TIDMGGP

RNS Number : 8437G

Greatland Gold PLC

30 November 2020

30 November 2020

Dissemination of a Regulatory Announcement that contains inside

information according to REGULATION (EU) No 596/2014 (MAR).

Greatland Gold plc

("Greatland" or "the Company")

Greatland Signs Two Joint Venture Agreements and Secures Funding

for Havieron

Newcrest and Greatland sign new landmark agreements to

facilitate the acceleration of early works and expanded exploration

activities at Havieron

In addition, Newcrest and Greatland sign a second farm-in and

joint venture agreement (the "Juri Joint Venture") for Greatland's

Black Hills and Paterson Range East licences

Greatland Gold plc (AIM:GGP), the precious and base metals

exploration and development company, is pleased to announce that

the Company, and its wholly-owned subsidiary Greatland Pty Ltd,

have signed a series of new agreements, including a fully formed

Joint Venture Agreement for the Havieron project (the Havieron

Joint Venture Agreement), a new Joint Venture Agreement for the

Black Hills and Paterson Range East licences (the Juri Joint

Venture and Farm-in Agreement) and a Loan Agreement for Havieron

(the Havieron Loan Agreement), with Newcrest Operations Limited

("Newcrest"), a wholly owned subsidiary of Newcrest Mining Limited

(ASX:NCM).

Background

-- In March 2019, Greatland signed a four-stage Farm-in

Agreement with Newcrest, to explore and develop Greatland's

Havieron gold-copper deposit in the Paterson region of Western

Australia.

-- Excellent drilling results to date from Newcrest's ongoing

exploration campaign have highlighted the world-class potential of

the Havieron gold-copper deposit, and the parties see real

potential to further expand the deposit, with the extent of the

Havieron system still to be defined.

-- In addition, the Havieron project is progressing faster than

was anticipated at the time the Farm-in Agreement was entered into,

with early works expected to commence in late 2020 or early 2021,

subject to receipt of required approvals.

Summary of Agreements

-- Building on recent success at Havieron: Newcrest and

Greatland have entered into a series of new agreements in relation

to Havieron, most notably, the Havieron Joint Venture Agreement and

the Havieron Loan Agreement. These new agreements are expected to

deliver the following primary benefits to Greatland :

o The agreements provide a formal framework for the arrangements

between the two parties beyond the existing Farm-in Agreement, and

facilitate the expansion of exploration activities at Havieron and

the acceleration of early works, including the construction of a

box-cut and decline.

o The Havieron Loan Agreement secures funding for Greatland

(approximately US$50m), which, together with Newcrest's existing

sole funding commitments under the Farm-in Agreement, is expected

to fund Greatland's share of joint venture costs (based on current

forecasts) up to the completion of Feasibility Study.

-- Havieron Joint Venture Agreement ("Havieron Joint Venture" or

"Havieron JV"): A fully-termed Joint Venture Agreement between

Newcrest and Greatland to govern the joint venture ownership and

operations of the Havieron project .

o In order to support the planned acceleration of the

construction of a box-cut and decline and a faster rate and scope

of planned spending on exploration activities, the parties have

agreed to fund these activities in proportion to their post-Farm-in

period interests (70% Newcrest; 30% Greatland).

o In order to incorporate ongoing growth drilling activities,

the parties have agreed a structure that allows Newcrest to deliver

the Pre-Feasibility Study in Stage 4.

o Consequently, Newcrest has now met the Stage 3 expenditure

requirements and is entitled to earn an additional 20% interest in

the Havieron Joint Venture for an overall 60% interest (40%

Greatland).

o Newcrest's total farm-in commitment remains to incur

expenditure of US$65m and deliver a Pre-Feasibility Study to earn

70%.

-- Havieron Loan Agreement: Provides for a loan facility of

US$50m from Newcrest to Greatland, at an interest rate of LIBOR +

8%, which is expected (based on current forecasts) to fund

Greatland's share of joint venture costs, including Early Works and

Growth Drilling, up to the completion of the Feasibility Study.

-- New exploration joint venture ("Juri Joint Venture" or "Juri

JV"): In addition to the Havieron-related agreements, Newcrest and

Greatland have entered into a farm-in and joint venture agreement

to accelerate exploration at Greatland's Black Hills and Paterson

Range East licences:

o Newcrest immediately receives a 25% interest in both licences

and has the right to earn up to a 75% interest in the licences by

spending up to A$20m as part of a two-stage Farm-in over five

years, including an A$3m minimum commitment for Stage 1.

o Greatland has previously identified a number of high-priority

targets across the two licences, many of which display similar

geophysical characteristics to the Havieron gold-copper

deposit.

o Greatland retains 100% ownership of both the Scallywag and

Rudall licences which do not form part of the Juri Joint

Venture.

