Danone back to growth in Q2 with all categories contributing

2021

Half-Year

ResultsPress release – Paris, July 29, 2021

Danone back to

growth in Q2 with

all categories

contributing

-

Net sales of €6,171m in

the second quarter, up

+6.6% on a like-for-like (LFL)

basis, and +3.6% on a reported basis, leading H1 sales to

grow +1.6% on a like-for-like basis

-

Return to growth driven by focus on execution and

delivery: core portfolio renovation and innovation,

acceleration in strategic channels and selected investments in key

battles

-

Recurring operating margin at 13.1%: selective

pricing initiatives, coupled with efficient product mix management

and stepped-up productivity partially offsetting adverse category

mix and higher inflation

-

Reported EPS up +5.1% at €1.63 and

recurring EPS down

-9.3% at

€1.53

-

Continued disciplined cash management, with free

cash flow reaching €1.0 bn in H1, and

further progress on portfolio management

with the disposal of Mengniu stake and sale of Vega

-

Launch of a

share buyback program of up

to €800m in the second half of the year

- 2021

guidance reiterated: return to profitable growth in H2,

and FY recurring operating margin broadly in line with 2020

|

|

2021 Half-Year Key

Figures |

|

in millions of euros except if stated otherwise |

H1 2020 |

H1 2021 |

Reported Change |

Like-for-like(LFL) |

|

Sales |

12,189 |

11,835 |

-2.9% |

+1.6% |

|

Recurring operating income |

1,702 |

1,551 |

-8.9% |

-4.2% |

|

Recurring operating margin |

14.0% |

13.1% |

-86 bps |

-83 bps |

|

Non-recurring operating income and expenses |

(123) |

(700) |

(577) |

|

|

Operating income |

1,580 |

851 |

-46.1% |

|

|

Operating margin |

13.0% |

7.2% |

-576 bps |

|

|

Recurring net income – Group share |

1,100 |

1,000 |

-9.1% |

|

|

Non-recurring net income – Group share |

(86) |

68 |

+153 |

|

|

Net income – Group share |

1,015 |

1,068 |

+5.2% |

|

|

Recurring EPS (€) |

1.68 |

1.53 |

-9.3% |

|

|

EPS (€) |

1.55 |

1.63 |

+5.1% |

|

|

Free cash flow |

929 |

1,009 |

+8.6% |

|

|

Cash flow from operating activities |

1,305 |

1,381 |

+5.8% |

|

All references in this document to Like-for-like

(LFL) changes, Recurring operating income and margin, Recurring net

income, Recurring income tax rate, Recurring EPS, Free cash-flow,

and net financial debt, correspond to financial indicators not

defined in IFRS. Their definitions, as well as their reconciliation

with financial statements, are listed on pages 6 to 8. The

calculation of Net Debt/EBITDA is detailed in the universal

registration document.

Véronique Penchienati-Bosetta and Shane

Grant: interim

co-CEOs statement

“We are pleased to report a return to growth

across all our categories this quarter, thanks to the teams’

commitment and focus on execution and delivery. On a two-year

basis, our like-for-like sales growth is also positive, on both Q2

and H1. We maintained strong momentum in our EDP business, led by

growth in Dairy, and Plant-based reporting its 6th consecutive

quarter of double-digit growth, and a solid performance in Europe

and Noram. Specialized Nutrition returned to growth in Q2, with

notably a consistent high single-digit performance in Adult

Nutrition and a positive growth in Infant Nutrition. Waters was

also back to growth in Q2 as restrictions in some parts of Europe

lifted and thanks to market share gains in the region, yet emerging

geographies are still more impacted by the negative effect of

covid-related restrictions on out-of-home trends. Our continued

focus on core portfolio renovation and innovation, supported by

selective reinvestments and channel execution focus, has helped our

leading brands such as Alpro, Actimel, Neocate, evian and Oikos

grow market share, playing into global trends towards health and

immunity.

