TIDMDOM

RNS Number : 8109V

Domino's Pizza Group PLC

16 December 2021

LEI: 213800Q6ZKHAOV48JL75

16 December 2021

DOMINO'S PIZZA GROUP PLC

Resolution with franchisees heralds new era of collaboration and

accelerated growth

Domino's Pizza Group plc ("DPG" or "the Company") is pleased to

announce that it has reached resolution (the "Resolution") with its

franchisees to unlock the significant latent potential of the

Domino's system and accelerate both near-term and long-term

growth.

DPG believes the Resolution is a great outcome for all

stakeholders: both DPG and franchisees' long-term growth and

profitability stand to improve with increased system sales and more

new store openings, customers will benefit from further

strengthened innovation and service, employees in the system will

benefit from further recruitment and a more collaborative and

growth-oriented environment, and shareholders will benefit from

enhanced value creation.

Despite a long history of strong performance, the Board

recognises that in recent years DPG has lagged comparable Domino's

businesses around the world. This Resolution unlocks an issue which

has held the Company back and means DPG and its franchisees can

begin a new era of collaboration in which the system can realise

its full potential.

The Resolution was reached between the Domino's Franchisee

Association ("DFA") and DPG, and has received overwhelming support

with franchisees representing over 99% of UK stores voting in

favour of the Resolution.

Following the launch of a new strategy and capital allocation

framework in March the Company has made significant strategic

progress this year and is building strong momentum. We have made

excellent digital progress with our new App, launched our

'Domin-Oh-Hoo-Hoo' integrated media campaign, opened a new supply

chain centre, exited international markets, and continued to

recruit top talent to the Company. All this has been done in the

midst of a challenging operating environment. We are now delighted

to finish the year with a great Resolution with our

franchisees.

Terms of the Resolution

Under the Resolution, and consistent with our strategic growth

plan, DPG will make strategic investments in the system to improve

capabilities and drive system sales growth primarily through order

count. Specifically, the Company has committed to:

-- One-time capital investment of approximately GBP20m, spread

over three years, in digital acceleration, personalisation,

ecommerce app development and in-store innovation to enhance the

customer experience and drive top-line growth;

-- Increased marketing investment to support new national campaigns and promotions;

-- An enhanced food rebate mechanism for franchisees to

encourage order growth, which is conditional on franchisees meeting

new store opening targets and order count thresholds; and

-- An improved new store incentive scheme to reward, encourage

and accelerate new store openings.

In return for DPG's investments, franchisees have agreed to the

following important commitments, which also aim to drive system

sales growth through increased order count:

-- A commitment to an enhanced schedule of new store openings,

equating to at least 45 new stores to be opened per annum over the

next three years, significantly ahead of levels achieved in

previous years;

-- A commitment to participate in new national promotional deals

focused on both delivery and collection, in contrast to a lack of

national advertising and promotions in recent years;

-- An agreement to prioritise, test, and roll-out new technology

and product innovation (such as GPS tracking) and to test new store

formats, which would bring the DPG system in-line with peer

companies; and

-- Support for changes by DPG aimed at driving efficiency across the system.

The Resolution will run for an initial period of three years

from 3 January 2022.

Financial Guidance

DPG expects results for FY21 to be in line with

expectations.

In FY22, DPG expects an acceleration in system sales growth

(excluding the benefit of the reduced rate of VAT), largely driven

by increased store openings and an acceleration in LFL growth due

to the operating and capital investments associated with the

Resolution. Despite the investments associated with the Resolution,

the Company expects FY22 underlying EBITDA(1) and EPS(2) to be in

line with current market expectations. Furthermore, both DPG and

its franchisees are now positioned to drive higher system sales and

profitability, through the medium and longer-term.

The Company is also increasing its medium-term expectations and

now expects to achieve at least the upper end of the previously

announced targets of GBP1.6bn - GBP1.9bn of system sales and exceed

the medium-term target of 200 new stores. DPG can now drive growth

by capitalising on deeper collaboration and significant

opportunities such as increasing collection, leveraging national

advertising campaigns, increasing menu innovation, reducing

delivery times, improving digital innovation, and enhancing its

value orientation. The operating environment remains challenging

however we have shown throughout the pandemic that the strength of

our delivery business, brand and vertically integrated business

model can operate successfully and deliver strong results.