Key Upcoming Milestones

-- Initial Mineral Resource on Track: Initial Inferred Mineral

Resource Estimate for Havieron expected to be delivered in December

2020.

-- Early Works Commencement: New camp at Havieron, with

accommodation for up to 230 people, is nearly completed, and

construction of box cut and decline is expected to commence late

2020 or early 2021, subject to receipt of required approvals.

-- Pre-Feasibility Study: A Pre-Feasibility Study for Havieron,

including an Indicated Mineral Resource Estimate, is expected to be

delivered by late 2021.

-- Juri JV Exploration Activities: Drilling of high-priority

targets, including Parlay and Goliath, is expected to commence in

early 2021.

Gervaise Heddle, Chief Executive Officer of Greatland Gold,

commented : "These new agreements with Newcrest represent a

landmark moment for Greatland Gold, both in structuring the next

stage in Havieron's development and progressing our exploration

efforts across the Paterson region.

"The Havieron Joint Venture Agreement formalises our

relationship with Newcrest beyond the existing farm-in, and with

this agreement in place, we expect to progress rapidly towards the

potential establishment of mining operations over the next two to

three years. Importantly, the new Havieron Loan Agreement with

Newcrest secures for us our share of the necessary monies to

accelerate activities at the Havieron project. Indeed, based on

current forecasts, we now expect to be funded for our share of

expenditure, including the costs associated with the construction

of the decline and an expanded exploration programme at Havieron,

up to the completion of the Feasibility Study. With all this in

place, Newcrest and Greatland can now accelerate our efforts and

work together towards realising the world-class potential of this

exciting project.

"The Juri Joint Venture with Newcrest for the Paterson Range

East and Black Hills licences represents an affirmation of our

belief in the potential of these areas and one that we expect will

maximise the long-term strategic value of these licences. By early

2021, we expect to be moving forward with multiple exploration

campaigns in the Paterson as we advance exploration at the Havieron

Joint Venture, the Juri Joint Venture and across Greatland's

100%-owned licences.

"The transformation of Greatland over the past few years has

been remarkable and we are now in the strongest position we have

ever been to capitalise upon our recent success. We remain

committed to building shareholder value and, with these key

agreements now in place, we look forward to continuing this

exciting journey."

Havieron Joint Venture, Loan Agreement and Deed of Cross

Security

Background

In March 2019, Greatland signed a Farm-in Agreement with

Newcrest, to explore and develop Greatland's Havieron gold-copper

deposit in the Paterson region of Western Australia. Newcrest has

the right to earn up to a 70% interest in the joint venture which

includes Mining Lease 45/1287, a 12 block area that covers the

Havieron deposit, by completing a series of exploration and

development milestones in a four-stage Farm-in. Newcrest may

acquire an additional 5% interest at the end of the Farm-in Period

at fair market value.

As previously announced on 1 April 2020, Newcrest has satisfied

the Stage 1 Commitment and Stage 2 Commitment and has earned a 40%

interest in the Havieron Joint Venture (40% Newcrest, 60%

Greatland). Subsequently, in accordance with the terms of the

Havieron Joint Venture announced today, Newcrest has now met the

Stage 3 expenditure requirements and is entitled to earn an

additional 20% interest in the Havieron Joint Venture (60%

Newcrest, 40% Greatland).

Havieron Joint Venture Agreement

-- The Havieron Joint Venture Agreement will govern the joint

venture ownership and operations of the Havieron project in the

area covered by Mining Lease 45/1287 which includes the Havieron

gold-copper deposit (the "JV Area") . The current intention of both

parties is, that, subject to a successful exploration programme, a

positive Feasibility Study outcome and Decision to Mine, the ore

from the proposed Havieron Joint Venture will be toll processed at

Newcrest's Telfer Gold Mine ("Telfer"), which sits approximately

45km to the west of Havieron.

