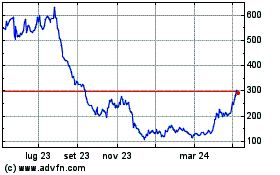

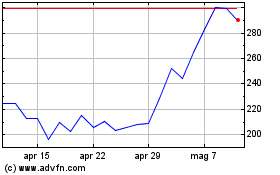

TIDMFDEV

RNS Number : 3949Y

Frontier Developments PLC

09 September 2020

Frontier Developments plc

FY20 Financial Results

Strong year and positive outlook

Frontier Developments plc (AIM: FDEV, 'Frontier', the 'Group' or

the 'Company') , a leading developer and publisher of videogames

based in Cambridge, UK, publishes its full-year results for the 12

months to 31 May 2020 ('financial year 2020' or 'FY20').

FY20 Financial Highlights

FY20 FY19

(12 months to (12 months to

31 May 2020) 31 May 2019)

Revenue GBP76.1m GBP89.7m

--------------- ---------------

Operating profit GBP16.6m GBP19.4m

--------------- ---------------

Operating margin % 22% 22%

--------------- ---------------

EBITDA* GBP31.5m GBP29.0m

--------------- ---------------

EPS (basic) ** 41.3p 46.9p

--------------- ---------------

Operating cashflow*** GBP13.6m GBP16.8m

--------------- ---------------

Net cash balance GBP45.8m GBP35.3m

--------------- ---------------

*Earnings before interest, tax, depreciation and

amortisation

** Restated for a deferred tax adjustment as per note 2

*** EBITDA excluding non-cash items less investments in game

developments and game technology

-- Our major new game release in FY20 was a 100% own-IP title,

Planet Zoo, which released exclusively on PC almost halfway through

FY20, in November 2019, and is Frontier's biggest selling game to

date on PC during an equivalent time period.

-- In comparison our major new game release in FY19 and our

biggest selling game to date, Jurassic World Evolution, benefited

from a major existing global IP franchise and launched

simultaneously on multiple platforms, releasing on PC, PlayStation

4 and Xbox One at the start of FY19 alongside the Jurassic World:

Fallen Kingdom film in June 2018.

-- Total revenue in FY20 was GBP76.1 million (FY19: GBP89.7

million). As expected the lower level of revenue year-on-year

reflected the timing of releases during the two financial years and

that Planet Zoo launched on the PC platform only.

-- All four games, Elite Dangerous, Planet Coaster, Jurassic

World Evolution and Planet Zoo, benefitted from Frontier's 'launch

and nurture' strategy in FY20, with each providing significant

revenue contributions through both base game sales and

paid-downloadable content ("PDLC").

-- Strong trading performance delivered operating profit, as

reported under IFRS, of GBP16.6 million for FY20 (FY19: GBP19.4

million), with operating profit margin maintained at 22% despite

the lower level of revenue.

-- Cash balances increased by GBP10.4 million during the year to

GBP45.8 million (FY19: GBP35.3 million).

FY20 Strategic Highlights

-- A fourth successful new game launch

o Planet Zoo released successfully in November 2019, quickly

establishing itself as a genre leader, reflecting its rich,

authentic animal and management simulations, with the tools which

enable players to craft and share the most beautiful creations with

a large and growing game community

o Over 1.0 million base game units sold in under six months

o Strong engagement with free content and PDLC has helped to

keep players active, attract new players and generate additional

revenue, with the Arctic pack released just before Christmas, the

South American pack at Easter and the Australia pack which launched

in August, after the end of FY20

-- Frontier's 'launch and nurture' portfolio strategy continues to deliver

o Frontier reduces risk by identifying opportunities to create

genre-leading games that build on its strengths and unique track

record

o Post-launch, Frontier nurtures its games for many years

through community engagement and additional content

o Elite Dangerous continues to grow, with the success of the

recent Fleet Carriers update helping to achieve its highest ever

player numbers. Elite Dangerous: Odyssey, our major new paid-for

update to launch in calendar Q1 2021 (in FY21), was revealed in

June 2020 to positive reception

o Planet Coaster also continues to grow, making more revenue in

FY20 than in FY19, wholly on PC. We have announced Planet Coaster

is coming to Xbox One, PlayStation 4, Xbox Series X and PlayStation

5 later this year

o Jurassic World Evolution benefitted from several PDLC packs in

FY20, including the Jurassic World Evolution: Return to Jurassic

Park pack at Christmas, our most successful PDLC to date, which

continues to perform well. Jurassic World Evolution: Complete

Edition is coming to the Nintendo Switch on 3 November 2020

o Nearly 60% of revenue in FY20 was generated by Elite

Dangerous, Planet Coaster and Jurassic World Evolution,

illustrating the ongoing popularity of the Company's games, and the

success of Frontier's launch and nurture strategy in generating

strong returns over many years

o Over 10 million base game units sold across our four titles as

of 31 May 2020 (Elite Dangerous 3.5 million, Planet Coaster 2.5

million, Jurassic World Evolution 3.0 million and Planet Zoo 1.0

million)

-- Strategic progress with new IP licences and the addition of third-party publishing

o IP licence signed for annual releases of Formula 1(R)

management games from 2022 onwards

o IP licence signed with Games Workshop for a real-time strategy

game based on the popular Warhammer Age of Sigmar brand

o Frontier Foundry, our own games label for third-party

publishing, started strongly with six games signed to date,

including one already released, one more announced and more coming

soon

-- Current trading and outlook: Strong roadmap for FY21 and beyond

o Sales across all our games in FY21 to date have been

consistent with expectations after a strong close to FY20

o Our fantastic team continue to deal positively with the

challenges posed by Covid-19; continuing to develop new content and

support our existing games, and each other

o Major platform launches for existing titles in FY21 - Planet

Coaster is coming to PlayStation and Xbox and Jurassic World

Evolution and RollerCoaster Tycoon 3 are coming to the Nintendo

Switch

o A new era for Elite Dangerous in FY21 with Elite Dangerous:

Odyssey coming in calendar Q1 2021

o Two award-winning new games launching from Frontier Foundry in

FY21: Struggling and Lemnis Gate

o On track to deliver record revenue in FY21 within the range of

GBP90 million to GBP95 million

o Two major new multi-platform internally-developed game

releases scheduled for each of FY22 and FY23, each benefitting from

world class IP licences

David Braben, Chief Executive, said:

"I am delighted to report on a year of great progress for

Frontier. We achieved our biggest PC launch to date with Planet

Zoo, we agreed two major new IP licences and we have now signed our

first six Frontier Foundry third-party publishing deals.

It's all thanks to our terrific team, who coped so well during

the Covid-19 lockdown, and our ever growing player communities

around the world. During the lockdown, we have seen an accelerated

move towards digital sales of games and many more people becoming

gamers, as games become an ever-more vital component of the

entertainment industry. Rich, community-focused games like ours

that are attractive to play but take years to master, have

performed very well during these challenging times, and we have

every expectation of them continuing to do so, notwithstanding the

macroeconomic uncertainties presented by the Covid-19 pandemic.

We have started the financial year well and are on track to

deliver record revenue in line with our expectations. Our future

looks bright with multiple major releases confirmed for FY21 and an

exciting roadmap for FY22 and beyond, adding great relationships

with Formula 1 and with Games Workshop to an already rich

portfolio."

