Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

15 Settembre 2021 - 2:26PM

Edgar (US Regulatory)

|

|

|

|

|

September 14, 2021

|

|

Filed pursuant to Rule 433

Registration Statement Nos. 333-254751 and

333-254751-02

|

PRICING TERM SHEET

U.S.$1,250,000,000 3.001% Fixed Rate Guaranteed Notes due 2052

|

|

|

|

|

Issuer:

|

|

BP Capital Markets America Inc. (“BP Capital America”)

|

|

|

|

|

Guarantor:

|

|

BP p.l.c. (“BP”)

|

|

|

|

|

Title:

|

|

Fixed Rate Guaranteed Notes due 2052 (the “2052 Notes”)

|

|

|

|

|

Total Principal Amount Being Issued:

|

|

$1,250,000,000

|

|

|

|

|

Denomination:

|

|

The 2052 Notes will be issued in denominations of $1,000 and integral multiples of $1,000.

|

|

|

|

|

Issuance Date:

|

|

September 17, 2021

|

|

|

|

|

Guarantee:

|

|

Payment of the principal of and interest on the 2052 Notes is fully guaranteed by BP.

|

|

|

|

|

Maturity Date:

|

|

March 17, 2052

|

|

|

|

|

Day Count:

|

|

30/360

|

|

|

|

|

Day Count Convention:

|

|

Following Unadjusted

|

|

|

|

|

Interest Rate:

|

|

3.001% per annum

|

|

|

|

|

Date Interest Starts Accruing:

|

|

September 17, 2021

|

|

|

|

|

Interest Payment Dates:

|

|

March 17 and September 17 of each year, subject to the Day Count Convention.

|

|

|

|

|

First Interest Payment Date:

|

|

March 17, 2022.

|

|

|

|

|

Treasury Benchmark:

|

|

2.375% due May 15, 2051

|

|

|

|

|

Treasury Benchmark Yield / Price:

|

|

1.831% / 112-13

|

|

|

|

|

Spread to Treasury Benchmark:

|

|

T + 117 bps

|

|

|

|

|

Re-offer Yield:

|

|

3.001%

|

|

|

|

|

Business Day:

|

|

Any week day on which banking or trust institutions in neither New York nor London are authorized generally or obligated by law, regulation or executive order to close.

|

|

|

|

|

Ranking:

|

|

The 2052 Notes are unsecured and unsubordinated and will rank equally with all of BP Capital America’s other unsecured and unsubordinated indebtedness.

|

|

|

|

|

Regular Record Dates for Interest:

|

|

The 15th calendar day preceding each Interest Payment Date, whether or not such day is a Business Day.

|

|

|

|

|

|

Payment of Additional Amounts:

|

|

In the event that BP is required to withhold any taxes by the laws of the jurisdiction in which BP is incorporated from a payment under the guarantee, BP will be required, subject to certain exceptions, to pay you an additional

amount so that the net amount you receive is the amount specified in the 2052 Notes to which you are entitled.

|

|

|

|

|

Listing:

|

|

Application will be made to list the 2052 Notes on the New York Stock Exchange, although neither BP Capital America nor BP can guarantee such listing will be obtained.

|

|

|

|

|

Redemption:

|

|

The 2052 Notes are not redeemable, except as described under “Description of Debt Securities and Guarantees—Optional Tax Redemption” on page 18 of the prospectus and as described below under “Optional

Redemption”. The provision for optional tax redemption described in the prospectus will apply in respect of changes in tax treatments occurring after September 14, 2021.

|

|

|

|

|

Optional Redemption:

|

|

Prior to September 17, 2051 (the date that is six months prior to the scheduled maturity date for the 2052 Notes), BP Capital America has the right to redeem the 2052 Notes, in whole or in part, at any time and from time to

time at a redemption price equal to the greater of (i) 100% of the principal amount of the 2052 Notes to be redeemed and (ii) the sum of the present values of the remaining scheduled payments of principal and interest on the 2052 Notes to be

redeemed that would be due if such Notes matured on September 17, 2051 (not including any portion of payments of interest accrued and unpaid to the redemption date) discounted to the redemption date on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the treasury rate plus 20 basis points, plus in either case accrued and unpaid interest to the date of redemption. On or

