TIDMFEVR

RNS Number : 2780Y

Fevertree Drinks PLC

08 September 2020

Fevertree Drinks plc

FY20 Interim Results to 30 June 2020

Resilient outcome for the half-year, further strengthening our

position as the clear global leading premium mixer brand

FY20 Interim Highlights

-- Strong Off-Trade performance and diversified revenues across

regions and channels has enabled the Group to mitigate the impact

of On-Trade closures caused by COVID-19

-- Off-Trade sales exceeded expectations across our regions

o Maintained position as number one brand in the UK mixer

category at retail

o Very strong US performance notably ahead of expectations as

the brand continues to gain traction

o Resilient underlying performance in Europe, with reported

revenue impacted by temporary importer de-stocking during

lockdown

o Very encouraging Off-Trade growth in key RoW markets of Canada

and Australia

-- Rapidly identified and reacted to evolving purchasing and consumption habits

o Upweighted marketing spend to focus on at-home consumption

with the Group's first ever national television advertisement in

the UK, driving significant growth in consumer awareness

o Successful roll out of larger pack format in UK delivering

good rate of sale growth

o Investment in online retail platforms drove significant growth

in this channel globally

-- A strong and secure financial position has enabled the Group

to remain focused on the long-term opportunity, continue to invest,

and to make strategic progress

o Successful launches of the Premium Soda range in the UK and

Sparkling Pink Grapefruit in the US

o Acquisition of GDP Global Drinks Partnership, the Group's

sales agent in Germany, just after period end, underlying the

Group's ambition in Germany and the wider European opportunity

Financial highlights

GBPm H1 FY20 H1 FY19 Change

------------------------------- -------- -------- ---------

Revenue

UK 48.3 60.7 (20)%

US 27.4 19.8 39%

Europe 20.5 29.0 (29)%

ROW 8.0 7.8 2%

Total 104.2 117.3 (11)%

Gross profit 48.7 60.8 (20)%

Gross margin 46.8% 51.9% (510)bps

Adjusted EBITDA(1) 23.8 36.7 (35)%

Adjusted EBITDA margin 22.8% 31.3% (850)bps

Diluted EPS (pence per share) 14.99 24.30 (38)%

Dividend (pence per share) 5.41 5.20 4%

Net cash 136.9 104.1 32%

------------------------------- -------- -------- ---------

(1) Adjusted EBITDA is earnings before interest, tax,

depreciation, amortisation, share based payment charges and finance

costs

-- Resilient revenue performance of GBP104.2 million in the

first half, a decrease of 11% year-on-year

-- Gross profit margin was impacted by COVID-related shift in

channel and regional sales mix, and the US price optimisation.

Excluding COVID-19 impacts, gross margin for the first half would

have been c.49.0%

-- Despite the short-term disruption of COVID-19, we continue to

upweight investment in marketing and our team to support the

long-term opportunity across all regions, maintaining previously

budgeted underlying operating costs of c.GBP60 million for the full

year

-- This increased investment and the impacts of COVID-19 on

revenue and gross margin impacted our Adjusted EBITDA margin in the

first half but we remain confident that continuing to invest in our

people and our brand will position us strongly as we emerge from

the current period of uncertainty

-- Asset light business model continues to support the Group's

secure financial position with net cash improving to GBP136.9

million at period end

-- Paying an interim dividend of 5.41 pence per share, an

increase of 4% year-on-year, reflecting the financial strength,

confidence in the business, as well as our strong cash

generation

Tim Warrillow, CEO of Fever-Tree, commented

"I am very proud of how the Fever-Tree team has responded over

the last six months and the results that we have delivered. Our

priority throughout the COVID-19 pandemic has been our close-knit

team, who are integral to the success of the business. We did not

furlough any team members and instead focused on redeploying talent

around the business. We have also continued to invest in building

the team across the globe, adding 20 new employees in the first

half of the year.

Our performance in the Off-Trade over the first half of the year

has been very encouraging with sales across our regions exceeding

our expectations. People's interest and excitement about mixing

drinks at home has really taken hold over the lockdown period,

attracting more households to the Fever-Tree brand than ever

before. Consequently, we have increased our penetration in the UK,

consolidated our number one position, and driven value share gains

in the US, Europe, and as far afield as Canada and Australia.

Despite the On-Trade closure for a large proportion of the first

half of the year, we have continued to support our On-Trade

partners across our regions and are well-placed to benefit from the

return of this important channel.

We have had an encouraging start to the second half of the year

and, while we certainly aren't immune to the ongoing challenges of

COVID-19, our performance and our investments so far this year,

coupled with the growing interest in long mixed drinks, gives me

confidence that we will exit the crisis in an even stronger

position than we entered it."

There will be live audio webcast on Tuesday 8(th) September 2020

at 10:00am BST. The webcast can be accessed

via: https://www.investis-live.com/fever-tree/5f4f4f7948ce9210001da533/temp

For more information please contact:

Investor queries

Ann Hyams, Director of Investor Relations I ann.hyams@fever-tree.com I +44 (0)7435 828 138

Media queries

Oliver Winters, Director of Communications I

oliver.winters@fever-tree.com I +44 (0)770 332 9024

Nominated Advisor and Joint Broker - Numis Securities

Garry Levin I Matt Lewis I Hugo Rubinstein I +44 (0)20 7260

1000

Joint Broker - Investec Bank plc

David Flin I Alex Wright I +44 (0)20 7597 5970

Financial PR advisers - Finsbury

Faeth Birch +44 (0)7768 943 171; Chris Ryall +44 (0)7342 713

748; Amanda Healy +44 (0)7795 051 635

COVID-19 update I Well-positioned to navigate uncertainties

The Group is in a strong financial position. We are debt-free,

with strong underlying cash flow conversion and an improved net

cash position at period end of GBP136.9m. Alongside our strong

balance sheet, we benefit from well diversified revenue streams,

generated across multiple regions, in both On-Trade and Off-Trade

channels, and across multiple end customers.