This announcement contains inside information as defined in

Article 7 of the Market Abuse Regulation (EU) 596/2014. The person

responsible for making this announcement on behalf of the Company

is Alex Bevis.

Enquiries:

Frontier Developments +44 (0)1223 394 300

David Braben, CEO

Alex Bevis, CFO

Liberum - Nomad and Joint Broker +44 (0)20 3100 2000

Neil Patel / Cameron Duncan

Jefferies - Joint Broker +44 (0)20 7029 8000

Max Jones / William Brown

Tulchan Communications +44 (0)20 7353 4200

Matt Low / Deborah Roney / David Allchurch

About Frontier Developments plc

Frontier is a leading independent developer and publisher of

videogames founded in 1994 by David Braben, co-author of the iconic

Elite game. Based in Cambridge, Frontier uses its proprietary COBRA

game development technology to create innovative genre-leading

games, primarily for personal computers and videogame consoles. As

well as self-publishing internally developed games, Frontier also

publishes games developed by carefully selected partner studios

under its Frontier Foundry games label.

Frontier's LEI number: 213800B9LGPWUAZ9GX18.

www.frontier.co.uk

Chairman's Statement

Frontier's amazing team has delivered another great year of

progress for the Company, which is particularly pleasing given the

operational challenges that were presented by Covid-19 during the

second half of the financial year.

The biggest launch event during the period was the release of

Planet Zoo in November 2019. I'm delighted for the team to see yet

another successful launch, the fourth major new game release since

the transition to self-publishing in 2013-2014, with Planet Zoo

becoming Frontier's biggest seller on PC to date, during an

equivalent time period. Frontier's 'launch and nurture' strategy

continues to deliver, with all four games achieving material

revenues in the period from both base game sales and PDLC sales. We

believe our proven model of identifying, and then executing upon,

opportunities to establish and maintain ourselves as genre leaders

creates one of the lowest risk and highest return business models

in the games industry.

FY20 was also a period of significant strategic progress for

Frontier. Our commitment to quality, expertise in digital

publishing and increased profile have helped us secure major new IP

licences with two fantastic organisations: Formula 1(R) and Games

Workshop. The Formula 1(R) licence is Frontier's first annual

sports licence and a significant strategic step, bringing together

our experience of developing deeply engaging, high-fidelity

simulation games and one of the most management-rich sports in the

world. The Games Workshop deal provides the team with a strategic

opportunity to bring a real-time strategy game to a wider audience

on console as well as PC. These agreements are further evidence of

Frontier's reputation as a trusted partner to some of the world's

highest-profile brand owners.

Significant progress was also made during the period with our

third-party publishing initiative, now branded under our Frontier

Foundry games label. Five games were signed during the period with

a further game signed in July 2020. Frontier Foundry is set to

become a material part of our business in the future, and it was

pleasing to see the first game, Struggling, release in August

2020.

Our Board of Directors, comprised of seven highly experienced,

capable and motivated individuals, continues to operate

effectively, facilitated by monthly reporting and regular meetings.

Meetings during the lockdown continued via video conference. There

is regular debate and challenge at Board meetings, which is

facilitated by each of our different areas of expertise, business

experiences and individual perspectives. I believe we are all well

aligned in terms of our strategy and direction, with a clear view

of Frontier's continued plans for success.

Frontier's success, as always, is due to the hard work and skill

of our talented team. I'd like to thank all of our staff for their

effort and dedication during the period, particularly through the

challenges of lockdown and working-from-home. We look to the future

with confidence based on our great team, our successful portfolio

and our exciting roadmap.

Chief Executive's Statement

Reflecting on our progress since writing my last report in the

summer of 2019, I am delighted with the achievements of our teams

across all areas of our business, particularly through the

challenges of Covid-19.

Regarding our internally developed game portfolio, we have

further expanded our offering with another successful major game

release, Planet Zoo, which has become our best-selling PC game,

crossing 1 million base game units in less than six months. As

usual we have supported all of our games with free and paid

content, together with active community management, which has in

turn delivered strong ongoing sales performance. As a result, all

four titles delivered material contributions in FY20, and it was

pleasing to pass a sales milestone for Frontier in the period with

a combined total of 10 million base game units sold across our four

titles since we listed.

In addition to new game developments and PDLC packs, our teams

have been working hard to deliver three major new releases for our

existing game portfolio during FY21. Jurassic World Evolution:

Complete Edition will be launching on the Nintendo Switch, Planet

Coaster: Console Edition is coming to PlayStation and Xbox, and

players will soon be able to get out of their ships and SRVs

(Surface Reconnaissance Vehicles) with Elite Dangerous: Odyssey.

These major achievements are made possible by the talent,

experience and hard work of our teams, combined with our technology

leadership through the continued investment in our own COBRA game

engine.

In spring 2020 we signed two major new IP licences to further

strengthen our future roadmap. In March 2020 we confirmed a deal

with Formula 1(R) with exclusive rights to an annual PC and console

management game, with the first game planned for the 2022 F1

season. In May 2020 we revealed a licence with Games Workshop for

exclusive rights to a real-time strategy game for the globally

popular Warhammer Age of Sigmar. It's great to see such strategic

progress with IP owners and follows on from our successful

partnership with Universal Games and Digital Platforms on Jurassic

World Evolution, Sony Pictures with Ghostbusters and previous

partnerships during our work-for-hire period.

These deals, together with the unrevealed major global IP

licence announced in March 2019, mean we now have two major new

multi-platform game releases for each of FY22 and FY23 which will

each benefit from world-class IP licences. We anticipate achieving

two major new releases per year on average thereafter from internal

developments, which is a significant step up from the cadence of

one release every two years from our first two releases in December

2014 (Elite Dangerous) and November 2016 (Planet Coaster).

FRONTIER FOUNDRY

Frontier Foundry, our own games label for third-party

publishing, leverages our publishing capability, industry

experience, commercial partnerships, and financial resources to

supplement our own development roadmap by partnering with other

high-quality developers to bring more games to market. It

emphasises the importance of our long experience of development and

our thorough understanding of the issues that arise during

development. I believe a significant reason we have been, and will

continue to be, successful here is that we are one of the few

developer-led publishers in the world and this translates to great

working relationships with developers who choose to work with

Frontier Foundry.

We have made excellent progress with six games signed to date,

including five signed during FY20. Through this initiative, we

published our first title, Struggling, on PC and Nintendo Switch in

August 2020. The response to this new and unique game has been

positive, for what is clearly quite a different game to our

existing internally developed portfolio. We have one more title,

Lemnis Gate, scheduled for the current financial year, FY21, with

three titles so far planned for FY22 and one for FY23. We are

aiming for Frontier Foundry to achieve five to six releases per

year from FY23 onwards, which should enable this exciting new part

of our business to become a material contributor.

CURRENT TRADING AND OUTLOOK

Frontier is very well placed for the future with exciting major

releases planned for FY21 to support and extend our four existing

and successful franchises, together with new games published by

Frontier Foundry.

Elite Dangerous has continued to be very successful since its

first early access launch in December 2013 and full release in

December 2014. It has hit its highest player numbers this year, in

its seventh year, helped by the launch of Fleet Carriers and the

announcement of the major forthcoming update Elite Dangerous:

Odyssey due later in FY21 (in calendar Q1 2021), in which players

will be able to explore and fight on foot.