-- In order to support the planned acceleration of the

construction of a box-cut and decline and a faster rate and scope

of planned spending on exploration activities, Greatland has agreed

to fund 30% of Early Works and Growth Drilling Expenditure prior to

completion of the farm-in :

o "Early Works Expenditure": all capital and operating

expenditure incurred during the Farm-in Period for activities such

as the construction of a box-cut and decline and associated early

works including camp, access roads, bore fields, offices and

related surface infrastructure, but does not include any

expenditure incurred for modifications to the Telfer Gold Mine

processing facility or for the construction of any haul road (which

are subject to a Decision to Mine). The commencement of the

construction of the box-cut and decline is subject to receipt of

required approvals.

o "Growth Drilling Expenditure": all exploration expenditure in

connection with growth drilling on that part of the JV Area being

outside of the area of the Initial Inferred Mineral Resource which

is expected to be delivered in December 2020.

o Greatland's obligation to contribute to Early Works

Expenditure and Growth Drilling Expenditure, in aggregate and prior

to the completion of the Pre-Feasibility Study, will be capped at

the amount of the Facility A Commitment (US$20m) or such greater

amount as provided by Newcrest.

-- In order to incorporate ongoing growth drilling activities,

the parties have agreed a structure that allows Newcrest to deliver

the Pre-Feasibility Study in Stage 4 (Pre-Feasibility Study

originally to be delivered in Stage 3):

o If Newcrest incurs an additional US$25 million by way of

Farm-in Expenditure (other than Early Work and Growth Drilling

Expenditure) in relation to the Havieron Joint Venture within a

period of 24 months from the date following satisfaction of the

Stage 2 Commitment, Newcrest will be entitled to earn an additional

20% interest (cumulative interests 60% Newcrest; 40% Greatland).

Newcrest has met this expenditure requirement for the Stage 3

interest.

o If Newcrest then incurs an additional US$20 million by way of

Farm-in Expenditure (other than Early Work and Growth Drilling

Expenditure) in relation to the Havieron Joint Venture and also

delivers a Pre-Feasibility Study within a period of 24 months,

Newcrest will have the right to earn an additional 10% interest (

cumulative interests 70% Newcrest; 30% Greatland). The

Pre-Feasibility Study must be supported by an Indicated Mineral

Resource.

o Newcrest retains its option to acquire an additional 5%

interest at fair market value ( cumulative interests 75% Newcrest;

25% Greatland). Fair market value will be determined by negotiation

between the parties, or, if the parties are unable to agree, then

by an independent valuer .

-- Newcrest has now met the Stage 3 expenditure requirements and

is entitled to earn an additional 20% interest in the Havieron

Joint Venture for an overall 60% interest (40% Greatland).

-- The Joint Venture Management Committee will be comprised of a

maximum of five representatives . As at Establishment Date, N

ewcrest shall be entitled to appoint three representatives and

Greatland shall be entitled to appoint two representatives to the

Management Committee.

-- Following the delivery of a Feasibility Study, the Management

Committee will meet to consider a Decision to Mine. A unanimous

vote by the Management Committee is required to approve a Decision

to Mine. If a Decision to Mine is not approved by a unanimous vote,

then the party who voted in favour shall have an option to purchase

the non-approving party's interest at fair market value.

-- As part of the joint venture, Newcrest and Greatland have

entered into standard cross security arrangements which in the case

of Greatland will also secure repayment of the Havieron Loan.

Havieron Loan Agreement

-- In order to support the expanded scope and pace of activities

at Havieron, Newcrest has agreed to provide funding of up to US$50m

to Greatland via two US Dollar loan facilities, Facility A and

Facility B, at an interest rate of LIBOR+8%. The Loan Agreement is

expected (based on current forecasts) to fund Greatland's share of

joint venture costs, including Early Works and Growth Drilling, up

to the completion of the Feasibility Study.

o "Facility A": a loan of up to US$20m, or a greater amount if

provided by Newcrest, for Greatland's 30% share of Early Works and

Growth Drilling prior to the completion of the Pre-Feasibility

Study. Greatland's obligation to contribute to Early Works

Expenditure and Growth Drilling Expenditure, in aggregate, will be

capped at the amount of the Facility A Commitment.

o "Facility B": a loan of up to US$30m for Greatland's share of

joint venture expenditure, post the completion of the

Pre-Feasibility Study, but prior to the completion of the

Feasibility Study.

o Scheduled quarterly repayments of the loan(s) will occur once

production commences at Havieron with repayments comprising 80% of

quarterly "Net Proceeds" (revenue from sale of Greatland's share of

JV product less statutory royalties, royalties payable under the JV

ILUA, all charges paid by Greatland under the Tolling Agreement

with Newcrest, and Greatland's share of Joint Venture operating

expenditure for that quarter).

o Greatland may prepay all or part of the total outstanding loan

balance(s) without premium or penalty at any time.

o If Newcrest exercises its option to acquire the Additional

Farm-In Interest , then the purchase price payable by Newcrest to

acquire the Additional Farm-in Interest will be set-off against (by

way of prepayment of) the total outstanding loan balance(s) at that

time.