after September 17, 2051 (the date that is six months prior to the scheduled maturity date for the 2052 Notes), BP Capital America has the right to redeem the 2052 Notes, in whole or in part, at any time and from time to time at a redemption

price equal to 100% of the principal amount of the 2052 Notes to be redeemed, plus accrued and unpaid interest, if any, thereon to, but excluding, the date of redemption. For purposes of determining the optional redemption price, the following

definitions are applicable. “Treasury rate” means, with respect to any redemption date, the rate per annum equal to the semi-annual equivalent yield to maturity or interpolated (on a day count basis) of the comparable treasury issue,

assuming a price for the comparable treasury issue (expressed as a percentage of its principal amount) equal to the comparable treasury price for such redemption date. “Comparable treasury issue” means the U.S. Treasury security or

securities selected by the quotation agent as having an actual or interpolated maturity comparable to the remaining term of the 2052 Notes to be redeemed that would be utilized, at the time of selection and in accordance with customary financial

practice, in pricing new issues of corporate debt securities of comparable maturity to the remaining term of such Notes.

|

|

|

|

|

|

|

|

|

|

“Comparable treasury price” means, with respect to any redemption date, the average of the reference treasury dealer quotations for such redemption date. “Quotation agent” means one of the reference

treasury dealers appointed by BP Capital America. “Reference treasury dealer” means one of Barclays Capital Inc., Goldman Sachs & Co. LLC, HSBC Securities (USA) Inc., J.P. Morgan Securities LLC, Morgan Stanley & Co. LLC.

and TD Securities (USA) LLC or one of their affiliates, which is a primary U.S. government securities dealer in the United States (a “primary treasury dealer”), and their respective successors, and two other primary treasury dealers

selected by BP Capital America, provided, however, that if any of the foregoing shall cease to be a primary treasury dealer, BP Capital America shall substitute therefor another primary treasury dealer. “Reference treasury dealer

quotations” means with respect to each reference treasury dealer and any redemption date, the average, as determined by the quotation agent, of the bid and asked prices for the comparable treasury issue (expressed in each case as a percentage

of its principal amount) quoted in writing to the quotation agent by such reference treasury dealer at 5:00 p.m. New York time on the third business day preceding such redemption date.

|

|

|

|

|

|

Sinking Fund:

|

|

There is no sinking fund.

|

|

|

|

|

|

|

Further Issuances:

|

|

BP Capital America may, at its sole option, at any time and without the consent of the then existing Note holders issue additional Notes in one or more transactions subsequent to the date of the related prospectus

supplement dated September 14, 2021 with terms (other than the issuance date, public offering price and, possibly, the first interest payment date and the date interest starts accruing) identical to the 2052 Notes issued pursuant to the

prospectus supplement. These additional Notes will be deemed part of the same series as and fungible with the 2052 Notes issued pursuant to the prospectus supplement and will provide the holders of these additional Notes the right to vote together

with holders of the 2052 Notes issued pursuant to the prospectus supplement, provided that such additional Notes will be issued with no more than de minimis original issue discount or will be part of a “qualified reopening” for U.S.

federal income tax purposes.

|

|

|

|

|

Public Offering Price:

|

|

Per 2052 Note: 100.000%; Total: $1,250,000,000

|

|

|

|

|

Underwriters’ Discount:

|

|

Per 2052 Note: 0.400%; Total: $5,000,000

|

|

|

|

|

Proceeds, Before Expenses, to Us:

|

|

Per 2052 Note: 99.600%; Total: $1,245,000,000

|

|

|

|

|

|

Underwriter:

|

|

Barclays Capital Inc.

|

|

$208,334,000

|

|

|

|

Goldman Sachs & Co. LLC

|

|

$208,334,000

|

|

|

|

HSBC Securities (USA) Inc.