Planet Coaster has also continued to perform well, earning

greater revenue in FY20 than it did in FY19, wholly on PC.

Traditionally, management and simulation games have tended not to

appear on console because of the complexity of the controls, but

the Frontier team did an excellent job with Jurassic World

Evolution on console and it was very successful. With this

invaluable experience now Planet Coaster: Console Edition is coming

to console later this year, on both the existing generation, Xbox

One and PlayStation 4, and the new generation coming out later this

year, PlayStation 5 and Xbox Series X, which is another exciting

milestone for the game.

Jurassic World Evolution is still very popular, with the

Jurassic World Evolution: Return to Jurassic Park PDLC pack

performing well in FY20. In August 2020 we revealed that on 3

November 2020 (in FY21) we will be bringing Jurassic World

Evolution to the Nintendo Switch console. We are incredibly proud

of the quality the team have achieved on Nintendo Switch, getting

the full game to work without compromise.

Planet Zoo launched to great acclaim in November 2019, and has

gone from strength to strength since its release. Both the Arctic

and South America PDLC packs performed superbly in FY20, with the

Australia PDLC pack in August 2020 (in FY21) following them after

the end of the financial year. Additional PDLC packs are

planned.

In addition to those major releases for our four existing games

in this financial year, FY21 will also benefit from two Frontier

Foundry games. The award-winning Struggling was launched in August,

and Lemnis Gate, also an award-winning game, is coming later in the

financial year. We are also very pleased that the timeless

RollerCoaster Tycoon 3 will be coming to Switch.

Taking into account actual performance to date and projections

for the remainder of FY21, including the anticipated sales of

future game/content/platform releases coming during the financial

year, the Company is on track to deliver record revenue within the

range of GBP90 million to GBP95 million for FY21 (the 12 months to

31 May 2021).

STRATEGIC REPORT

Our industry

The games market continues to grow strongly, and for several

years now it has been the largest sector within the $300+ billion

entertainment industry which includes games, film, TV, and

music.

With audiences craving greater levels of interactivity within

their entertainment experiences, the lines between games, film and

TV continue to blur as each look to add more interactions with

their audiences. Frontier already produces hundreds of hours of

live 'TV' content (via services like YouTube and Twitch TV)

directly each year supporting the different games and their

communities, with many thousands of hours from the numerous

streamers that regularly play the games, in addition to the games

themselves. Frontier is well placed to both drive and support

future changes in the wider industry, including the potential

addition of whole new forms of entertainment, leveraging our strong

relationships with leading entertainment companies.

Historically, the games market has been seen as three different

but very roughly equal sectors by revenue: PC, console and mobile,

but in the context of the rise of new services especially

streaming, it is worth looking at these again. PC and console are

characterised by their high-quality cinematic content. Typical

sessions are half an hour or more, with a fair amount of 'context'

that the player carries in their head. With mobile they are more

typically five minute sessions, where there is almost no 'context'

to remember - everything is immediately apparent on the screen.

That is not to say that 'cinematic' games with longer play times do

not appear on mobile, but they are more likely to be played

statically with a constant network connection, so arguably are not

literally 'mobile'; they are also not typically the more successful

- such games generally have better success on PC or console, at

least in the Western world. This, together with the expectation of

lower price or free to play makes mobile games a very different

market. The rise of streaming services may help blur the boundaries

once such services become more established over the next few

years.

Our main development focus is on rich, engaging cinematic

experiences on PC and console, as the audiences on these platforms

greatly value games exhibiting Frontier's key development strengths

of compelling gameplay and high production quality. Currently, the

mobile sector is overcrowded and has a very low barrier to entry,

making audiences less predictable and much less influenced by

quality. 'Discoverability' (the ability to find a title) is also

better on PC and console, with excellent support from reviewers,

content creators and social media.

The entire games market is moving rapidly towards digital

download as the primary delivery model, and this transition has

almost certainly been further accelerated by the Covid-19

stay-at-home restrictions during 2020. Mobile and PC have been

close to 100% digital for several years, and the console audience

is quickly catching up, as focus shifts to the new generation of

hardware, and older business models are replaced. Digital sales

represented 97% of Frontier's revenue in FY20, with only 3% from

sales of physical discs (FY19: 15%).

Streaming services provide an interesting new distribution model

which has emerged over the last couple of years. These services

have only taken a small share of the market to date, and technical

considerations and player inertia might mean that streaming games

from the cloud to consumer devices may take several years to become

mainstream.

Our particular focus on 'launch and nurture', which is

effectively a 'games as a service' model, is working very well,

producing four successful titles so far, but we will continue to

monitor and consider different delivery model options as the

industry continues to evolve.

Our vision

Our vision for Frontier is to become one of the most respected

entertainment companies in the world. As the boundaries between the

different entertainment mediums continue to blur, Frontier is in a

great position to lead the evolution and the merging of those

mediums. As a leading developer and publisher of high-quality

sophisticated and immersive game experiences, the foundations for

achieving our vision are strong. We have a long and diverse track

record of success in both development and publishing, we have

strong relationships with platforms and IP owners and have become a

trusted and go-to partner for major global IPs, and we nurture our

games and our player communities over many years to achieve

sustainable success.

In the medium term we are laser focused on continuing to support

and grow our game portfolio, which includes both our own internal

developments and our partner developments under our Frontier

Foundry games label. Meanwhile, we continue to expand our existing

relationships and add new ones within the wider entertainment

industry, to support our longer-term vision of being a key player

in digital entertainment.

If you look back ten years and imagine listing what you thought

the top dozen most respected entertainment companies would be in

2020, it is likely even those in the industry would only get about

half of them right (failing for example to include companies like

Amazon, Netflix and Tencent). The industry now is pretty well

unrecognisable from what it was then. Similarly in ten years' time

the entertainment industry will again be unrecognisable from where

it is now, as will Frontier, but our goal is to be on that

list.

Our strategy and business model

We believe that publishing our own games, and selectively those

of other high-quality development studios, is the best way to

maximise the benefit of our core skills, our assets and our COBRA

technology platform. The Company's focus is on identifying,

developing and delivering top-quality, PC and console titles for

digital distribution.

We will continue to follow our repeatable model to support our

games over many years with new releases and updates, and to create

further titles in underserved game genres where we can use our key

expertise, knowledge and/or valuable external IP to deliver highly

differentiated, best-in-class player experiences. Frontier's games

take a long time to fully master, so yield longevity and great

value for players. This longevity and loyalty of our great

communities should help further build our revenue pipeline over the

long term.

Our strategic objective is to create long-term sustainable

growth through successfully publishing a growing number of game

franchises. Our strategic focus is on two key areas:

-- developing our business to achieve repeatable success; and

-- creating and managing game franchises.

We continue to grow our teams so that we can continue to support

our existing games while also increasing the frequency of major new

releases. The increase in the number of releases supporting our

existing games, such as major PDLC launches, helps to smooth

revenue, but major releases of new games are still a significant

factor in the revenue stream. As we scale the frequency of new game

releases over future years this will have a smoothing effect on

growth, but in the meantime revenue is sensitive to the specific

schedule of such releases and may therefore exhibit 'stepped'

behaviour across financial years, as those new games are

released.

We are growing our portfolio, and consequently we are increasing

our development team to enable us to support additional games while

generating new content for our existing titles. We will continue to

grow our resources and capability to enable us to achieve two major

new internally developed releases per year, on average, from FY22.

