Hermès and LVMH Stocks Are As Trendy as Their Handbags

06 Marzo 2021 - 12:14AM

Dow Jones News

By Rory Satran

Off Brand is a thrice-monthly column that delves into trends in

fashion and beauty.

FOR MOST of us, Valentine's Day during the pandemic involved a

slightly nicer dinner at home, if anything at all. But for "Creed"

superstar Michael B. Jordan and his girlfriend, Lori Harvey, it

meant renting out a public aquarium -- its floor strewn with rose

petals -- a sushi feast and a bounty of presents. Among the gifts

the besotted Mr. Jordan offered Ms. Harvey was a certificate of

stock in Hermès, the French luxury brand. The tabloid press

chronicled the entire romantic extravaganza, but that stock

certificate is what people are still talking about.

It's a move that resonated with fledgling retail investors -- a

group that has been growing in number this year due in part to the

GameStop phenomenon. Many of them are increasingly trading single

stocks using online brokerages like Robinhood, making decisions

based on nothing but word of mouth or personal affinity. Newbies to

the stock market often instinctually follow an investment strategy

popularized by American investor Peter Lynch: "Buy what you know."

Mr. Lynch famously invested in the parent company of Hanes in the

1970s because his wife liked its L'Eggs pantyhose, the

grocery-store staple sold in a plastic, egg-shaped pod.

Today's fashion-minded investors tend to aim a bit higher. They

covet high-end retail stocks including Hermès, VF Corporation

(which owns Supreme) and LVMH, the parent company of brands like

Louis Vuitton and Celine. These investors' influences include

pop-cultural figures like Mr. Jordan, or the rapper Jay-Z, whose

Armand de Brignac champagne recently attracted LVMH as an

investor.

Mr. Jordan's gift underlined an idea on many fashion fans'

minds: Why buy an ephemeral handbag or a piece of jewelry from a

beloved brand when you could invest in the company itself?

Rafael V. DeLeón, an actor and investor in Los Angeles, owns

LVMH stock and praised the gifting strategy Mr. Jordan used for Ms.

Harvey: deliberate wealth building in lieu of materialism. Mr.

Jordan's "providing her equity in the company is a thing that

hasn't always been at the forefront in communities of color," said

Mr. DeLeón. He credits this trend to what he called "the Obama

effect," which he said "created a generation of people who want to

pursue the world from a different angle than what was previously

available or afforded."

Mr. Jordan was hardly the first gift-giver to recognize the

appeal of a flashy consumer-facing stock. Kanye West made news a

few Christmases back when he gave Apple, Netflix and Disney stock

to Kim Kardashian. Back down here on Planet Earth, Coop Datrille, a

31-year-old artist and YouTuber based in Dallas, bought LVMH stock

for his significant other for Christmas in 2019 after listening to

an investing podcast. "She was in shock, she felt like it was a

level-up," he reported. His girlfriend, who does not own

merchandise from any LVMH companies, told him, "You're not buying

me a liability, you're buying me an asset." The gift spurred her to

invest in other fashion companies. Mr. DaTrille sees it as a

paradigm shift. He said, "It's a bigger flex when you can invest in

something and get paid from it."

To purchase his gift, Mr. DaTrille used the online investing

platform Stockpile, which lets users easily give stocks to others,

even as fractional shares. Victor Wang, the San Francisco-based CEO

of Stockpile, is interested in recruiting non-traditional

investors. He called fashion "a kind of gateway drug into

investing," adding, "if you are a big fan of, let's say Hermès,

then it's not a chore for you to read up on the latest things

they're doing because that's interesting to you."

Mr. Wang said he's seen an uptick in interest in gifting fashion

stocks over the past year. He attributes that in part to the way

the pandemic put a damper on buying fashion to wear out and about.

"Now when you're thinking about buying a luxury item like a handbag

or a dress," explained the CEO, you have nowhere to go to show it

off. "So when [people] have familiarity with a luxury brand, this

is a way for them to have an outlet." He also sees the trend as a

potentially economical solution for those who love high-end brands

but can't necessarily afford their goods. Fractional shares of

designer stocks can be a far cheaper way to get what he calls

"pride of ownership" than a luxury handbag. (On Stockpile, one can

buy a gift card of fractional stock including Hermès for as little

as $5, while the most coveted luxury handbags easily top

$10,000.)

That pride of ownership, however, is not necessarily linked to

financial fundamentals. What fashionistas love about brands --

design, quality, hype -- does not always translate to the company's

valuation on the stock market. Even a successful brand may be on

the cusp of facing any number of disruptions, like a lawsuit,

regulation or executive change, that might affect its stock. The

emotional connection we have with fashion brands does not always

result in a sound investment.

Leigh Drogen, a financial technology entrepreneur and former

equity hedge fund portfolio manager, spoke to me about the "tribal"

nature of investing. He pointed out that a consumer-facing stock

such as Peloton has value as a "cocktail-party" conversation

starter. "Everybody wants to be part of something, especially

[since] we're all sitting in our homes away from being able to

operate in groups...and this is absolutely a way that people

affiliate themselves with certain tribes." Sounds a lot

like...fashion.

Of course, for those who fetishize the craft of a beautifully

tooled handbag or the confidence-boosting power of a tailored

blazer, a stock certificate doesn't quite compare. "I like tangible

assets, personally," confessed Tina Craig, the Dallas influencer

behind the "Bag Snob" blog and founder of skincare company U

Beauty. She continued, "A bag from Hermès or Chanel, for example,

is better than a stock, in my opinion. You can enjoy it and make

use of it. If it's a Kelly or Birkin, or Chanel Classic flap, it'll

actually increase in value. Given the option, I'll take wearable

art over stock anytime."

(END) Dow Jones Newswires

March 05, 2021 17:59 ET (22:59 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

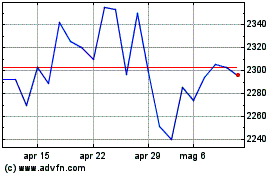

Grafico Azioni Hermes (EU:RMS)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Hermes (EU:RMS)

Storico

Da Apr 2023 a Apr 2024