Home Depot: Why is This Retailer Giant a Buy Right Now?

20 Luglio 2021 - 11:07PM

Finscreener.org

If you are looking to invest in the stock market, it makes sense

to diversify your portfolio by holding a basket of stocks across

sectors. You need to hold growth stocks, blue-chip stocks, and most

importantly income-generating dividend stocks.

For people who are just beginning their investment journey, the

dual strategy of dollar-cost averaging and dividend reinvestments

can help them generate compounded returns over time. Alternatively,

you can also withdraw these dividend payouts to support your living

expenses.

The Dow Jones Industrial Average or Dow Jones

30 has several dividend stocks including Home Depot (NYSE:

HD),

a company that has a solid underlying business, robust financials,

and enviable long-term potential, making it a good bet for 2021 and

beyond.

Home Depot is valued at a market cap of $337

billion

The Home Depot, Inc. operates as a home improvement retailer. It

owns a portfolio of The Home Depot stores that sell building

materials, home improvement products, building materials, lawn, and

garden products, as well as provide installation, home maintenance,

and professional service programs to do-it-yourself and

professional customers.

The company also offers installation programs and provides tool

and equipment rental services. It primarily serves homeowners,

professional renovators/remodelers, general contractors, handymen,

property managers, building service contractors, and specialty

tradesmen, such as electricians, plumbers, and painters. As of

January 31, 2021, the company operated 2,296 retail stores in the

United States, Canada, Mexico, and other countries.

Home Depot is valued at a market cap of $337 billion. In 2018,

the company aimed to deploy $11 billion to invest across its

physical stores, employees, supply chain as well as to enhance the

overall digital experience. These investments bore fruit amid the

pandemic as home improvement projects surged during COVID-19,

allowing Home Depot to increase sales by 20% year over year in

2020. Comparatively, earnings also grew by 16.5% last year.

In May 2021, Home Depot increased its dividends by 10% and

announced a share repurchase program of $20 billion.

Stellar quarterly results

In the fiscal first quarter of 2022 that ended in April, Home

Depot’s sales were up 33% year over year while its net earnings

surged by an impressive 85%.

During the earnings call, Home Depot CEO Craig Menear said,

“Fiscal 2021 is off to a strong start as we continue to build on

the momentum from our strategic investments and effectively manage

the unprecedented demand for home improvement projects.”

This strong demand has continued in the last quarter allowing

Home Depot to aggressively buy back shares as well as increase

payouts, increasing shareholder wealth in the process. HD stock

currently provides investors with a forward yield of 2.05%.

Analysts tracking HD stock expect sales to

rise by 8.6% year over year to $143.35 billion in 2022 and by

2% to $146.34 billion in 2023. Wall Street also forecasts its

earnings to rise at an annual rate of 10.6% over the next five

years.

What next for HD stock investors?

Home Depot is trading at a forward price to sales multiple of

2.36x and a price to earnings multiple of 22.2x which seems

reasonable. The company’s total debt of $42 billion is high but HD

also has over $6.6 billion in cash reserves reflecting a vigorous

liquidity position.

People are maintaining their spending habits developed during

COVID-19, as economies continue to reopen. This trend continues to

benefit Home Depot. Further,

a low-interest-rate environment will drive homeownership higher

allowing Home Depot to reach its financial goals at an accelerated

pace.

In the last 10 years, HD stock has gained over 1,000% compared

to the S&P

500 gains of 302%, while the Dow Jones 30 has surged 251% in

this period. Analysts continue to remain optimistic about Home

Depot stock and have a 12-month average price target of $346 which

is 10% higher than its current price.

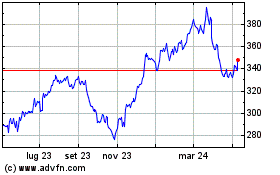

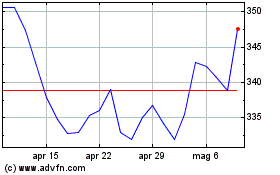

Grafico Azioni Home Depot (NYSE:HD)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Home Depot (NYSE:HD)

Storico

Da Apr 2023 a Apr 2024