This will not require us to increase our workforce linearly because

supporting an existing title typically requires fewer staff than

creating a new one.

As stated in the Group's previous Annual Reports and other

communications, in addition to the current core model of using

internal resources, supplemented by outsourced services, the Group

will continue to explore other opportunities to accelerate its

scale-up.

Frontier Foundry, our own games label for third-party publishing

first announced in June 2019, continues to grow, with six titles

signed to date, including two for FY21 (Struggling and Lemnis

Gate), three for FY22 and one for FY23. We are looking to achieve

five to six releases per year from FY23 onwards, which should

enable this exciting new part of our business to become a material

contributor.

We will also continue to explore opportunities for commissioning

(outsourcing the majority of development of Frontier games to other

developers) and enhancing the Group's franchise portfolio or

capabilities via acquisitions. The Group has considered a number of

possible acquisitions, but so far none has met our valuation,

product alignment and culture fit thresholds.

Our people

Frontier employs amazing people who are instrumental in making

games that define genres, break boundaries and sell millions of

copies to gamers around the world. We share a vision of developing,

launching and nurturing world-class games that put both Frontier

and the games industry itself at the forefront of the global

entertainment industry.

Our Frontier team continues to expand, giving us more

opportunity to grow our game portfolio. Three years ago Frontier

initiated an ambitious hiring and scale-up plan which enabled us to

achieve an average of 10 new hires per month during both FY19 and

FY20. This puts our Frontier team at 520 as of 31 May 2020 and over

560 as at 31 August 2020.

Frontier is committed to providing a stimulating atmosphere for

high achievers who are passionate about what they do. Our aim is to

create and maintain a safe, collaborative and rewarding environment

for our people.

As a self-publishing developer, we effectively plan our roadmap

in order to optimise team work schedules. We seek to avoid a need

for excessive overtime by plotting challenging yet realistic

timelines for project delivery. A healthy work-life balance is an

important part of our culture and we support this through offering

a range of family-focussed benefits as well.

We reward our teams through a structure of remuneration which

includes a competitive base package, bonus and equity schemes, as

well as a wide array of benefits and perks. Frontier reviews this

rewards and remuneration structure regularly to ensure that

everyone in the team continues to share in the success that they

help to deliver.

Developing our business to achieve repeatable success

We invest our development resources in games with strong

franchise potential, primarily on PC and console. In order to

maximise the return on our core skills and assets we target game

genres where we have established expertise and/or intellectual

property within our teams. Audiences on the chosen platforms tend

to value games that exhibit Frontier's key development

strengths.

To accelerate our progress and increase the frequency of

launches we are continuing to scale up our organisation, not just

in terms of staff numbers, but also in terms of leadership skills,

training, organisational structure, process and external

partnerships.

We also invest in the necessary facilities to support our

world-class team. In April 2018 we moved all of our staff into a

brand new office space on the Cambridge Science Park, with a great

many custom features. Our teams managed admirably during the

work-from-home restrictions of Covid-19, and now as we carefully

and selectively transition back to the office we will strive to

maximise the efficiency and effectiveness of office working,

potentially in combination with increased flexibility, and perhaps

ultimately the ability to grow further without seeking additional

office space.

We use online channels to create and engage with player

communities during game development, a practice which provides a

valuable source of feedback, and these player communities provide

excellent advocacy for each title prior to launch.

Our development process uses our proprietary COBRA development

tools and technology to facilitate innovative features and the

creation of top-quality games with strong differentiation for the

PC and console audiences. Our control of this technology also

removes the risks related to ongoing access to third-party licensed

technology alternatives, as has happened in the past where

successful tool providers are acquired by a major rival player. In

addition, the direct engagement with those involved in the engine

development, and the ability to control the delivery dates and new

feature roadmap of that technology can be invaluable, for example

giving first-mover advantage with new technologies.

Creating and managing game franchises

In order to maximise the return on our core skills and assets we

target game genres where we believe we can deliver both

high-quality, differentiated offerings using established expertise

and intellectual property, and have a strong chance of successful

market entry.

We use this proven, rigorous and repeatable model to invest our

resources with the intention of creating world-class games with

strong franchise potential and plans for strong post-launch product

support to help realise this potential. With Elite Dangerous we

knew there had been significant success in the past, not least

because of our own games in that area in previous decades, and also

that there were no games like it at the time, and we believed that

we possessed the differentiated technical capability to digitally

replicate our own Milky Way Galaxy. We verified that there was a

significant appetite for such a game with Kickstarter crowdfunding

at the end of 2012 and early 2013, and the game itself has now

vindicated that decision with continued success in its sixth year

of full release (its seventh year since early access). For

comparison, other high-profile space exploration games that entered

Kickstarter in the early 2010s have still not released at all,

speaking to the challenges of the genre and to our teams expertise

and ability to deliver compelling product in a timely fashion.

With Planet Coaster, we were releasing a title in competition

with an established and well-loved franchise, RollerCoaster Tycoon

3. Frontier developed RollerCoaster Tycoon 3 for Atari in 2004 when

we were a work-for-hire business and it was a very successful game

for over a decade. The success of RollerCoaster Tycoon 3 over such

a long period of time meant there was no meaningful Coaster Park

competition within the sector for all that time. We knew we could

do a better job, and many of the same team that made it back in

2002-2004 were still at Frontier, hence our confidence we could

'knock it out of the park' with a new game. In other words, we were

confident it was therefore underserved and that we could create its

natural successor as another genre-defining title. The fans loved

what they saw during early access and, despite Atari launching

RollerCoaster Tycoon World the day prior to Planet Coaster's

launch, we achieved that aim and Planet Coaster now dominates the

sector and continues to be successful in its fourth year of

release, indeed earning more revenue in FY20 than it did in FY19.

We believe our iterative success with RollerCoaster Tycoon 3 and

Planet Coaster has built up unique capabilities within Frontier to

create and manage "simulation management" experiences.

Jurassic World Evolution followed in June 2018 (in collaboration

with the team at Universal Games and Digital Platforms), and in

November 2019 Planet Zoo released as our fourth self-published

game, following the same model and leveraging our unparalleled

expertise of in-game creature portrayal, and management gameplay.

The last successful game in the zoo game sector was Zoo Tycoon with

Microsoft in 2013, developed by Frontier for Microsoft, and with

Planet Zoo we are confident we have developed a game that will

dominate its sector for many years to come. As we progressed from

Zoo Tycoon to Jurassic World Evolution and now Planet Zoo, we

believe we have developed unique skillsets in terms of

realistically simulating and bringing beautifully to life large

animals, alone and in herds, both historical and current.

With each of our game franchises, we plan for the long term, and

how best to support and sustain the audience for each one. A

dedicated team monitors progress based on sentiment towards the

games, success of each of the distribution channels and platforms,

and the up-take of additional content both free and paid, allowing

us to reach the widest possible audience over time. Free content is

a valuable tool to help retain and restore existing audiences and

support sentiment, while paid content both helps monetise the game

and brings new players as new content triggers online coverage on

platforms like YouTube or Twitch, increasing sales of the

corresponding base game and for other paid expansion content.

We also monitor the geographical performance of our titles,

understanding and monitoring under and over performance versus

expectations in each territory, and will continue to look for

opportunities to tailor our price to a level more appropriate to

each local economy.

