Current Report Filing (8-k)

19 Ottobre 2021 - 11:02PM

Edgar (US Regulatory)

REGIONS FINANCIAL CORP Depositary Shares, each representing a 1/40th Interest in a Share of 6.375% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series B Depositary Shares, each representing a 1/40th Interest in a Share of 5.700% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series C Depositary Shares, each representing a 1/40th Interest in a Share of 4.45% Non-Cumulative Perpetual Preferred Stock, Series E false 0001281761 0001281761 2021-10-19 2021-10-19 0001281761 us-gaap:CommonStockMember 2021-10-19 2021-10-19 0001281761 us-gaap:SeriesBPreferredStockMember 2021-10-19 2021-10-19 0001281761 us-gaap:SeriesCPreferredStockMember 2021-10-19 2021-10-19 0001281761 us-gaap:SeriesEPreferredStockMember 2021-10-19 2021-10-19

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 19, 2021

REGIONS FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-34034

|

|

63-0589368

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

1900 Fifth Avenue North

Birmingham, Alabama 35203

(Address, including zip code, of principal executive office)

Registrant’s telephone number, including area code: (800) 734-4667

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, $.01 par value

|

|

RF

|

|

New York Stock Exchange

|

|

Depositary Shares, each representing a 1/40th Interest in a Share of 6.375% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series B

|

|

RF PRB

|

|

New York Stock Exchange

|

|

Depositary Shares, each representing a 1/40th Interest in a Share of 5.700% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series C

|

|

RF PRC

|

|

New York Stock Exchange

|

|

Depositary Shares, each representing a 1/40th Interest in a Share of 4.45% Non-Cumulative Perpetual Preferred Stock, Series E

|

|

RF PRE

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.☐

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

On October 19, 2021, the Compensation and Human Resources Committee of the Board of Directors of Regions Financial Corporation elected to amend the Regions Financial Corporation Post 2006 Supplemental Executive Retirement Plan (the “SERP”), effective immediately, generally to allow a fully vested and retirement eligible participant to freeze his or her accrued benefit (“Accrued Benefit”), convert the Accrued Benefit to a lump sum in accordance with the applicable terms of the SERP, and credit the Accrued Benefit to an account under the Regions Financial Corporation Non-Qualified Excess 401(k) Plan (“Excess 401(k) Plan”). A participant who elects to have his or her Accrued Benefit credited to an account under the Excess 401(k) Plan in this manner will no longer accrue any additional benefits under the SERP. The Accrued Benefit will be payable from the Excess 401(k) Plan to the participant upon his or her termination of employment in the same manner as it would have been payable under the SERP. Additionally, the amendment modifies the interest rate that is used to convert an Accrued Benefit to a lump sum. Effective January 1, 2022, the applicable interest rate will be averaged over three years rather than a spot rate in a single year.

The foregoing description of the amendment to the SERP is qualified in its entirety by reference to the full text of such amendment, which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

Date: October 19, 2021

|

|

|

|

REGIONS FINANCIAL CORPORATION

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

/s/ Tara A. Plimpton

|

|

|

|

|

|

Name:

|

|

Tara A. Plimpton

|

|

|

|

|

|

Title:

|

|

Chief Legal Officer and Corporate Secretary

|

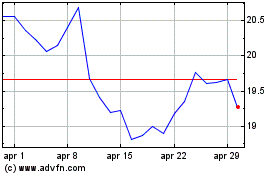

Grafico Azioni Regions Financial (NYSE:RF)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Regions Financial (NYSE:RF)

Storico

Da Apr 2023 a Apr 2024