|

|

$208,333,000

|

|

|

|

J.P. Morgan Securities LLC

|

|

$208,333,000

|

|

|

|

Morgan Stanley & Co. LLC

|

|

$208,333,000

|

|

|

|

TD Securities (USA) LLC

|

|

$208,333,000

|

|

|

|

|

|

|

|

|

CUSIP Number:

|

|

10373QBS8

|

|

|

|

|

ISIN:

|

|

US10373QBS84

|

|

|

|

U.S.$250,000,000 3.379% Fixed Rate Guaranteed Notes due 2061

|

|

|

|

|

Issuer:

|

|

BP Capital Markets America Inc. (“BP Capital America”)

|

|

|

|

|

Guarantor:

|

|

BP p.l.c. (“BP”)

|

|

|

|

|

Title:

|

|

Fixed Rate Guaranteed Notes due 2061 (the “2061 Notes,” and with the 2052 Notes, the “Notes”)

|

|

|

|

|

Total Principal Amount Being Issued:

|

|

$250,000,000. The 2061 Notes offered under this free writing prospectus will have the same terms (other than the public offering price and issuance date), form part of the same series and trade freely with the $1,250,000,000

aggregate principal amount of 3.379% Guaranteed Notes due 2061 issued on February 8, 2021 (the “Original 2061 Notes”) and the $550,000,000 3.379% Guaranteed Notes due 2061 (the “First

Re-opened 2061 Notes”). Upon completion of this offering, $2,050,000,000 aggregate principal amount of 2061 Notes, First Re-opened 2061 Notes and Original 2061

Notes will be outstanding.

|

|

|

|

|

Denomination:

|

|

The 2061 Notes will be issued in denominations of $1,000 and integral multiples of $1,000.

|

|

|

|

|

Issuance Date:

|

|

September 17, 2021

|

|

|

|

|

Guarantee:

|

|

Payment of the principal of and interest on the 2061 Notes is fully guaranteed by BP.

|

|

|

|

|

Maturity Date:

|

|

February 8, 2061

|

|

|

|

|

Day Count:

|

|

30/360

|

|

|

|

|

Day Count Convention:

|

|

Following Unadjusted

|

|

|

|

|

Interest Rate:

|

|

3.379% per annum

|

|

|

|

|

Date Interest Starts Accruing:

|

|

August 8, 2021

|

|

|

|

|

Interest Payment Dates:

|

|

February 8 and August 8 of each year, subject to the Day Count Convention.

|

|

|

|

|

First Interest Payment Date:

|

|

February 8, 2022. The interest payable on February 8, 2022 to the purchasers of the 2061 Notes will include interest deemed to have accrued from and including August 8, 2021 to, but excluding, September 17,

2021, totaling $915,145.83.

|

|

|

|

|

Treasury Benchmark:

|

|

2.375% due May 15, 2051

|

|

|

|

|

Treasury Benchmark Yield / Price:

|

|

1.831% / 112-13

|

|

|

|

|

Spread to Treasury Benchmark:

|

|

T + 127 bps

|

|

|

|

|

Re-offer Yield:

|

|

3.101%

|

|

|

|

|

|

Business Day:

|

|

Any week day on which banking or trust institutions in neither New York nor London are authorized generally or obligated by law, regulation or executive order to close.

|

|

|

|

|

Ranking:

|

|

The 2061 Notes are unsecured and unsubordinated and will rank equally with all of BP Capital America’s other unsecured and unsubordinated indebtedness.

|

|

|

|

|

Regular Record Dates for Interest:

|

|

The 15th calendar day preceding each Interest Payment Date, whether or not such day is a Business Day.

|

|

|

|

|

Payment of Additional Amounts:

|

|

In the event that BP is required to withhold any taxes by the laws of the jurisdiction in which BP is incorporated from a payment under the guarantee, BP will be required, subject to certain exceptions, to pay you an additional

amount so that the net amount you receive is the amount specified in the 2061 Notes to which you are entitled.

|

|

|

|

|

Listing:

|

|

The Original 2061 Notes issued on February 8, 2021 and the First Re-opened 2061 Notes issued on June 17, 2021 are listed on the New York Stock Exchange. Application will be made

to list the 2061 Notes on the New York Stock Exchange, although neither BP Capital America nor BP can guarantee such listing will be obtained.

|

|

|

|

|

Redemption:

|

|

The 2061 Notes are not redeemable, except as described under “Description of Debt Securities and Guarantees—Optional Tax Redemption” on page 18 of the prospectus and as described below under “Optional

Redemption”. The provision for optional tax redemption described in the prospectus will apply in respect of changes in tax treatments occurring after February 3, 2021.