Reducing risk

Over our long, successful track record of developing a wide

variety of game genres in the work-for-hire model we developed many

areas of unique technical expertise, as well as the understanding

of how to identify and execute developments to succeed in very

different game genres.

There is a great deal of risk in the work-for-hire model, with

the biggest issue being major changes at publishers, particularly

when they became financially compromised. Moving to self-publish

our own games allowed us to gain much greater commercial reward on

the deployment of our development resources compared to our

previous (pre-2013) work-for-hire business model, and addressed

this key risk. The change of business model has enabled us to

significantly grow our revenue and our profit margins, and generate

cash, helping us to build a strong balance sheet.

Self-publishing puts us in full control of our development

roadmap, allowing us to gain the efficiencies that come from a

long-term strategic overview of our development and publishing

plans, and also insulates us against the risk of the commercial

performance of third party publishers.

Our development expertise and strategic focus on sophisticated

games that engage audiences for the long term means we have been

able to deliver great commercial success and continuing multi-year

revenues for each of our first four genre-leading games.

Building an on-going revenue stream in this way - c.60% of

revenues in FY20 were generated by our first three titles which

first released in 2014, 2016 and 2018 respectively - acts to reduce

the overall risk to the company of each subsequent new game that we

develop. As part of our publishing operations we engage with

elements of our core audience for each new game early, during

development, which also greatly helps mitigate the risk of bringing

an entirely new game to market.

Our profitability has increased through our move to

self-publishing. While we do benefit from Video Games Tax Relief

(VGTR), we report our financial operating performance before VGTR

to represent better our underlying financial performance. With

operating profit margins of 22% achieved in both FY19 and FY20

(pre-VGTR) we believe our strategy - identifying opportunities to

develop, launch and nurture high-quality, self-published,

genre-leading games that build on our strengths and unique track

record - is one that reduces risk while achieving high returns in

an industry often associated with 'hit-risk'.

We are reducing risk further, while generating incremental

revenue and profit, through our Frontier Foundry games label for

third party publishing, a strategy which further leverages our

experience and expertise. Our intimate understanding of the

development process and the strong publishing expertise we have

developed are key elements of our attraction for third party

developers.

Our expertise also allows us to curate the overall balance of

our Frontier Foundry portfolio towards success, while rapidly

broadening our audience beyond our current internally developed

genres.

The third-party publishing business model is an efficient use of

capital that reduces risk and helps us bring scale and diversity to

our portfolio which in turn helps our retail monetisation

activities - it will allow us to accelerate the growth of revenues,

profits and shareholder value.

Our future plans

We will continue to grow the capacity and capability of our

organisation in both commercial and development areas in order to

further the successful evolution of our franchises.

As part of this process, we will explore additional potential

partnerships and licensing opportunities. We will also continue to

review potential acquisition targets that could augment our

capacity or add new capabilities as well as IP that may help us

achieve our goals. In March 2019 we announced an as yet unrevealed

major global IP for a game launch in FY22, and during FY20 we

signed strategically important IP licences with Formula 1(R) and

Games Workshop.

We will endeavour to enhance and expand our franchises and grow

their audiences using appropriate additional products, platforms,

media, marketing, distribution channels and charging models through

investing in the necessary people, organisation, resources and

infrastructure.

We are building a broad portfolio of franchises, each different

to the last and each with the capabilities to expand over time. At

the same time we are scaling up for the future so we can release

games more frequently. All upcoming franchises will be selected

using the same approach set out above, and we already have several

in different phases of development.

Our future franchise portfolio is likely to continue to contain

a blend of Frontier-owned IP, like Elite Dangerous, Planet Coaster

and Planet Zoo, and some with third-party licensed IP, like

Jurassic World Evolution and our future plans for the Formula 1(R)

and Warhammer Age of Sigmar games. Games based on owned IP provide

Frontier with the benefit of having complete creative freedom and

higher margins, while games based on licensed IP have the potential

to more easily reach large new audiences and leverage existing lore

and characters, such as with Jurassic World Evolution. We review

the value of licensing proven third-party major global IP versus

developing our own IP for each potential future franchise on a

case-by-case basis. We also consider the long-term benefits of

relationships with these IP partners and how they can help with

future opportunities as the wider entertainment sector continues to

change, presenting ever more opportunities for new types of

entertainment.

We plan to establish and grow a significant third-party

publishing business through our Frontier Foundry games label,

working with carefully selected development partners. We have six

titles signed to date, with Struggling and Lemnis Gate for FY21,

three games signed so far for FY22 and one for FY23. We are looking

for Frontier Foundry to achieve five to six releases per year from

FY23 onwards. This not only continues our existing repeatable

model, in terms of leveraging our expertise in identifying

opportunities and publishing, but also diversifies our business

model, allowing us to increase more quickly the size of our game

portfolio, which has retail cross-selling advantages and is an

efficient use of our financial resources.

OUR IMPACT - ENVIRONMENTAL, SOCIAL AND GOVERNANCE

Since the founding of the company in 1994, Frontier has

endeavoured to conduct business in a considerate, responsible and

ethical manner. To do this, we have placed our key stakeholders -

our people, our players, our partners and our investors - at the

core of everything we do. We aim to be a leader in our industry for

creating games which in themselves, and through the process of

creating and nurturing them, resonate with the key environmental,

social and governance ('ESG') principles of our stakeholders, as

well as society as a whole.

Environmental Principles:

Frontier is committed to reducing energy use, plastic

production, carbon waste and the use of fossil fuels.

Our digital-focussed business model is such that only 3% of our

games in FY20 were released onto physical disc, much lower than

many publishers in our industry. All of our games are also heavily

compressed to ensure that our players benefit from a reduction in

the energy usage required for download time.

Our office building has a BREEAM 'Excellent' rating, which puts

Frontier's headquarters within the top 10% of environmental

commercial buildings in the UK. We've also implemented

eco-initiatives such as solar panels, a heat recovery and

ventilation system, use of 100% green energy for electricity and a

segregated waste process.

Frontier encourages similar environmentally-conscious conduct

with our people, particularly in relation to their commute to work

and the use of energy in their roles.

The company aids teams in making smart journeys through our

association with Travel Plan Plus+. As part of this, prior to

lockdown, Frontier encouraged staff commuting via car to do so in

joint occupancy with at least one team member - thereby reducing

the harmful emissions and road congestion of their daily travel. We

are proud to report we hold the highest percentage of shared

occupancy car travel in the Cambridge Science Park community.

We are also an active promoter of the cycle-to-work scheme with

an average of 130 team members cycling to work on a typical day,

prior to the national lockdown. We incentivise our people to take

advantage of this environmentally-beneficial and tax-free scheme

through secure, complimentary bike parking as well as regular

on-site bike maintenance and repairs.

Both inside the office and during our current remote-working

period, our teams work together to reduce energy usage by adhering

to a 'switch-off' policy for computers, laptops and other

equipment.

Social Principles:

Frontier carefully considers the social impact of the business

across four core areas: our people, our games, our communities and

our wider social responsibility.

-- Our People - Employee welfare is of the utmost importance to

Frontier. We are committed to creating a safe, collaborative and

rewarding work environment where members of our team can prosper.

To achieve this Frontier looks to provide stimulating experiences

which ensure our staff feel engaged, connected and satisfied in

their work lives.

