Diverging Covid-19 Aftermath Leads Gap to Leave UK While Primark Capitalizes on Its Exit

01 Luglio 2021 - 12:05PM

Dow Jones News

--Retailers take different paths as U.K. economy reopens, with

some enjoying a sales boost while other wind down operations

--AB Foods' Primark in 3Q more than offset lost sales on account

of Covid-19, generating revenue of GBP1.61 billion

--Conversely, a stagnating brand and high costs has prompted Gap

to shed all of its stores in the U.K. and Ireland, and it has plans

for further exits across Europe

By Matteo Castia

The road to recovery from the coronavirus pandemic could hardly

be more diverse among major players in the clothing retail sector,

with Primark experiencing a roaring return to business amid easing

restrictions while Gap seeks exits.

Gap Inc. said Thursday that it will close all of its physical

stores in the U.K. and Ireland and shift to an online-only model.

The company, which has operated in the U.K. since 1987 and in

Ireland since 2006, said it is in talks to sell its stores in

France and Italy too, as it aims to find more cost-effective ways

to maintain a presence in Europe.

While shedding expensive rents makes sense for Gap as its

business in Europe languishes, Primark--the retail arm of

Associated British Foods PLC--has been experiencing a buoyant

return to in-store sales, driving the U.K. conglomerate's

third-quarter revenue up 47% on the year and getting ready to

capitalize on Gap's departure.

"Primark, one of the big fashion chains left standing, is likely

to clean up from GAP's exodus, attracting browsing shoppers whose

options are dwindling. It is still turning heads on the high

street, while one by one other fashion retailers fall by the

wayside," Hargreaves Lansdown analyst Susannah Streeter said.

While Gap seems to be going all-in for e-commerce, Primark's

store-only model appears to continue to succeed, as the retailer

generated quarterly revenue of 1.61 billion pounds ($2.23 billion),

more than offsetting the GBP1.10 billion of lost sales owing to the

pandemic.

Even more remarkably, this result has been achieved even without

the lifting of all restrictions, which have kept opening hours,

store capacity and tourism limited. "There is still more to go for,

with tourism travel and opening hours restrictions still in place,"

Interactive Investor analyst Richard Hunter said.

"A tale of two very different retailers has unfolded with Gap

closing U.K. shops for good to go online only, while with these

impressive numbers, Primark seems even more unlikely to reverse its

decision not to launch a digital sales platform," Ms. Streeter

said.

Write to Matteo Castia at matteo.castia@dowjones.com

(END) Dow Jones Newswires

July 01, 2021 06:01 ET (10:01 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

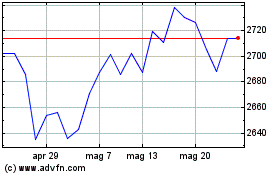

Grafico Azioni Associated British Foods (LSE:ABF)

Storico

Da Mar 2024 a Apr 2024

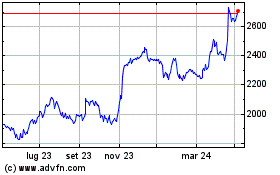

Grafico Azioni Associated British Foods (LSE:ABF)

Storico

Da Apr 2023 a Apr 2024