We have maintained the cross-departmental team that was

established at the start of the crisis as we continue to monitor

the changing situation and co-ordinate our response. Our asset

light, outsourced business model, with few capital commitments and

a low fixed cost base provides both resilience to withstand the

ongoing impacts of COVID-19 and the flexibility to react to

changing channel dynamics and consumer demand.

Reflecting the financial strength and long-term prospects of the

business, we will be paying an interim dividend of 5.41 pence per

share, an increase of 4% year-on-year.

COVID-19 update I Supporting our people and communities

Fever-Tree has always been a close-knit team, with every

employee valued and integral to the business. The way the Global

team has adapted to working remotely and the commitment they have

demonstrated through a challenging period is a testament to the

talent and dedication of all our employees. As we grow as a

business, we continue to strengthen our team, adding 20 new

employees during the first half of the year.

Through the crisis we have strived to provide security and

certainty to our team and therefore decided very early into the

COVID-19 pandemic not to use the UK government's furlough scheme or

receive government grants. Instead, during lockdown periods our

On-Trade teams globally have focused on new projects and

initiatives as we look to 2021 and beyond, whilst some individuals

were deployed to different departments across the business to

broaden their knowledge and skill set.

We remain determined to emerge on the other side of COVID-19 not

only as an even stronger business but also one that has made a

difference during the crisis. As well as a focus on our employees,

we have offered support to communities and groups across our

regions, including financial support to local charities,

encouraging staff with capacity to volunteer their time, and

through donations to initiatives supporting key workers. In the UK

we supported "Salute the NHS" in their mission to provide one

million meals to NHS frontline staff, donating 100,000 soft drinks

to be included in their meal packs. In addition, we have continued

to support our charitable partner, Malaria No More in keeping the

fight against Malaria in the public eye by continuing our GBP1

million commitment over three years.

Strategic update I Resilient performance as focus remains on the

long-term opportunity

Against the backdrop of disruption caused by COVID-19,

Fever-Tree has delivered a resilient performance, with revenue of

GBP104.2m representing a decline of 11% year-on-year. The On-Trade,

which typically represents approximately 45% of Group revenue, has

been severely impacted as lockdowns have led to closures in most of

our territories since March, with only limited re-openings prior to

the end of the period.

As consumption has shifted away from the On-Trade we have worked

proactively to drive growth in the Off-Trade and have delivered a

consistently strong performance in this channel globally. Alongside

this we have seen increasing evidence that the lockdown period has

provided a further catalyst to the movement towards long mixed

drinks. Spirits companies are increasingly looking to capitalise on

this trend, and as the clear pioneer and global leader of the

premium mixer category we remain very well placed to continue to

partner with them to drive this significant long-term

opportunity.

Therefore, whilst the On-Trade closures have impacted our

revenue in the short-term, we have remained focused on the

long-term opportunity, continuing to build our team and invest in

the brand across all our regions. This approach has been enabled by

our financial strength and operational agility, and whilst there

will be some inevitable impacts on our operational margins this

year, we are confident that we will emerge from this crisis in a

stronger position than we entered it, and are increasingly well

placed to deliver our plans for long term growth.

UK I Positive momentum in the Off-Trade

Fever-Tree delivered a robust performance given the challenges

posed by COVID-19, with revenue of GBP48.3m, a decline of 20%

year-on-year. The On-Trade, which typically represents half of UK

revenue, was closed from mid-March, and consequently revenue was

down 61% in this channel in the first half of the year.

In the Off-Trade, following a modest start to the year as we

continued to lap tough comparators from early 2019, we saw a strong

ramp up in sales in the weeks leading up to mid-March as consumers

increased frequency of shops and basket size in anticipation of

imminent lockdowns. During the lockdown period, the Off-Trade

performed consistently ahead of expectations, as consumers

increased their at-home consumption, seeking out long mixed drinks

as an everyday affordable treat. As a result, sales in the

Off-Trade channel increased by 24% in the first half of the year, a

strong performance which has consolidated Fever-Tree's market

leading position.

Our agile business model meant we were quick to adapt to

changing consumer purchasing habits that emerged during the period,

such as the preference for larger pack formats, encouraging us to

accelerate the roll out of our 15 x 150ml can pack which has

delivered a very strong rate of sale in the retailers where it has

been listed so far. We also increased our focus and resource in the

convenience channel, which saw strong growth as consumers shopped

closer to home, resulting in new distribution secured in Co-Op

stores during the period. In addition, we have continued to invest

for the long-term by taking advantage of cost effective marketing

opportunities in the Off-Trade, redeploying marketing funds away

from On-Trade and events into new on-shelf initiatives in retail,

as well as launching our first ever national television advertising

campaign which has driven an increase in consumer awareness.

As a result, Fever-Tree has increased volume share year-on-year,

continued to strongly outperform other premium mixer competitors

and remained the number one mixer by value at UK Off-Trade, with

37.6%(2) value share.

Alongside mixers, we have seen the spirits category perform

strongly at retail during the lockdown period, notably gin, as

consumers have sought to treat themselves with a long mixed drink

at the end of the day during lockdown. Spirits companies are

increasingly looking to capitalise on this trend, be it gin and

tonic, whisky and ginger, or vodka and soda, and are engaging on

potential co-promotion opportunities. We are, therefore, very

optimistic that the lockdown period has been a further catalyst to

the long-term trend towards long mixed drinks which Fever-Tree,

with our category leadership position, range and relationships,

remains uniquely placed to continue to drive.

The On-Trade channel remained closed from mid-March,

significantly impacting our overall performance. During this

period, our team was proactive in offering support to our On-Trade

customers through credit extensions and payment plans, as well as

working closely with our end accounts to ensure they were offered

the support required to adapt to the new ways of trading on

reopening. These were gratefully received and have strengthened our

relationships with many of our key long-term customers.

Since period end, the On-Trade has seen a gradual and cautious

reopening. There have been differences in reopening rates and

footfall between pubs, bars and restaurants, as well as regional

differences, and we expect to continue to see a very gradual

recovery as we proceed through the remainder of the year.

