- Strengthening of the order book to 190,000 tons (+18%), in

line with the commercial roadmap, thanks to the signing of numerous

technical and commercial collaboration contracts with leading

players in the construction sector

- Further industrial development: construction of H2 launched

and ongoing review of sites for the future H3

- 2020 production volumes in line with the Company’s

expectations

- Solid financial situation with shareholders’ equity of over

€64 million

Regulatory News:

Hoffmann Green Cement Technologies (ISIN: FR0013451044, Ticker:

ALHGR) (“Hoffmann Green” or the “Company”), a pioneer

in low-carbon cement, today announces its 2020 annual results. The

Company’s Supervisory Board met on March 26, 2021 and reviewed the

2020 accounts approved by the Management Board and audited and

certified by the statutory auditors.

Key elements of the Company’s consolidated annual

accounts

€ thousands – IFRS

FY 2020

FY 2019

Revenue

504

620

EBITDA

(4,131)

(1,846)

Recurring Operating profit/loss

(EBIT)

(5,882)

(3,079)

Financial profit/loss

(2,128)

(3,131)

Tax

1,978

1,913

Net profit/loss

(6,119)

(4,339)

€ thousands – IFRS

At 31/12/2020

At 31/12/2019

Cash and cash equivalents

46,268

40,914

Shareholders’ Equity

64,643

70,548

Commenting on the publication of the Company’s 2020 annual

results, Julien Blanchard and David Hoffmann, co-founders of

Hoffmann Green Cement Technologies, said: “We are happy with

what we achieved at Hoffmann Green in 2020, in spite of the

pandemic. In accordance with our industrial roadmap, 2020 saw us

reach a key milestone in our development, with the launch of the

construction of our second production site, H2, in the Vendée

region of Western France. Built entirely using Hoffmann Green

cement, this new site will enable us to meet the growing demand for

our low-carbon cement from clients. Indeed, we signed numerous

technical and commercial collaboration contracts in 2020 with key

players in the construction sector such as GCC, KP1, Cemex and

Eiffage Génie Civil, taking our order book to over 190,000 tons to

date. We are reconfirming our target of addressing 3% of the French

cement market by 2025/2026. The commercial dynamic continues at the

beginning of 2021 with the signing of contracts with Ouest

Réalisations, for the construction of housing, and EDYCEM, the

concrete subsidiary of the HERIGE Group, to develop low carbon

footprint concretes. 2021 will be the year of increasing production

volumes with the execution of large-scale projects such as the

housing estate in Saint-Leu-La-Forêt, the senior citizens'

residence in La Croix-Blanche, the Gaité Montparnasse in Paris and

the "Batignolles 2025" district project in the Nantes region.

Lastly, ongoing and future regulations should benefit us, as they

are in line with our vision of building tomorrow’s infrastructures

in a more eco-responsible way.”

2020: a year marked by the launch of H2’s construction and a

strengthening of the order book despite the unprecedented public

health and economic context

From an industrial perspective, in the fourth quarter of 2020

Hoffmann Green met a major milestone in its development by

launching the construction of its second plant, H2, for the

clinker-free production of cement. This exceptional structure

located next to the first production site, “H1”, in Bournezeau

(Vendée, western France) and built entirely from Hoffmann Green

cement, will have a production capacity of 250,000 tons a year. The

plant’s construction is expected to be completed by the second half

of 2022.

At the same time, the Company is continuing its search for land

in the Paris area to construct the H3 plant, which will be modeled

on the H2 plant.

From a commercial perspective, the growth momentum has continued

despite the impact of the lockdowns. Numerous contracts were signed

in the second half of 2020, notably with:

- GCC: three-year commitment to supply cement for the

development of effective low-carbon buildings

- Capremib: supplying of low-carbon cement over 3 years

for the construction of wooden concrete sound barriers

- Bétonic: technical collaboration to develop low-carbon

fluid screed solutions

- KP1: 5-year commitment to supply low-carbon cement for

prefabricated building systems

- Immobilière 3F: production of more than 1,600 m3 of

concrete sheets, floor slabs, posts, beams and stairs for

low-carbon social housing

- Cemex: 3-year commitment for the distribution of

low-carbon cement on the ready-mix concrete market

- LG Béton: supplying of low-carbon cement for the

production of stairs as part of the emblematic ‘l1ve’ site in

Paris

- Soriba: manufacturing of low-carbon staircases using

Hoffmann Green cement

- Eiffage Génie Civil: 3-year contract to supply cement

for the construction of civil engineering infrastructures.

