ESI building a foundation for improved

long-term growth and profitability

- First quarter revenues: +1.2% (+3.7% constant exchange rate

- cer) at €55.5m

- Clear roadmap aligning all Group efforts to accelerate

revenue growth

- Team focused on growing New Business pipeline in

2021

- Committed to continuing to manage costs in 2021

Regulatory News:

ESI Group, Paris, France,

(ISIN Code: FR0004110310, Symbol: ESI), today releases its sales

for the first quarter of 2021 (period from January 1st to March

31st).

Cristel de Rouvray, Chief Executive Officer of ESI Group,

comments: “Q1 2021 confirmed the resiliency of ESI

Group’s business model: our existing customers, and even more so

our top 20 customers have clearly signaled their need for more

virtual prototyping to navigate the global industry crisis and

enable their digital transformation. On this foundation of growing

repeat business, we can drive ambitious efforts to increase new

business for sustainable and profitable revenue growth. I am

committed to lead an energized management team, aligned by industry

and by outcome, to release growing employee, customer and partner

energy.”

Revenues (€m)

Q1-2021

Q1-2020

Change

Change Constant exchange rate

(cer)

Q1 - Licenses

49.6

48.8

+1.6%

+4.2%

Q1 – Services

5.9

6.1

-2.5%

-0.1%

Q1 - Total

55.5

54.9

+1.2%

+3.7%

In the first quarter of its fiscal year (January 1, 2021 - March

31, 2021), ESI recorded revenues of €55.5m, up 1.2% (+3.7% cer);

slightly above the range announced (€52-55m). We saw growth in

revenue in all regions in Q1:

- EMEA by

+1.4% (+1.7% cer) - Asia

by +0.2% (+4.7% cer) -

Americas by +2.4% (+10.9% cer)

Licensing revenue was up +1.6%

(+4.2% cer) with growth in all regions, led by the Americas, up by

3.1% (+11.5% cer). Services revenues were down -2.5% (-0.1% cer),

with EMEA and Americas increasing by 3.5% cer and 3.7% cer

respectively, while Asia decreased by -8.6% cer.

The growth is led by Repeat

Business with an increase of +1.3% (+3.7% cer). Central to ESI’s go

to market strategy, Focus Accounts drove the License performance of

the Group with a +4.7% increase.

Team focused on growing New Business pipeline in 2021

Identified as a key focus for the

Group’s management, the New Business activity amounted to €3.1m

(-€0.2m) in Q1. While down slightly from Q1 2020, this represents

the best year over year result since the start of the pandemic and

gives confidence for a continued recovery along 2021. To accelerate

the pipeline of new business the Group recently aligned all revenue

related activities, under Mike Salari in his new role leading

Revenue Generation. This effort benefits from the global business

tools and methodologies that ESI has deployed over the past 2

years. ESI’s transformed approach by industry and by outcome, to

deliver industry solutions, enables focus and alignment of R&D

and S&M resources for sustained momentum in new business, and

early benefits are visible in the Group’s go-to-market and

marketing activities.

Supporting the industry transformation The Group's four priority focus industries -

Automotive & Ground Transportation, Aeronautics &

Aerospace, Heavy Industry, Energy - accounted for around 91% of

revenues. In Licensing activities, the robustness of the Automotive

was once again proven with an increase of 2.8% for the first

quarter. Main customers of

the Group renewed their collaboration during this quarter which

reinforces the relevance of ESI’s value and solutions.

Collaborating with Honda for

over two decades, and for ten years in manufacturing, ESI is

considered as a key “Assembly” partner helping them to ensure the

link between manufacturing and performance. The Group accompanies

them in several projects from the accurate prediction of vehicle

performance during assembly processes to the validation of their

manufacturing processes resulting to cost reduction and increased

quality. Extending the collaboration year over year, ESI

strengthens and proposes unique solutions to continuously answer to

Honda’s needs and requirements. Lately, the 2 players started

working on Multi-Material Joining & Assembly, a brand-new

industry solution developed by ESI’s team.

Guidance

The Group expects H1 2021

revenue to be in the range of €80.5 million to €82.5 million

compared to €80.8m in H1 2020.

Committed to continuing to manage costs in 2021

Management remains committed

to disciplined expense management, in order to deliver on the

healthy run rate plan and improve its profitability in 2021. In

addition, the leadership team is currently working with the Board

on a longer-term financial plan to deliver industry standard

operating performance for a global software company of its scale.

ESI Group will share a multi-year financial plan at an investor day

in early fall 2021.

General Assembly Meeting information

ESI Group's Annual General

Meeting will be held on Tuesday, June 22, 2021 at 4 pm CET behind

closed doors with no physical attendance due to the pandemic.

Participation and document consulting procedures are detailed in

the notice of meeting will be made available on the company's

website. Shareholders are invited to regularly consult the section

dedicated to the Shareholders' Meeting on the Company's

website: HERE

Group’s new corporate documents available for

shareholders

- 2020 Universal Registration Document – HERE

- Investors’ notebook – HERE

- Group’s Ethics Charter – HERE

Forward-looking Statements This release contains “forward-looking

statements”. The Group expects H1 2021 revenue to be in the range

of €80.5 million to €82.5 million compared to €80.8m in H1 2020.

These statements are subject to a number of risks and

uncertainties, including those related to the COVID-19 virus and

associated further economic and market disruptions; further adverse

changes or fluctuations in the global economy; further adverse

fluctuations in our industry, foreign exchange fluctuations,

changes in the current global trade regulatory environment;

fluctuations in customer demands and markets; fluctuations in

demand for our products including orders from our large customers;

cyber-attacks; expense overruns; and adverse effects of price

changes or effective tax rates. The company directs readers to its

Universal Registration Document – Chapter 3 presenting the risks

associated with the company’s future performance.

Upcoming event

- Annual General meeting – June 22, 2021 (4pm CET)

- Half year results – September 7, 2021 (6pm CET)

- Investor day – early Fall 2021 (date to be announced)

About ESI Group Founded in 1973, ESI Group envisions a

world where Industry commits to bold outcomes, addressing high

stakes concerns - environmental impact, safety & comfort for

consumers and workers, adaptable and sustainable business models.

ESI provides reliable and customized solutions anchored on

predictive physics modeling and virtual prototyping expertise to

allow industries to make the right decisions at the right time,

while managing their complexity. Acting principally in automotive

& land transportation, aerospace, defense & naval, energy

and heavy industry, ESI is present in more than 20 countries,

employs 1200 people around the world and reported 2020 sales of

€132.6 million. ESI is headquartered in France and is listed on

compartment B of Euronext Paris. For further information, go to

www.esi-group.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210429005744/en/

ESI - Shareholder Relations Florence Barré investors@esi-group.com +33 1 49 78 28 28

Verbatee - Press & Shareholder Relations JJérôme Goaer, j.goaer@verbatee.com, +33 6 61

61 79 34 Aline

Besselièvre, a.besselievre@verbatee.com, +33 6 61 85 10

05

Grafico Azioni Esi (EU:ESI)

Storico

Da Mar 2024 a Apr 2024

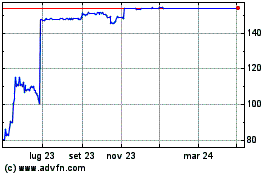

Grafico Azioni Esi (EU:ESI)

Storico

Da Apr 2023 a Apr 2024