The wellbeing of our team is a key part of this experience and

we support this through various initiatives including promotion of

a healthy work-life balance, on-site and virtual facilities,

seminars and events, private healthcare, an employee assistance

programme and a flexitime work system. Frontier also looks to

provide a competitive remuneration package including an array of

optional benefits which can be tailored to best complement each

individual's personal lifestyle.

Our workforce is comprised of over 30 nationalities from around

the globe. We seek to diversify the company skillset through our

sponsorship for Tier 2 Visa, which enables us to source first-class

talent not only from our local regions but also across Europe. This

sponsorship status will automatically transfer to a similar scheme

post-Brexit.

Frontier is also proud to support a community of co-workers who

associate with LGBTQIA+ views and preferences. The team shares a

rich tapestry of culture and diversity which aids the business in

bringing authenticity and representation to our games and player

communities.

We aim to offer all team members equal opportunities for

development, progression and giving feedback; and continue to

identify new ways for the company to achieve more ground in this

area. One of the key challenges still facing the UK Tech sector is

a disparity in the national talent pool between female and male

software developers. As an illustration of these challenges, whilst

Frontier has increased our overall female-filled roles in the last

year, there has been less increase within technical programming

roles due to only 15% of the UK's coding talent associating as

female. Frontier will continue to support existing and new

initiatives to increase the female talent pool for technical

programming in the longer term. Our strategy is to target

individuals at a younger age in order to generate interest and

educate on the career possibilities within the gaming industry.

-- Our Games - Our portfolio delivers sophisticated, creative,

immersive and social experiences, which typically provide large

digital worlds that our players enjoy across 203 regions over 7

continents. Fundamentally we value quality in our products, through

a dedication to excellent standards which has continued to attract

existing and new players to our diverse titles. We have been

particularly proud of the strong engagement with our games during

the Covid-19 lockdown. Frontier has looked to positively contribute

to and support the lives of our players through these unprecedented

times.

Transparent communication with our users is another significant

focus for our business. We ensure that players are clearly informed

of what they are purchasing - whether it's a game or PDLC - and the

company seeks to avoid any systems which relate to a "loot box"

type of monetisation.

We also feel strongly about our responsibility for players' data

privacy and protection. Frontier secures any player data under

government GDPR regulations and through conditions of the Data

Protection Act of 2018.

-- Our Communities - We create and nurture large player

communities for our games, providing free and paid content, news,

video streaming, and competitions to achieve long-term positive

engagement. We support and encourage player connectivity through

forums and regular community events which allow the various

personalities of each title to come together. This year we pivoted

the annual 'Lavecon' event, which celebrates Elite Dangerous, onto

a digital platform to engage the community through virtual panels,

interviews and hosting gameplay streams whilst in lockdown.

-- Wider Social Contributions - Frontier looks for regular

opportunities to support both our physical neighbours and our peers

within the gaming industry and wider sector. We focus our

assistance on sponsoring various charitable initiatives, including

strong support and regular partnerships with a few key causes such

as:

-- Special Effect - A really worthwhile charity that puts fun

and inclusion back into the lives of people with physical

disabilities through discovery, exploration and creativity in video

games.

-- MIND - A reputable mental health charity supporting and

raising awareness for individuals with mental health problems.

-- Cambridge Half Marathon - A local fundraising event

supporting both national and Cambridge-based initiatives and

bringing the local community together to showcase our beautiful

city.

Frontier actively promotes computer science and digital skills

within the UK. This year we have sponsored the Centre for Computing

History in Cambridge, helping to fund the museum's ambitious

computer and video game preservation and education project. We hold

a strong and positive influence on computer science education -

with our CEO, David Braben as one of the founders of the Raspberry

Pi foundation, which has enabled affordable access to computing

technology across the world. Frontier continues to push for

positive change in education to support future generations in their

understanding of computer science and career development.

Governance Principles:

We take governance seriously, and strive to achieve best

practice, including through compliance with the QCA's corporate

governance code.

Our governance arrangements support our objective of creating

and maintaining a safe, collaborative and rewarding environment

with appropriate policies, processes and monitoring. Further

details are set out in the governance section of our Annual Report,

which can be found via the Frontier website.

2021-2025 ESG Plans

Frontier strives for quality and this includes our approach to

our internal and external systems which have an impact on our

stakeholders and the wider world. We continue to review

opportunities to implement best practice ESG processes as well as

improving communications of our progress through ESG reporting. Any

new initiatives will be reviewed on a periodic basis to ensure we

continue to evolve with new data and protect and strengthen our

alignment with stakeholder values.

Financial Review

OVERVIEW

The combination of the ongoing financial performance of our

first three titles, together with the successful launch of Planet

Zoo in the year, yielded a strong set of financial results in FY20.

In terms of both revenue and profit FY20 was Frontier's second

biggest ever year in our 26-year history, following the record set

of results posted in FY19 through the launch of Jurassic World

Evolution in June 2018. We start FY21 in excellent financial shape,

with a strong portfolio of four existing games, an exciting roadmap

to support those four games and develop new titles, the anticipated

financial contribution from our Frontier Foundry games label, and

our strongest ever cash position - GBP45.8 million as at 31 May

2020.

TRADING

Planet Zoo was our biggest revenue contributor in the period,

generating a positive reception during the pre-order and at launch

in November 2019. As planned, Planet Zoo has gone on to continue to

deliver strong sales after its initial launch spike, quickly

becoming the clear number one immersive and high-quality zoo

simulation experience. Our usual strategy of creating and

supporting a large and active game community, supported by both

free and paid content, continues to generate sales to both existing

players and new players. It's encouraging to see Planet Zoo become

our biggest selling title to date on PC during an equivalent time

period.

That strategy of supporting and nurturing both our game, and the

community of players of our game, has been learned and refined

through our experiences on our first three titles, Elite Dangerous,

Planet Coaster and Jurassic World Evolution. That strategy

continues to pay dividends across all three of those games, with

each title providing material financial contributions in FY20

through both base game sales and PDLC.

The performance of all four games generated total revenue in

FY20 of GBP76.1 million (FY19: GBP89.7 million), with almost 60%

coming from our first three titles. The record performance in FY19

reflected a full 12 months of sales of Jurassic World Evolution

which launched alongside the film Jurassic World: Fallen Kingdom in

June 2018 on PC, PlayStation 4 and Xbox One. In comparison, FY20's

big release, Planet Zoo, was a PC-only launch which released almost

halfway through FY20.

Our primary sales strategy is through digital distribution,

working with key partners like Steam and Humble on PC and with

console owners: Microsoft for Xbox, Sony for PlayStation and more

recently Nintendo for Switch. We also added digital PC platform

aggregator Genba as a partner during the period. Digital sales

represented 97% of revenue in FY20, with only 3% from sales of

physical discs (FY19: 15%). The higher proportion of physical in

FY19 related to disc sales of Jurassic World Evolution on

PlayStation 4 and Xbox One, which accounted for around one-third of

the base game unit sales of Jurassic World Evolution on console

during that financial year.

Gross profit was GBP51.6 million in the year (FY19: GBP54.6

million) with gross margin at 68% (FY19: 61%). The 7% increase in

gross margin percentage was due to three factors: a higher

proportion of own-IP revenue rather than licenced-IP revenue (with

associated royalty costs), with own-IP Planet Zoo the big release

in FY20, compared to licenced-IP Jurassic World Evolution launching

in FY19; a lower proportion of physical disc sales which typically

achieve lower profit margins; and the tiered commission structure

established by Steam in October 2018.

