TIDMFLTR

RNS Number : 5652W

Flutter Entertainment PLC

23 December 2021

23 December 2021

Flutter Entertainment plc

Acquisition of Sisal, Italy's leading online gaming operator

Flutter Entertainment plc ( "Flutter" or the "Group") is pleased

to announce the acquisition of Sisal ("Sisal"), Italy's leading

online gaming operator, from CVC Capital Partners Fund VI for a

consideration of EUR1.913bn/GBP1.62bn. This acquisition fully

aligns with the Group's strategy of investing to build leadership

positions in regulated markets globally. The transaction is likely

to complete during Q2 2022 and is expected to be accretive to

adjusted earnings in the first 12 months post-completion.

Sisal is a leading betting, gaming and lottery operator

headquartered in Milan. In the 12 months to December 2021(1) ,

Sisal expects to generate EBITDA of EUR248m/GBP211m, with 58%

coming from its online offering and the remainder coming from a

combination of retail and lottery operations. Approximately 90% of

Sisal's 2021 EBITDA is generated in Italy with the balance coming

from regulated lottery operations in Turkey and Morocco. The

business employs circa 2,500 people today.

The addition of Sisal to Flutter delivers several key strategic

outcomes:

-- Secures a gold medal position in Italy by bringing the

leading online brand into the Flutter portfolio. The combination of

Sisal with Flutter's existing online Italian presence through

PokerStars and Betfair will result in a combined online share of

20%(2)

-- Increases the Group's exposure to an attractive,

fast-growing, regulated online market: Italy is Europe's 2(nd)

largest regulated gambling market and one that has seen online

penetration grow from 10% in 2019 to approximately 20% today.

Sisal's online revenues have grown by a compound annual rate of 34%

since 2016

-- Sisal's omni-channel offering will deliver a competitive

advantage to Flutter's business, particularly given Italy's

advertising restrictions and the prevalence of cash deposits and

withdrawals through retail

-- Increases Flutter's recreational customer base with the

addition of 300,000(3) highly engaged online average monthly

players and over 9.5m retail customers

-- Further diversifies Flutter's product and geographical

footprint and increases the proportion of Flutter's revenue from

regulated markets which in Q3 2021 was over 91%

-- Bolsters Flutter's existing talent pool by adding a proven

management team that will continue to lead the business and who

have sought to take a leadership position in the promotion of safer

gambling in Italy

Peter Jackson, Flutter Chief Executive, commented:

"I am delighted to add Sisal, Italy's leading gaming brand, to

the Group as we look to attain a gold medal position in the Italian

market. For some time we have wanted to pursue this market

opportunity via an omni-channel strategy and this acquisition will

ideally position us to do so. Sisal has grown its online presence

significantly in recent years, aided by its proprietary platform

and commitment to innovation. I'm excited to see how Flutter can

complement these capabilities through our scale, differentiated

products and operational capabilities. We look forward to welcoming

Francesco and the rest of the Sisal team to Flutter in 2022."

Francesco Durante, Sisal Chief Executive, commented:

"Over the last five years, thanks to CVC's support, we have

successfully transformed Sisal into a leading digital and

international gaming company. Through our commitment to digital

innovation, international expansion and safer gambling, we have

achieved a leadership position in Italy's online gaming market and

developed our global footprint by winning lottery tenders in

Morocco and Turkey. We are delighted to join Flutter and are

convinced that through its scale and operational capabilities, we

will be able to further strengthen our leadership in the markets we

operate in. I look forward to working with Peter and the team on

the next chapter of Sisal history."

Giampiero Mazza, Managing Partner at CVC Italy commented:

"We are very proud of the success achieved by Sisal and its

transformation since our acquisition in 2016. Through heavy

investment in its digital competencies, Sisal has become Italy's

leader in online gaming while also growing its international

operations. Furthermore, the Company is leading the Italian

industry in ensuring responsible and safe gaming. We want to thank

Francesco and the whole management team for their incredible

dedication, focus and ambition, and for leading this successful

journey in spite of regulatory challenges and the pandemic. Flutter

is a fantastic new partner for Sisal and we wish them the very

best."

1. Attractiveness of the Italian market to Flutter

The Italian market offers the following attractive

characteristics:

-- Size: Italy is the second largest regulated gambling market

in Europe after the UK, with total estimated gross gaming revenue

(GGR) in 2019 of EUR19bn/GBP16bn(4)

-- Potential for online growth due to ongoing migration from retail:

o Whilst just 10% of total Italian GGR was generated online in

2019, the Covid-19 pandemic has led to a material increase to

around 20% over the last two years. We expect that a sizable

proportion of migrated customers are likely to remain online as

trading conditions normalise

o Online penetration rates remain well below the UK and

Australia where online share of total gambling spend was estimated

to be circa 60% and 70% respectively in 2019

o With good ongoing structural momentum, the Italian online

market is projected to be worth GBP3.6bn by 2024, equating to

forecast 5-year compound annual growth of 18%(5)

