TIDMFAB

RNS Number : 9370F

Fusion Antibodies PLC

20 November 2020

Prior to publication, the information contained within this

announcement was deemed by the Company to constitute inside

information for the purposes of Article 7 under the Market Abuse

Regulations (EU) No. 596/2014 ("MAR"). With the publication of this

announcement, this information is now considered to be in the

public domain.

20 November 2020

Fusion Antibodies plc

("Fusion" or the "Company")

Half year Report

Fusion Antibodies plc (AIM: FAB), specialists in pre-clinical

antibody discovery, engineering and supply for both therapeutic

drug and diagnostic applications, announces its unaudited interim

results for the six months ended 30 September 2020 ("H1

FY2021").

Highlights

Operational

-- 9% growth in revenues in H1 FY2021 over H1 FY2020

-- COVID-19 programme introduced as part of the Mammalian Antibody Library development project

-- Recruitment of a Director of Research & Development, and

additional research scientist appointments

Financial

-- Trading for the period has been in line with the Directors' expectations

-- Continued improvement in revenues: H1 FY2021 revenues of

GBP1.90 million (H1 FY2020: GBP1.75 million)

-- R&D expenditure of GBP271,000, an increase of 50% on H1 FY2020

-- Losses held at same level as same period last year: H1 FY2021

loss of GBP0.47 million (H1 FY2020: GBP0.47 million loss)

-- GBP3.0 million (gross proceeds) raised via placing of new ordinary shares

-- Cash position at 30 September 2020 was GBP3.24 million (31 March 2020: GBP1.54 million)

Commenting on the interim results, Paul Kerr, CEO of Fusion

Antibodies plc, said: "I'm pleased to report that our revenues have

grown despite the fact that the period has been dominated by the

COVID-19 pandemic. We have expanded our R&D programme to

include a COVID-19 target along with our oncology targets, with the

goal of using our Mammalian Antibody Library, which will be branded

as "OptiMAL(TM)", to produce neutralising antibodies against the

virus, and have raised capital for that purpose. We have remained

operational throughout changing levels of government restrictions

and have taken the steps to sustain the business in the coming

months. I would like to thank our shareholders and staff for all

their valued support to enable us to continue to grow in these

challenging times."

Enquiries:

Fusion Antibodies plc www.fusionantibodies.com

Dr Paul Kerr, Chief Executive Officer Via Walbrook PR

James Fair, Chief Financial Officer

Allenby Capital Limited Tel: +44 (0)20 3328 5656

James Reeve / Asha Chotai (Corporate

Finance)

Tony Quirke (Sales)

Walbrook PR Tel: +44 (0)20 7933 8780 or fusion@walbrookpr.com

Anna Dunphy Mob: +44 (0)7876 741 001

Paul McManus Mob: +44 (0)7980 541 893

About Fusion Antibodies plc

Fusion is a Belfast based biotechnology company providing a

range of antibody engineering services for the development of

antibodies for both therapeutic drug and diagnostic

applications.

The Company's ordinary shares were admitted to trading on AIM on

18 December 2017. Fusion provides a broad range of services in

antibody generation, development, production, characterisation and

optimisation. These services include antigen expression, antibody

production, purification and sequencing, antibody humanisation

using Fusion's proprietary CDRx(TM) platform and the production of

antibody generating stable cell lines to provide material for use

in clinical trials. Since 2012, the Company has successfully

sequenced and expressed over 250 antibodies and successfully

completed over 200 humanisation projects for its international,

blue-chip client base, which has included eight of the top 10

global pharmaceutical companies by revenue.

Fusion is a Collaborative Research Organisation (CRO) which

provides antibody discovery, engineering and supply, through to

cell line development. At every stage, our client's vision is

central to how we work, ensuring the best molecule goes to the

clinic. Our world-class humanization and antibody optimization

platforms harness the power of the natural diversity of antibodies.

