Getlink: 2020 Annual Results

25 Febbraio 2021 - 7:30AM

Business Wire

Operational and financial discipline that is

paying off to get through the health crisis and anticipate

Brexit

- Robust revenue at €816 million (-24%1)

- EBITDA down 41% to €328 million

- Net available cash of €629M (+20%) at end of December 2020

and a positive Free Cash Flow (€31M)

- Reduction in net financial debt of €92M

Regulatory News:

Getlink (Paris:GET):

Yann Leriche, Group Chief Executive Officer said: “In

2020, thanks to rigorous management and strong commitment from our

teams, Getlink delivered a solid operational and financial

performance, in an exceptional context marked by the Covid crisis

and Brexit. Our collective ability to adapt to this new economic

environment and to continue to provide a vital service to our

customers has enabled us to end this year with a historic level of

cash, confirming the Group’s resilience. This year we shall

continue to be just as disciplined in the management of our cash

flow and our costs, whilst reinforcing our CSR actions.”

ANNUAL HIGHLIGHTS

Group

- Absolute priority given to the health of our employees and our

customers.

- Change in the governance structure from 1 July 2020 with Yann

Leriche becoming Chief Executive Officer and Jacques Gounon

remaining as Chairman of the Board of Directors.

- Appointment of Géraldine Périchon as Administrative and

Financial Director.

- Strong liquidity with the refinancing of 2023 Green Bonds and

successful placement maturing in 2025, confirmed cash and credit

lines and secured covenants.

- Ranking by Sustainalytics among the best companies in the

transport sector in the most demanding category "ESG Risk Rating

Negligible".

Eurotunnel

- Yield increase of 15% due to an increase of last-minute

bookings and premium and flexible tickets. Le Shuttle and Le

Shuttle Freight services have confirmed their position as leading

market players on the Short Straits, with market shares of 70.1%

for the car activity and 39.5% for trucks respectively.

- In 2020, more than 1.4 million passenger vehicles crossed the

Channel aboard Passenger Shuttles, a remarkable performance

compared to our competitors.

- Preparation of the new procedures for Brexit using new

infrastructure and services such as the Pit-Stops, French e-gates,

customs and sanitary and phytosanitary (SPS) control centre, export

parking and the Eurotunnel Border Pass.

- Post-Brexit agreement concluded on 24 December 2020 between the

EU and the UK.

Europorte

- Europorte recorded a small decrease in annual revenue, down 2%

to €123 million, despite the impact of the pandemic.

- Europorte achieved a substantial EBITDA of €28 million, up

17%.

- Europorte recorded a positive net result before tax, confirming

its profitability.

ElecLink

- Converter stations connected to the national electricity

networks, RTE and National Grid.

- The Intergovernmental Commission (IGC) reinstated the project’s

approval on 10 December which will enable the completion of the

interconnector construction.

FINANCIAL RESULTS

The Group’s consolidated revenue for the 2020 financial year

amounts to €816 million.

Consolidated EBITDA amounts to €328 million, down €229 million

compared to 2019 at a constant exchange rate, due to the Covid

pandemic.

Operating profit was €134 million, down 67% compared to

2019.

The Group’s consolidated net loss for the 2020 financial year

was €113 million.

€629 million of cash held at the end of December 2020, up €104

million compared to the end of December 2019.

FINANCIAL OUTLOOK

In the absence of clear visibility on the future decisions by

the governments concerning the public health crisis and associated

travel restrictions, the Group is postponing any announcement

regarding its 2021 financial performance.

The lack of short-term visibility does not undermine the Group's

confidence in the strength of its various activities, their growth

potential in the medium and long term, and its ability to improve

its operational and environmental performance.

Dates for 2021:

22 April 2021: 2021 first quarter traffic and revenue 28 April

2021: AGM 22 July 2021: 2021 half-year results

Additional information:

The Board of Directors at its meeting on Wednesday 24 February

2021 under the chairmanship of Jacques Gounon, approved the

financial statements for the year ending 31 December 2020.

The financial analysis of the consolidated financial statements

is available on the Group’s website: www.getlinkgroup.com.

Getlink SE’s consolidated and parent company accounts for 2020

have been audited and certified by the statutory auditors.

1 All comparisons with the 2019 income statement are based on

the average exchange rate for 2020 of £1 = €1.126.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210224006035/en/

For UK media enquiries John Keefe on + 44 (0) 1303 284491

Email: press@getlinkgroup.com

For other media enquiries Anne-Laure Desclèves on +33(0)1

4098 0467

For investor enquiries Jean-Baptiste Roussille on +33

(0)1 40 98 04 81 Email:

jean-baptiste.roussille@getlinkgroup.com

Michael Schuller on +44 (0) 1303 288749 Email:

Michael.schuller@getlinkgroup.com

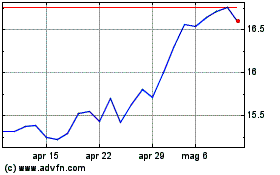

Grafico Azioni Getlink (EU:GET)

Storico

Da Mar 2024 a Apr 2024

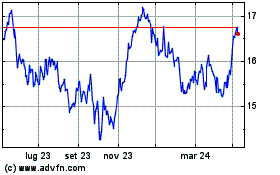

Grafico Azioni Getlink (EU:GET)

Storico

Da Apr 2023 a Apr 2024