Financière de l'Odet: 2019 Revenue

13 Febbraio 2020 - 5:50PM

Financière de l'Odet: 2019 Revenue

|

Revenue for 2019 fiscal year |

February 13, 2020 |

2019 Revenue: +3% organic

growth

- Revenue for the 4th quarter 2019: €6,895 million

- -0.1% at constant scope and exchange rates

- +6% as reported

- 2019 Revenue: €24,843 million

- +3% at constant scope and exchange rates

- +8% as reported

Revenue for the 4th

quarter 2019

At constant scope and exchange rates, Group

revenue remained stable during the 4th quarter 2019 (-0.1%) at

€6,895 million. This development mainly includes:

- a 3% slowdown in the transportation and logistics business

caused by declining air and sea volumes in freight forwarding,

which was partially offset by growth in port terminals;

- a 9% decline in the oil logistics business resulting from the

drop in volumes, which were negatively affected by unfavorable

weather conditions and lower oil product prices;

- 2% growth in the communications business, attributable mainly

to Vivendi, which notably benefited from growth at UMG

(+6%);

- a 5% increase in electricity storage and systems driven mainly

by growth in Bus operations.

Revenue as reported increased by 6% compared

with the 4th quarter 2018 due notably to changes in the Vivendi

scope related to the consolidation of Editis.

Revenue for the year 2019

At constant scope and exchange rates, 2019

revenue increased by 3% to €24,843 million.

Revenue as reported rose 8%, taking into account

€878 million in changes in scope, related mainly to the

consolidation of Editis at Vivendi, and a positive foreign exchange

impact in the amount of €285 million related to the decrease in the

value of the euro against almost all currencies, particularly the

US dollar.

| Change in

revenue by business |

|

(in millions of euros) |

4th quarter |

12-month total |

|

|

|

2019 |

2018 |

Growth |

Growth |

2019 |

2018 |

Growth |

Growth |

|

|

|

|

reported |

organic |

|

|

reported |

organic |

|

Transportation and Logistics |

1,503 |

1,546 |

-3% |

-3% |

5,939 |

6,007 |

-1 % |

-2% |

|

Oil logistics |

727 |

799 |

-9% |

-9% |

2,650 |

2,699 |

-2% |

-2% |

|

Communications |

4,571 |

4,052 |

13% |

2% |

15,891 |

13,924 |

14% |

6% |

|

Electricity Storage and Systems |

85 |

93 |

-9% |

5% |

329 |

358 |

-8% |

-5% |

|

Others (Agricultural Assets, Holding Companies) |

10 |

9 |

12% |

12% |

34 |

36 |

-6% |

-6% |

|

Total |

6,895 |

6,499 |

6% |

0% |

24,843 |

23,024 |

8% |

3% |

At constant scope and exchange rates, compared

to fiscal year 2018, the main sectors changed as follows:

- Transportation & Logistics, Oil

Logistics:

- transportation and logistics revenue narrowed 2% due to

declining revenue in freight forwarding and logistics, which was

penalized by the widespread downturn in air and sea volumes.

However, this did include growth in port terminal activities,

notably with significant increases in volumes recorded by the

Abidjan Terminal (Ivory Coast), the Conakry Terminal (Guinea), the

Freetown Terminal (Sierra Leone), as well as the Congo Terminal,

Bénin Terminal and Togo Terminal, and a decrease in the logistics

and handling businesses, primarily in East Africa. Lastly, sharp

growth in rail operations was driven by hydrocarbon traffic and

benefited from the larger locomotive fleet.

- oil logistics revenue decreased 2% due to the drop in volumes

related to unfavorable weather conditions, despite a slight

increase in oil product prices in 2019.

- Communications: the revenue of the

communications business (Vivendi) reported organic growth of 6%

compared with the 2018 fiscal year, boosted by 14% growth at

Universal Music Group, thanks to the 22% increase in subscriptions

and streaming revenues and a 3% rise in physical sales, as well as

the consolidation of Editis (+6%). This also includes in 1%

revenue declines for the Canal+ Group and 1% revenue decrease for

Havas.

- Electricity Storage & Systems: revenue

from industrial activities (electricity storage, plastic films,

specialist terminals and systems) decreased by 8% year-on-year, in

light of the downturn in the car-sharing business following the

termination of the Autolib service, as well as the downturn in the

specialist terminals division (terminals and double-door chambers

for stations and airports), which was notably affected by a drop in

passenger activity. It did however benefit from stronger battery

revenue driven by growth in new generation IT3 prototype battery

sales and the growth of Bluebus, with the sale of 67 buses

including 26 buses of 12 meters since the beginning of the year.

The order book for delivery at end-2019 stood at 67 buses of 12

meters and 8 buses of 6 meters.

| Change in

revenue per quarter |

|

(in millions of euros) |

1st quarter |

2nd quarter |

3rd quarter |

4th quarter |

|

|

|

2019 |

2018(1) |

2018 |

2019 |

2018 (1) |

2018 |

2019 |

2018(1) |

2018 |

2019 |

2018(1) |

2018 |

|

Transportation and Logistics |

1,483 |

1,448 |

1,435 |

1,491 |

1,521 |

1,511 |

1,462 |

1,529 |

1,514 |

1,503 |

1,546 |

1,546 |

|

Oil logistics |

665 |

671 |

670 |

613 |

592 |

590 |

645 |

643 |

641 |

727 |

801 |

799 |

|

Communications |

3,458 |

3,271 |

3,123 |

3,893 |

3,614 |

3,349 |

3,969 |

3,703 |

3,399 |

4,571 |

4,464 |

4,052 |

|

Electricity Storage and Systems |

75 |

90 |

89 |

85 |

94 |

93 |

85 |

84 |

83 |

85 |

81 |

93 |

|

Others (Agricultural Assets, Holding Companies) |

8 |

10 |

10 |

8 |

10 |

10 |

7 |

7 |

7 |

10 |

9 |

9 |

|

Total |

5,690 |

5,490 |

5,327 |

6,090 |

5,831 |

5,555 |

6,168 |

5,965 |

5,644 |

6,895 |

6,900 |

6,499 |

(1) At constant scope and

exchange

rates All

amounts are expressed in millions of euros and rounded to the

nearest decimal.As a result, the sum of the rounded amounts may

differ slightly from the reported total.

- 2020 02 13_Odet CAT4 2019_EN

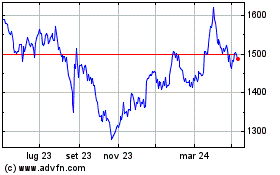

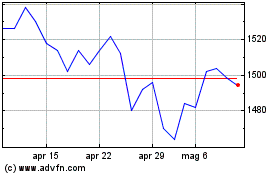

Grafico Azioni Compagnie de lOdet (EU:ODET)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Compagnie de lOdet (EU:ODET)

Storico

Da Apr 2023 a Apr 2024