Margin held up well despite an adverse category

mix and accelerated inflation. Strong productivity delivery coupled

with selective pricing and mix management allowed us to partially

offset headwinds.

Looking ahead, we reiterate our guidance for the

full year. Although the macro context is still uncertain, we have

strong foundations across our categories, geographies and brands.

Local First project is progressing according to plan. We will

continue to adopt a disciplined approach to capital management and

remain focused on delivering on our growth priorities and plans in

the second half.”

I.

2021 HALF-YEAR

RESULTS

Second quarter

and half-year sales

In the first

half of

2021, consolidated sales stood at

€11.8 bn, up +1.6% on a like-for-like basis, led by +2.6% in value

and -1.0% in volume. On a reported basis, sales were down -2.9%,

mainly driven by the negative impact of exchange rates (-5.5%) that

resulted from currencies’ depreciation against the euro in the

United States, Latin America, Indonesia, Turkey and Russia. On the

other hand, reported sales benefited from a slightly positive scope

effect (+0.5%), as well as the +0.4% organic contribution of

hyperinflation geographies to growth.

In the second

quarter, sales increased by +6.6% on a

like-for-like basis, with value up +4.7% and volumes +1.8%.

Reported sales rose +3.6%, mainly impacted by a still strong

negative effect of -4.0% from exchange rates.

In terms of regional dynamics,

strong growth was broad-based in the second quarter. Europe and

North America sales were up +6.4% on a like-for-like basis, led by

the recovery in Waters, as well as sustained solid momentum for

EDP, and a return to growth for Specialized Nutrition. Sales in the

Rest of the World increased by +6.9% on a like-for-like basis,

notably led by the softer basis of comparison in EDP and

Waters.

|

€ millionexcept % |

Q22020 |

Q2 2021 |

Reported change |

LFL Sales Growth |

Volume Growth |

H12020 |

H12021 |

Reported change |

LFL Sales Growth |

Volume Growth |

|

BY REPORTING ENTITY |

|

|

|

|

|

|

|

|

|

|

|

EDP |

3,238 |

3,254 |

+0.5% |

+4.8% |

+2.2% |

6,599 |

6,406 |

-2.9% |

+3.2% |

+1.3% |

|

Specialized Nutrition |

1,792 |

1,793 |

+0.1% |

+2.8% |

-1.4% |

3,739 |

3,513 |

-6.0% |

-2.6% |

-4.3% |

|

Waters |

925 |

1,125 |

+21.6% |

+19.5% |

+6.6% |

1,851 |

1,916 |

+3.5% |

+4.5% |

-2.3% |

|

BY GEOGRAPHICAL AREA |

|

|

|

|

|

|

|

|

|

|

|

Europe & Noram1 |

3,352 |

3,510 |

+4.7% |

+6.4% |

+4.1% |

6,822 |

6,784 |

-0.6% |

+1.7% |

+0.7% |

|

Rest of the World |

2,602 |

2,661 |

+2.3% |

+6.9% |

-0.0% |

5,368 |

5,051 |

-5.9% |

+1.4% |

-2.2% |

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL |

5,954 |

6,171 |

+3.6% |

+6.6% |

+1.8% |

12,189 |

11,835 |

-2.9% |

+1.6% |

-1.0% |

1North America (Noram): United States and

CanadaRecurring Operating Margin

Danone’s recurring operating income reached

€1.6bn in H1 2021. Recurring operating margin stood at

13.1%,

down -86 basis points (bps) on a reported basis and -83 bps on a

like-for-like basis. This change was mainly driven by the negative

impact of input costs inflation as well as a negative category mix,

for a combined impact of -490 bps. These headwinds were partially

offset by the effects of valorization and productivity that added

+430 bps to the margin in the first half, as Danone reinvested

selectively in its brands. Reported margin also reflects the

negative impact of its change in scope (-16 bps), the positive

currency impact (+15 bps), and +3 bps reflecting the impact of

organic contribution from hyperinflation geographies.

