TIDMFLO

RNS Number : 2253U

Flowtech Fluidpower PLC

28 July 2020

NEWS RELEASE

Issued on behalf of Flowtech Fluidpower

plc

Immediate Release

The information contained within this announcement is deemed by

the Company to constitute inside information stipulated under the

Market Abuse Regulation (EU) No. 596/2014. Upon the publication of

this announcement via the Regulatory Information Service, this

inside information is now considered to be in the public

domain.

FLOWTECH FLUIDPOWER PLC

("Flowtech Fluidpower", the "Group" or "Company")

Group Trading Update, Board Changes

and

Notice of Half-year Results

"We are delighted with the way we have reacted to the unforeseen

and unprecedented challenges presented by COVID-19. Improved

trading as markets recover, combined with our focus on

restructuring and cost saving initiatives, should result in a

profitable and cash generative second half of 2020"

London: Tuesday, 28 July 2020: AIM listed specialist technical

fluid power products supplier Flowtech Fluidpower plc (LSE: symbol

FLO) , announces the following unaudited trading update on its

performance for the six-month financial reporting period ended 30

June 2020

COVID-19

Since the onset of the COVID-19 lockdown we have prioritised the

health and wellbeing of our people, while maintaining a full

service to our customer base. We are extremely grateful to all our

employees for the resilience and adaptability they have shown in

the face of this adversity.

GROUP Trading Update AND FINANCIALS

HY1 2020 HY1 2019 FY 2019 Change

Unaudited Unaudited Audited H1 2020

GBP'm GBP'm GBP'm v H1 2019

----------- ----------- ----------

Divisional revenue:

Components 39.1 51.2 96.3 (23.6%)

Services 7.5 8.4 16.1 (11.0%)

Total Group revenue for

the period 46.6 59.6 112.4 (21.8%)

----------- ----------- ----------

Net debt 14.6* 18.8 16.6

------------------------- ----------- ----------- ---------- -----------

* Excludes IFRS16 related debt but including c.GBP1.6m (2019:

GBPNIL) of deferred VAT linked to Government COVID related support

schemes.

Revenue for the six-month period to June 2020 was down GBP13.0m,

or 22% on a like for like trading day basis. Q2 was the most

materially affected by COVID-19, down 33% against prior year.

April's revenue was the most impacted, down 41% on a like-for-like

basis, as a large proportion of our customers were closed. However,

we are pleased to report their gradual return resulted in an

improving trend, with the like-for-like revenue down 34% and 25% in

May and June, respectively.

All our key customers have now returned, our supply chain is

functioning effectively, and the trends remain encouraging, with

July revenue approximately 15% ahead of the same point in June. As

a result, we have welcomed back a number of UK furloughed employees

and now have only 43 furloughed compared with a peak of 189 in

April.

NET DEBT/BANKING FACILITIES

We continue to focus on all areas of working capital management

to ensure our cash position remains well controlled, and net debt

at 30 June 2020 was GBP14.6m. This represents a GBP1.0m reduction

from the position at 31 March 2020, GBP2.0m from the 31 December

2019, and GBP4.2m over the last 12 months. There is no outstanding

deferred consideration in respect of our historic acquisition

activity.

In line with the normal course of business we entered into

discussions with our Bank regarding the extension of facilities.

The Bank has recently approved the continuation of our aggregate

GBP25m of facilities and this is in the process of being

documented.

RESTRUCTURING/COST REDUCTION ACTIVITIES

We went into this crisis part way through a significant

programme of rationalisation and streamlining. We have previously

reported anticipated annualised savings of GBP1.6m and are pleased

that execution remains on track. In addition, we have commenced

further restructuring activities, including some redundancies and

anticipate the aggregate impact of this will lead to further

annualised savings of c.GBP1.0m. Activity in Ireland has been

slightly delayed in order to undertake a broader exercise which is

expected to deliver significant benefits. Whilst the overall annual

cost savings have increased, the estimated benefit (excluding

implementation costs) to our 2020 performance remains unchanged at

GBP0.8m.

SUMMARY & OUTLOOK

We reacted quickly to the unforeseen demands caused by COVID-19

and managed our trading and cash performance effectively. Entering

the second half of the year we look forward to improving trading

conditions. This coupled with our ongoing restructuring activities,

should result in a profitable and cash generative second half of

2020.

While the threat of further disruption remains real, we consider

it prudent to make no further commitments towards reinstating the

dividend. We recognise the importance of this income to our

shareholders but wish to retain the cash in the business until the

outlook is clearer. For similar reasons, we have no immediate plans

to reinstate formal earnings guidance.

BOARD CHANGES

As outlined in the announcement dated 27 March 2020, the Company

had commenced a search for a new Non-Executive Director. The Board

is pleased to announce that the result of this search is the

appointment of Paul Gedman as Non-Executive Director with immediate

effect. Paul will sit as a member of all Board Committees.

Paul has extensive experience in the global ecommerce industry

having held positions that included CEO of the Beauty, Wellness and

Luxury Divisions at the Hut Group for over eight years. Prior to

this, Paul held the role of Head of Online at Littlewoods Clearance

(part of the Shop Direct Group). Paul brings with him a wealth of

knowledge in growing international businesses through leveraging

ecommerce and digital capabilities. The Board feel this experience

will bring additional skills which can serve to benefit the

Company's e-business operation, in turn expanding our

online-presence and cross-border selling opportunities, placing us

at the forefront of the sector as a progressive industrial

distributor.