The Group has continued to innovate and pioneer the category

through the first half of the year. We launched our Premium Soda

range in March and have seen a very positive response in the

Off-Trade, with new listings secured and very encouraging rate of

sale performance across retailers. Our intention is to roll-out the

range across the On-Trade as it gradually reopens.

At the end of the period we were delighted to work alongside

Sainsbury's and spirits partners to bring to life our first ever

Fever-Tree Gin & Tonic Bay. This was the first mixer-led

spirits co-promotion of its kind at UK retail, encouraging shoppers

to find their perfect pairing in store across the Fever-Tree range

with recommended gin partners, underlining the brand's strength and

position as the enabler for consumers to explore and experiment

across the gin category.

In summary, notwithstanding the disruption of COVID-19 and the

short-term impact on our On-Trade sales, the Group has made good

progress in the UK in the first half of the year. We have responded

proactively to the rapid shift to at-home consumption, launched new

formats, new flavours, pioneered a new co-promotional approach, and

produced a national television advertising campaign. The

performance of the brand in the Off-Trade, along with the support

we have provided to our On-Trade partners during lockdown puts us

in a strong position as normality gradually returns to both

channels.

(2) IRI 13 weeks to 28 June 2020

US I Successful pricing optimisation contributing to a strong

Off-Trade performance

The Group performed very strongly in the US over the first half

of the year as we continue to build momentum in the region. Despite

the impact of COVID-19 on On-Trade sales, total US revenue for the

first half of the year increased by 39% to GBP27.4m (35% on a

constant currency basis).

Our priorities since we took direct control of US operations in

June 2018 have remained unchanged. Initially our focus was on

building the team, strengthening our route to market and building

strong relationships with our distributors, customers and the

trade, then using these foundations to expand our distribution

across both channels and activate our marketing agenda.

The next step was addressing the opportunity to optimise our

pricing and format architecture. Rigorous quantitative and

qualitative analysis undertaken in the second half of 2019

reaffirmed our belief that there was a significant opportunity to

unlock an affordable premium positioning similar to that achieved

by the Group in other markets, catering to a wider audience of

consumers and occasions to encourage both trial and consumption. We

engaged with our distributors and customers in the early stages of

this year and worked alongside them to successfully implement the

price optimisation over the period from March to June. These

discussions also demonstrated the potential for incremental

distribution and a broadening of our format mix, however,

implementation of these has currently been delayed by COVID-19.

Sales in the Off-Trade started the year strongly with continued

momentum and the benefit of new distribution gained in 2019. Since

lockdowns began across the US, we have seen sales accelerate

further in the Off-Trade channel, both at grocery and across liquor

stores. Fever-Tree has delivered +72% value growth(3) over the

first half of 2020 at US retail, exceeding our expectations and

ensuring we remain the clear market leader in grocery in the

premium mixer category, which itself is the fastest growing segment

in the category.

This performance is partly attributable to the switch to at-home

consumption following On-Trade closures, although just as seen in

the UK, this has been further amplified by the increased propensity

towards making long mixed drinks at home, with spirits taking share

from beer and wine during the lockdown. In addition, we have

started to see the benefit of the price optimisation which was

gradually introduced on shelf during the period, although it is too

early to isolate the exact impact of this on rate of sale given the

other factors influencing Off-Trade growth. Our strong performance

in the Off-Trade demonstrates we are significantly growing our

consumer base which will greatly enhance our On-Trade efforts when

the On-Trade channel fully opens for business.

On-Trade sales in the US have been materially affected in the

first half by closures related to lockdowns, which have varied by

state in length and extent, but overall have led to very

challenging conditions since March. Despite this, we continue to

enjoy a strong relationship with Southern Glazer's Wines and

Spirits (SGWS), with whom we have performed well, especially in the

liquor store channel. We have also continued to win new mandates

and distribution with national hotel and restaurant groups in the

first half, positioning the Group well as the On-Trade gradually

reopens.

Within the portfolio we have seen strong growth across our full

range of mixers, targeting multiple drinks occasions, from the Mule

(Ginger Beer), to tonics (Tonic Water) and spritzes (Club Soda).

Tequila continues to show very strong growth, and in the first half

of the year we launched a new Sparkling Pink Grapefruit to pair

with Tequila to create the perfect Paloma cocktail. This launch has

been a great success, already gaining significant attention from

retailers and consumers, and we are optimistic about the Pink

Grapefruit opportunity as we look forward to 2021.

Marketing and investment remain important focus areas as we grow

brand awareness with consumers and the trade. We have increased our

level of investment during the COVID-19 crisis, redeploying spend

to where it will be most impactful. Throughout lockdown this

redeployed spend was focused on digital execution to gain maximum

exposure, broadening our work with the Google Accelerator program,

working closely with partners such as TimeOut (renamed TimeIn) and

engaging with bar-tenders to create online content delivered via

social media takeovers, video and emails focused on creating simple

long mixed drinks at home. In addition, we started to build strong

relationships with a number of online retailers, including Drizly

and Minibar, with performance across Amazon especially notable as

volumes increased by 130% year-on-year over the period.

(3) Nielsen 26 weeks to 29 June 2020

Europe I Optimising the business to access the opportunity

Revenue for the first half of the year declined by 29% to

GBP20.5m (30% on a constant currency basis), impacted by importer

destocking and therefore not fully reflective of underlying

trading, especially in the Off-Trade, which performed well in many

key markets.

Due to the uncertainties related to COVID-19 many of our

European importers placed significantly reduced orders from March

to May as they chose to manage their inventory and credit risk by

depleting their existing stockholdings. This meant our reported

sales in the first half of the year are significantly behind sales

made in-market by our importers, where Fever-Tree had a good

performance in the Off-Trade. We have subsequently seen a strong

increase in orders placed in the period from June to August,

correcting the majority of the discrepancy between our sell-in and

our importers sell-out seen at June.