Gross research and development (R&D) expenses in the period

grew by 20% to GBP24.6 million (FY19: GBP20.5 million). The

continued growth reflects further investment to support Frontier's

franchise portfolio strategy, through increases in internal staff

combined with greater levels of outsourced activity. As at 31 May

2020, Frontier had grown its total headcount to 520 staff compared

to 466 at 31 May 2019 and 377 at 31 May 2018. An element of the

increase in gross R&D expenditure also related to investments

in externally developed games through the Company's Frontier

Foundry games label for third-party publishing, which kicked off at

the start of FY20 with the Haemimont Games deal announced in June

2019.

Capitalisation of costs for game development related intangible

assets, together with continued investment in our leading game

technology, accounted for GBP19.8 million in the period (FY19:

GBP13.4 million). Costs related to new chargeable products, or the

development of technology to support new chargeable products, are

typically capitalised, subject to the usual criteria set out under

accounting standard IAS 38. Development costs associated with the

development or support of existing products are generally expensed

as incurred. Costs capitalised in FY20 represented 80% of gross

R&D expenditure compared with 66% in FY19 and 85% in FY18. The

lower capitalisation percentage rate in FY19 reflected a greater

allocation of development time spent on free content during that

period, particularly related to the launch of the Beyond series of

free updates for Elite Dangerous. The capitalisation rates in FY20

and FY18 are more typical of the Company's usual approach to the

mix of development effort between free and paid content. Frontier

believes that investment in free updates is an important part of

its strategy in supporting and nurturing games after launch.

Amortisation charges for game development and game technology

related intangibles grew to GBP11.2 million for the period (FY19:

GBP7.8 million). The increase reflected the 48-month amortisation

of the development cost of Planet Zoo, starting at launch in

November 2019, together with amortisation charges for paid content

delivering during the year for all four games, including the

substantial PDLC launched in December 2019 for Jurassic World

Evolution, the Jurassic World Evolution: Return to Jurassic Park

Pack, which is Frontier's biggest selling PDLC pack to date.

Net research and development expenses recorded in the income

statement in the period were GBP16.0 million (FY19: GBP14.9

million), being gross spend, less capitalised costs, plus

amortisation charges.

Sales, marketing and administrative expenses totalled GBP18.9

million in FY20 (FY19: GBP20.4 million). The reduction mainly

related to marketing spend, which had been higher in FY19 to

support the launch of Jurassic World Evolution alongside the film

Jurassic World: Fallen Kingdom in June 2018.

Frontier adopted IFRS 16 effective 1 June 2019, which is the

International Financial Reporting Standard for lease accounting.

IFRS 16 requires a lessee to recognise assets and liabilities for

all leases with a term of more than 12 months, unless the

underlying asset is of low value. A lessee is required to recognise

a right-of-use asset representing its right to use the underlying

leased asset and a lease liability representing its obligation to

make lease payments. Frontier has identified that its one and only

lease impacted by this new accounting standard is the lease for its

office building on the Science Park in Cambridge, which Frontier

occupied from April 2018. A right-of-use asset valued at GBP24.4

million was therefore recorded as at 1 June 2019, with a

corresponding lease liability of GBP24.4 million. Before the

adoption of IFRS 16 all costs associated with the lease would have

been charged to administrative costs. During FY20, a total of

GBP2.3 million was charged to the income statement in relation to

the lease, being GBP1.6 million within administrative costs and

GBP0.7 million within interest charges.

Overall net operating expenditure in FY20 of GBP34.9 million was

similar to the total spend in FY19 (GBP35.3 million), with higher

R&D costs being offset by a lower level of marketing spend.

Operating profit of GBP16.6 million was recorded in the year

(FY19: GBP19.4 million) representing an operating margin of 22%

which is consistent with FY19.

EBITDA (earnings before interest, tax, depreciation and

amortisation) increased to GBP31.5 million (FY19: GBP29.0 million).

However, the Company does not consider this to be a particularly

useful 'cash profit' measure of performance since it adds back

amortisation charges relating to game developments and game

technology but without also adjusting for (i.e. deducting) the

costs capitalised in the period related to those intangible assets,

producing a one-sided measure. The operating cashflow measure,

described in the later cash section, is a more appropriate measure

of 'cash profit'.

A corporation tax charge of GBP0.3 million was recorded in the

income statement for FY20 (FY19: a restated charge of GBP1.7

million as per note 2). Frontier benefits from enhanced tax

deductions from Video Games Tax Credits (VGTR) and R&D Tax

Credits, both of which help to reduce taxable profits. The Company

also benefits from tax deductions relating to employee share option

exercises, although a large element of these deductions are

credited directly to reserves rather than being recorded in the

income statement.

Profit after tax for FY20 was GBP15.9 million (FY19: GBP18.0

million) and basic earnings per share was 41.3p (FY19: 46.9p).

BALANCE SHEET AND CASHFLOW

Frontier ended FY20 with its strongest cash position to date,

with GBP45.8 million in total (31 May 2019: GBP35.3 million). Total

net cash inflow during the year of GBP10.4 million (FY19: GBP11.2

million) reflected the continued strong financial performance of

the portfolio of four existing titles, supporting further

investments in those four games, in addition to investments in new

internally developed games and third-party developed games too.

Operating cashflow, which is effectively a measure of 'cash profit'

being EBITDA excluding non-cash items less investments in game

developments and game technology related intangible assets, was

GBP13.6 million in FY20 (FY19: GBP16.8 million).

Intangible assets increased by GBP16.2 million to GBP52.7

million at 31 May 2020 (31 May 2019: GBP36.5 million) across four

asset categories: game technology, game developments, third-party

software and IP licences. Game technology and developments account

for the majority of the asset value at GBP42.9 million at 31 May

2020 (31 May 2019: GBP34.3 million). The growth in value in FY20

reflected investments in assets exceeding amortisation charges as

Frontier continues to grow its portfolio of games. IP licences grew

to GBP9.5 million at 31 May 2020 (31 May 2019: GBP2.0 million) as a

result of the deals signed with Formula 1(R) in March 2020 and

Games Workshop in April 2020.

Tangible assets relate mainly to the fit-out of the leased

office facility, which the Company occupied in April 2018. The net

balance at 31 May 2020 was GBP5.9 million (31 May 2019: GBP6.4

million).

Following the adoption of IFRS 16 "Leases" effective for

Frontier from 1 June 2019, the Company's balance sheet at 31 May

2020 includes a right-of-use asset valued at GBP22.7 million for

the Company's lease over its headquarters office building in

Cambridge. A similar figure, being GBP23.5 million in total, is

recorded as a lease liability for the lease as at 31 May 2020,

split between current and non-current liabilities.

Trade and other receivables totalled GBP12.3 million at the end

of the period (FY19: GBP5.2 million). The higher balance was due to

the strong sales of all four of Frontier games running up to the

end of the financial year, with demand for Frontier's immersive and

creative games benefitting from a boost during Covid-19 lockdowns

around the world in March, April and May, as well as planned price

promotions.

Within current liabilities (amounts due within 12 months), trade

and other payables totalled GBP13.7 million (FY19: GBP9.0 million)

with the largest factor being distribution platform commissions due

on the strong sales during the final months of FY20. Within

non-current liabilities (amounts due after 12 months), the increase

in other liabilities from GBP0.9 million to GBP8.2 million related

to the IP licences signed with Formula 1 (R) and Games Workshop

during the period.

