TIDMFAR

RNS Number : 7373X

Ferro-Alloy Resources Limited

02 September 2020

2 September 2020

Ferro-Alloy Resources Limited

("Ferro-Alloy" or "the Company")

Electrolyte for Vanadium Flow Batteries

Bond Issue on AIX

Ferro-Alloy Resources Limited (LSE:FAR), the vanadium mining and

processing company with operations based in Southern Kazakhstan ,

announces that the Company has developed technology for the

production of electrolyte for vanadium flow batteries ("VFBs").

Ferro-Alloy has developed the technology and applied for a

patent for the production of vanadium electrolyte directly from

ammonium metavanadate ("AMV"). Vanadium electrolyte is used in the

operation of VFBs.

The ability to make electrolyte directly from AMV cuts out the

cost of conversion of AMV to vanadium pentoxide from which

electrolyte is usually made, giving the Company not only the

required know-how to enter this market, but also a cost advantage

over traditional processes.

Vanadium is considered to be a battery metal as a result of its

use in VFBs which are used for the storage of energy from

intermittent green sources such as solar or wind.

VFBs have several advantages over the more familiar lithium-ion

battery technologies, including:

-- they can be fully charged and discharged repeatedly without damage

-- the electrolyte does not degrade over time

-- energy storage capacity can be scaled independently of power

by adding larger electrolyte tanks

-- they are not susceptible to thermal runaway

-- the electrolyte can be easily reused or recycled at the end of the battery life; and

-- suitable for long discharge periods

The market for VFBs is expected to grow rapidly as the world

moves towards increased use of renewables with forecasts of almost

60% annual growth to 2025(1) . This largely new demand for

vanadium, combined with strong growth expected from vanadium's

traditional markets, is expected to lead to exceptionally strong

growth in vanadium consumption. Ferro-Alloy aims to become a

regional supplier of electrolyte and is currently in early

discussions with battery producers.

1 Source: Adroit Market Research 2019

Bond Issue

The Company has issued five bonds with a nominal value of

US$2,052.78 on the Astana Stock Exchange in Kazakhstan totaling

US$10,263.90. The bonds are unsecured, have a term of three years

and carry an interest rate of 5.8% per annum, payable twice yearly.

The bonds have a term of three years from the date of the

subscription and the investor has the right to ask for early

repayment after a minimum period of 12 months.

Nick Bridgen, CEO, commented: "Developing this electrolyte

technology demonstrates the capability of our technical team and

will allow us to take part in the growing clean energy revolution.

We are already perhaps the only significant new producer that can

provide the huge quantities of vanadium that will be needed without

driving the price up to levels which are uneconomic for the VFB

industry."

For further information, visit www.ferro-alloy.com or

contact:

Ferro-Alloy Resources Limited

Nick Bridgen, Chief Executive Officer info@ferro-alloy.com

Shore Capital (Broker)

Corporate Advisory: Toby Gibbs / Mark Percy / John More Tel: +44 (0)207 408 4090

Corporate Broking: Jerry Keen

VSA Capital (Financial Adviser) Tel: +44 (0)203 005 5000

Andrew Monk / Simon Barton

St Brides Partners Limited (Financial PR & IR Adviser)

Catherine Leftley / Megan Dennison Tel: +44 (0)207 236 1177

Further information about Ferro-Alloy Resources Limited

The Company's operations are all located at the Balasausqandiq

Deposit in Kyzylordinskaya Oblast in the South of Kazakhstan.

Currently the Company has two main business activities:

a) the high grade Balasausqandiq Vanadium Project (the "Project"); and

b) an existing vanadium concentrate processing operation (the "Existing Operation")

Balasausqandiq is a very large deposit, with vanadium as the

principal product, together with by-products of carbon, molybdenum,

uranium, rare earth metals, potassium, and aluminium. Owing to the

nature of the ore, the capital and operating costs of development

are very much lower than for other vanadium projects.

A reserve on the JORC 2012 basis has been estimated only for the

first ore-body (of five) which amounts to 23 million tonnes, not

including the small amounts of near-surface oxidised material which

is in the Inferred resource category. In the system of reserve

estimation used in Kazakhstan the reserves are estimated to be over

70m tonnes in ore-bodies 1 to 5 but this does not include the full

depth of ore-bodies 2-5.

The existing production facilities were originally created from

a 15,000 tonnes per year pilot plant which was then adapted to

treat low-grade concentrates and is now in the process of being

expanded and further adapted to treat a wider variety of raw

materials.

The Company has already completed the first steps of a

development plan for the existing operation which is expected to

result in annualised production capacity increasing gradually to

around 1,500 tonnes of contained vanadium pentoxide. The

development plan includes upgrades to infrastructure, an extension

to the existing factory and the installation of equipment to

increase the throughput and to add the facilities to convert AMV

into vanadium pentoxide and then to ferro-vanadium.

The strategy of the Company is to develop both the project and

the Existing Operation in parallel. Although they are located on

the same site and use some of the same infrastructure, they are

separate operations.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCKZGGLNMGGGZM

(END) Dow Jones Newswires

September 02, 2020 02:02 ET (06:02 GMT)

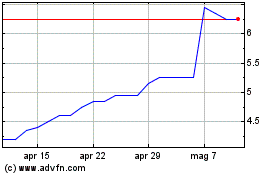

Grafico Azioni Ferro-alloy Resources (LSE:FAR)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Ferro-alloy Resources (LSE:FAR)

Storico

Da Apr 2023 a Apr 2024