|

Recurring operating profit (€m) and margin (%) |

H1 2020 |

H1 2021 |

Change |

|

€m |

Margin (%) |

€m |

Margin (%) |

Reported |

Like-for-like |

|

BY REPORTING ENTITY |

|

|

|

|

|

|

|

EDP |

598 |

9.1% |

584 |

9.1% |

+5 bps |

-4 bps |

|

Specialized Nutrition |

987 |

26.4% |

804 |

22.9% |

-351 bps |

-293 bps |

|

Waters |

117 |

6.3% |

163 |

8.5% |

+219 bps |

+185 bps |

|

BY GEOGRAPHICAL AREA |

|

|

|

|

|

|

|

Europe & Noram2 |

880 |

12.9% |

898 |

13.2% |

+34 bps |

+34 bps |

|

Rest of the World |

822 |

15.3% |

653 |

12.9% |

-239 bps |

-245 bps |

|

|

|

|

|

|

|

|

|

Total |

1,702 |

14.0% |

1,551 |

13.1% |

-86 bps |

-83 bps |

2North America (Noram): United States and

CanadaPerformance by reporting entity

- ESSENTIAL DAIRY AND

PLANT-BASED (EDP)

Essential Dairy &

Plant-based posted sales growth of +3.2% in H1 2021 on a

like-for-like basis and recurring operating margin remained broadly

stable at 9.1%, with strong productivity mitigating the heightened

milk inflation.

In the second quarter, sales

accelerated from Q1, reaching +4.8% on a like-for-like basis,

reflecting a +2.2% increase in volume and +2.6% in value. The

Essential Dairy portfolio delivered solid growth while Plant-based

posted its 6th quarter of double-digit growth. Europe and

Noram delivered another quarter of solid growth, led by

the Plant-based, Probiotics and Protein platforms. In Europe, Alpro

registered another quarter of steep double-digit growth on the back

of strong investments and global market share gains, while

Probiotics showed solid growth led by Actimel. Noram posted its

second successive record sales quarter, led by yogurt returning to

broad-based growth and share gains led by Oikos, Two Good and

Activia, with sustained growth in Creamers, and its highest ever

share in Premium Dairy. In Plant-based, growth was led by Creamers

and Yogurt. In the Rest of the World, sales growth

was strong, thanks to the favorable basis of comparison in Latam

and Africa, while CIS performance remained soft amid a challenging

macro-economic and sanitary environment.

Specialized Nutrition sales declined -2.6% in

H1 2021 on a like-for-like basis. Recurring operating margin

decreased by -351 bps to 22.9%, strongly impacted by a negative

country mix.

In the second

quarter, sales increased by +2.8% on a

like-for-like basis, with a decrease of -1.4% in volume and an

increase of +4.2% in value, after a heavily negative first quarter.

Adult Nutrition, which now represents

approximately 15% of Specialized Nutrition revenues, delivered high

single-digit sales growth, with all geographies and all segments

contributing. Infant Nutrition posted low

single-digit sales growth. In Europe, sales grew by high single

digits on a back of softer bases of comparison. In China,

performance remained polarized. Domestic labels posted positive

growth in the quarter, despite the very high base of comparison,

leading to a semester growing at around mid single digits.

E-commerce platforms for International labels delivered very strong

growth, while indirect cross-border channels, which include

Daigous, Friends&Family and the Hong-Kong platform, continued

to be under pressure and declined within the -45% to -60% range

they delivered in the second half of 2020. Aptamil market share

continued to be resilient. In other regions, Danone’s platforms

delivered another solid quarter of growth.

Waters sales increased by +4.5%

in H1 2021 on a like-for-like basis, driven by the gradual recovery

in volumes and a positive country and product mix. Recurring

operating margin was up +219 bps to 8.5%, despite a strong

inflationary environment, thanks to the volume recovery, a positive

product mix, and strong efforts on productivity, including plastic

hedging.

In the second

quarter, sales were up +19.5% on a like-for-like

basis, led by volumes up +6.6% and value +12.9%.