To address remaining market needs in antibody discovery, Fusion is

creating a fully human antibody library to capture the entire human

antibody repertoire.

Fusion Antibodies growth strategy is based on combining the

latest technological advances with cutting edge science to deliver

new platforms that will enable Pharma and Biotech companies get to

the clinic faster and ultimately speed up the drug development

process.

The global monoclonal antibody therapeutics market was valued at

$95.5 billion in 2017 and is forecast to surpass $174.2 billion in

2026, an increase at a CAGR of 6.9 per cent. for the period 2018 to

2026. In 2018, seven of the world's ten top selling drugs were

antibody-based therapeutics with the combined annual sales of these

drugs exceeding $62 billion.

Operational Review

The period began early in the United Kingdom's COVID-19 lockdown

which was a time of high uncertainty as we and our customers

adjusted to new working arrangements. The Company continued to

operate throughout the initial lockdown and varying levels of

restrictions and has delivered a 9% increase in revenues compared

to the same period of the previous year.

The pandemic has created unusual patterns in customer needs as

businesses have adapted their working practices and their research

priorities. This has established opportunities for the Company to

provide additional services to some customers, which has balanced

out certain projects that have been delayed or paused by other

customers. In particular, our core Antibody Engineering service

continues to deliver and our Antibody Supply offering has performed

well during the period, together underpinning the revenue growth

achieved. As companies globally have adjusted to new circumstances,

we have begun to see improved customer confidence.

The next service in the Company's development pipeline is the

Mammalian Antibody Library Discovery Platform ("the Library"). The

Library will add an important new offering for antibody discovery

and the Directors believe it will represent a technologically

superior solution when compared to traditional discovery methods

and to other library offerings already available in the market. The

Company had originally planned to use three therapeutic targets in

the proof-of-concept R&D programme but early in the period

added a new COVID-19 project. We successfully completed a GBP3.0m

equity raise in April to support this and to provide additional

working capital.

We are pleased to report that development work to date has

progressed well throughout the period and potential antibodies from

the Library are currently being screened prior to being evaluated

against the COVID-19 target. This project is supported by an Invest

Northern Ireland grant with Queen's University Belfast to test the

resultant antibodies against the live virus in the University's

virology facility.

To further demonstrate the potential of the Library, the next

two development projects against oncology targets are underway. The

fourth planned project is against a challenging target, and we are

currently in discussions with a potential development partner to

collaborate on this project. The Library will complement the

Company's existing discovery services and will be offered alongside

these, thus providing a broader range of services to our customers.

Commercial collaborations are planned to commence in in FY2022,

with meaningful revenues anticipated in FY2023. To aid marketing

and promotion, the Company has registered the trademark OptiMAL(TM)

for the Library and will use this name in future reports and

marketing material.

Senior R&D scientists have been recruited to accelerate the

research programmes and a newly created post of Director of

Research and Development has recently been filled.

Financial Review

Revenues for the six-month period to 30 September 2020 were

GBP1.90 million (H1 FY2020: GBP1.75 million).

Operating loss for the first half was GBP0.56 million (H1

FY2020: GBP0.62 million). This result reflects R&D expenditure

of GBP271,000, an increase of 50% compared with H1 FY2020 and the

continued programme of expansion of capacity and development of

sales and marketing.

In April 2020, the Company raised GBP3.0 million of equity

(gross proceeds) by issuing 3,333,333 new ordinary shares in an

oversubscribed placing. The primary purpose of this raise was to

finance the additional COVID-19 project of the Library

development.

As a result of the increased number of shares in issue, basic

loss per share has further reduced to GBP0.019 per share versus

GBP0.021 loss per share in H1 FY2020.

Gross profit margin of 46% has improved on H1 FY 2020 (42%) and

is similar to that achieved for the full year FY2020. In addition

to the continued recruitment and training of scientists to enable

the Company to deliver future growth, there were added costs

arising from adjustments to working practices and higher consumable

costs as a result of COVID-19 restrictions. Revenue grants relating

to employment are included in other income.