On the basis of underlying sales made by our importers in

Europe, volumes in the Off-Trade have been up approximately 30%

year-on year across the region. However, as with elsewhere,

On-Trade sales have been materially impacted by closures,

especially in Southern Europe which tends to rely more on the

On-Trade, as well as the tourism industry.

As outlined in our Full Year 2019 results in April, our strategy

and approach in European markets is segmented into three groups.

Core Markets, including Belgium, Denmark and Ireland, are markets

where premium tonic has achieved a strong or market-leading share

and provide a blueprint for what can be achieved elsewhere in the

region. Our focus is on maintaining the position we have

established in the tonic category whilst driving growth in new

flavours and formats.

Next Wave Markets, including Germany, Spain and Italy, are

countries where Fever-Tree currently has relatively low penetration

in sizable mixer markets and where significant growth opportunities

exist. Spain and Italy are both On-Trade led markets and as such,

sales in these countries have been more severely impacted in the

first half of the year. The relationship with our local importers

remains strong and our focus is on identifying opportunities as the

On-Trade reopens. Germany represents an exciting long-term

opportunity in a market that has performed well through COVID-19.

The acquisition of our sales agent, GDP Global Drinks Partnership

GmbH ("GDP") post period end, another example of the Group's

proactive approach during the period, will provide us with a strong

operational footprint with which to continue to drive our growth in

Germany.

Finally, in Earlier Stage markets, such as France and

Netherlands, we are focused on establishing the conditions to allow

for growth within currently immature mixer categories. This

includes building the optimum distribution and route to market, as

well as increasing headcount where appropriate.

We have continued to invest across the region despite the

disruption caused by COVID-19, however, there has been a

redeployment of spend away from the On-Trade and events activities

towards the Off-Trade. This has included investment in retail

display visibility across our Core Markets, co-promotional activity

with Lillet on a Spritz serve in Belgium, co-promotional activity

on gin and tonic with Bombay Sapphire in Germany, and in our

Earlier Stage markets, including Netherlands and France, we have

increased our distribution footprint within convenience stores.

Whilst the impact of COVID-19 will continue to be felt across

the region as the On-Trade gradually recovers, we remain confident

and optimistic about the medium and long-term opportunity in

Europe. There are a number of markets that offer real potential and

we continue to invest and focus on the opportunity that they

present, as evidenced by the post period end acquisition of

GDP.

RoW I Building momentum in Australasia and Canada

Our RoW markets have all been impacted by closures to the

On-Trade. However, our two largest markets with sizeable mixer

categories, Australasia and Canada, both delivered a very

encouraging Off-Trade performance during the first half of the

year, contributing to an overall revenue increase for the region of

2% to GBP8.0m.

In Australia, Fever-Tree continues to be the clear premium mixer

category leader and is responsible for driving growth within this

segment. Long mixed drinks continue to gain popularity, led by the

gin and tonic. Gin was the fastest growing spirit category in 2019,

with +21% value growth, and Fever-Tree is driving growth in the

tonic category. Fever-Tree's increasing brand awareness, along with

significant distribution gains, have enabled the brand to grow in

major retailers such as Coles, where our tonic sales were up just

over 100% year-on-year at the end of the half and now contribute

over a quarter of tonic sales for this major retailer. As well as

maximising the momentum in the gin and tonic serve, we also see

opportunities to premiumise other mixer categories such as gingers

going forward.

In June, Fever-Tree hosted a Gin & Tonic Festival in

Australia, an event that was brought to life online through

tastings and masterclasses, having originally been planned to take

place in Sydney. The virtual event was used to educate consumers on

the premiumisation of the gin and tonic, drive trial and awareness,

and build trade advocacy during a time when the On-Trade was

closed.

In Canada, Fever-Tree has used its strong presence in the

premium mixer category to increase trial and awareness, and secure

new distribution with a number of key accounts. We grew our tonic

sales by more than 100% year-on-year over the last 12 months to

become the largest tonic brand by value in Canada, with over a

third of the market share at retail. Based on our strong rate of

sale in major retailers, we are confident of continuing to gain new

distribution, both in terms of number of accounts and facings

in-store. This is underpinned by the premiumisation of the mixer

category, led by Fever-Tree, with premium mixers far outpacing the

growth of standard serves.

In Asia we continue to focus on key cities across the region.

The appointment of our first Regional Director for Asia last year

demonstrates our long-term ambition for the region, where we are

starting to establish ourselves by enhancing our distribution

network and building our relationships with spirits companies to

promote premium long mixed drinks.

FY20 outlook

The first half of 2020 has been a challenging period for most

companies navigating through the uncertainties created by COVID-19.

However, our diverse set of revenues, across multiple geographies

and channels, has led to a resilient first half performance.

We have now established a market leading position in a number of

key markets, with long-term relationships across the On-Trade and

Off-Trade, with our production and distribution partners, and with

various spirit partners. It is the success in our established

markets that provides us with the case studies and platform to turn

to the global opportunity with real confidence. We are in the early

stage of execution in a number of markets with significant

potential, where our focus is on investing in great people,

building the right route to market, creating an optimal portfolio

and creating a bespoke marketing strategy to ensure we are ideally

positioned to realise these opportunities.

Whilst the long-term aspirations of the Group remain unchanged,

this year's performance will be impacted by the challenges and

uncertainties COVID-19 has created, most notably the closure of the

On-Trade across our regions for a significant proportion of the

year followed by what we expect to be a gradual reopening. We are

well positioned to benefit from the reopening but remain mindful of

the impact of continued social distancing implications alongside

the risk of further local or national lockdowns as the year

progresses.

Given the level of uncertainty and the dynamic nature of the

situation, the impact of COVID-19 on the remainder of the financial

year is still hard to predict. However, on the assumption of no

further significant lockdowns in our regions as seen in the second

quarter this year, and a continued gradual recovery of the

On-Trade, and incorporating the acquisition post-period end of GDP,

we expect FY20 revenues of between GBP235m and GBP243m. The channel

and regional mix impacts on gross margin seen in the first half of

the year will continue throughout the second half, and we remain

committed to spending c.GBP60m of underlying operating

expenditure.

