TIDMFFWD

RNS Number : 8672O

FastForward Innovations Limited

12 February 2021

FastForward Innovations Ltd / AIM: FFWD / Sector: Closed End

Investments

12 February 2021

FastForward Innovations Ltd ("FastForward" or, "FFWD")

New Investment in ASX-Listed Vertically Integrated Medical

Cannabis Business

FastForward Innovations Ltd, the AIM quoted company focusing on

making investments in fast growing and industry leading businesses,

is pleased to announce that it has invested A$1 million

(GBP560,000) in a placing undertaken by Little Green Pharma (ASX:

LGP and 'LGP'), an ASX-Listed, vertically integrated, medicinal

cannabis business with operations from cultivation and production

through to manufacturing and distribution. The LGP placing raised a

total of A$22m at a price of $0.65c; accordingly, FFWD expects to

hold 0.9% of the Company following issue of the placing shares.

Highlights

-- Investment further develops FFWD's exposure to the medicinal cannabis industry

-- LGP supplies compliant medical-grade cannabis products to Australian and overseas markets

-- Strong support for LGP's A$22 million fundraise leaves the

business well capitalised for further growth

-- As announced by LGP on 29 January 2021, LGP achieved record

quarterly results for the December 2020 quarter with s ales revenue

up 90% on the previous quarter to A$2.45 million (unaudited)

-- Significant recent progress made in establishment of offshore

distribution channels including to the UK, Germany, and New

Zealand

-- A$0.65 placing price per share, as at today's date shares currently trading at A$0.85

Ed McDermott, CEO of FastForward, commented: "As an experienced

medical cannabis company investor, we have a very good

understanding of the market opportunity, the international

regulatory landscape and a team's ability to deliver. Having been

aware of their progress we are delighted to now support LGP, which

ticks all the boxes; it has great assets, strong management, is

well capitalised, and continuously delivers on its forecasts in a

market where many do not. Furthermore, having engineered excellent

European growth, we are confident that it will have further success

internationally and deliver strong newsflow in the coming months

and we look forward to supporting LGP and its management wherever

we can."

DETAILS

Investment

LGP has raised a total of A$22 million by way of a placement of

34 million new ordinary shares ('New Shares') at A$0.65 per New

Share to new and existing shareholders. The funds will be used to

execute LGP's next phase of growth by accelerating sales and

marketing efforts in Australia and in offshore markets; expanding

cultivation and manufacturing capacity; and providing general

working capital.

Having invested A$1 million (GBP560,000) in LGP's placing, and

following admission to trading on the ASX, FFWD will have a holding

of 1,538,462 ordinary shares in LGP.

About Little Green Pharma

Little Green Pharma is a vertically integrated medicinal

cannabis business with operations from cultivation and production

through to manufacturing and distribution. It has an indoor

cultivation facility and manufacturing facility in Western

Australia to produce its own-branded range of GMP-grade medicinal

cannabis products.

LGP's growing product range comply with all required Therapeutic

Goods Administration regulations and testing requirements. With a

growing range of products containing differing ratios of active

ingredients, LGP supplies medical-grade cannabis products to

Australian and overseas markets. Recently, it has made progress in

the establishment of offshore distribution channels including to

the UK, Germany, and New Zealand to further strengthen its

geographic reach.

LGP achieved record quarterly results for the December 2020

quarter :

-- Sales revenue of A$2.45 million (unaudited), up 90 per cent. on previous quarter;

-- 12,500+ unit sales in Australia, up 50 per cent. on previous quarter;

-- 20 per cent. growth in new patients on the previous quarter -

some 9,500 now been prescribed LGP medicines in Australia.

LGP has a strong focus on patient access in the emerging global

medicinal cannabis market and is actively engaged in promoting

education and outreach programmes, as well as participating in

clinical investigations and research projects to develop innovative

new delivery systems.

Based on the 11 February 2021 closing price of A$0.85, LGP has a

fully diluted market capitalisation of A$142 million, net assets as

at 30 June 2020 of A$12.3 million and reported a loss before tax of

A$9.3million on revenue of A$2.2million.

Further information about Little Green Pharma can be found at

www.littlegreenpharma.com .

ENDS

For further information on the Company please visit www.fstfwd.co or contact:

Ed McDermott FastForward Innovations E: info@fstfwd.co

Lance de Jersey Ltd

James Biddle Beaumont Cornish Limited, T: (0)20 7628 3396

Roland Cornish Nomad

-------------------------- -------------------------------

Isabella Pierre Shard Capital Partners T: (0)20 7186 9927

Damon Heath LLP

Broker

-------------------------- -------------------------------

Catherine Leftley St Brides Partners E: info@stbridespartners.co.uk

Beth Melluish Ltd,

Financial PR

-------------------------- -------------------------------

Notes

FastForward Innovations is an AIM quoted investment company

focused primarily on disruptive high growth life sciences and

technology businesses particularly within the medical cannabis

arena. The Company's strategy is to identify early-stage

opportunities that have an upcoming investment catalyst and grow

its portfolio in terms of value whilst limiting the number of

investee companies to a level where relevant time can be devoted to

each.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDKDBDOBKDKBD

(END) Dow Jones Newswires

February 12, 2021 02:00 ET (07:00 GMT)

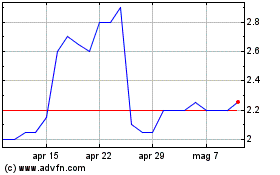

Grafico Azioni Seed Innovations (LSE:SEED)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Seed Innovations (LSE:SEED)

Storico

Da Apr 2023 a Apr 2024