Hoffmann Green’s global order book was not affected by the

pandemic. However, its execution has been pushed back, with delays

currently estimated at between 6 and 24 months. At the end of March

2021, the order book stood at over 190,000 tons of cement, a level

in keeping with the Company’s commercial roadmap.

In terms of human resources, the Company has continued to

structure itself thanks to the recruitment of additional staff in

the technical, development and production fields, notably

recruiting a Head of New Construction and two Promoters. These

resources will help support Hoffmann Green’s future development,

and in particular its commercial and industrial development. The

Company had 21 employees at the end of December 2020, versus 16 at

December 31, 2019. Additional recruitments are planned in the first

half of 2021.

Regarding the CSR roadmap, the 2020 priority action plan was

delivered. The Company undertook and published a Bilan Carbone®

scope 3 carbon assessment in order to initiate an approach

assessing its contribution to 2050 carbon neutrality. At the same

time, to have an accurate assessment of the impact of its activity,

the Company has committed to following the ACT (Assessing low

Carbon Transition®) approach, an initiative developed by ADEME (the

French agency for ecological transition) and the Carbon Disclosure

Project to assess companies’ climate strategies. Hoffmann Green has

obtained a rating of 13A+, one of the highest ratings in the ACT

database, reflecting the pertinence of its business model.

Furthermore, the Company’s ESG (Environment, Social &

Governance) performances have been assessed by two independent

players specializing in extra-financial ratings. Hoffmann Green has

thus received a rating of 54 from consulting agency Ethifinance.

This assessment puts the Company in 131st place in Gaïa Rating’s

ESG 230 panel and in 23rd place out of the 78 companies in the

panel with revenue of less than €150 million. At the same time, the

Company has received a rating of 20.8 from international ratings

agency Sustainalytics, putting it in 3rd place of the 115 companies

assessed that produce building materials.

Lastly, to improve its operational and financial efficiency, at

the end of 2019 the Company initiated the implementation of an ERP

(Enterprise Resource Planning), due for implementation in July

2020.

Annual results

Over the year to December 31, 2020, the Company recorded revenue

of €504 thousand corresponding primarily to sales by volume,

representing 1,775 tons of cement. The volume of cement sold has

thus grown over the year (1,098 tons in 2019). The slight decrease

in revenue in 2020 was due to the fall in engineering services.

Operating expenses include personnel costs of €1.2 million,

reflecting the scaling up of the teams. They also include external

expenses of €3.2 million notably associated with purchases of raw

materials and tests undertaken with the Company’s partners over the

period.

EBITDA was -€4.1 million in 2020 versus -€1.8 million in 2019

because of the increase in operating expenses.

At December 31,2020, the Company recorded an increase in its

amortization charges associated with the commissioning of

facilities and equipment in 2019 and early 2020.

The Recurring Operating loss (EBIT) was thus €5.9 million at

December 31, 2020.

The 2020 financial loss was €2.1 million, and notably consists

of an expense on the divestment of securities of €2.1 million. Once

tax income of €2.0 million is taken into account, the Net Loss at

December 31, 2020 was €6.1 million.

A solid balance sheet

At December 31, 2020, the Company had a solid balance sheet with

Shareholders’ Equity of €64.6 million and available cash of €46.3

million (€56.3 million including UCITS). The change in the cash

position over the period (+€5.3 million) was primarily due to the

divestment of UCITS undertaken by the Company.

It should also be noted that the cash position was impacted by

other investment cash flow, for €5.6 million, and operating cash

flow, for €2.9 million, which was partly offset by the issuing of

bank loans for €7.0 million.

The Company has an unused credit line of €10.0 million.

The Company did not take advantage of a State-Guaranteed Loan,

as its cash position did not require it.

Outlook

The Company is continuing to closely monitor the pandemic and

any developments that could have an impact on its 2021 commercial

activity, production and construction of the H2 production

site.

The Company is reaffirming its 2025/2026 production targets,

i.e. achieve a total production capacity of 550,000 tons of

low-carbon cement a year with the construction of its two

additional production sites (H2 and H3) and generate revenue of

around €120 million representing a 3% share of the French cement

market at that time, with an EBITDA margin of approximately

40%.

Boosted by its solid financial situation, the Company has every

confidence in the pertinence of its corporate project and estimates

that its fundamentals and the low-carbon construction market’s

positive prospects will be all the more topical in the

post-pandemic world.