While we are not immune to the current situation, the Group is

financially well placed and its unique asset light outsourced

business model provides it with the agility to adapt to and

mitigate the challenges arising from the current circumstances. The

wider long-term trend towards premium spirits and premium long

mixed drinks continues and we are confident the Group will be well

placed once the current period of disruption and uncertainty

ends.

Financial review

The Group entered 2020 in a very strong financial position;

debt-free, with GBP128.3m cash on the balance sheet and strong

underlying cash flow conversion. Alongside this strong financial

position, the Group operates an asset light, outsourced business

model, which underpins a low fixed cost base, requires low levels

of capital expenditure and most importantly enables operational

agility and flexibility.

This combination of operational agility and financial strength

has informed our approach to navigating the disruption caused by

COVID-19.

Operationally we have worked very closely with our network of

five bottlers and two canners across the UK and Europe to ensure

continuity of production through the period despite multiple and

varied on-going challenges, further underlining the strength and

value of our outsourced model. Alongside this, post period end we

have completed the acquisition of our German sales agent, GDP,

giving the Group an operational footprint in a key European

market.

Our financial stability has allowed us to remain focused on

delivering against the long-term opportunity despite the impact in

the short-term that COVID-related closures have had on our On-Trade

revenues globally. We took the decision very early on not to

furlough any of our staff, and indeed have continued to build our

team. During COVID-19, we have necessarily re-deployed and

re-focused elements of our marketing spend, continued to invest and

have significant marketing activities planned for the second half

of this year. As a result of these decisions our operating margins

will temporarily be impacted in 2020 but we remain confident that

the continued investment in our people and our brand will position

us strongly as we emerge from the current period of

uncertainty.

Since the period of lockdowns began in March, we have managed

both our credit risk and working capital profile carefully.

Alongside this, we committed to pay a 2019 final dividend during

the period. Subsequently we have seen strong operating cash flow

conversion and our cash position has improved to GBP136.9m at

period end. As a reflection of the Board's confidence in the

financial strength of the business, we will pay an interim dividend

of 5.41 pence per share, an increase of 4% year-on-year.

GBPm H1 FY20 H1 FY19 Change Constant currency

-------- -------- ---------

Revenue 104.2 117.3 (11.2)% (11. 9)%

------------------- -------- -------- --------- ------------------

Gross profit 48.7 60.8 (19.9)% 48.1

------------------- -------- -------- --------- ------------------

Gross margin 46.8% 51.9% (510)bps 46.5%

------------------- -------- -------- --------- ------------------

Adjusted EBITDA 23.8 36.7 (35.2)% 23.4

------------------- -------- -------- --------- ------------------

Adjusted EBITDA

margin 22.8% 31.3% (850)bps 22.6%

------------------- -------- -------- --------- ------------------

Operating profit 21.4 34.8 (38.3)%

------------------- -------- -------- --------- ------------------

Profit before tax 21.7 35.0 (37.9)%

------------------- -------- -------- --------- ------------------

Cash 136.9 104.1 31.5%

------------------- -------- -------- --------- ------------------

Gross margin and operating expenses

Gross margin of 46.8% represents a retraction from the 51.9%

gross margin reported in the first half of 2019. Certain known

factors, including the US price optimisation implemented in the

first half of this year, would have resulted in a gross margin for

the Group in line with our expectations of c.49% for the

period.

Whilst there was some marginal upside from foreign currency

movements, the most significant impacts on gross margin beyond the

expected level of c.49% relate to the effect of COVID-19 on channel

and territory mix. In the UK, the On-Trade reduced to 26% of UK

sales in the first half of 2020 (H1 2019: 52%), whilst the US

contribution to regional sales mix for the Group increased to 26%

of Group revenue (H1 2019: 17%). We would expect the impact on

gross margin of these sudden shifts in channel and regional mix to

unwind gradually as the On-Trade recovers globally. However, in the

longer term we do expect the US to increase in the regional sales

mix given the scale of opportunity in that market. The US currently

operates at a lower gross margin than the rest of the Group. Whilst

we continue to command a strong price point in the US the lower

percentage gross margin is a function of the elevated logistics

costs related to transporting product from the UK to the US,

storing high levels of stock due to the lead time into the US, and

then transporting the product across continental US. Whilst

servicing the US from UK production has been the appropriate

approach to date as we have established the brand in the US, we

believe there will be an opportunity over time to drive

efficiencies in our US logistics costs as we move production from

the UK to the US and then scale with local production partners.

Underlying operating expenses increased by 3.4% in the first

half of the year to GBP24.9m (H1 2019: GBP24.1m) as we continued to

invest despite the impact on revenue of COVID-related closures of

the On-Trade. As a result, underlying operating expenses increased

to 24.0% of revenue (H1 2019: 20.6%).

Within this, marketing spend in the first half of the year

reduced to 8.0% of revenue (H1 2019: 10.4%), reflecting the paring

back of planned On-Trade and events-related spend from March

onwards, including most notably the cancellation of the Fever-Tree

Championships at The Queen's Club. Whilst there was a redeployment

of an element of this spend during the period, for instance with

regards our UK television advertising campaign and increased

digital spend in the US, a significant upweight in marketing spend

is planned for the second half of the year.

Staff costs and other overheads represented 16.0% of revenue in

the first half of the year (H1 2019: 10.2%). This reflected a

continued investment in building our team in in the first half of

2020, including the appointment of a Chief Marketing Officer,

combined with the annualisation of new hires made in 2019. Within

other overheads we increased our bad debt provision as a reflection

of the elevated level of credit risk associated with COVID-19's

ongoing impact on our customers and partners.

As previously disclosed, we remain committed to continue

spending against our originally budgeted levels of underlying

operating expenses of c.GBP60m for 2020. Within this, whilst there

is significant marketing activity planned for the second half, we

expect our full year spend to be weighted towards staff costs and

other overheads.