Administrative expenses include expenditure on overheads, Board

costs, sales and marketing, research & development as well as

depreciation. Administrative expenses of GBP1.48 million have

increased compared with H1 FY2020 of GBP1.41 million as a result of

further investment in research and development.

Cash used in operations was GBP0.73 million compared with

GBP0.55 million used in H1 FY2020. This includes planned investment

of funds in research & development as well as increased working

capital requirements in H1 FY2021. The Company expects to increase

consumable stocks further to mitigate against supply chain risks

from COVID-19 and from Brexit which is an added risk for H2 FY2021.

EBITDA losses are reducing as shown in the Key Performance

Indicators below and are mainly attributable to investment in

research and development.

The Board is not recommending the payment of a dividend in

relation to the first half of the current financial year (H1

FY2020: nil).

Key Performance Indicators

The key performance indicators (KPIs) regularly reviewed by the

board are:

KPI H1 2021 H1 2020

--------------------------------------------- ------------ ------------

Revenue growth against same period in prior

year 9% 166%

EBITDA* (GBP0.218m) (GBP0.315m)

Cash used in operations (GBP0.727m) (GBP0.551m)

--------------------------------------------- ------------ ------------

* Earnings before interest, tax, depreciation and

amortisation

Outlook

The Board is pleased to report that the Company has maintained

and slightly grown revenues in the first six months of the year, in

what were unprecedented times.

The Directors believe that the antibody therapeutic market

continues to grow, and that Fusion remains in a strong position to

grow and return to profitability in future years. The Company's

core services are reliant on multiple orders which the Company can

execute within two to three months, which limits the visibility of

orders and revenues beyond that timeframe. However, the current

pipeline is in line with the Board's expectations and the Directors

are confident that progress will be made.

There are two major factors of uncertainly facing the Company

and its customers in the second half of this financial year.

COVID-19 restrictions continue to play a major part in many of our

key markets with unplanned workforce and supply chain interruptions

having a global impact. However, we will continue to operate the

business and make our services available to our customers to the

extent possible which, to date, has been with limited disruption.

In addition, the United Kingdom will leave the European Union on 31

December 2020 ("Brexit"). The Company will maintain unrestricted

access to EU markets due to its location in Northern Ireland which

the Directors believe will reduce the impact of Brexit. The Board

continues to believe that the Company has the expertise and

financial resources to meet these challenges and capitalise on

opportunities in the remainder of this period and beyond.

Statement of Directors' Responsibilities

The Directors confirm, to the best of their knowledge:

-- The condensed set of financial statements has been prepared

in accordance with IAS34 'Interim Financial Reporting', as adopted

by the European Union;

-- The interim management report includes a fair review of the

information required by DTR 4.2.7R of the Disclosure and

Transparency Rules of the of the United Kingdom's Financial Conduct

Authority, being an indication of important events that have

occurred during the first six months of the financial year and

their impact on the condensed set of financial statements, and a

description of the principal risks and uncertainties for the

remaining six months of the year, and gives a true and fair view of

the assets, liabilities, financial positions and profit for the

period of the company; and

-- The interim management report includes a fair review of the

information required by DTR 4.2.8R of the Disclosure and

Transparency Rules of the United Kingdom's Financial Conduct

Authority, being a disclosure of related party transactions and

changes therein since the previous annual report.