Juri Joint Venture

Background & Overview

Greatland's Paterson project , excluding the Havieron Joint

Venture (M45/1287), comprises three granted exploration licences

and one licence application: Scallywag (E45/4701, granted, formerly

"Havieron"), Paterson Range East (E45/4928, granted), Black Hills

(E45/4512, granted) and Rudall (E45/5533, application). All four

licences are located in the Paterson region of north Western

Australia. Over the past few years, Greatland has identified a

number of high-priority targets across these licences, many of

which display similar geophysical characteristics to the Havieron

gold-copper deposit.

As of today's announcement, the Paterson Range East licences and

Black Hills are part of the Juri Joint Venture. The Black Hills

licence was acquired by Greatland in November 2017 for

approximately A$225,000 in cash and shares. The Paterson Range East

licence application was granted to Greatland in September 2018 for

minimal upfront cost. Greatland retains 100% ownership of both the

Scallywag and Rudall licences which do not form part of the Juri

Joint Venture. Newcrest retains a right of first refusal over the

Scallywag licence under the Havieron Joint Venture Agreement.

Juri Farm-in & Joint Venture Agreement

-- Newcrest has the right, but not the obligation, to earn up to

a 75% interest in the Paterson Range East (E45/4928) and Black

Hills (E45/4512) licences (the "Juri Joint Venture"), an area of

approximately 249 square kilometres, by spending up to A$20m as

part of a two-stage Farm-in over five years.

o Initial Participating Interest: Newcrest immediately receives

a 25% interest in the Paterson Joint Venture in consideration for

entering into the Stage 1 Commitment.

o Stage 1 Commitment (the "Minimum Commitment"): Newcrest must

satisfy the Stage 1 Commitment by incurring and/or funding A$3m in

expenditure within 24 months to earn an additional 26% interest

(cumulative 51% interest) in the Paterson Joint Venture (if A$3m in

expenditure has not been incurred, the balance must be paid to

Greatland).

o Stage 2 Commitment: if Newcrest incurs and/or funds an

additional A$17 million in expenditure in relation to the Paterson

Joint Venture within a period of 36 months from the date following

satisfaction of the Stage 1 Commitment, Newcrest will have the

right, but not the obligation, to acquire an additional 24%

interest in the Paterson Joint Venture (cumulative 75%

interest).

-- Greatland will be the Manager of the Juri Joint Venture until

the end of calendar 2021 (the "Initial Period"). Newcrest will have

the right, but not the obligation, to be appointed as Manager at

the end of that Initial Period. Following technical review by both

parties, Greatland and Newcrest have agreed an exploration

programme for the Juri Joint Venture during the Initial Period.

-- The 2021 exploration programme for the Juri JV is expected to

include the following activities:

o Drill testing of the Parlay target, a discrete magnetic

anomaly with coincident gravity response in the south-west of the

Black Hills licence.

o Drill testing of several high-priority targets across the

Paterson Range East licence, including Goliath, Outamind and Los

Diablos.

o Further geophysical work to identify and prioritise other

targets including Black Hills and Prefect.

-- As part of the joint venture, Newcrest and Greatland have

entered into standard cross security arrangements .

Overview of Greatland's Paterson Project and the Havieron Joint

Venture

Greatland's Paterson project is comprised of the Havieron Joint

Venture (Mining Lease 45/1287) , three granted exploration licences

(Scallywag, Paterson Range East and Black Hills) and one licence

application (Rudall), collectively covering more than 450 square

kilometres in the Paterson region of northern Western Australia.

The Paterson region is considered to be prospective for Telfer and

Havieron style gold-copper deposits.

The Paterson region is currently one of the most active

exploration areas in Australia. Recent discoveries by Greatland

(Havieron) and Rio Tinto (Winu) demonstrate the potential of the

region and highlight the lack of historical exploration,

particularly over the extensive areas under cover. As well as

hosting several large gold and copper deposits such as Telfer and

Nifty, more recent exploration has outlined several other deposits

including Magnum (Au), Calibre (Au), O'Callaghans (W, Cu) and

Maroochydore (Cu). The region is remote, however, infrastructure is

good with several operating mines, roads, formed tracks and rail

networks nearby which branch out from the regional industrial hub

of Port Hedland 500km to the west.