Europe delivered steep double-digit growth on the

back of recovering mobility, as well as market share gains in key

markets including France, Germany, the UK and Poland.

In the Rest of the World, Mizone

closed its third consecutive positive quarter in China, delivering

low double-digit growth in the second quarter, and continued to

gain market share as it enters the peak season for consumption.

Indonesia and Latin America platforms delivered steep double-digit

growth in the quarter, from a lower basis of comparison, but

mobility is still restricted and highly volatile as both regions

remain heavily exposed to Covid infections and have low vaccination

rates.

Net income and Earnings per

share

Other operating income and

expense reached -€700 million vs -€123 million in the

prior year, resulting mostly from the Local First project and the

transformation of Danone’s operations. As a result, reported

operating margin was down -576 bps from 13.0% to 7.2%.

Net financial costs were down

by €42 million to -€129 million, resulting notably from a decrease

in the cost of net debt due to two bond reimbursements in 2020

issued at higher interest rates, as well as a new bond issuance at

0% coupon in June 2021. The Recurring income tax

rate stood at 27.5%, broadly in line with the prior year.

The Recurring net income from associates decreased

significantly from €21 million to €9 million, reflecting mainly the

disposal of Danone’s stakes in Mengniu and Yakult. Danone is also

engaged in a disposal process of its 20% stake in the Fresh Dairy

JV with Mengniu, which is thus classified as an asset held for sale

under IFRS 5 as from June 30, 2021. Recurring

minority interests stood at €40 million,

broadly in line with the prior year, reflecting a performance

across entities with minorities still under pressure.

As a result, Recurring

EPS was €1.53, down -9.3% vs. last year, but Reported EPS

increased by 5.1% to €1.63.

|

|

H1 2020 |

H1 2021 |

|

|

in millions of euros except if stated otherwise |

Recurring |

Non-recurring |

Total |

|

Recurring |

Non-recurring |

Total |

|

|

Recurring operating income |

1,702 |

|

1,702 |

|

1,551 |

|

1,551 |

|

|

Other operating income and expense |

|

(123) |

(123) |

|

|

(700) |

(700) |

|

|

Operating income |

1,702 |

(123) |

1,580 |

|

1,551 |

(700) |

851 |

|

|

Cost of net debt |

(110) |

|

(110) |

|

(87) |

|

(87) |

|

|

Other financial income and expense |

(60) |

0 |

(60) |

|

(43) |

0 |

(42) |

|

|

Income before taxes |

1,532 |

(123) |

1,410 |

|

1,422 |

(699) |

722 |

|

| Income

tax |

(414) |

36 |

(378) |

|

(391) |

173 |

(218) |

|

|

Effective tax rate |

27.0% |

|

26.8% |

|

27.5% |

|

30.2% |

|

|

Net income from fully consolidated companies |

1,118 |

(86) |

1,032 |

|

1,031 |

(527) |

504 |

|

| Net income

from associates |

21 |

0 |

22 |

|

9 |

593 |

602 |

|

| Net

income |

1,139 |

(86) |

1,053 |

|

1,040 |

66 |

1,106 |

|

|

• Group share |

1,100 |

(86) |

1,015 |

|

1,000 |

68 |

1,068 |

|

|

• Non-controlling interests |

39 |

(0) |

39 |

|

40 |

(2) |

38 |

|

|

EPS (€) |

1.68 |

|

1.55 |

|

1.53 |

|

1.63 |

|

Cash flow and Debt

Free cash flow reached €1,009

million in H1 2021, up +8.6% from the prior year, reflecting

persistent pressure on operating performance. This implies a cash

conversion rate of 8.5%, up +90 bps from H1 2020. Capex stood at

€390 million, broadly stable compared to last year (€381 million in

H1 2020).

As of June 30, 2021, Danone’s net debt

stood at €11.1 bn, down

€827 million from December 31, 2020.

II. 2021 OUTLOOK AND

GUIDANCE

Macro-economic outlookDespite

short-term uncertainties, a gradual reopening of economies is

assumed to continue in H2 as vaccination programs are rolled out.