Deferred tax assets and deferred tax liabilities have been

recorded as at 31 May 2020 for the estimated values of temporary

and permanent timing differences, and the potential value of tax

deductions relating to future share option exercises. The net

position as at 31 May 2020 is a net deferred tax asset of GBP2.1

million (31 May 2019 restated: asset of GBP3.2 million).

The current tax asset balance as at 31 May 2020 of GBP2.4

million relates to VGTR claims for FY19 (31 May 2019: a net current

tax liability of GBP0.8 million).

IFRS 16 ADJUSTMENT TO RETAINED EARNINGS

As well as creating additional assets and liabilities in the

statement of financial position, and changing the way that lease

costs are charged to the income statement, the adoption of IFRS 16

also generated an adjustment to the retained earning reserve of

GBP1.3 million in FY20. This adjustment related to the rent-free

incentive period on Frontier's building lease. Previously the

benefit of the rent-free period was spread over the minimum lease

period, which at the inception of the lease was a period of over 15

years. For the adoption of IFRS 16 on 1 June 2019 lease costs were

calculated based on the remaining future cash outflows, which

therefore did not include the benefit of the rent-free period which

had expired prior to 1 June 2019. The result of this was an

acceleration of the remaining unaccounted value of the rent-free

period as at 1 June 2019, with this credit of GBP1.3 million being

recorded only in the statement of changes in equity, and not in the

income statement. This is a one-off credit adjustment to reserves

and further adjustments are not expected.

CONSOLIDATED INCOME STATEMENT

FOR THE YEARED 31 MAY 2020

Restated*

31 May 2020 31 May 2019

Notes GBP'000 GBP'000

------------------------------------------------ ------ ------------ ------------

Revenue 3 76,089 89,669

Cost of sales (24,532) (35,021)

------------------------------------------------ ------ ------------ ------------

Gross profit 51,557 54,648

Research and development expenses (16,014) (14,891)

Sales and marketing expenses (5,747) (7,852)

Administrative expenses (13,172) (12,536)

------------------------------------------------ ------ ------------ ------------

Operating profit 16,624 19,369

Finance income (401) 289

------------------------------------------------ ------ ------------ ------------

Profit before tax 16,223 19,658

Income tax (329) (1,668)

------------------------------------------------ ------ ------------ ------------

Profit for the period attributable to

shareholders 15,894 17,990

------------------------------------------------ ------ ------------ ------------

Earnings per share

Basic earnings per share 4 41.3 46.9

Diluted earnings per share 4 39.4 44.7

------------------------------------------------ ------ ------------ ------------

All the activities of the Group are classified

as continuing.

* Restated for a deferred tax adjustment

as per note 2

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 MAY 2020

Restated*

31 May 2020 31 May 2019

GBP'000 GBP'000

------------------------------------------------ ------ ------------ ------------

Profit for the period 15,894 17,990

Other comprehensive income

Items that will be reclassified subsequently

to profit or loss

Exchange differences on translation of

foreign operations (6) (4)

------------------------------------------------ ------ ------------ ------------

Total comprehensive income for the period

attributable to the equity holders of

the parent 15,888 17,986

------------------------------------------------ ------ ------------ ------------

* Restated for a deferred tax adjustment as per note 2

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 MAY 2020

(REGISTERED COMPANY NO: 02892559)

Restated*

31 May 2020 31 May 2019

Notes GBP'000 GBP'000

----------------------------------- --------------- --------------- --------------------------------

Non-current assets

Intangible assets 5 52,668 36,450

Property, plant and equipment 6 5,926 6,352

Right-of-use asset 22,732 -

Deferred tax asset 6,175 3,185

87,501 45,987

----------------------------------- --------------- --------------- --------------------------------

Current assets

Trade and other receivables 12,284 5,178

Current tax asset 2,377 141

Cash and cash equivalents 45,751 35,332

----------------------------------- --------------- --------------- --------------------------------

60,412 40,651

----------------------------------- --------------- --------------- --------------------------------

Total assets 147,913 86,638

----------------------------------- --------------- --------------- --------------------------------

Current liabilities

Trade and other payables (13,669) (9,026)

Lease liability (1,337) -

Deferred income (1,439) (1,036)

Current tax liabilities - (966)

(16,445) (11,028)

----------------------------------- --------------- --------------- --------------------------------

Net current assets 43,967 29,623

----------------------------------- --------------- --------------- --------------------------------

Non-current liabilities

Provisions (27) (13)

Lease liability (22,198) -

Deferred income (234) (465)

Other payables (8,237) (939)

Deferred tax liabilities (4,038) -

----------------------------------- --------------- --------------- --------------------------------

(34,734) (1,417)

----------------------------------- --------------- --------------- --------------------------------

Total liabilities (51,179) (12,445)

----------------------------------- --------------- --------------- --------------------------------

Net assets 96,734 74,193

----------------------------------- --------------- --------------- --------------------------------

Equity

Share capital 195 194

Share premium account 34,589 34,390

Equity reserve (925) (3,073)

Foreign exchange reserve (22) (16)

Retained earnings 62,897 42,698

----------------------------------- --------------- --------------- --------------------------------

Total equity 96,734 74,193

----------------------------------- --------------- --------------- --------------------------------

*Restated for a deferred tax

adjustment

as per note 2

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEARED 31 MAY 2020

Share Foreign

Share premium Equity exchange Retained Total

capital account reserve reserve earnings equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 31 May 2018 193 34,132 780 (12) 20,195 55,288

------------------ --------------- --------------- --------------- --------------- --------------- ------------

Profit for the

year - - - - 17,990 17,990

Other

comprehensive

income:

Exchange

differences on

translation

of foreign

operations - - - (4) - (4)

Total

comprehensive

income/(expense)

for the year - - - (4) 17,990 17,986

------------------ --------------- --------------- --------------- --------------- --------------- ------------

Issue of share

capital net of

expenses 1 258 - - - 259

Share-based

payment charges - - 1,564 - - 1,564

Share-based

payment transfer

relating to

option exercises

and lapses - - (535) - 535 -

EBT share inflows

from issues

and/or purchases - - (5,000) - - (5,000)

EBT share

outflows from

option

exercises - - 118 - - 118

Tax credits on

share options

taken directly

to reserves - - - - 1,978 1,978

Deferred tax

movements posted

directly to

reserves -

restated

* - - - - 2,000 2,000

------------------ --------------- --------------- --------------- --------------- --------------- ------------

Transactions with

owners 1 258 (3,853) - 4,513 919

------------------ --------------- --------------- --------------- --------------- --------------- ------------

At 31 May 2019 -

restated* 194 34,390 (3,073) (16) 42,698 74,193

------------------ --------------- --------------- --------------- --------------- --------------- ------------

Adjustment for

adoption of IFRS

16 - lease

accounting - - - - 1,313 1,313

------------------ --------------- --------------- --------------- --------------- --------------- ------------

At 1 June 2019

(adjusted) 194 34,390 (3,073) (16) 44,011 75,506

------------------ --------------- --------------- --------------- --------------- --------------- ------------

Profit for the

year - - - - 15,894 15,894

Other

comprehensive

income:

Exchange