-- Strategic advantages of retail network access:

o Omni-channel operators, such as Sisal, are capable of

maximising growth due to their retail presence and ability to

engage with customers across both channels

o Advertising restrictions in particular have emphasised the

opportunity for omni-channel operators to acquire online customers,

allowing them to leverage their high brand awareness through having

a retail presence. Since these restrictions were introduced, large

omni-channel operators have gained market share at the expense of

online-only operators

o In addition, a significant proportion of online

deposits/withdrawals are done via the retail network, with retail

staff acting as brand advocates, providing multi-channel operators

with a competitive moat around their businesses

-- Diversified product demand:

o In 2022(5) an estimated 95% of online revenue is expected to

come from gaming (59%) and sports betting (36%) combined, a mix

that overlaps well with Flutter's core areas of expertise

o The majority of retail revenue is expected to be derived from

gaming machines (57%) and lottery (37%), with just 6% coming from

sports betting

2. Sisal - Italian market leader and key online asset

We believe that Sisal is very well-positioned to benefit from

the structural growth drivers highlighted above. Key features of

the business include:

-- A leadership position today: Sisal's online market share is

currently 11.9%(2) . Combined with Flutter's existing assets we

will reach circa 20% share(2)

-- A market leading brand: Clear #1 brand for 'top of mind'

awareness in the Italian market, aided by a retail footprint of

circa 1,700 Sisal outlets and a further 40,000 concession

points/points of sale

-- A diverse product offering: Across gaming, sports and lottery

-- Highly engaged player base: Over 300,000(3) online average

monthly players in Italy and a retail base of 9.5m customers to

migrate online

-- Proprietary technology: The business operates on a fully

proprietary technology stack with a strong focus and track record

in delivering product innovation, powered by over 1,000 employees

dedicated to online product development

-- Experienced management team that will continue to lead the business

-- Scope to grow in other markets/product verticals: Lotteries

have enabled Sisal to successfully grow outside of Italy. In

Turkey, its lottery operation is projected to generate GBP22m

EBITDA in 2021 despite only launching in 2020. This acquisition

provides Flutter with lottery capabilities for the first time

-- Focus on sustainability: Market leading focus on ESG and

safer gambling underpinned by AI and the highest standards of

industry certification

3. Financials and consideration(1)

Sisal expects to report revenue (after deduction of gaming

duties) in 2021 of GBP590m (EUR694m)(6) . It expects to report

consolidated EBITDA(7) of GBP211m (EUR248m), 90% of which will come

from its Italian operations (online 59%, retail 31%).

We see tangible opportunities to deliver material revenue

synergies from the acquisition of Sisal through (i) leveraging

Sisal's retail channel to grow online deposits for existing Flutter

brands (PokerStars and Betfair), (ii) enhancing Sisal's sports

betting offering by utilising Flutter's pricing and risk management

capabilities and (iii) enhancing Sisal's casino product by

providing it with access to Flutter's in-house gaming content. Cost

synergies from the transaction are expected to be circa GBP10m,

principally due to potential procurement savings. We anticipate

that revenue synergies will exceed cost synergies over time.

The total consideration for Sisal is EUR1.913bn/GBP1.62bn, which

is payable in cash and in full on completion of the transaction.

This amount includes full repayment of all Sisal's debt upon

completion. The transaction will be financed by way of additional

Flutter debt facilities, agreed with Barclays Bank PLC. The

transaction is conditional on merger control clearance and

customary gaming and foreign investment consents. Subject to these

approvals, it is expected that the transaction will complete in Q2

2022.

Ends.

The person responsible for arranging release of this

Announcement on behalf of Flutter is Edward Traynor, Company

Secretary of Flutter.

Contacts:

Investor Relations:

David Jennings, Group Director of Investor

Relations & FP&A + 353 87 951 3560

Ciara O'Mullane, Investor Relations + 353 87 947 7862

Liam Kealy, Investor Relations + 353 87 665 2014

Press:

Lindsay Dunford, Corporate Communications + 44 79 3197 2959

Robert Allen, Corporate Communications + 44 75 5444 1363

Billy Murphy, Drury Communications + 353 1 260 5000

James Murgatroyd, Finsbury + 44 20 7251 3801

(1) Financial projections for FY 2021 have been provided by

Sisal management and are consistent with 10 months of actual EBITDA

performance (GBP163m) and 2 months of projected performance

(GBP48m). FY 2021 has been used in this release as we believe it is

a better reflection of the ongoing earnings power of the business;

2020 performance was materially impacted by Covid-19 related retail

restrictions

(2) Online market share of gross gaming revenue in October

2021

(3) Average number of players in the 12 months to 30 June

2021

(4) Source: ADM (Agenzia delle Dogane e dei Monopoli - Italian

gaming regulator), MDF Partners. Includes lotteries of GBP5bn

(5) Source: MDF Partners

(6) We will align Sisal's revenue definition with Flutter's

(which is reported before deduction of gaming duties) post

completion and report consistent revenue numbers accordingly.

(7) The consolidated EBITDA figure of EUR248m for 2021 includes

EUR13m accruing to minority shareholders

(8) Gross asset value of Sisal was EUR1,658m as at 30 September

2021

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQTTBJTMTJTTFB

(END) Dow Jones Newswires

December 23, 2021 02:00 ET (07:00 GMT)

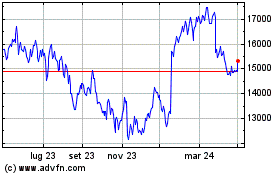

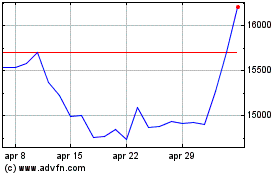

Grafico Azioni Flutter Entertainment (LSE:FLTR)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Flutter Entertainment (LSE:FLTR)

Storico

Da Apr 2023 a Apr 2024