By Maitane Sardon

The financial industry, once seen as a stronghold of older,

mostly white men, now leads the S&P 500 index in terms of

overall workforce diversity.

Banks and insurance companies received the highest score on

average in a ranking by The Wall Street Journal's research analysts

of the most diverse and inclusive industries in the S&P 500,

based on 10 metrics. The communication-services sector finished a

close second in the study, while consumer staples was third.

The push for change in the banking industry has come from a

variety of sources.

Banks have agreed to narrow pay disparities and actively recruit

a more diverse workforce to settle racial- and

gender-discrimination claims brought by employees over the past few

decades. Post-financial-crisis regulations, meanwhile, encourage

financial companies to do annual self-assessments of their

diversity policies and practices.

More recently, banks and insurers have faced growing competition

to attract and retain millennial workers, as well as reach an

increasingly diverse customer base.

"Banks have to adapt to the global changing demographics of

their clientele: They are younger, more diverse in terms of gender

and ethnic diversity, and they are putting mandates on them to say,

'Look, we want you to look like us,' " says Nadia Jones, former

senior diversity officer for Morgan Stanley Wealth Management and

now a principal at Culture Cipher Consulting.

A desire to harness the investment power of women, in

particular, has inspired financial firms to polish their D&I

strategies, Ms. Jones says. Although they control a significant

portion of household wealth, women as recently as a few years ago

were a large untapped market for the financial-advice industry.

"Not only were [financial companies] being sued, but they also

realized that diversifying their boards or their approaches to

wealth will ultimately create a better bottom line for them," she

says. "Those two things alone helped push them into that

space."

The efforts helped banks and insurers achieve an average score

of 50.4 out of 100 in the study, from The Wall Street Journal's

environment, social and governance research analysts.

Communications-services companies were second, with an average

score of 49.5, followed by consumer-staples firms at 48.8. In all,

six banks and two insurers were among the study's 20 most diverse

companies in the S&P 500, with Progressive Corp. and JPMorgan

Chase & Co. claiming the top two spots, with scores of 85 and

80, respectively.

The financial sector earned high marks versus other industries

in categories such as age diversity among senior management, ethnic

diversity in the workforce, and number of diversity and inclusion

programs in place. However, the sector trailed many others in terms

of gender and age diversity among board members, as well as board

independence.

Eight of the 10 most diverse banks and insurers in the research

have an operating profit margin (the profit a company generates

from its core business before interest and taxes as a percentage of

sales) above the financial-industry average of 5.8%, the project

found. And shares of Progressive and JPMorgan, the study's top two

scorers, outperformed both the financial-industry average and the

S&P 500 on a five-year and 10-year basis through June.

Even the best performers, though, have room to grow.

While women currently make up 30% of the senior leadership

globally at JPMorgan,I ethnic diversity at the top is considerably

lower. Pam Lipp-Hendricks, head of executive talent management and

diversity, says that is something the company is working to

improve.

"In the U.S., 50% of our firm's workforce is ethnically

diverse," she says. "That said, we know we have work to do to

increase the representation of ethnically diverse employees at

senior levels of the company."

Citigroup, meanwhile, said earlier this year that its female

employees earn 29% less than men without adjusting for factors like

job title and seniority. The company, which disclosed the data

following pressure from activist investor Arjuna Capital, has now

set a goal to have at least 40% of its mid- and senior-level roles

filled by women by 2021.

"This analysis underscores the importance of our goals to

increase the representation of women and U.S. minorities in senior

and higher-paying roles at Citi by the end of 2021," says Terry

Hogan, global head of diversity and talent management at Citi. "We

are focused on this work and empowering teams to implement new

programs to increase diversity across the company, to learn from

each other's successes and to scale these approaches across the

organization."

Some say incumbent firms are facing additional pressure to hire,

promote and retain diverse talent from fintech startups.

Fintech companies are smaller, more flexible and highly

adaptable to societal changes, so they are able to have

conversations around diversity and inclusion in a way that

traditional institutions sometimes can't, says Ms. Jones.

"These new companies can have a stand on #MeToo and Black Lives

Matter and be very vocal about it, and they can do so because they

are not beholden to the parameters of the old guard," she says.

Financial companies also have to keep up with traditional peers

who are rolling out diversity initiatives.

"The reality is that there is a lot of competition" within the

financial sector to have the best D&I strategies, says Cynthia

Bowman, chief diversity and inclusion and talent acquisition

officer at Bank of America.

"You have to ensure that over time you are becoming much more

granular and targeted, identifying areas of opportunities, being

more transparent around how you use data," she says.

Ms. Sardon is a reporter for The Wall Street Journal in

Barcelona. She can be reached at maitane.sardon@wsj.com.

(END) Dow Jones Newswires

October 26, 2019 08:14 ET (12:14 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

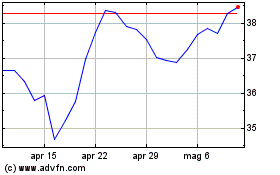

Grafico Azioni Bank of America (NYSE:BAC)

Storico

Da Mar 2024 a Apr 2024

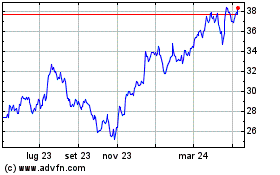

Grafico Azioni Bank of America (NYSE:BAC)

Storico

Da Apr 2023 a Apr 2024