The combination of the impact on revenue of On-Trade closures

alongside the effect on gross margin of shifts in channel and

territory mix, whilst maintaining underlying operating expenditure,

has resulted temporarily in a significant retraction in Adjusted

EBITDA margin. As a result, the Group generated Adjusted EBITDA of

GBP23.8m, a 35.2% decline from the first half of 2019, at a margin

of 22.8% (H1 2019: 31.3%).

Amortisation costs were flat year-on-year at GBP0.4m, and share

based payments remained flat year-on-year whilst depreciation

increased to GBP1.2m (H1 2019: GBP0.7m). As a result of these

movements, the 35.2% decline in Adjusted EBITDA translates to a

38.3% decrease in operating profit to GBP21.4m (H1 2019:

GBP34.8m).

Tax

The effective tax rate in the first half of 2020 was 19.4% (H1

2019: 19.0%). A change in the phasing of quarterly tax instalments

required by HMRC has resulted in a net Corporation Tax debtor of

GBP4.4m at period end, which will unwind in the second half of

2020.

Earnings per share

The basic earnings per share for the period is 15.06 pence (H1

2019: 24.39 pence) and the diluted earnings per share for the

period is 14.99 pence (H1 2019: 24.30 pence), a decrease of

38.3%.

In order to compare earnings per share period on period,

earnings have been adjusted to exclude amortisation and the UK

statutory tax rates have been applied (disregarding other tax

adjusting items). On this basis, normalised earnings per share for

the first half of 2020 is 15.38 pence per share and for the first

half of 2019 was 24.63 pence per share, a decrease of 37.6%.

Balance sheet and working capital

There has been significant focus on credit control in the first

half of the year. As lockdowns were enacted the Group sought to

strike the appropriate balance between managing credit risk and

supporting our customers and distribution partners globally.

Initially we proactively extended terms with our UK On-Trade

customers and our network of international importers, which was

widely welcomed and further improved our already strong

relationships. We have since established payment plans with all

customers and are monitoring adherence very closely. The level of

outstanding debtors from March 2020 and earlier has reduced from

GBP37.2m to a current level of GBP1.1m, with payments expected

against this remaining balance over the coming months. As a

reflection of the increased credit risk related to on-going

COVID-19 uncertainty we have increased our bad debt provision to

4.3% of trade debtors (H1 2019: 2.6%).

Working capital(4) decreased to GBP41.9m (H1 2019: GBP55.8m),

with lower inventory and debtor levels largely a reflection of the

reduced level of trading whilst creditors have remained consistent

with the prior period. This reduction in working capital has

resulted in cash generated from operations improving to 146% of

Adjusted EBITDA (H1 2019: 106%).

(4) Working capital is inventory and trade receivables less

trade payables and derivative financial instruments

Cash

The Group continues to retain a strong cash position. Cash at

period end has increased to GBP136.9m (H1 2019: GBP104.1m), an

increase of 31.5% from June 2019 and 6.7% from December 2019.

Capital Allocation Framework and Dividend

The Group's Capital Allocation Framework remains unchanged. Our

financial strength and cash position has allowed us to maintain our

long-term focus despite the uncertainty relating to the impacts of

COVID-19. As such, we will continue to retain sufficient cash to

allow for investment against the Global opportunity, will remain

vigilant with regards to M&A opportunities and beyond that will

consider additional distributions to shareholders where the Board

considers there to be surplus cash held on the Balance Sheet.

As a reflection of our confidence in the financial strength of

the Group the Directors are pleased to declare an interim dividend

of 5.41 pence per share, 4% ahead of the 2019 interim dividend. The

dividend will be paid on 16 October 2020, to shareholders on the

register on 25 September 2020.

Operational review

Since March, there have been, and continue to be, multiple

challenges impacting our outsourced production model. These have

ranged from dramatic variations in demand from month to month

across regions and formats, up to threefold increases in lead times

on certain ingredients and packaging, and delays in the

commissioning of our new US bottling partner, which has now been

rescheduled to the latter stages of this year assuming conditions

allow.

We have worked very closely with our network of five bottlers

and two canners to mitigate the impacts of this disruption and have

retained continuity of production throughout the period. This has

required steps such as the early securing of significant

contingency stocks of key ingredients, establishment of secondary

warehousing in the UK to mitigate potential disruption and

granular, real-time demand forecasting and highly fluid production

planning. Whilst continuity of production has been retained through

the period, it is important to state that network capacity,

efficiency and lead times for supply into markets have all been

impacted to differing extents by the disruption caused by

COVID-19.

First and foremost, the management of bottling capacity and

changing production plans alongside our key partners has been

vital, and this period has further underlined the value of the

network of production partners we have built over recent years, the

importance and the quality of these partners and the strength of

our working relationship with them.

Post period events

In July, the Group was pleased to announce the acquisition of

GDP Global Drinks Partnership GmbH "GDP", the Group's sales agent

in Germany for a total consideration comprising EUR2.6m cash, plus

a c.EUR5m consolidation of historic balances owed to Fever-Tree by

GDP at completion.

GDP is a well-established sales agent and importer, with a

strong portfolio of premium drinks and a good track record of

growing premium brands. This portfolio approach is highly suited to

the size and outlet fragmentation of the German market and,

alongside Fever-Tree, GDP distributes complementary premium beer

and spirits brands, which generated c.EUR10m of sales in 2019.

Germany is currently Fever-Tree's second largest market in

Europe(5) and represents a notable opportunity for the Group. It is

one of the largest mixer markets in Europe and is underpinned by

emerging premiumisation trends evident in both the mixer and

spirits categories. The acquisition of GDP, with established

management, distribution relationships and sales channels already

in place allows the Group to accelerate the strength and depth of

its presence in Germany much faster than could have been achieved

by building the same capabilities from scratch.