|

|

|

|

|

Optional Redemption:

|

|

Prior to August 8, 2060 (the date that is six months prior to the scheduled maturity date for the 2061 Notes), BP Capital America has the right to redeem the 2061 Notes, in whole or in part, at any time and from time to time

at a redemption price equal to the greater of (i) 100% of the principal amount of the 2061 Notes to be redeemed and (ii) the sum of the present values of the remaining scheduled payments of principal and interest on the 2061 Notes to be

redeemed that would be due if such 2061 Notes matured on August 8, 2060 (not including any portion of payments of interest accrued and unpaid to the redemption date) discounted to the redemption date on a semi-annual basis (assuming a 360-day year consisting of twelve 30-day months) at the treasury rate plus 25 basis points, plus in either case accrued and unpaid interest to the date of redemption. On or

after August 8, 2060 (the date that is six months prior to the scheduled maturity date for the 2061 Notes), BP Capital America has the right to redeem the 2061 Notes, in whole or in part, at any time and from time to time at a redemption price

equal to 100% of the principal amount of the 2061 Notes to be redeemed, plus accrued and unpaid interest, if any, thereon to, but excluding, the date of redemption. For purposes of determining the optional redemption price, the following definitions

are applicable. “Treasury rate” means, with respect to any redemption date, the rate per annum equal to the semi-annual

|

|

|

|

|

|

|

|

equivalent yield to maturity or interpolated (on a day count basis) of the comparable treasury issue, assuming a price for the comparable treasury issue (expressed as a percentage of its principal amount) equal to the comparable

treasury price for such redemption date. “Comparable treasury issue” means the U.S. Treasury security or securities selected by the quotation agent as having an actual or interpolated maturity comparable to the remaining term of the 2061

Notes to be redeemed that would be utilized, at the time of selection and in accordance with customary financial practice, in pricing new issues of corporate debt securities of comparable maturity to the remaining term of such 2061 Notes.

“Comparable treasury price” means, with respect to any redemption date, the average of the reference treasury dealer quotations for such redemption date. “Quotation agent” means one of the reference treasury dealers appointed by

BP Capital America. “Reference treasury dealer” means one of Citigroup Global Markets Inc., Deutsche Bank Securities Inc., Goldman Sachs & Co. LLC., J.P. Morgan Securities LLC, Morgan Stanley & Co. LLC or NatWest Markets

Securities Inc. or one of their affiliates, which is a primary U.S. government securities dealer in the United States (a “primary treasury dealer”), and their respective successors, and two other primary treasury dealers selected by BP

Capital America, provided, however, that if any of the foregoing shall cease to be a primary treasury dealer, BP Capital America shall substitute therefor another primary treasury dealer. “Reference treasury dealer quotations” means with

respect to each reference treasury dealer and any redemption date, the average, as determined by the quotation agent, of the bid and asked prices for the comparable treasury issue (expressed in each case as a percentage of its principal amount)

quoted in writing to the quotation agent by such reference treasury dealer at 5:00 p.m. New York time on the third business day preceding such redemption date.

|

|

|

|

|

Sinking Fund:

|

|

There is no sinking fund.

|

|

|

|

|

Further Issuances:

|

|

BP Capital America may, at its sole option, at any time and without the consent of the then existing 2061 Note holders issue additional 2061 Notes in one or more transactions subsequent to the date of the related prospectus

supplement dated September 14, 2021 with terms (other than the issuance date, public offering price and, possibly, the first interest payment date and the date interest starts accruing) identical to the 2061 Notes issued pursuant to the

prospectus supplement. These additional 2061 Notes will be deemed part of the same series as and fungible with the 2061 Notes issued pursuant to the prospectus supplement and will provide the holders of these additional 2061 Notes the right to vote

together with holders of the 2061 Notes issued pursuant to the prospectus supplement, provided that such additional 2061 Notes will be issued with no more than de minimis original issue discount or will be part of a “qualified

reopening” for U.S. federal income tax purposes.

|

|

|

|

|

|

|

|

|

|

|

Public Offering Price:

|

|

Per 2061 Note: 106.254%; Total: $265,635,000 (in each case, plus accrued interest from and including August 8, 2021 to, but excluding, September 17, 2021)

|

|

|

|

|

Underwriters’ Discount:

|

|

Per 2061 Note: 0.400%; Total: $1,000,000

|

|

|

|

|

Proceeds, Before Expenses, to Us:

|

|

Per 2061 Note: 105.854%; Total: $264,635,000 (in each case, plus accrued interest from and including August 8, 2021 to, but excluding September 17, 2021)

|

|

|

|

|

|

Underwriter:

|

|

Barclays Capital Inc.

