TIDMFEN TIDMNAH

RNS Number : 6028L

Frenkel Topping Group PLC

13 January 2021

THIS IS AN ANNOUNCEMENT FALLING UNDER RULE 2.8 OF THE UK CITY

CODE ON TAKEOVERS AND MERGERS (THE "CODE")

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

FOR IMMEDIATE RELEASE

13 January 2021

Frenkel Topping Group plc

(" Frenkel Topping " or the " Group ")

Statement Regarding Possible Offer for NAHL

Frenkel Topping today announces that it has concluded not to

make a firm offer for NAHL Group plc ("NAHL") and that the parties

have agreed to terminate discussions. Frenkel Topping will

separately provide an update on trading and its financial

performance for the year ended 31 December 2020 on 14 January

2021.

The basis and rationale for a possible combination of the two

companies was set out in the Frenkel Topping's announcement of 23

September 2020. Since that date, Frenkel Topping and NAHL have

engaged in constructive and open discussions and a period of mutual

due diligence. It has however become apparent that a combination

presents certain commercial and integration challenges. Therefore,

the Board of Frenkel Topping believes that other growth and

acquisition opportunities are more compelling at this time and in

the best interest of its shareholders. The Board of Frenkel Topping

recognises that this is a disappointing outcome but, as a

significant shareholder in NAHL, also wishes NAHL the best for the

future.

As a result of this announcement, Frenkel Topping, and any

person acting in concert with Frenkel Topping, is bound by the

restrictions under Rule 2.8 of the Code save in the circumstances

set out below or otherwise with the consent of the Panel on

Takeovers and Mergers (the "Panel").

Under Note 2 on Rule 2.8 of the Code, Frenkel Topping, and any

person acting in concert with Frenkel Topping, reserves the right

to announce an offer or make or participate in an offer or possible

offer for NAHL or to take any other action which would otherwise be

restricted under Rule 2.8 of the Code within six months from the

date of this announcement in the following circumstances: (a) with

the agreement of the board of NAHL; (b) if any third party

announces a firm intention to make an offer for NAHL; (c) if NAHL

announces a "whitewash" proposal (see Note 1 of the Notes on

Dispensations from Rule 9 of the Code) or a reverse takeover (as

defined in the Code); or (d) if there has been a material change of

circumstances (as determined by the Panel).

Frenkel Topping, and any person acting in concert with Frenkel

Topping, reserves the right to acquire and/or offer to acquire NAHL

shares or interests in NAHL shares subject to and in accordance

with Rule 2.8 of the Code.

For further information:

Frenkel Topping Group plc Tel: 0161 886 8000

Richard Fraser, Chief Executive Officer www.frenkeltopping.co.uk

finnCap Ltd Tel: 020 7220 0500

Carl Holmes / Henrik Persson / Giles

Rolls (Corporate Finance)

Tim Redfern / Richard Chambers (ECM)

Important notices

This announcement is not intended to, and does not, constitute

or form part of any offer, invitation or the solicitation of any

offer to buy, sell, subscribe for any securities or the

solicitation of any vote in any jurisdiction.

The distribution of this announcement in jurisdictions outside

the United Kingdom may be restricted by law and therefore persons

into whose possession this announcement comes should inform

themselves about, and observe, such restrictions. Any failure to

comply with the restrictions may constitute a violation of the

securities law of any such jurisdiction.

About Frenkel Topping Group:

The financial services firm consists of Frenkel Topping Limited,

Ascencia Investment Management, Obiter Wealth Management, Equatas

Accountants and Forth Associates.

The group of companies specialises in providing financial advice

and asset protection services to clients at times of financial

vulnerability, with particular expertise in the field of personal

injury and clinical negligence.

With more than 30 years' experience in the industry, Frenkel

Topping has earned a reputation for commercial astuteness

underpinned by a strong moral obligation to its clients, employees

and wider society, with a continued focus on its Environmental,

Social and Governance (ESG) impact.

Through its core business, Frenkel Topping Limited, the firm

supports litigators pre-settlement in achieving maximum damages, by

providing expert witness services, and post-settlement to achieve

the best long-term financial outcomes for clients after injury. It

boasts a client retention rate of 99%.

The Group's discretionary fund manager, Ascencia, provides

financial portfolios for clients in unique circumstances. In recent

years Ascencia has diversified its portfolios to include a

Sharia-law-compliant portfolio and a number of ESG portfolios in

response to increased interest in socially responsible investing

(SRI).

Obiter provides a generalist wealth management service -

including advice on Savings and Investments; Tax planning; Life

Insurance; Critical Illness and Income protection; Endowment advice

and Keyman Insurance, with a particular specialism in financial

advice on pensions and pension sharing orders for the clients of

divorce and family lawyers. Obiter applies the same core principles

of honesty, transparency, responsibility and reliability to

individuals, regardless of background or situation.

In 2019, Frenkel Topping launched its accountancy arm, Equatas,

to assist clients with tax planning and move closer to providing a

full end-to-end service under the Group brand, improving the

experience for clients and maintaining the Group's standards

throughout the client journey.

In 2020 Frenkel Topping acquired Forth Associates, a specialist

forensic accounting services business which assists in financial

and legal disputes. The acquisition makes Frenkel Topping the

largest independent provider of financial expert witness reports to

the claimant marketplace.

For more information visit: www.frenkeltopping.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

OFDSFFFMDEFSESF

(END) Dow Jones Newswires

January 13, 2021 11:30 ET (16:30 GMT)

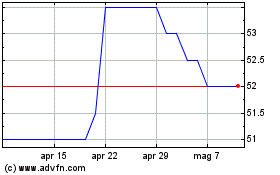

Grafico Azioni Frenkel Topping (LSE:FEN)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Frenkel Topping (LSE:FEN)

Storico

Da Apr 2023 a Apr 2024