(5) Based on depletion volumes over 2019

Consolidated statement of comprehensive income

For the six months ended 30 June 2020

(unaudited)

(unaudited) 6 months Audited year

6 months to to 30 June to 31 December

30 June 2020 2019 2019

Notes GBPm GBPm GBPm

Revenue 2 104.2 117.3 260.5

Cost of sales (55.5) (56.5) (129.0)

============== ============ ================

Gross profit 48.7 60.8 131.5

Administrative expenses (27.3) (26.0) (59.3)

Adjusted EBITDA 1 23.8 36.7 77.0

Depreciation (1.2) (0.7) (2.2)

Amortisation (0.4) (0.4) (0.7)

Share based payment charges (0.8) (0.8) (1.9)

=================================== ====== ============== ============ ================

Operating profit 21.4 34.8 72.2

Finance costs

Finance income 0.3 0.2 0.5

Finance expense - - (0.2)

Profit before tax 21.7 35.0 72.5

Tax expense (4.2) (6.7) (14.0)

============== ============ ================

Profit for the year / period 17.5 28.3 58.5

Items that may be reclassified

to profit or loss

Foreign currency translation

difference of foreign operations 0.1 - 0.1

Effective portion of cash

flow hedges (1.4) - 0.2

============== ============ ================

(1.3) - 0.3

Comprehensive income attributable

to equity holders of the parent

company 16.2 28.3 58.8

Earnings per share for profit

attributable to the owners

of the parent during the year

Basic (pence) 4 15.06 24.39 50.46

Diluted (pence) 4 14.99 24.30 50.26

Consolidated statement of financial position

30 June 2020

(unaudited) (unaudited) Audited

30 June 31 December

30 June 2020 2019 2019

Notes GBPm GBPm GBPm

Non-current assets

Property, plant & equipment 6.3 4.9 6.9

Intangible assets 40.6 41.3 41.0

Deferred tax asset 0.8 0.3 0.5

Other financial assets 2.3 2.2 2.1

============== ============ =============

Total non-current assets 50.0 48.7 50.5

============== ============ =============

Current assets

Inventories 23.6 30.4 20.8

Trade and other receivables 50.1 55.6 60.8

Corporation tax debtor 4.4 - -

Derivative financial instruments - - 0.1

Cash and cash equivalents 136.9 104.1 128.3

============== ============ =============

Total current assets 215.0 190.1 210.0

============== ============ =============

Total assets 265.0 238.8 260.5

============== ============ =============

Current liabilities

Trade and other payables (30.0) (29.9) (27.5)

Corporation tax liability - (5.9) (5.1)

Derivative financial instruments (1.8) (0.3) -

Lease liability (0.6) (0.6) (0.6)

============== ============ =============

Total current liabilities (32.4) (36.7) (33.2)

============== ============ =============

Non-current liabilities

Lease liability (1.0) (1.5) (1.2)

============== ============ =============

Total non-current liabilities (1.0) (1.5) (1.2)

============== ============ =============

Total liabilities (33.4) (38.2) (34.4)

============== ============ =============

Net assets 231.6 200.6 226.1

============== ============ =============

Equity attributable to equity

holders of the company

Share capital 0.3 0.3 0.3

Share premium 54.8 54.8 54.8

Capital Redemption Reserve 0.1 0.1 0.1

Cash Flow Hedge Reserve (1.2) - 0.2

Translation Reserve 0.1 (0.1) -

Retained earnings 177.5 145.5 170.7

Total equity 231.6 200.6 226.1

============== ============ =============

Consolidated statement of cash flows

For the six months ended 30 June 2020

(unaudited) (unaudited)

6 months 6 months Audited year

to 30 June to 30 June to 31 December

2020 2019 2019

Notes GBPm GBPm GBPm

Operating activities

Profit before tax 21.7 35.0 72.5

Finance expense - - 0.2

Finance income (0.3) (0.2) (0.5)

Depreciation of property, plant

& equipment 1.2 0.7 2.2

Amortisation of intangible

assets 0.4 0.4 0.7

Share based payments 0.8 0.8 1.9

============ ============ ================

23.8 36.7 77.0

(Increase)/ Decrease in trade

and other receivables 11.1 7.5 1.3

(Increase)/ Decrease in inventories (2.7) (2.0) 5.7

Increase/ (Decrease) in trade

and other payables 2.5 (3.1) (4.0)

10.9 2.4 3.0

Cash generated from operations 34.7 39.1 80.0

Income tax paid (14.1) (3.8) (12.0)

============ ============ ================

Net cash flows from operating

activities 20.6 35.3 68.0

============ ============ ================

Investing activities

Purchase of property, plant

and equipment (0.5) (0.7) (2.6)

Interest received 0.3 0.2 0.5

============ ============ ================

Net cash used in investing

activities (0.2) (0.5) (2.1)

============ ============ ================

Financing activities

Interest (paid) - - (0.2)

Issue of shares - - -

Dividends paid (11.5) (11.9) (18.0)

Repayment of loan - (6.1) (6.1)

Issue of other financial assets - (2.2) (2.2)

Other financing activities (0.3) (0.1) (0.5)

============ ============ ================

Net cash used in financing

activities (11.8) (20.3) (27.0)

============ ============ ================

Net increase in cash and cash

equivalents 8.6 14.5 38.9

Cash and cash equivalents at

beginning of period 128.3 89.7 89.7

============ ============ ================

Effect of movement in exchange

rates on cash held - (0.1) (0.3)

Cash and cash equivalents at

end of period 136.9 104.1 128.3

============ ============ ================

Notes to the consolidated financial information

For the six months ended 30 June 2020

1. Basis of preparation and accounting policies

The interim financial information has been prepared in

accordance with the recognition and measurement requirements of

International Financial Reporting Standards (IFRS) and IFRIC

interpretations issued by the International Accounting Standards

Board (IASB) adopted by the European Union.

The principal accounting policies adopted in the preparation of

the interim financial information are unchanged from those applied

in the Group's financial statements for the year ended 31 December

2019. The accounting policies applied herein are consistent with

those expected to be applied in the financial statements for the

year ended 31 December 2020.