By order of the Board

Dr Simon Douglas

Non-executive Chairman

20 November 2020

Condensed Statement of Comprehensive Income

For the six months ended 30 September 2020

6 months 6 months Year to

to 30.09.20 to 30.09.19 31.03.20

Notes Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

Revenue 1,905 1,753 3,895

Cost of sales (1,032) (1,014) (2,123)

------------------------------- -------- ------------- ------------- ----------

Gross profit 873 739 1,772

Other operating income 10 43 53 56

Administrative expenses (1,479) (1,408) (2,887)

------------------------------- -------- ------------- ------------- ----------

Operating loss (563) (616) (1,059)

------------------------------- -------- ------------- ------------- ----------

Finance income 3 1 4 6

Finance costs 3 (10) (9) (20)

------------------------------- -------- ------------- ------------- ----------

Loss before tax (572) (621) (1,073)

Income tax credit 4 101 148 376

------------------------------- -------- ------------- ------------- ----------

Loss for the period (471) (473) (697)

Total comprehensive expense

for the period (471) (473) (697)

------------------------------- -------- ------------- ------------- ----------

Pence Pence Pence

Basic loss per share 5 (1.9) (2.1) (3.2)

Condensed Statement of Financial Position

As at 30 September 2020

As at As at 30.09.19 As at

30.09.20 Unaudited 31.03.20

Notes Unaudited GBP'000 Audited

GBP'000 GBP'000

---------------------------------- -------- ----------- --------------- ----------

Assets

Non-current assets

Intangible assets 3 5 4

Property, plant and equipment 6 1,401 1,558 1,470

Deferred tax assets 7 2,045 1,488 1,764

---------------------------------- -------- ----------- --------------- ----------

3,449 3,051 3,238

---------------------------------- -------- ----------- --------------- ----------

Current assets

Inventories 373 231 340

Trade and other receivables 1,171 1,200 887

Current tax receivable 69 39 38

Cash and cash equivalents 3,243 1,313 1,537

---------------------------------- -------- ----------- --------------- ----------

4,856 2,783 2,802

---------------------------------- -------- ----------- --------------- ----------

Total assets 8,305 5,834 6,040

---------------------------------- -------- ----------- --------------- ----------

Liabilities

Current liabilities

Trade and other payables 607 580 828

Borrowings 8 161 124 161

---------------------------------- -------- ----------- --------------- ----------

768 704 989

---------------------------------- -------- ----------- --------------- ----------

Net current assets 4,088 2,079 1,813

Non-current liabilities

Borrowings 8 148 170 219

Provisions for other liabilities

and charges 20 20 20

---------------------------------- -------- ----------- --------------- ----------

Total liabilities 936 894 1,228

---------------------------------- -------- ----------- --------------- ----------

Net assets 7,369 4,940 4,812

---------------------------------- -------- ----------- --------------- ----------

Equity

Called up share capital 13 1,017 884 884

Share premium reserve 7,535 4,872 4,872

(Accumulated losses)/retained

earnings (1,183) (816) (944)

---------------------------------- -------- ----------- --------------- ----------

Equity 7,369 4,940 4,812

---------------------------------- -------- ----------- --------------- ----------

Condensed Statement of Changes in Equity

For the six months ended 30 September 2020

6 months ended 30 September Called Share premium

2020 up share reserve Accumulated

Unaudited capital GBP'000 losses Equity

GBP'000 GBP'000 GBP'000

------------------------------- ----------- ---------------- -------------- ----------

At 1 April 2020 884 4,872 (944) 4,812

Loss for the period - - (471) (471)

------------------------------- ----------- ---------------- -------------- ----------

Issue of share capital 133 2,867 - 3,000

Cost of issuing share capital - (204) - (204)

Share options - value of

employee services - - 21 21

Tax credit relating to

share option scheme - - 211 211

------------------------------- ----------- ---------------- -------------- ----------

Total transactions with

owners, recognised directly

in equity 133 2,663 232 3,028

------------------------------- ----------- ---------------- -------------- ----------

At 30 September 2020 1,017 7,535 (1,183) 7,369

------------------------------- ----------- ---------------- -------------- ----------

6 months ended 30 September Called Share premium

2019 up share reserve Retained

Unaudited capital GBP'000 earnings Equity

GBP'000 GBP'000 GBP'000

------------------------------- ----------- ---------------- -------------- ----------