As announced on 12 May 2020, the Company confirms that as at 1

August 2020, Roger McDowell will be appointed Non-Executive

Chairman with the current Non-Executive Chairman Malcolm Diamond

MBE retiring from the Board. We would like to sincerely thank

Malcolm for the huge contribution he has provided over the last six

years.

The Board will then comprise Roger McDowell (Non-Executive

Chairman), Bryce Brooks (Chief Executive Officer), Russell Cash

(Chief Financial Officer), Nigel Richens and Paul Gedman

(Non-Executive Directors).

NOTICE OF RESULTS

The Group is planning to release its Half-year results for the

period ended 30 June 2020 on Tuesday, 8 September. The announcement

will be available to view and download from the Company's website

www.flowtechfluidpower.com .

Enquiries:

FLOWTECH FLUIDPOWER PLC

Bryce Brooks, Chief Executive

Russell Cash, Chief Financial Officer

Tel: +44 (0) 1695 52796

Email: info@flowtechfluidpower.com

To read more about the Group please visit www.flowtechfluidpower.com

Zeus Capital Limited (Nominated Adviser and Joint Broker)

Andrew Jones, Kieran Russell (corporate finance)

Dominic King, John Goold (sales & broking)

Tel: +44 (0) 20 3829 5000

finnCap Limited (Joint Broker)

Ed Frisby, Kate Bannatyne (corporate finance)

Rhys Williams, Andrew Burdis (sales & broking)

Tel: +44 (0) 20 7220 0500

TooleyStreet Communications (IR and media relations)

Fiona Tooley

Tel: +44 (0) 7785 703523

or email : fiona@tooleystreet.com

Further information relating to Paul Jonathan Gedman:

In accordance with Schedule 2(g) of the AIM Rules for Companies, Paul

Jonathan Gedman (aged 39) holds, or has held in the past five years, the

following directorships and partnerships:

Current Past five years

The Hut Management Company The Hut Group Limited

Limited

PJG Growth Limited The Hut.com Limited

Lookfantastic Group Limited

Lookfantastic Salons

Limited

Lookfantastic London

Limited

Lookfantastic.com Limited

Lookfantastic Training

Limited

Mankind Direct Limited

Mama Mio Limited

Mama Mio Distribution

Limited

EI Spa Holdings (UK)

Limited

ESPA International (UK)

Limited

Illamasqua (Holdings)

Limited

Illamasqua Limited

Primavera Aromatherapy

Limited

Paul holds no shares in the Company.

About Flowtech Fluidpower plc

Founded as Flowtech in 1983, the Flowtech Fluidpower Group is the UK's

leading specialist supplier of technical fluid power products.

The business joined AIM in 2014. Today, the Group has two distinct divisions:

Division: What we do: Locations:

----------- ---------------------------------------------- ----------------------------------

Components Supply of hydraulic and pneumatic Flowtechnology Benelux (Deventer)

consumables, predominantly through Flowtechnology China ( Guangzhou

distribution for urgent maintenance )

and repair operations across all industry Flowtechnology UK (Skelmersdale)

sectors. Additionally, support a broad Indequip (Skelmersdale)

range of OEMs supplying off-the-shelf Beaumanor (Leicester)

and tailored components and assemblies. Hydravalve (Willenhall)

Primary Fluid Power Components

(Skelmersdale)

Nelson Hydraulics (Dublin,

Lisburn, Dungannon, UK)

HTL (Ludlow)

Hi-Power Hydraulics (Cork,

Dublin, Belfast Manchester)

Hydroflex (Brussels, Rotterdam

and OudBeijerland)

Hydraulic Equipment Supermarkets

(Gloucester, Leeds)

Derek Lane & Co (Newton Abbot,

Devon)

HES Tractec (Gloucester)

----------- ---------------------------------------------- ----------------------------------

Services Bespoke design, manufacturing, commissioning, Primary Fluid Power Systems

installation and servicing of systems (Knowsley)

to manufacturers of specialised industrial Branch Hydraulic Systems

and mobile hydraulic original equipment and HES Automatec (Gloucester)

manufacturers (OEMs) and additionally HES Lubemec (Gloucester)

a wide range of industrial end users. HES Onsite (Leeds, Gloucester)

Flow Connect (Gloucester)

Orange County (Spennymoor)

----------- ---------------------------------------------- ----------------------------------

Both Group's divisions have overlapping product sets, allowing procurement

synergies to be maximised.

The above divisions are supported by a centralised back office team based

at the Skelmersdale, Lancashire, and Wilmslow, Cheshire sites in the UK

and a procurement and quality control team in Shanghai, China. In total,

the business employs over 550 people. For more information please visit,

www.flowtechfluidpower.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTEAPXXASKEEFA

(END) Dow Jones Newswires

July 28, 2020 02:00 ET (06:00 GMT)

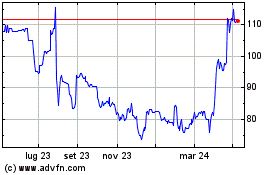

Grafico Azioni Flowtech Fluidpower (LSE:FLO)

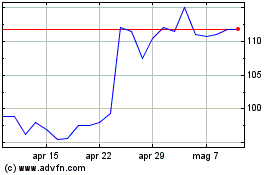

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Flowtech Fluidpower (LSE:FLO)

Storico

Da Apr 2023 a Apr 2024