This report is not prepared in accordance with IAS 34. The

financial information does not constitute statutory accounts within

the meaning of section 435 of the Companies Act 2006. Statutory

accounts for Fevertree Drinks plc for the year ended 31 December

2019 have been delivered to the Registrar of Companies. The

auditor's report on those accounts was unqualified, did not draw

attention to any matters by way of emphasis and did not contain a

statement under Section 498 (2) or (3) of the Companies Act

2006.

Adjusted EBITDA has been calculated consistently with the method

applied in the financial statements for the year ended 31 December

2019. Operating profit is adjusted for a number of non-cash items,

including amortisation of the Fever-Tree brand intangible acquired

in March 2013, depreciation, and the share-based payment charge

which recognises the fair value of share options granted. The

intention is for Adjusted EBITDA to provide a comparable,

year-on-year indicator of underlying trading and operational

performance.

The impact of COVID-19 has also been reflected in the Directors'

assessment of the going concern basis of preparation for the Group

financial statements. This has been considered by modelling the

impact on the Group's cashflow for the period to the end of

December 2021.

Whilst the Group is financially strong and has well balanced

revenue streams, it is clear that COVID-19 will have a material

impact on 2020 trading with the potential for further impacts in

2021. Sales have been strong in the Off-Trade channel across

regions, but the On-Trade channel, which makes up 45% of Group

sales, has been severely challenged, as government advice led to

the temporary closing of all On-Trade outlets across our key

regions during the first half of the year. Whilst the On-Trade is

now partially reopened in most of our key regions, we expect the

recovery to be gradual, and the risk of further local and regional

lockdowns remains as we proceed through 2020. In light of this

uncertainty and the related heightened credit risk, we have

increased our provision for bad debts to GBP2.1m.

Due to the high level of uncertainty in relation to the length,

breadth and depth of the potential impacts of COVID-19, the

Directors have modelled the impact on the Group under three

separate scenarios which consider different rates of recovery of

the On-Trade globally over the period to December 2021.

Under these differing scenarios, the forecasts for the period to

the end of December 2021 indicate that the Group continues to have

positive cashflows and significant cash balances and as a result is

able to continue operating and to meet its liabilities as they fall

due. This strong financial position and ongoing cash generation has

underpinned the Directors' decision to pay an interim dividend of

5.41 pence per share.

The Directors have therefore concluded that the Group has

adequate resources to continue in operational existence for at

least the 12 months following the publication of the interim

financial statements, that it is appropriate to continue to adopt

the going concern basis of preparation in the financial statements,

that there is

Notes to the consolidated financial information

For the six months ended 30 June 2020

not a material uncertainty in relation to going concern and that

there is no significant judgement involved in making that

assessment.

2. Revenue by region

(unaudited) (unaudited)

6 months 6 months Audited year

to 30 June to 30 June to 31 December

2020 2019 2019

GBPm GBPm GBPm

United Kingdom 48.3 60.7 132.7

United States of America 27.4 19.8 47.6

Europe 20.5 29.0 64.4

Rest of the World 8.0 7.8 15.8

============ ============ ================

Group 104.2 117.3 260.5

============ ============ ================

3. Dividend

The interim dividend of 5.41 pence per share will be paid on 16

October 2020 to shareholders on the register on 25 September

2020.

4. Earnings per share

(unaudited) (unaudited)

6 months 6 months Audited year

to 30 June to 30 June to 31 December

2020 2019 2019

GBPm GBPm GBPm

Profit

Profit used to calculate basic

and diluted EPS 17.5 28.3 58.5

Number of shares

Weighted average number of

shares for the purpose of basic

earnings per share 116,139,794 116,121,648 116,126,293

Weighted average number of

employee share options outstanding 482,873 427,211 448,508

Weighted average number of

shares for the purpose of diluted

earnings per share 116,622,667 116,548,859 116,574,801

Basic earnings per share (pence) 15.06 24.39 50.46

============ ============ ================

Diluted earnings per share

(pence) 14.99 24.30 50.26

============ ============ ================

Notes to the consolidated financial information

For the six months ended 30 June 2020

Normalised EPS (unaudited) (unaudited)

6 months 6 months Audited year

to 30 June to 30 June to 31 December

2020 2019 2019

GBPm GBPm GBPm

Profit

Reported profit before tax 21.7 35.0 72.5

Add back:

Amortisation 0.4 0.4 0.7

Adjusted profit before tax 22.1 35.4 73.2

Tax - assume standard rate

(19%) (4.2) (6.7) (13.9)

Normalised earnings 17.9 28.7 59.3

Number of shares 116,139,794 116,121,648 116,126,293

Normalised earnings per share

(pence) 15.38 24.63 51.08

============ ============ ================

Normalised EPS is an Alternative Performance Measure in which

earnings have been adjusted to exclude amortisation and the UK

statutory tax rates have been applied (disregarding other tax

adjusting items).

5. Events after the reporting period

On 1 July, the Group acquired 100% of the share capital of GDP

Global Drinks Partnership GmbH, "GDP", the Group's former sales

agent in Germany. The total consideration for the acquisition

comprises EUR2.6m cash, and c.EUR5m consolidation of historic

balances owed to Fever-Tree by GDP at the acquisition date. GDP

also distributes complementary premium beer and spirits brands,

which generated c.EUR10m of sales in 2019.

Initial acquisition accounting under IFRS 3 is on-going and will

be disclosed in the Group's financial statements for the year-ended

31 December 2020.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BIGDCXBGDGGR

(END) Dow Jones Newswires

September 08, 2020 02:00 ET (06:00 GMT)

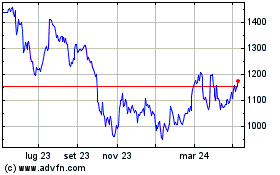

Grafico Azioni Fevertree Drinks (LSE:FEVR)

Storico

Da Mar 2024 a Apr 2024

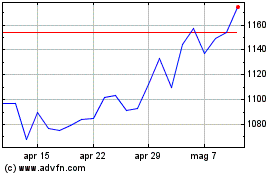

Grafico Azioni Fevertree Drinks (LSE:FEVR)

Storico

Da Apr 2023 a Apr 2024