At 1 April 2019 884 4,872 (402) 5,354

Loss for the period - - (473) (473)

------------------------------- ----------- ---------------- -------------- ----------

Share options - value of

employee services - - 46 46

Tax credit relating to

share option scheme - - 13 13

------------------------------- ----------- ---------------- -------------- ----------

Total transactions with

owners, recognised directly

in equity - - 59 59

------------------------------- ----------- ---------------- -------------- ----------

At 30 September 2019 884 4,872 (816) 4,940

------------------------------- ----------- ---------------- -------------- ----------

Year ended 30 March 2020 (Accumulated

Audited Called Share premium losses)/

up share reserve Retained

capital GBP'000 earnings Equity

GBP'000 GBP'000 GBP'000

------------------------------- ----------- ---------------- -------------- ----------

At 1 April 2019 884 4,872 (402) 5,354

Loss for the year - - (697) (697)

------------------------------- ----------- ---------------- -------------- ----------

Share options - value of

employee services - - 72 72

Tax credit relating to

share option scheme - - 83 83

------------------------------- ----------- ---------------- -------------- ----------

Total transactions with

owners, recognised directly

in equity - - 155 155

------------------------------- ----------- ---------------- -------------- ----------

At 31 March 2020 884 4,872 (944) 4,812

------------------------------- ----------- ---------------- -------------- ----------

Statement of Cash Flows

For the six months ended 30 September 2020

6 months 6 months Year to

to to 30.09.19 31.03.20

30.09.20 Unaudited Audited

Unaudited GBP'000 GBP'000

GBP'000

--------------------------------------- ----------- ------------- ----------

Cash flows from operating activities

Loss for the period (471) (473) (697)

Adjustments for:

Share based payment expense 21 46 83

Depreciation 344 300 620

Amortisation of intangible assets 1 1 2

Finance income (1) (4) (6)

Finance costs 10 9 20

Income tax credit (101) (148) (376)

Decrease/(increase) in inventories (33) 11 (97)

(Increase)/decrease in trade and

other receivables (276) (144) 169

(Decrease)/increase in trade and

other payables (221) (149) 99

--------------------------------------- ----------- ------------- ----------

Cash used in operations (727) (551) (183)

Income tax received - - 23

--------------------------------------- ----------- ------------- ----------

Net cash used in operating activities (727) (551) (160)

Cash flows from investing activities

Purchase of intangible assets - - -

Purchase of property, plant and

equipment (275) (44) (109)

Finance income - interest received 1 4 6

--------------------------------------- ----------- ------------- ----------

Net cash used in investing activities (274) (40) (103)

Cash flows from financing activities

Proceeds from issue of share capital 2,796 - -

Repayments of borrowings (85) (71) (172)

Finance costs - interest paid (4) (9) (12)

--------------------------------------- ----------- ------------- ----------

Net cash generated from/(used in)

financing activities 2,707 (80) (184)

Net increase/(decrease) in cash

and cash equivalents 1,706 (671) (447)

Cash and cash equivalents at the

beginning of the period 1,537 1,984 1,984

--------------------------------------- ----------- ------------- ----------

Cash and cash equivalents at the

end of the period 3,243 1,313 1,537

--------------------------------------- ----------- ------------- ----------

Notes to the Interim Results

For the six months ended 30 September 2020

1 Basis of Preparation

The condensed financial statements comprise the unaudited

results for the six months to 30 September 2020 and 30 September

2019 and the audited results for the year ended 31 March 2020. The

financial information for the year ended 31 March 2020 does not

constitute the full statutory accounts for that period. The Annual

Report and Financial Statements for the year ended 31 March 2020

have been filed with the Registrar of Companies. The Independent

Auditor's Report on the Annual Report and Financial Statements for

2020 was unmodified and did not contain a statement under s498(2)

or s498(3) of the Companies Act 2006.