|

|

$41,667,000

|

|

|

|

Goldman Sachs & Co. LLC

|

|

$41,667,000

|

|

|

|

HSBC Securities (USA) Inc.

|

|

$41,667,000

|

|

|

|

J.P. Morgan Securities LLC

|

|

$41,667,000

|

|

|

|

Morgan Stanley & Co. LLC

|

|

$41,666,000

|

|

|

|

TD Securities (USA) LLC

|

|

$41,666,000

|

|

|

|

|

|

CUSIP Number:

|

|

10373Q BQ2

|

|

|

|

|

|

|

|

ISIN:

|

|

US10373QBQ29

|

|

|

|

|

|

|

Supplemental Information on U.S. Taxation:

|

|

BP Capital America expects that the 2061 Notes will be treated as issued in a “qualified reopening” of the outstanding $1,250,000,000 3.379% Guaranteed Notes due 2061 (CUSIP: 10373Q BQ2, ISIN: US10373QBQ29),

previously issued by BP Capital America for U.S. federal income tax purposes. Debt securities issued in a qualified reopening for U.S. federal income tax purposes are deemed to be part of the same issue as the original debt securities. Under such

treatment, the 2061 Notes would be deemed to have the same issue date and the same adjusted issue price as the Original 2061 Notes for U.S. federal income tax purposes. Payments on the 2061 Notes that are attributable to accrued interest for the

period from and including August 8, 2021, up to and excluding the date of delivery which is expected to be September 17, 2021 should not be includible in income.

|

* * * * * * * *

UK MiFIR professionals / ECPs-only — the UK manufacturer’s target market (UK MiFIR product governance) is eligible counterparties and

professional clients only (all distribution channels).

No EEA PRIIPs KID — no EEA PRIIPs key information document (KID) has been

prepared as the Notes are not available to retail in the EEA.

No UK PRIIPs KID – no UK PRIIPs key information document (KID) has been

prepared as the Notes are not available to retail in the United Kingdom.

We expect that delivery of the Notes will be made to investors on or about September 17, 2021 (such

settlement being referred to as “T+3”). Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended, trades in the secondary market are required to settle in two business days,

unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade the Notes prior to the second business day before the delivery of the Notes will be required, by virtue of the fact that the Notes initially

will settle T+3, to specify an alternative settlement arrangement at the time of any such trade to prevent a failed settlement. Purchasers of the Notes who wish to trade the Notes prior to their date of delivery hereunder should consult their own

advisors.

The Issuer and the Guarantor have filed a registration statement (including a prospectus) with the SEC for the offering to which this

communication relates. Before you invest, you should read the prospectus in that registration statement and the other documents the Issuer and the Guarantor have filed with the SEC for more complete information about the Issuer, the Guarantor and

this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Issuer, the Guarantor, any underwriter or any dealer participating in the offering will arrange to send you the prospectus

if you request it by calling Barclays Capital Inc. toll-free at 1-888-603-5847, Goldman Sachs & Co. LLC toll-free at 1-866-471-2526, HSBC Securities (USA) Inc. toll-free at 1-866-811-8049, J.P. Morgan Securities LLC toll-free at 1-212-834-4533, Morgan

Stanley & Co. LLC, toll-free at 1-866-718-1649, and TD Securities (USA) LLC toll-free at

1-855-495-9846.

*

* * * * * * *

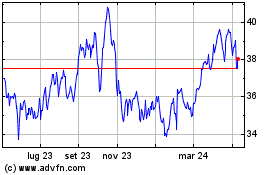

Grafico Azioni BP (NYSE:BP)

Storico

Da Mar 2024 a Apr 2024

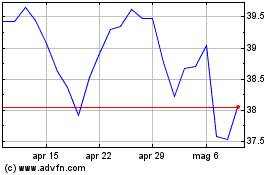

Grafico Azioni BP (NYSE:BP)

Storico

Da Apr 2023 a Apr 2024