Halma PLC Trading update (7856Z)

23 Settembre 2020 - 8:00AM

UK Regulatory

TIDMHLMA

RNS Number : 7856Z

Halma PLC

23 September 2020

Halma plc

Trading update

23 September 2020

Halma today releases its scheduled trading update, for the

period from 1 April 2020 to date, and confirmation of a management

appointment to its Executive Board.

Halma has delivered a resilient performance during the period in

line with the Board's expectations and, despite the operational

challenges arising from the Covid-19 pandemic, the Group has

continued to benefit from the long-term growth drivers in its

markets, the breadth of its portfolio and the agility of its

business model.

At the end of the first quarter we reported that revenue was 13%

lower than last year on an organic constant currency basis. Since

then, the Group's revenue trends have gradually improved, while

continued control of costs and working capital have protected

profit and ensured good cash generation. Order intake was ahead of

revenue albeit marginally down on the same period last year. Given

the evolving and uncertain situation in our major markets, the

Board continues to expect Adjusted profit before tax (note 1) for

FY2021 to be 5%-10% below FY2020 and more weighted to the second

half than in previous years.

There has continued to be a significant variation in demand in

individual end-markets and geographic regions. The USA and Mainland

Europe regions have delivered the most resilient overall trading

performances. The UK and Asia Pacific have remained more

challenging, although the latter has benefited from prior year

acquisitions and a gradual recovery in China.

The Environmental & Analysis sector has performed well, and

the Medical sector has started to see a modest improvement in

demand for products related to elective surgical and diagnostic

procedures. The Safety sectors were impacted by limitations of

physical access to sites in the first quarter, however this has

steadily improved during the second quarter to date.

The currency translation effect on the Group's results in the

first half of the year is expected to be broadly neutral.

The Group's financial position remains robust, with committed

facilities totalling approximately GBP750 million at current

exchange rates. The earliest maturity in these facilities is for

GBP73 million in January 2021, with the remaining maturities from

2023 onwards. Our sector M&A teams have been actively

cultivating opportunities, and the Group continues to see a healthy

acquisition pipeline for the future.

The results for the half year ending 30 September 2020 will be

released on 19 November 2020.

New Group General Counsel and Executive Board member

On 14(th) September 2020, Funmi Adegoke joined Halma as our

Group General Counsel. Funmi will continue our work to maintain a

strong legal and compliance capability to support the Group's

growth, including oversight of our Company Secretariat

activities.

Before joining Halma, Funmi spent nine years at BP in various

roles, most recently as Managing Counsel for BP's Downstream

Commercial Development and Transformation business. Prior to BP,

Funmi held senior legal and commercial roles with Bombardier. Funmi

is a qualified Barrister and holds a law degree from the University

of Cambridge. She is a Non-Executive Director of Melrose Industries

plc.

For further information, please

contact:

Halma plc

Marc Ronchetti, Chief Financial

Officer +44 (0)1494 721111

MHP Communications

Rachel Hirst/ Giles Robinson +44 (0)20 3128 8788

About Halma

Halma is a global group of life-saving technology companies,

focused on growing a safer, cleaner, healthier future for everyone,

every day. Our innovative products and solutions address many of

the key issues facing the world today. We operate in four sectors:

Process Safety, Infrastructure Safety, Medical and Environmental

& Analysis. We employ over 7,000 people in more than 20

countries, with major operations in the UK, Mainland Europe, the

USA and Asia-Pacific. We target global niche markets where

sustainable growth and high returns are supported by long-term

drivers. Halma is listed on the London Stock Exchange and has been

a member of the FTSE 100 index since December 2017.

Notes

1. Adjusted profit before tax is before amortisation and

impairment of acquired intangible assets, acquisition items,

restructuring costs and profit or loss on disposal of

businesses.

2. This Trading Update is based upon current management accounts

information. Forward-looking statements have been made by the

Directors in good faith using information available up until the

date that they approved this statement. Forward-looking statements

should be regarded with caution because of the inherent

uncertainties in economic trends and business risks, including the

effects of the current COVID-19 outbreak.

3. A copy of this announcement, together with other information

about Halma, may be viewed on our website www.halma.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTSEEFMEESSEDU

(END) Dow Jones Newswires

September 23, 2020 02:00 ET (06:00 GMT)

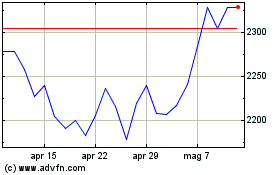

Grafico Azioni Halma (LSE:HLMA)

Storico

Da Mar 2024 a Apr 2024

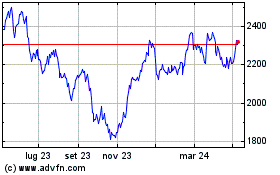

Grafico Azioni Halma (LSE:HLMA)

Storico

Da Apr 2023 a Apr 2024