In March 2019, Greatland signed a Farm-in Agreement with

Newcrest Operations Limited, a wholly-owned subsidiary of Newcrest

Mining Limited (ASX:NCM), to explore and develop Greatland's

Havieron gold-copper deposit in the Paterson region of Western

Australia. Newcrest has the right to earn up to a 70% interest in

Mining Lease 45/1287 by spending US$65 million and completing a

Pre-Feasibility Study. Newcrest may acquire an additional 5%

interest at the end of the Farm-in period at fair market value. The

Farm-in Agreement includes tolling principles reflecting the

intention of the parties that, subject to a successful exploration

programme and Feasibility Study, the resulting joint venture ore

will be processed at Telfer, located 45km west of Havieron.

As of today's announcement, the Paterson Range East licences and

Black Hills are part of the Juri Joint Venture. Greatland retains

100% ownership of both the Scallywag and Rudall licences which do

not form part of the Juri Joint Venture. Newcrest retains a right

of first refusal over the Scallywag licence under the Havieron

Joint Venture Agreement.

A map of the Havieron Joint Venture and Greatland's Paterson

licences can be found on the Greatland Gold website at:

https://greatlandgold.com/paterson/

Enquiries:

Greatland Gold PLC

Gervaise Heddle/Callum Baxter

Tel: +44 (0)20 3709 4900

Email: info@greatlandgold.com

www.greatlandgold.com

SPARK Advisory Partners Limited (Nominated Adviser)

Andrew Emmott/James Keeshan

Tel: +44 (0)20 3368 3550

Berenberg (Joint Corporate Broker and Financial Adviser)

Matthew Armitt/Jennifer Wyllie/Detlir Elezi

Tel: +44 (0)20 3207 7800

Hannam & Partners (Joint Corporate Broker and Financial

Adviser)

Andrew Chubb/Matt Hasson/Jay Ashfield

Tel: +44 (0)20 7907 8500

SI Capital Limited (Joint Broker)

Nick Emerson/Alan Gunn

Tel: +44 (0)14 8341 3500

Luther Pendragon (Media and Investor Relations)

Harry Chathli/Alexis Gore/Joe Quinlan

Tel: +44 (0)20 7618 9100

Notes for Editors:

Greatland Gold plc is a London Stock Exchange AIM-listed

(AIM:GGP) natural resource exploration and development company with

a current focus on precious and base metals. The Company has six

main projects; four situated in Western Australia and two in

Tasmania.

In March 2019, Greatland signed a Farm-in Agreement with

Newcrest Operations Limited, a wholly-owned subsidiary of Newcrest

Mining Limited (ASX:NCM), to explore and develop Greatland's

Havieron gold-copper deposit in the Paterson region of Western

Australia. Newcrest has the right to earn up to a 70% interest in

Mining Lease 45/1287 by spending US$65 million and completing a

Pre-Feasibility Study. Newcrest may acquire an additional 5%

interest at the end of the Farm-in period at fair market value. The

Farm-in Agreement includes tolling principles reflecting the

intention of the parties that, subject to a successful exploration

programme and Feasibility Study, the resulting joint venture ore

will be processed at Telfer, located 45km west of Havieron.

Greatland is seeking to identify large mineral deposits in areas

that have not been subject to extensive exploration previously. It

is widely recognised that the next generation of large deposits

will come from such under-explored areas and Greatland is applying

advanced exploration techniques to investigate a number of

carefully selected targets within its focused licence

portfolio.

The Company is also actively investigating a range of new

opportunities in precious and strategic metals and will update the

market on new opportunities as and when appropriate.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGRBLBTTMTATTFM

(END) Dow Jones Newswires

November 30, 2020 02:00 ET (07:00 GMT)

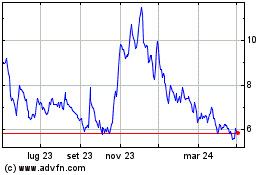

Grafico Azioni Greatland Gold (LSE:GGP)

Storico

Da Mar 2024 a Apr 2024

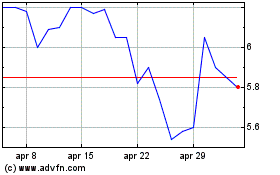

Grafico Azioni Greatland Gold (LSE:GGP)

Storico

Da Apr 2023 a Apr 2024