Dollar Down On Democratic Lead, Stimulus Hopes

09 Ottobre 2020 - 10:55AM

RTTF2

The U.S. dollar depreciated against its most major counterparts

in the European session on Friday, as a jump in Democratic

presidential candidate Joe Biden's lead over President Donald Trump

in several polls and renewed hopes for a U.S. stimulus deal boosted

investor sentiment.

Reuters/Ipsos opinion polls showed Biden ahead by 10 percentage

points over Trump.

Growing hopes for a Democratic victory in the November election

and the prospect of significant further stimulus reduced the demand

for the safe-haven currency.

The Trump administration indicated on Thursday night that it was

open to a broader coronavirus stimulus package - one that includes

support for airlines, state and local government aid, and jobless

benefits.

U.S. House Speaker Nancy Pelosi and Treasury Secretary Steven

Mnuchin resumed their talks over the coronavirus aid plan, after

Trump abruptly called off negotiations earlier this week.

Better-than-expected China services PMI also aided

sentiment.

The Caixin composite services Purchasing Managers' Index for

China rose to 54.8 in September from 54.0 in August, marking the

fifth consecutive increase in service sector output. The expansion

was underpinned by a sustained rise in total new business.

The greenback eased back to 105.83 against the yen, on track to

pierce a 2-day low of 105.81 seen in the Asian session. The dollar

is seen finding support around the 104.00 mark.

The greenback fell to 0.9122 against the franc, which was its

weakest level since September 21. Next key support for the

greenback is likely seen around the 0.90 level.

The greenback declined to more than a 2-week low of 1.1809

against the euro, versus Thursday's closing quote of 1.1758. The

greenback is likely to face support around the 1.20 region, if it

drops again.

Reversing from its early highs of 1.3196 against the loonie,

0.7167 against the aussie and 0.6575 against the kiwi, the

greenback dropped to a 3-week low of 1.3160, 3-day lows of 0.7195

and 0.6623, respectively. The next possible support for the

greenback is seen around 1.29 against the loonie, 0.75 against the

aussie and 0.68 against the kiwi.

In contrast, the greenback rebounded from a 3-day low of 1.2973

against the pound and was trading at 1.2922. If the dollar

strengthens further, 1.28 is seen as its next resistance level.

Data from the Office for National Statistics showed that the UK

economy grew at a moderate pace in August as lockdown measures

continued to ease.

Gross domestic product climbed 2.1 percent on month, slower than

the 6.4 percent expansion seen in July.

U.S. wholesale inventories for August will be released in the

New York session.

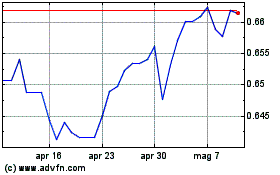

Grafico Cross AUD vs US Dollar (FX:AUDUSD)

Da Mar 2024 a Apr 2024

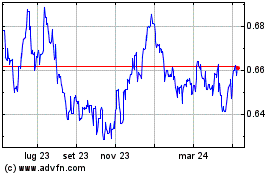

Grafico Cross AUD vs US Dollar (FX:AUDUSD)

Da Apr 2023 a Apr 2024