The condensed financial statements for the period ended 30

September 2020 have been prepared in accordance with the Disclosure

Guidance and Transparency Rules of the Financial Conduct Authority

and with IAS 34 'Interim Financial Reporting' as adopted by the

European Union. The information in these condensed financial

statements does not include all the information and disclosures

made in the annual financial statements.

Going concern

At 30 September 2020 the Company had a cash balance of GBP3.24

million. The Directors have reviewed detailed projections for the

Company. These projections are based on estimates of future

performance and have been adjusted to reflect various scenarios and

outcomes that could potentially impact the forecast outturn. Based

on these estimates, the Directors have a reasonable expectation

that the company has adequate resources to continue in operational

existence for 12 months from the reporting date. Accordingly, they

have prepared these condensed financial statements on the going

concern basis.

Accounting policies

The condensed financial statements have been prepared in a

manner consistent with the accounting policies set out in the

financial statements for the year ended 31 March 2020 and on the

basis of the International Financial Reporting Standards (IFRS) as

adopted for use in the EU that the company expects to be applicable

at 31 March 2021. IFRS are subject to amendment and interpretation

by the International Accounting Standards Board (IASB) and there is

an ongoing process of review and endorsement by the European

Commission.

2 Segmental information

For all the financial periods included in these condensed

financial statements, all the revenues and costs relate to the

single operating segment of research, development and manufacture

of recombinant proteins and antibodies.

3 Finance income and costs

6 months to 6 months Year to

30.09.20 to 30.09.19 31.03.20

Unaudited Unaudited Audited

Income GBP'000 GBP'000 GBP'000

--------------------------- ------------ ------------- ----------

Bank interest receivable 1 4 6

--------------------------- ------------ ------------- ----------

6 months to 6 months Year to

30.09.20 to 30.09.19 31.03.19

Unaudited Unaudited Audited

Cost GBP'000 GBP'000 GBP'000

--------------------------- ------------ ------------- ----------

Interest expense on other

borrowings 10 9 20

--------------------------- ------------ ------------- ----------

4 Income tax credit

6 months 6 months Year to

to 30.09.20 to 30.09.19 31.03.20

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------ ------------- ------------- ----------

Current tax (31) (16) (38)

Deferred tax (70) (132) (338)

------------------ ------------- ------------- ----------

Total tax credit (101) (148) (376)

------------------ ------------- ------------- ----------

5 Earnings per share

The calculation of earnings per share is based on loss after tax

from continuing operations for six months to 30 September 2020 of

GBP471,000 (6 months to 30 September 2019: GBP473,000 loss, year to

31 March 2019: GBP697,000 loss).

The weighted average number of shares used in the calculation of

the basic earnings per share are as follows:

6 months 6 months Year to

to 30.09.20 to 30.09.19 31.03.20

Unaudited Unaudited Audited

Number Number Number

---------------------------- ------------- ------------- -------------

Issued ordinary shares at

the end of the period 25,437,025 22,091,192 22,091,192

Weighted average number

of shares in issue during

the period 24,875,220 22,091,192 22,091,192

---------------------------- ------------- ------------- -------------

Basic earnings per share is calculated by dividing the basic

earnings for the period by the weighted average number of shares in

issue during the period.

6 Property, plant and equipment

Right Fixtures,

of use Leasehold Plant fittings

assets property & & equipment Total

GBP'000 GBP'000 machinery GBP'000 GBP'000

GBP'000

-------------------------- --------- ------------ ------------ ------------- ----------

Cost

At 1 April 2020 226 725 1,916 220 3,087

Additions 14 - 253 8 275

Disposals - - - - -

-------------------------- --------- ------------ ------------ ------------- ----------

At 30 September 2020 240 725 2,169 228 3,362

-------------------------- --------- ------------ ------------ ------------- ----------

Accumulated depreciation

At 1 April 2020 68 425 1,015 109 1,617

Disposals - - - - -

Depreciation charged

in the period 34 72 214 24 344

-------------------------- --------- ------------ ------------ ------------- ----------

