellers, and Bank of America, N.A., Citibank, N.A. and JPMorgan Chase Bank, National Association, as forward purchasers.

|

|

|

|

|

1.2

|

|

Confirmation of Registered Forward Transaction, dated September 8, 2021, by and between Digital Realty Trust, Inc. and Bank of America, N.A.

|

|

|

|

|

1.3

|

|

Confirmation of Registered Forward Transaction, dated September 8, 2021, by and between Digital Realty Trust, Inc. and Citibank, N.A.

|

|

|

|

|

1.4

|

|

Confirmation of Registered Forward Transaction, dated September 8, 2021, by and between Digital Realty Trust, Inc. and JPMorgan Chase Bank, National Association.

|

|

|

|

|

5.1

|

|

Opinion of Venable LLP.

|

|

|

|

|

23.1

|

|

Consent of Venable LLP (included in Exhibit 5.1).

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Digital Realty Trust, Inc.

|

|

|

|

|

By:

|

|

|

|

|

|

|

|

|

|

Executive Vice President, General Counsel and Secretary

|

|

|

|

|

|

|

Digital Realty Trust, L.P.

|

|

|

|

|

By:

|

|

Digital Realty Trust, Inc.

|

|

|

|

Its general partner

|

|

|

|

|

By:

|

|

|

|

|

|

|

|

|

|

Executive Vice President, General Counsel and Secretary

|

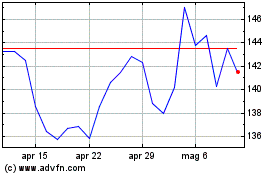

Grafico Azioni Digital Realty (NYSE:DLR)

Storico

Da Mar 2024 a Apr 2024

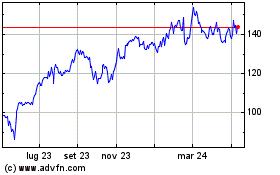

Grafico Azioni Digital Realty (NYSE:DLR)

Storico

Da Apr 2023 a Apr 2024