Meanwhile, a broad-based acceleration of inflation in milk,

ingredients, packaging and logistics is expected.

2021 guidance reiteratedDanone

expects to return to profitable growth in H2, and FY recurring

operating margin is expected to be broadly in line with 2020.

III.

SHARE BUYBACK

As announced in February in the press release on

the conversion and disposal of Danone’s stake in Mengniu, and in

line with its disciplined capital allocation, Danone expects to buy

back up to €800m worth of shares, in one or more tranches, in the

second half of 2021.

IV.

MAJOR DEVELOPMENTS OVER THE PERIOD

Change in management

On May 17, 2021, Danone announced the

appointment of Antoine de Saint-Affrique as Chief Executive

Officer, effective September 15, 2021, following a rigorous

selection process led by the Governance Committee. Antoine de

Saint-Affrique will succeed the joint interim leadership of

Véronique Penchienati-Bosetta and Shane Grant. His appointment as a

new member of the Board of Danone will be proposed at the next

annual shareholders’ meeting in April 2022.

Major financial

transactions

- April

29,

2021: At Danone’s 2021 Annual General

Meeting, Shareholders approved all resolutions submitted to a vote,

including the proposed dividend of €1.94 per share in cash, as well

as the proposed renewals of terms of office as members of the Board

of Directors of Guido Barilla, Cécile Cabanis, Michel Landel and

Serpil Timuray, and the ratification of the co-opting of Gilles

Schnepp as Director.

- May 13, 2021:

Danone announced that it had finalized the strategic sale of its

approximately 9.8% stake in China Mengniu Dairy Company Limited,

originally announced on May 12, 2021. The transaction resulted in

total gross proceeds of HKD 15.4 billion, representing c. €1.6

billion, for a book value of €850 million (as of 31/12/2020). The

settlement of the transaction took place on May 17, 2021.

- May 25, 2021:

Danone issued a €1 billion bond with a 4.5-year maturity and a 0%

coupon. In line with the company’s active liquidity management,

this issue enables Danone to take further advantage of market

windows to enhance its funding flexibility, extend the maturity of

its debt and optimize its cost.

- June 17, 2021:

Danone signed an agreement to sell Vega, the Canada and US

plant-based nutritional products business, to funds managed by WM

Partners, a US-based private equity investment firm focused on the

health and wellness industry. The sale of Vega is part of Danone’s

continuous capital allocation optimization and of the strategic

review of Danone’s portfolio of brands, SKUs and assets announced

in October 2020. The deal was closed on July

28.

- June 30, 2021:

Danone Manifesto Ventures announced that it acquired an additional

majority stake in Harmless Harvest, becoming its majority

shareholder. Harmless Harvest is a leader in organic coconut-based

products including coconut water and dairy-free coconut yogurt

alternatives.

- July 29, 2021:

S&P Global Ratings assigned Danone an ESG Evaluation score of

85/100. This reflects Danone’s comprehensive sustainability

strategy, viewed as strongly embedded in its broader long-term

strategy, decision-making, and culture. As a result, Danone is

confirmed as one of the companies most prepared to take advantage

of long-term trends in the food and beverage industry and adapt to

potential disruptions.

V. IFRS STANDARDS AND

FINANCIAL INDICATORS NOT DEFINED IN IFRS

IAS29: impact on reported

data

Danone has been applying IAS 29 in

hyperinflation countries as defined in IFRS. Adoption of IAS 29 in

these hyperinflationary countries requires its non-monetary assets

and liabilities and its income statement to be restated to reflect

the changes in the general pricing power of its functional

currency, leading to a gain or loss on the net monetary position

included in the net income. Moreover, its financial statements are

converted into euros using the closing exchange rate of the

relevant period.