DPG's one-time capital expenditure related to the Resolution

will equate to approximately GBP20m over three years, which will

result in a temporary increase in depreciation over the next few

years, normalising thereafter. In FY22, we anticipate investments

in the business to be weighted toward the first half of the

year.

DPG has a highly cash generative, asset-light business model

which is underpinned by a clear capital allocation framework. Our

first priority is to invest in the business to drive long-term

organic growth. We will continue to maximise shareholder returns

through a sustainable and progressive dividend and distributing an

annual allocation of surplus cash through share buybacks. In FY21

we have returned GBP136m of surplus capital to shareholders via

dividends and share buybacks and will update the market with

guidance for the FY22 dividend and buyback programme at the full

year results in March 2022.

Dominic Paul, Chief Executive Officer, said:

"This is an important moment for Domino's, and I'm delighted we

have reached what is truly a great resolution with our

franchisees.

"We saw first-hand through the pandemic how, when we work

together, we win together. I firmly believe that the resolution we

have reached is a good one for franchisees, our people, and our

shareholders. It means that our interests are aligned, and we are

now in an even stronger position to execute our strategic plan. Our

franchisees are truly world-class, and we are looking forward to

accelerating our growth together.

"Our business continues to perform strongly, and we are looking

to the future with confidence. Combined with our new strategic plan

which is focused on accelerating our growth in both delivery and

collection, the resolution we are announcing today can unleash the

power of the Domino's brand, and enable us to deliver long-term,

sustainable growth which will benefit all our stakeholders."

Mark Millar, DFA Chairman, said:

"This framework for growth is the result of many months of

discussions, and the DFA and its members are pleased to have

reached an agreement that brings Domino's and its franchisees

closer together and enables us to focus on a future that delivers

growth for all. The DFA represents the overwhelming majority of

franchisees and what unites all of us is our belief in, and passion

for, the Domino's brand.

"We are excited about the opportunities ahead and look forward

to working closely with the management team at Domino's to deliver

the full potential of the brand."

1. Underlying EBITDA is defined as underlying earnings before

tax, interest, depreciation and amortisation

2. Underlying EPS is defined as underlying basic earnings per share

Analyst and Investor call

A call for investors and analysts will be held at 9am (GMT)

today. The call can be accessed via the registration link and will

also be available on the Results, Reports and Presentations page of

our corporate website.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulations (EU) No. 596/2014

("MAR") and is disclosed in accordance with DPG's obligations under

Article 17 of MAR.

The person responsible for making this notification is Adrian

Bushnell, Company Secretary.

For further information, please contact:

Domino's Pizza Group plc:

Will MacLaren, Head of Investor Relations - 07443 192 118

Brunswick:

Tim Danaher, Samantha Chiene - 020 7404 5959

About Domino's Pizza Group

Domino's Pizza Group plc is the UK's leading pizza brand and a

major player in the Irish market. We hold the master franchise

agreement to own, operate and franchise Domino's stores in the UK

and the Republic of Ireland. We also have an associate investment

in Germany and Luxembourg.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBIBDDXUBDGBU

(END) Dow Jones Newswires

December 16, 2021 02:00 ET (07:00 GMT)

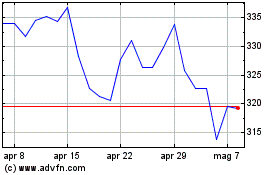

Grafico Azioni Domino's Pizza (LSE:DOM)

Storico

Da Mar 2024 a Apr 2024

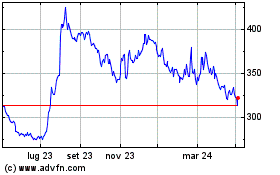

Grafico Azioni Domino's Pizza (LSE:DOM)

Storico

Da Apr 2023 a Apr 2024