At 30 September 2020 102 497 1,229 133 1,961

-------------------------- --------- ------------ ------------ ------------- ----------

Net book value

At 30 September 2020 138 228 940 95 1,401

-------------------------- --------- ------------ ------------ ------------- ----------

At 31 March 2020 158 300 901 111 1,470

-------------------------- --------- ------------ ------------ ------------- ----------

7 Deferred tax assets

Deferred tax assets are recognised for the carry forward of

corporation tax losses to the extent that the realisation of a

future benefit is probable. The deferred tax arising from future

utilisation of taxable losses of GBP8.8 million (30 September 2019:

GBP8.7 million) is dependent on future taxable profits arising in

the UK. During the period the Company raised GBP2.8m (net proceeds)

of capital to invest in research and development and to finance

growth and as a consequence this will increase taxable losses in

the next two to three years. The Directors have prepared forecasts

indicating a return to profitability in the future and they have an

expectation that the Company will make sufficient future taxable

profits against which the tax losses can be deducted and

accordingly, a deferred tax asset has been recognised in the

financial statements.

8 Borrowings

At 30 At 30 September At 31

September 2019 March

2020 GBP'000 2020

GBP'000 GBP'000

-------------------------- ----------- ---------------- ---------

At 1 April 380 140 140

Adoption of IFRS 16 (see

note 12) - 226 226

Additions in period 14 - 166

Interest 10 9 20

Repayments (95) (81) (172)

-------------------------- ----------- ---------------- ---------

At period end 309 294 380

-------------------------- ----------- ---------------- ---------

Amounts due in less than

1 year 161 124 161

Amounts due after more

than 1 year 148 170 219

-------------------------- ----------- ---------------- ---------

309 294 380

-------------------------- ----------- ---------------- ---------

Borrowings are secured by a fixed and floating charge over the

whole undertaking of the company, its property, assets and rights

in favour of Northern Bank Ltd trading as Danske Bank.

9 Retirement benefits obligations

The company operates a defined contribution scheme, the assets

of which are managed separately from the company.

10 Transactions with related parties

The Company had the following transactions with related parties

during the year:

Invest Northern Ireland ("Invest NI") is a shareholder in the

Company. The Company leases its premises from Invest Northern

Ireland and received invoices for rent and estate services

amounting to GBP40,000 (6 months ended 30 September 2019:

GBP46,000, year ended 31 March 2020: GBP78,000). A balance of

GBPnil (30 September 2019: GBPnil, 31 March 2020: GBPnil) was due

and payable to Invest NI at the reporting date. The Company

received various grants during the period from Invest NI amounting

to GBP43,000 (6 months ended 30 September 2019: GBP53,000, year

ended 31 March 2020 GBP56,000).

11 Events after the reporting date

There have been no events from the reporting date to the date of

approval which need to be reported.

12 Changes in accounting policies in the prior period

This note explains the impact of the adoption of IFRS 16

'Leases' on the Company's financial statements and discloses the

new accounting policies applied from 1 April 2019, where they are

different to those applied before that date.

(a) Impact on financial statements

The adoption of IFRS 16 'Leases' from 1 April 2019 resulted in

changes in accounting policies and adjustments to the amounts

recognised in the financial statements. The new accounting policies

are set out in note 12(c) below.

In adopting IFRS 16 the modified retrospective approach has been

used such that the right of use assets arising is equal in value to

the lease liabilities recognised as borrowings. In accordance with

the transitional provisions of IFRS 16, a restatement of prior year

financial statements was not required. The reclassifications and

the adjustments arising from adoption of this standard are

therefore not reflected in Statement of Financial Position as at 31

March 2019, but are recognised in the opening Statement of

Financial Position on 1 April 2019.