Indeed, the current crisis is highlighting the need to put

environmental issues at the very heart of industrial innovation and

to take rapid and tangible action. Driven by an eco-responsible

model, the Company is fully committed in this perspective by

implementing low-carbon solutions to preserve tomorrow’s world, and

firmly believes in the possibility of seizing new opportunities

once this global crisis is behind us.

About Hoffmann Green Cement Technologies

Founded in 2014, Hoffmann Green Cement Technologies designs,

produces and distributes innovative clinker-free low-carbon cement

with a substantially lower carbon footprint than traditional

cement. Fully aware of the environmental emergency and the need to

reconcile the construction sector, cement manufacturing and the

environment, the Group believes it is at the heart of a genuine

technological breakthrough based on altering cement’s composition

and the creation of a heating-free and clean manufacturing process,

without clinker. Hoffmann Green’s cements, currently manufactured

on a first 4.0 industrial site with no kiln nor chimney in western

France, address all construction sector markets and present, at

equivalent dosage and with no alteration in the concrete

manufacturing process, higher performances than traditional

cement.

For further information, please go to:

www.ciments-hoffmann.fr

Appendices

Simplified income statement

€ thousands – IFRS

31/12/2020

31/12/2019

Revenue

504

620

Other income from activity

9

10

Purchases consumed

(544)

(225)

Other external purchases and

expenses

(3,239)

(2,025)

Personnel costs

(1,215)

(532)

Tax

(94)

(16)

Change in inventories

(2)

2

Other operating income and

expenses

449

320

EBITDA

(4,131)

(1,846)

Depreciation, amortization and

provisions

(1,751)

(1,233)

Recurring Operating

Profit/Loss (EBIT)

(5,882)

(3,079)

Other operating income and

expenses

(88)

(43)

Operating Profit/Loss

(5,970)

(3,123)

Financial Profit/Loss

(2,128)

(3,131)

Tax

1,978

1,913

Consolidated Net

Profit/Loss

(6,119)

(4,339)

Balance sheet

€ thousands – IFRS

At 31/12/2020

At 31/12/2019

Intangible assets

3,579

2,302

Tangible assets

16,026

12,314

Other financial assets

10,073

20,004

Other non-current assets

223

629

Non-current tax assets

5,439

3,432

Total non-current

assets

35,340

38,681

Inventories and

work-in-progress

46

177

Accounts receivable

445

1,287

Other current assets

2,970

2,696

Current tax assets

4

1

Cash and cash equivalents

46,268

40,914

Total current assets

49,733

45,074

TOTAL ASSETS

85,074

83,755

€ thousands – IFRS

At 31/12/2020

At 31/12/2019

Shareholders’ Equity – Group

share

64,643

70,548

Shareholders’ Equity – minority

interests

-

-

Total Shareholders’

Equity

64 643

70,548

Borrowings and financial debt

13,637

7,280

Provisions for pensions

37

10

Other non-current liabilities

1,833

1,306

Non-current tax liabilities

62

27

Total non-current

liabilities

15,569

8,623

Borrowings and financial debt

2,175

1,032

Accounts payable

2,142

2,644

Other current liabilities

537

908

Current tax liabilities

7

Total current

liabilities

4,861

4,585

TOTAL LIABILITIES

85,074

83,755

View source

version on businesswire.com: https://www.businesswire.com/news/home/20210329005720/en/

Hoffmann Green Jérôme Caron Chief Financial Officer

finances@ciments-hoffmann.fr +33 (0)2 51 46 06 00

NewCap Pierre Laurent Thomas Grojean/Quentin Massé

Investor Relations ciments-hoffmann@newcap.eu +33 (0)1 44 71 94

94

NewCap Nicolas Merigeau Media Relations

ciments-hoffmann@newcap.eu +33 (0)1 44 71 94 98

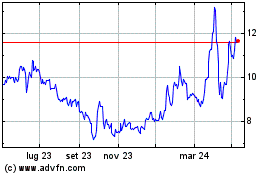

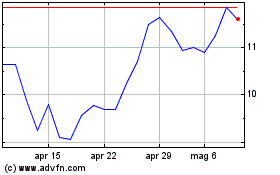

Grafico Azioni Hoffmann Green Cement Te... (EU:ALHGR)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Hoffmann Green Cement Te... (EU:ALHGR)

Storico

Da Apr 2023 a Apr 2024