|

IAS29: impact on reported data €

million except % |

Q2

2021 |

|

H1 2021 |

|

|

Sales |

4 |

|

15 |

|

|

Sales growth (%) |

+0.07% |

|

+0.13% |

|

|

Recurring Operating Income |

|

|

-15 |

|

|

Recurring Net Income – Group share |

|

|

-12 |

|

Breakdown by quarter of first-half 2021 sales

after application of IAS 29H1 2021 sales correspond to the addition

of:

- Q2 2021

reported sales;

- Q1 2021 sales

resulting from the application of IAS29 until June 30, 2021 to

sales of entities of hyperinflation countries (application of the

inflation rate until June 30, 2021 and translation into euros using

June 30, 2021 closing rate) and provided in the table below for

information (unaudited data).

|

€ million |

Q1 20211 |

Q2 2021 |

H1 2021 |

|

EDP |

3,153 |

3,254 |

6,406 |

|

Specialized Nutrition |

1,721 |

1,793 |

3,513 |

|

Waters |

791 |

1,125 |

1,916 |

|

|

|

|

|

|

Total |

5,664 |

6,171 |

11,835 |

1 Results from the application of IAS29 until

June 30, 2021 to Q1 sales of entities of hyperinflation

countries.

Financial indicators not defined in

IFRS

Due to rounding, the sum of values presented may

differ from totals as reported. Such differences are not

material.

Like-for-like changes in sales,

recurring operating income and recurring operating margin reflect

Danone's organic performance and essentially exclude the impact

of:

- changes in

consolidation scope, with indicators related to a given fiscal year

calculated on the basis of previous-year scope, both previous-year

and current-year scopes excluding entities in countries under

hyperinflation according to IAS 29 during the previous year (as for

Argentinian entities since January 1st, 2019);

- changes in

applicable accounting principles;

- changes in

exchange rates with both previous-year and current-year indicators

calculated using the same exchange rates (the exchange rate used is

a projected annual rate determined by Danone for the current year

and applied to both previous and current years).

Bridge from reported data to

like-for-like data

|

(€ million except %) |

H1 2020 |

Impact of changesin scope of

consolidation |

Impact of changes in exchange rates and others, including

IAS29 |

Organic contribution from

hyperinflation countries |

Like-for-like growth |

H1 2021 |

|

|

|

|

|

|

|

|

|

Sales |

12,189 |

+0.5% |

-5.5% |

+0.4% |

+1.6% |

11,835 |

|

Recurring operating margin |

14.0% |

-16 bps |

+9 bps |

+3 bps |

-83 bps |

13.1% |

Recurring operating income is

defined as Danone’s operating income excluding Other operating

income and expenses. Other operating income and expenses comprise

items that, because of their significant or unusual nature, cannot

be viewed as inherent to Danone’s recurring activity and have

limited predictive value, thus distorting the assessment of its

recurring operating performance and its evolution. These mainly

include:

- capital gains

and losses on disposals of fully consolidated companies;

- impairment

charges on intangible assets with indefinite useful lives;

- costs related

to strategic restructurings or transformation plans;

- costs related

to major external growth transactions;

- costs related

to major crisis and major litigations;

- in connection

with of IFRS 3 (Revised) and IAS 27 (Revised) relating to business

combinations, (i) acquisition costs related to business

combinations, (ii) revaluation profit or loss accounted for

following a loss of control, and (iii) changes in earn-outs

relating to business combinations and subsequent to acquisition

date.

Recurring operating margin is

defined as Recurring operating income over Sales ratio.

Other non-recurring financial income and

expense corresponds to financial income and expense items

that, in view of their significant or unusual nature, cannot be

considered as inherent to Danone’s recurring financial management.

These mainly include changes in value of non-consolidated

interests.

Non-recurring income tax

corresponds to income tax on non-recurring items as well as tax

income and expense items that, in view of their significant or

unusual nature, cannot be considered as inherent to Danone’s

recurring performance.

Recurring effective tax rate

measures the effective tax rate of Danone’s recurring performance

and is computed as the ratio income tax related to recurring items

over recurring net income before tax.