GBP'000

------------------------------------ --------

Lease liabilities at 31 March 2019 250

Effect of discounting (24)

Right of use asset at 1 April 2019 226

------------------------------------ --------

The following table shows the adjustments recognised for each

individual line item. Line items that were not affected by the

changes have not been included. As a result, the sub-totals and

totals disclosed cannot be recalculated from the numbers provided.

The adjustments are explained in more detail below.

Impact on the opening balance on the statement of financial as

at 1 April 2019:

Balance sheet extract

------------------------- --------- -----------------------------

31 March Adoption of 1 April 2019

2019 IFRS 16 GBP'000

GBP'000 GBP'000

------------------------- --------- ------------ -------------

Non-current assets

Property, plant and

equipment 1,588 226 1,814

Current liabilities

Borrowings (67) (64) (131)

Non-current liabilities

Borrowings (73) (162) (235)

Equity

Accumulated losses (402) - (402)

------------------------- --------- ------------ -------------

(b) Impact of adoption

IFRS 16 'Leases' replaces IAS17 'Leases' and related

interpretations. It introduces a single lessee accounting model,

eliminating the previous classification of leases as either

operating or finance. This has resulted on operating leases

previously treated solely through profit or loss being recorded in

the statement of financial position in the form of a right-of-use

asset and a lease liability, subject to certain exemptions.

The adoption of IFRS 16 'Leases' from 1 April 2019 resulted in

changes in accounting policies and adjustments to the amounts

recognised in the financial statements. The new accounting policies

are set out in note 12 (c). In accordance with the transitional

provisions in IFRS 16, comparative figures have not been

restated.

The total impact on the Company's retained earnings was GBPnil

as shown in 12(a) above.

Leases

The directors considered all leases in place at 31 March 2019

and the only lease identified for adjustment under IFRS 16 is for

the Company's premises in Belfast. At 31 March 2019 this lease had

40 months remaining and annual lease payments of GBP75,000. The

Company was required to recognise a right-of-use asset at 1 April

2019 for this asset of GBP226,000 and a corresponding liability in

borrowings.

Rental payments will no longer be charged to profit or loss,

however, a depreciation charge for the asset and an interest charge

on the borrowings will be charged to profit or loss.

The following judgements have been made by the directors:

-- The agreement for the use of the premises constitutes a lease under IFRS 16;

-- The lease term was assessed as ending on the expiry of the agreement as set out in the lease;

-- The discount rate used of 4.7% was judged by the directors to

be the rate at which the Company would be able to borrow a similar

amount for the purposes of acquiring premises.

The impact on earnings per share for the year ended 31 March

2020 is a reduction of approximately GBP3,000 in reported earnings

or an additional GBP0.0001 per share.

(c) IFRS 16 Leases - Accounting policies applied from 1 April

2019

Leases

Leases in which a significant portion of the risks and rewards

of ownership remain with the lessor are deemed to give the Company

the right-of-use and accordingly are recognised as property, plant

and equipment in the statement of financial position. Depreciation

is calculated on the same basis as a similar asset purchased

outright and is charged to profit or loss over the term of the

lease. A corresponding liability is recognised as borrowings in the

statement of financial position and lease payments deducted from

the liability. The difference between remaining lease payments and

the liability is treated as a finance cost and taken to profit or

loss in the appropriate accounting period.

13 Share capital

During the period the Company issued 3,345,833 Ordinary Shares

of 4 pence each for gross proceeds of GBP3,000,000 before related

expenses. Costs of the share issue totalled GBP204,000 and have

been deducted from the Share Premium Reserve.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FFEFWUESSEFF

(END) Dow Jones Newswires

November 20, 2020 02:00 ET (07:00 GMT)

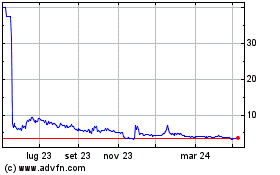

Grafico Azioni Fusion Antibodies (LSE:FAB)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Fusion Antibodies (LSE:FAB)

Storico

Da Apr 2023 a Apr 2024