Non-recurring results from

associates include items that, because of their

significant or unusual nature, cannot be viewed as inherent to the

recurring activity of those companies and thus distort the

assessment of their recurring performance and its evolution. These

mainly include (i) capital gains and losses on disposal and

impairment of Investments in associates, and (ii) non-recurring

items, as defined by Danone, included in the net income from

associates.

Recurring net income (or

Recurring net income – Group Share) corresponds to the Group share

of the consolidated Recurring net income. The Recurring net income

excludes items that, because of their significant or unusual

nature, cannot be viewed as inherent to Danone’s recurring activity

and have limited predictive value, thus distorting the assessment

of its recurring performance and its evolution. Such non-recurring

income and expenses correspond to Other operating income and

expenses, Other non-recurring financial income and expenses,

Non-recurring income tax, and Non-recurring income from associates.

Such income and expenses, excluded from Net income, represent

Non-recurring net income.

Recurring EPS (or Recurring net

income – Group Share, per share after dilution) is defined as the

ratio of Recurring net income adjusted for hybrid financing over

Diluted number of shares. In compliance with IFRS, income used to

calculate EPS is adjusted for the coupon related to the hybrid

financing accrued for the period and presented net of tax.

|

|

H1 2020 |

|

H1 2021 |

|

|

Recurring |

|

Total |

|

Recurring |

|

Total |

|

|

Net income-Group share (€ million) |

1,100 |

|

1,015 |

|

1,000 |

|

1,068 |

|

|

Coupon related to hybrid financing net of tax (€ million) |

(7) |

|

(7) |

|

(8) |

|

(8) |

|

|

Number of shares |

|

|

|

|

|

|

|

|

|

• Before dilution |

648,871,267 |

|

648,871,267 |

|

650,135,856 |

|

650,135,856 |

|

|

• After dilution |

649,710,104 |

|

649,710,104 |

|

650,695,040 |

|

650,695,040 |

|

|

EPS (€) |

|

|

|

|

|

|

|

|

|

• Before dilution |

1.68 |

|

1.55 |

|

1.53 |

|

1.63 |

|

|

• After dilution |

1.68 |

|

1.55 |

|

1.53 |

|

1.63 |

|

Free cash flow represents cash

flows provided or used by operating activities less capital

expenditure net of disposals and, in connection with IFRS 3

(Revised), relating to business combinations, excluding (i)

acquisition costs related to business combinations, and (ii)

earn-outs related to business combinations and paid subsequently to

acquisition date.

|

(€ million) |

H1 2020 |

H1 2021 |

|

Cash-flow from operating activities |

1,305 |

1,381 |

|

Capital expenditure |

(381) |

(390) |

|

Disposal of tangible assets & transaction fees related to

business combinations1 |

5 |

17 |

|

Free cash-flow |

929 |

1,009 |

1 Represents acquisition costs related to business combinations

paid during the period.

Net financial debt represents

the net debt portion bearing interest. It corresponds to current

and non-current financial debt (i) excluding Liabilities related to

put options granted to non-controlling interests and earn-outs on

acquisitions resulting in control and (ii) net of Cash and cash

equivalents, Short term investments and Derivatives – assets

managing net debt.

|

(€ million) |

December 31, 2020 |

June 30, 2021 |

|

Non-current financial debt |

12,343 |

12,733 |

|

Current financial debt |

4,157 |

4,922 |

|

Short-term investments |

(3,680) |

(5,686) |

|

Cash and cash equivalents |

(593) |

(604) |

|

Derivatives — non-current assets1 |

(259) |

(179) |

|

Derivatives — current-assets1 |

(27) |

(72) |

|

Net debt |

11,941 |

11,114 |

- Liabilities related to put options granted to non-controlling

interests — non-current

|

(7) |

(47) |

- Liabilities related to put options granted to non-controlling

interests and earn-outs on acquisitions resulting in control —

current

|

(355) |

(380) |

|

Net financial debt |

11,579 |

10,687 |

1 Managing net debt only

o o O o o

FORWARD-LOOKING STATEMENTS

This press release contains certain

forward-looking statements concerning Danone. In some cases, you

can identify these forward-looking statements by forward-looking

words, such as “estimate”, “expect”, “anticipate”, “project”,

“plan”, “intend”, “objective”, “believe”, “forecast”, “guidance”,

“foresee”, “likely”, “may”, “should”, “goal”, “target”, “might”,

“will”, “could”, “predict”, “continue”, “convinced” and

“confident,” the negative or plural of these words and other

comparable terminology. Forward looking statements in this document

include, but are not limited to, predictions of future activities,

operations, direction, performance and results of Danone.

Although Danone believes its expectations are

based on reasonable assumptions, these forward-looking statements

are subject to numerous risks and uncertainties, which could cause

actual results to differ materially from those anticipated in these

forward-looking statements. For a detailed description of these

risks and uncertainties, please refer to the “Risk Factor” section

of Danone’s Universal Registration Document (the current version of

which is available at www.danone.com).

Subject to regulatory requirements, Danone does

not undertake to publicly update or revise any of these

forward-looking statements. This document does not constitute an

offer to sell, or a solicitation of an offer to buy Danone

securities.

The

presentation to analysts and investors, held by

interim co-CEOs Véronique

Penchienati-Bosetta and Shane Grant, and CFO

Juergen Esser, will be broadcast live today from

9:00 a.m. (Paris time) on Danone’s website

(www.danone.com).

Related slides will also be available on the website in the

Investors section.

APPENDIX – Sales by reporting entity and

by geographical area (in € million)

| |

First quarter |

Second quarter |

First half |

| |

2020 |

2021 |

2020 |

2021 |

2020 |

2021 |

|

BY REPORTING ENTITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EDP |

3,364 |

3,149 |

3,238 |

3,254 |

6,599 |

6,406 |

|

Specialized Nutrition |

1,949 |

1,719 |

1,792 |

1,793 |

3,739 |

3,513 |

|

Waters |

928 |

790 |

925 |

1,125 |

1,851 |

1,916 |

|

BY GEOGRAPHICAL AREA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Europe & Noram1 |

3,469 |

3,273 |

3,352 |

3,510 |

6,822 |

6,784 |

|

Rest of the World |

2,772 |

2,384 |

2,602 |

2,661 |

5,368 |

5,051 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

6,242 |

5,657 |

5,954 |

6,171 |

12,189 |

11,835 |

| |

First quarter 2021 |

Second quarter 2021 |

First half 2021 |

| |

Reported change |

Like-for-like change |

Reported change |

Like-for-like change |

Reported change |

Like-for-like change |

|

BY REPORTING ENTITY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EDP |

-6.4% |

+1.6% |

+0.5% |

+4.8% |

-2.9% |

+3.2% |

|

Specialized Nutrition |

-11.8% |

-7.7% |

+0.1% |

+2.8% |

-6.0% |

-2.6% |

|

Waters |

-14.9% |

-11.6% |

+21.6% |

+19.5% |

+3.5% |

+4.5% |

|

BY GEOGRAPHICAL AREA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Europe & Noram1 |

-5.6% |

-2.8% |

+4.7% |

+6.4% |

-0.6% |

+1.7% |

|

Rest of the World |

-14.0% |

-4.2% |

+2.3% |

+6.9% |

-5.9% |

+1.4% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

-9.4% |

-3.3% |

+3.6% |

+6.6% |

-2.9% |

+1.6% |

1North America (Noram): United States and

Canada

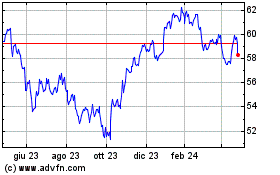

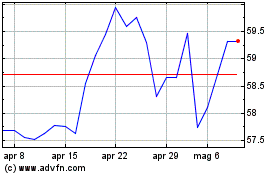

Grafico Azioni Danone (EU:BN)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Danone (EU:BN)

Storico

Da Apr 2023 a Apr 2024